Overview

This article outlines five essential steps for securing the best commercial rates for your business. It emphasizes the importance of:

- Understanding loan terms

- Assessing financial needs

- Comparing lenders

- Preparing documentation

- Negotiating effectively

Each step is supported by detailed explanations of the factors influencing loan rates and practical advice on enhancing your chances of obtaining favorable financing conditions. For instance, preparing a solid business case and understanding market dynamics can significantly improve your position in negotiations.

Introduction

Navigating the world of commercial loans presents a formidable challenge for business owners, particularly when striving for the most competitive rates in a bustling market. It is essential to grasp the intricate factors influencing loan costs—ranging from interest rates to lender reputations—to make informed financial decisions. Yet, many entrepreneurs find themselves daunted by the complexities of securing favorable terms.

How can businesses effectively position themselves to not only comprehend these dynamics but also leverage them to obtain optimal financing? This guide delineates five essential steps designed to assist businesses in maneuvering through the lending landscape and achieving the best commercial rates tailored to their unique needs.

Understand Commercial Loan Rates

Commercial borrowing costs are influenced by several critical elements, including the type of financing, lender regulations, and the borrower's credit history. Understanding these elements is essential for securing the best commercial rates for your business, especially when exploring refinancing opportunities. Here are the key components to consider:

-

Interest Rates: Commercial loans can feature fixed rates, which remain constant throughout the loan term, or variable rates, which fluctuate based on market conditions. Fixed rates provide consistency, making them a preferred choice for long-term financial strategies, especially in an environment of rising interest rates. Conversely, adjustable rates may offer initial savings but carry the risk of future increases.

-

Market Conditions: Economic indicators such as inflation and the Federal Reserve's interest rate decisions significantly impact business financing costs. For example, as of May 2025, the Reserve Bank of Australia lowered the cash rate to 3.85%, which is expected to positively influence lending costs. Monitoring these trends can help you time your application effectively, potentially leading to more favorable conditions.

-

Types of Financing: Various commercial financing options, including SBA financing and traditional loans, come with distinct terms and conditions. For instance, SBA 7(a) Loans offer funding up to $5 million, with interest rates typically ranging from 7.50% to 9.00%. Understanding the nuances of each loan type enables you to select the most appropriate option for your business needs.

-

Key Factors Influencing Costs: Factors such as the loan-to-value ratio (LTV), property location, and the borrower's creditworthiness are crucial in determining interest rates. Properties situated in developed areas often secure lower costs, while a reduced LTV can lead to improved pricing. For instance, properties financed at a 50-60% LTV may achieve rates 0.25-0.50% lower than those at a 65-75% LTV.

-

Expert Insights: Industry experts note that commercial properties present higher risks for financial institutions, typically resulting in higher interest rates compared to residential loans. Understanding these dynamics can empower you to make informed decisions when seeking financing. At Finance Story, we specialize in crafting polished and highly customized financial cases to present to banks, ensuring you secure the right funding tailored to your unique circumstances. We also provide access to a comprehensive range of financial institutions, including high street banks and private lending panels, to meet your refinancing needs.

By grasping these concepts, you will be better equipped to navigate the lending landscape and secure the best commercial rates that are tailored to your business's unique circumstances.

Assess Your Financial Needs and Goals

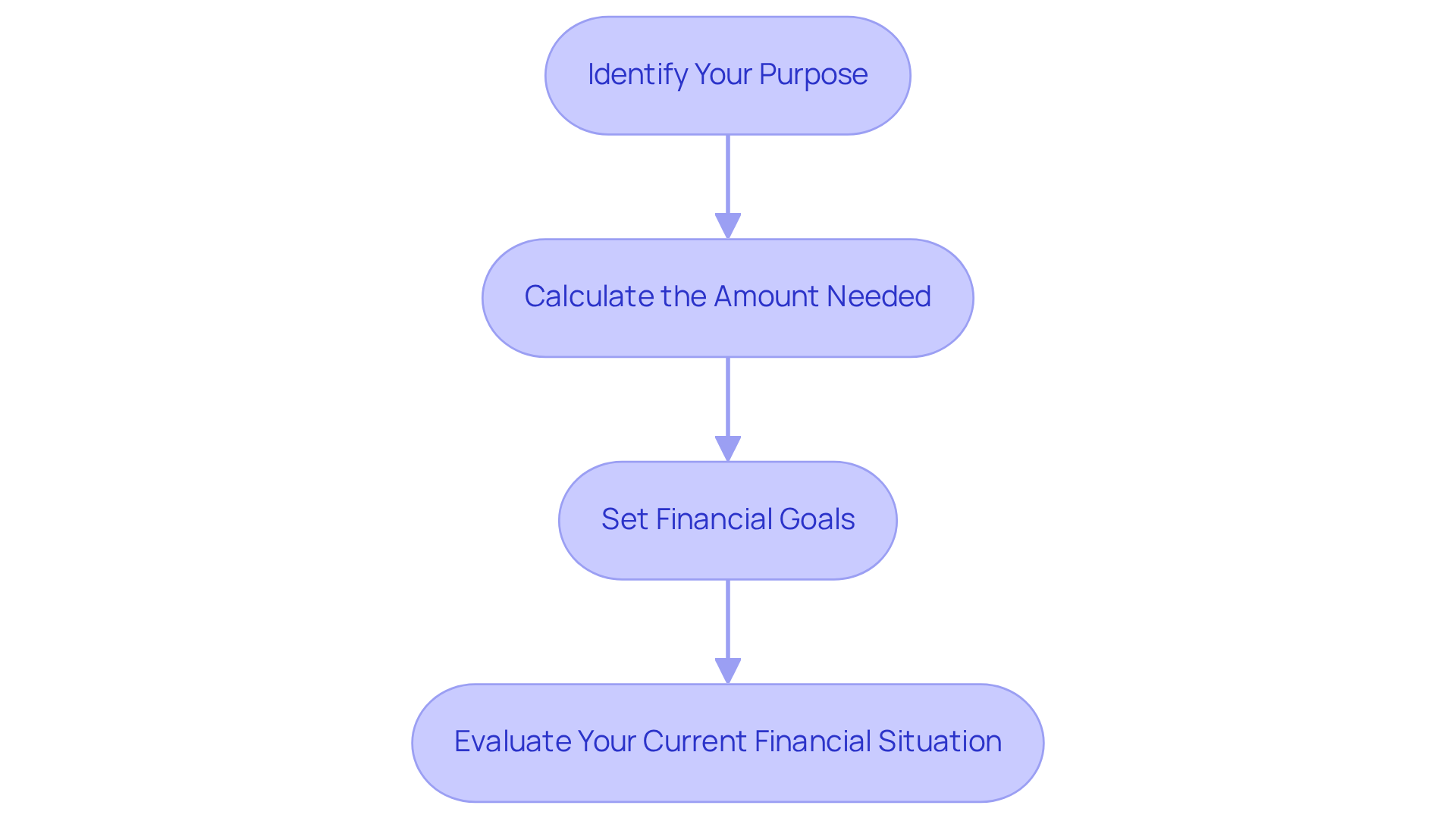

Before contacting financial institutions, it is essential to have a clear understanding of your monetary requirements and objectives. Follow these steps to prepare effectively:

- Identify Your Purpose: What specific reason drives your need for financial assistance? Whether it’s for expansion, purchasing equipment, or managing cash flow, this clarity will guide your discussions with lenders and help tailor your approach.

- Calculate the Amount Needed: Assess the total funding required, factoring in all costs associated with your project, including any hidden expenses. The average financing amount for small enterprises in Australia is roughly $94,845, so ensure your calculations represent realistic needs.

- Set Financial Goals: Clearly define what you aim to achieve with the funding. Are you targeting short-term gains or long-term growth? Setting these objectives is crucial, as they will affect the kind of financing you should seek and the conditions you discuss.

- Evaluate Your Current Financial Situation: Review your existing debts, cash flow, and credit score. Comprehending your financial well-being will assist you in figuring out what you can realistically afford and what financial institutions will take into account when assessing your application. With 60% of SMEs expecting growth in the coming year, demonstrating a solid financial foundation can enhance your credibility.

By thoroughly evaluating your financial requirements and objectives, you will be well-equipped to approach financiers with a clear and persuasive argument, enhancing your opportunities for obtaining the best commercial rates.

Research and Compare Lenders

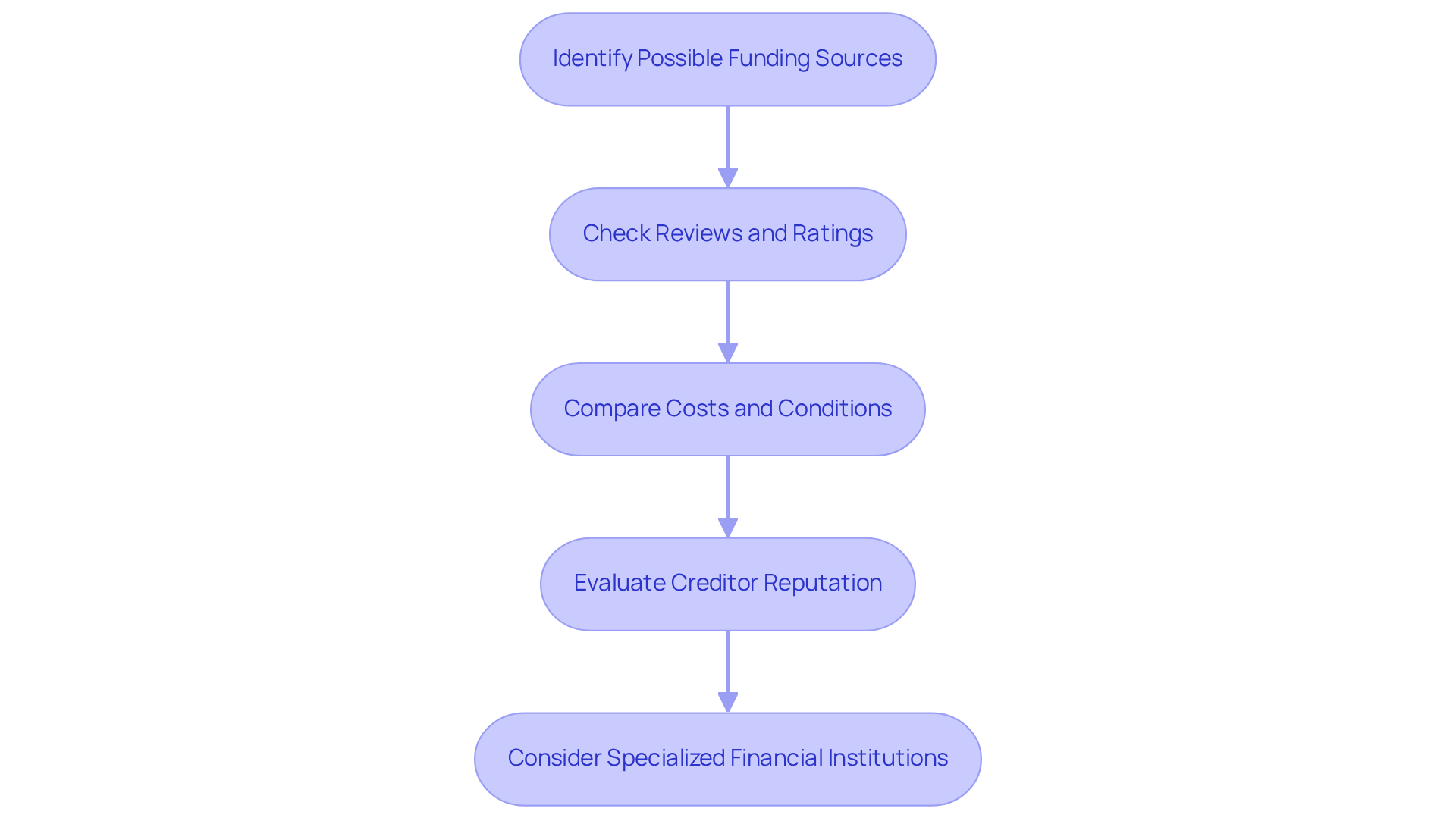

Selecting the appropriate creditor can significantly impact your borrowing experience. Here’s how to effectively research and compare lenders:

- Identify Possible Funding Sources: Begin by compiling a comprehensive list of potential funding sources, including banks, credit unions, and alternative financing options. Consider those that specialize in commercial loans, such as non-major banks and building societies, which may provide the best commercial rates and higher Loan to Value Ratios (LVRs).

- Check Reviews and Ratings: Investigate customer reviews and ratings online. Websites such as Trustpilot or Google Reviews provide valuable insights into other borrowers' experiences, assisting you in evaluating the reliability of financial institutions.

- Compare Costs and Conditions: Request quotes from various lenders and assess their interest charges, fees, and repayment conditions. Focus on the total expense of the loan, not just the interest percentage, as even a 0.50% difference can lead to substantial savings over time. For instance, a minor rate difference could result in an additional $60,000 per year on a $12,000,000 facility. Finance Story specializes in crafting refined and highly customized business cases to present to financiers, ensuring you secure the most favorable terms for your financing needs.

- Evaluate Creditor Reputation: Research the creditor's standing within the industry. A lender with a strong track record of customer service and transparency is preferable. Client testimonials, including those from satisfied customers like Natasha B. from VIC, who stated, 'I will certainly be recommending your service to anyone. We are finished with the constant worry,' can underscore exceptional service and dedication, reinforcing the credibility of your choice. Finance Story has been recognized for its tailored mortgage services, assisting enterprises of all sizes in successfully navigating their financing journeys.

- Consider Specialized Financial Institutions: If your business has unique financing requirements, explore institutions that focus on your industry or type of financing. They may offer more tailored solutions. Additionally, be aware that a General Security Agreement (GSA) might be necessary when seeking commercial property financing, granting the bank security over all assets owned by the guarantor.

By conducting thorough research and comparison, you can identify the lender that provides the best commercial rates to meet your financial needs, leveraging the expertise of professionals such as Finance Story to enhance your chances of obtaining advantageous financing conditions.

Prepare Your Documentation

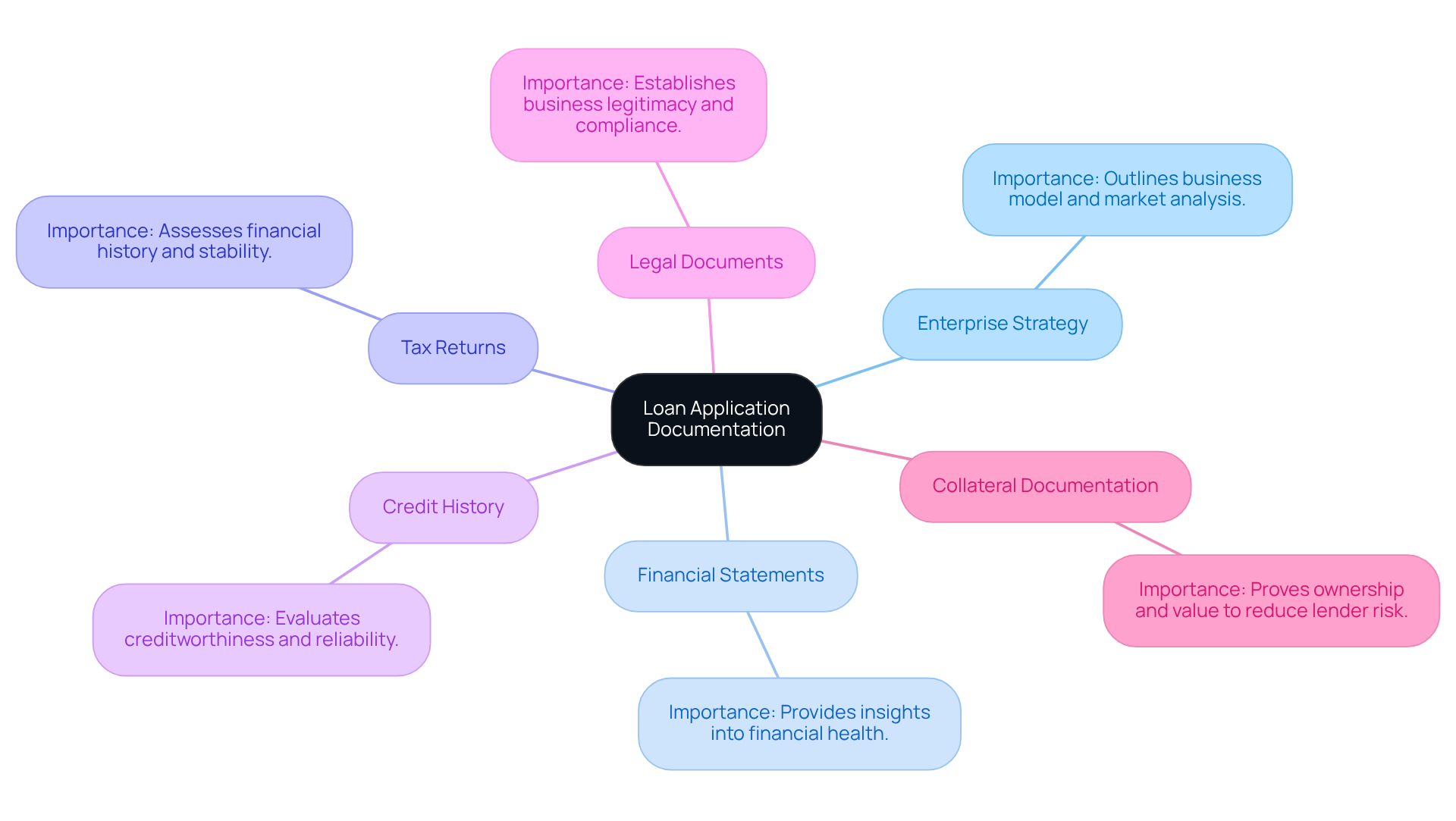

To streamline your loan application process, having the right documentation ready is essential. Here’s a comprehensive list of what you typically need:

- Enterprise Strategy: A well-crafted enterprise strategy is crucial. It should outline your enterprise model, market analysis, and financial forecasts, assisting lenders in evaluating your venture's potential and viability.

- Financial Statements: Prepare your balance sheet, income statement, and cash flow statement for the past three years. These documents provide valuable insights into your company's financial health and operational performance.

- Tax Returns: Lenders typically request personal and corporate tax returns for the past two years. These documents help assess your financial history and stability.

- Credit History: Be ready to provide your credit report. Lenders will review your credit history to evaluate your creditworthiness and reliability as a borrower.

- Legal Documents: Include any legal documents pertaining to your enterprise, such as incorporation papers, licenses, and permits. These establish your business's legitimacy and compliance with regulations.

- Collateral Documentation: If you are offering collateral, provide documentation that proves ownership and value. This can enhance your application by reducing the lender's risk.

By preparing these documents ahead of time, you can submit a strong application that greatly enhances your likelihood of approval. Experts emphasize that a detailed business plan not only aids in securing funding but also demonstrates your preparedness and commitment to your business's success.

Negotiate Terms with Lenders

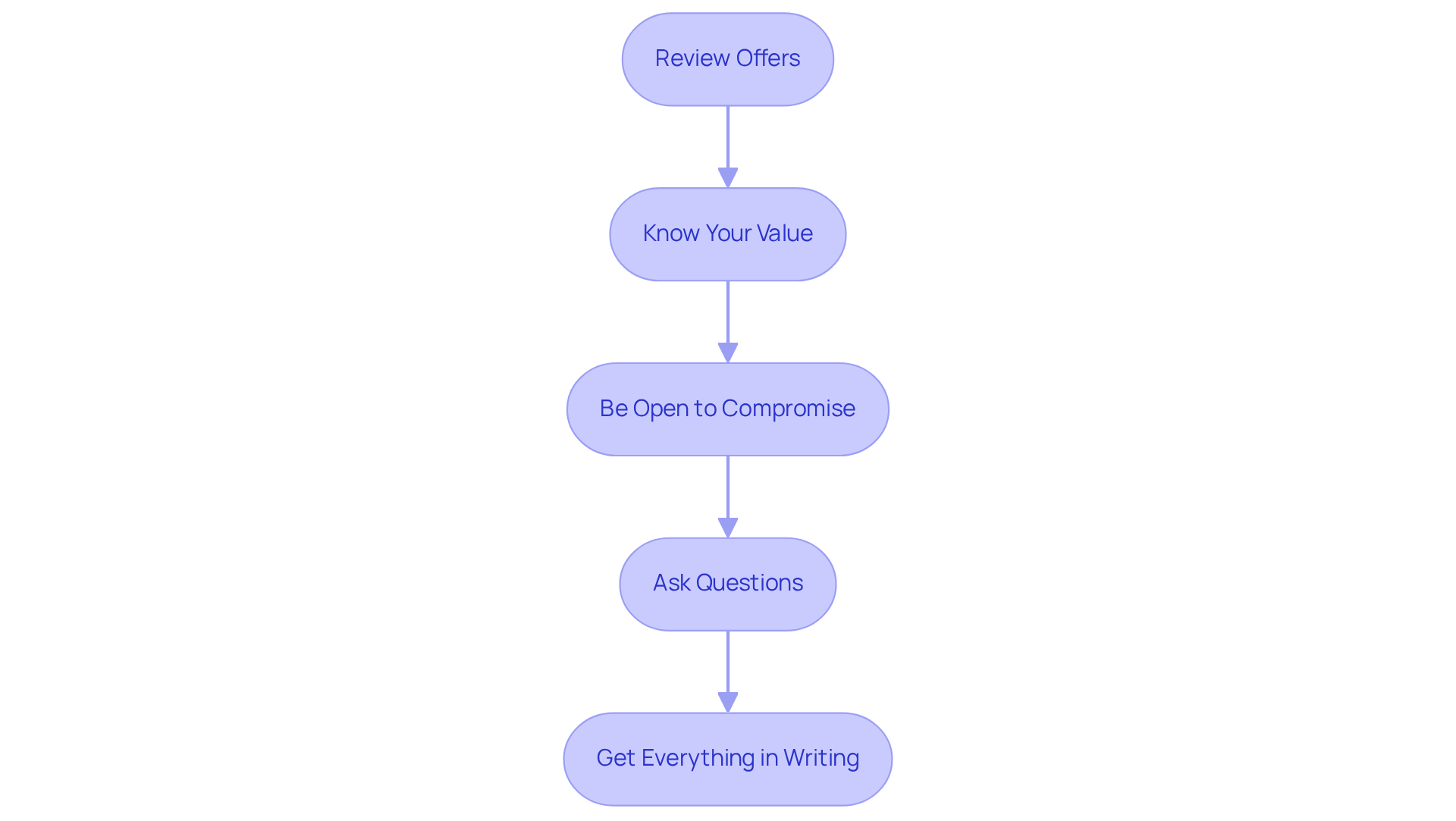

Upon receiving loan offers, it is essential to negotiate effectively. Here’s how to approach this process:

- Review offers thoroughly by examining each one in detail, focusing on interest rates, fees, repayment terms, and ensuring you secure the best commercial rates. Identify specific areas where improvements can be made, such as reducing fees or adjusting repayment schedules.

- Know Your Value: Be prepared to discuss your firm's strengths and financial health. Highlight your creditworthiness and any positive trends in your financial statements, as this can bolster your negotiating position.

- Be Open to Compromise: While aiming for the best terms, be willing to find a middle ground. Lenders often have flexibility in certain areas, which can lead to mutually beneficial agreements.

- Ask Questions: Don’t hesitate to seek clarification on any terms you don’t understand. Inquiring can reveal opportunities for improved negotiations and ensure you fully comprehend the implications of the financial agreement.

- Get Everything in Writing: Once you reach an agreement, ensure all terms are documented in writing before signing any contracts. This protects both parties and solidifies the negotiated terms.

Effective negotiation can help you secure the best commercial rates for financing terms, ultimately benefiting your business in the long run. By utilizing these strategies, you can navigate the intricacies of credit offers and secure the most advantageous funding for your needs.

Finalize Your Loan Agreement

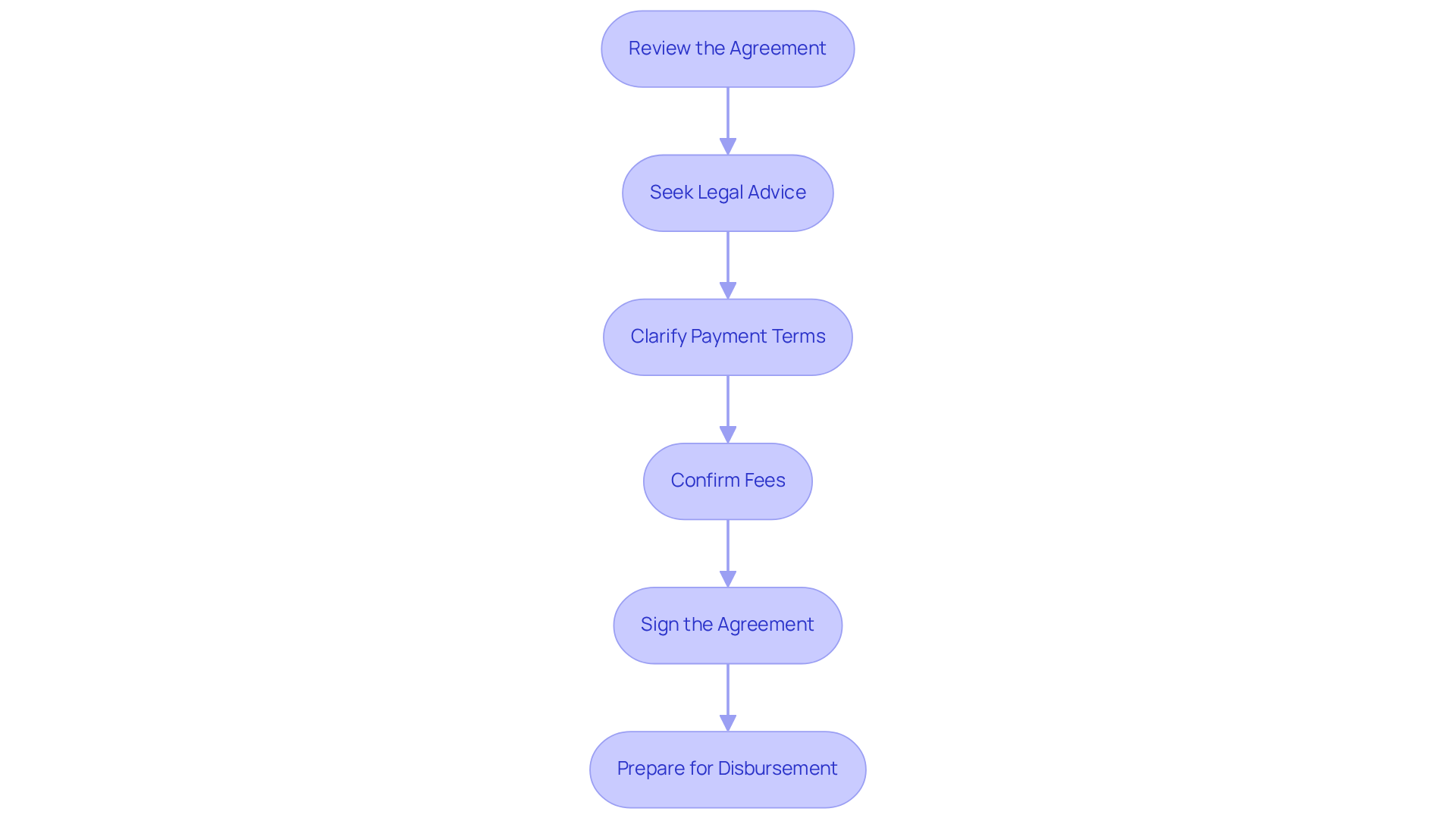

After successfully negotiating your financing terms, it is essential to finalize the agreement with meticulous attention to detail. Follow these steps to ensure a smooth process:

- Review the Agreement: Thoroughly read the entire financing agreement to confirm that all negotiated terms are accurately reflected. This step is crucial, as overlooking details can lead to misunderstandings later.

- Seek Legal Advice: Consulting a legal professional can provide valuable insights into the agreement. They can help identify any potential issues or unfavorable terms that may not be immediately apparent. As Alex Solo, co-founder and principal attorney, highlights, "Legal counsel is essential when negotiating financing agreements, comprehending your obligations, and safeguarding your interests as your business expands."

- Clarify Payment Terms: Ensure you fully understand the repayment schedule, including due dates and any penalties for late payments. Clear comprehension of these terms is vital to avoid unexpected financial strain. Understanding the repayment criteria is particularly crucial when collaborating with various financial institutions, from high street banks to private funding panels, as they may have different requirements.

- Confirm Fees: Verify all fees associated with the financing, such as origination fees, closing costs, and any other charges. Being aware of these expenses aids in effective budgeting. Common fees may include a 1% origination fee and closing costs averaging around $5,000.

- Sign the Agreement: Once you are satisfied with the terms, sign the agreement and keep a copy for your records. This documentation is essential for future reference.

- Prepare for Disbursement: After signing, coordinate with the lender regarding the release of funds and any additional steps required to access your financing.

Finalizing your financial agreement is a critical step that ensures you are fully aware of your obligations and can proceed with confidence. Remember, understanding your repayment terms is not merely a formality; it is a crucial aspect of sustaining financial health and preventing possible pitfalls. As emphasized in numerous case studies, companies that thoroughly examine their loan agreements prior to signing frequently evade expensive errors and secure improved financial results. Additionally, creating polished and individualized business cases to present to lenders can significantly enhance your chances of securing favorable terms.

Conclusion

Securing the best commercial rates for your business is a multifaceted process that demands a thorough understanding of various financial elements. By grasping the intricacies of commercial loan rates, assessing financial needs, researching lenders, preparing documentation, negotiating terms, and finalizing agreements, businesses can strategically position themselves to obtain favorable financing options that align with their goals.

Key insights from this guide underscore the significance of understanding market conditions, types of financing, and factors influencing costs, such as creditworthiness and loan-to-value ratios. Furthermore, effective preparation and negotiation can dramatically impact the terms of the loan, ensuring that businesses not only secure funding but do so in a manner that supports their long-term financial health.

Ultimately, the journey to obtaining the best commercial rates transcends mere fund acquisition; it is about making informed decisions that will drive growth and sustainability. Are you ready to leverage expert insights and resources, such as those offered by Finance Story, to navigate this complex landscape? By taking proactive steps and approaching financing with diligence and clarity, organizations can significantly enhance their chances of achieving optimal outcomes in their commercial endeavors.