Overview

The primary focus of this article is on securing the optimal commercial mortgage loan. To accomplish this, five essential steps are outlined:

- Understanding commercial mortgages

- Preparing a robust financial profile

- Selecting the appropriate lender and loan type

- Negotiating favorable terms

- Finalizing the mortgage application

It is emphasized that thorough preparation and a solid grasp of market conditions can significantly enhance a borrower's chances of success. Are you ready to elevate your financial standing and navigate the complexities of commercial mortgages?

Introduction

Navigating the world of commercial mortgages can be a daunting task for many business owners, particularly due to the unique financial structures and requirements involved. However, with the right knowledge and strategy, securing the best commercial mortgage loan can transform into a manageable endeavor. This guide explores essential steps to understand various loan types and lender expectations while effectively preparing a compelling financial profile.

What challenges might arise during this process?

How can potential obstacles be turned into opportunities for success?

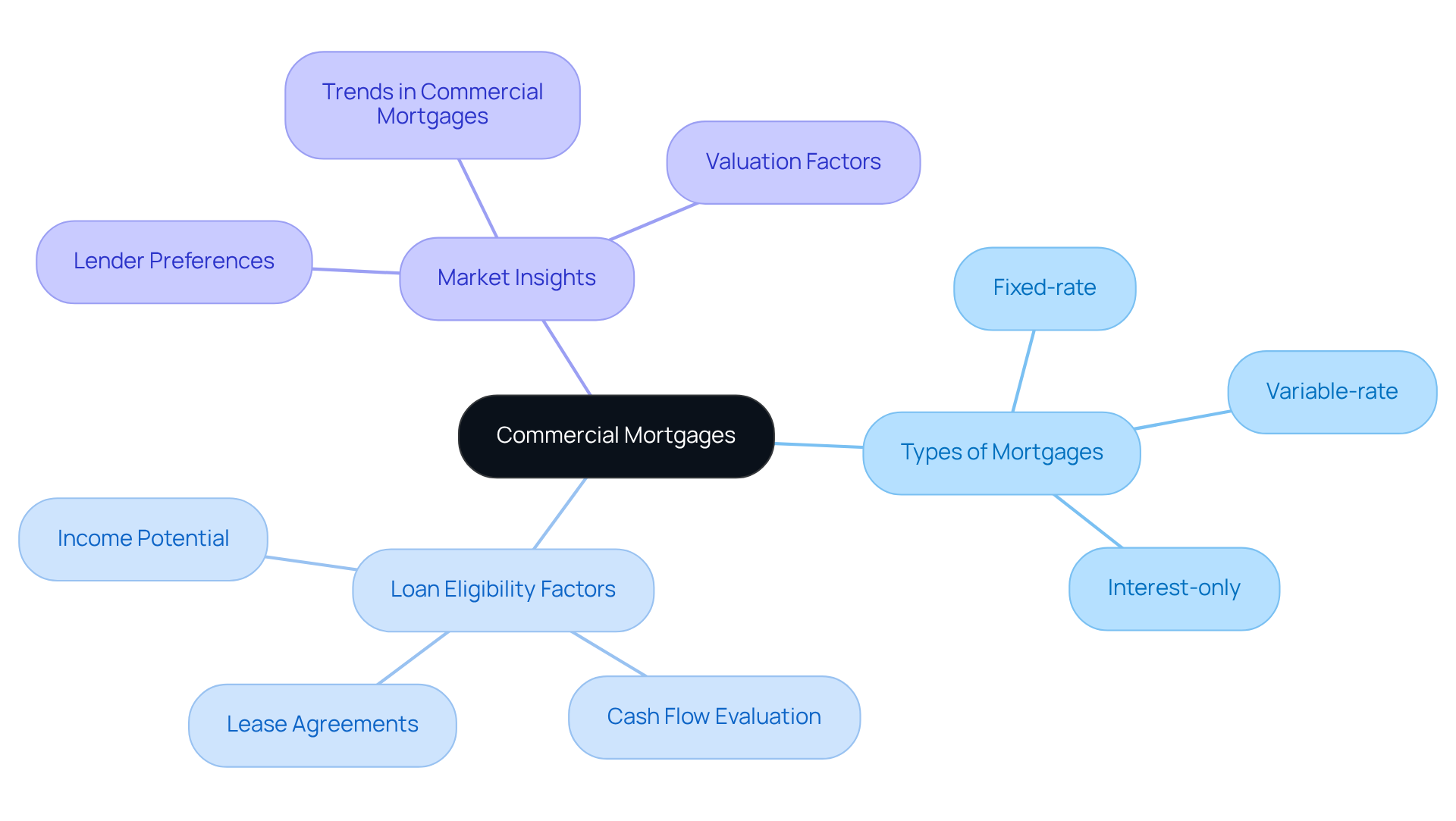

Understand Commercial Mortgages

Commercial financing options represent secured funds specifically designed for properties such as office buildings, retail spaces, and industrial warehouses. Unlike home loans, these financial products typically feature shorter durations and higher interest rates, reflecting the increased risk associated with business lending. In 2025, average interest rates for business loans are expected to remain competitive, with many lenders expressing a desire to expand their business real estate investments despite economic fluctuations.

Understanding the various types of the best commercial mortgage loan is essential for potential borrowers. These include fixed-rate, variable-rate, and interest-only options, each tailored to different financial strategies and risk appetites. For example, fixed-rate mortgages offer stability against interest rate fluctuations, while variable-rate mortgages may present lower initial rates but carry the risk of future increases.

When assessing loan eligibility, lenders place significant emphasis on the income-generating potential of the property. This underscores the importance of a thorough evaluation of the property's cash flow, as it directly influences the decision-making process of the financial institution. Properties with robust rental income and favorable lease agreements are more likely to secure financing.

At Finance Story, we provide access to a wide range of lenders, including high street banks and innovative private lending panels, ensuring you can secure the best commercial mortgage loan for your business financing needs. Additionally, restructuring your business financing can help address the evolving requirements of your enterprise. Familiarizing yourself with these aspects of commercial mortgages will equip you with the knowledge necessary to navigate the complexities of obtaining financing. As the market progresses, staying informed about trends and lender preferences will further enhance your chances of a successful application. For personalized assistance, consider reaching out to Finance Story to develop a tailored financial proposal that meets your specific needs.

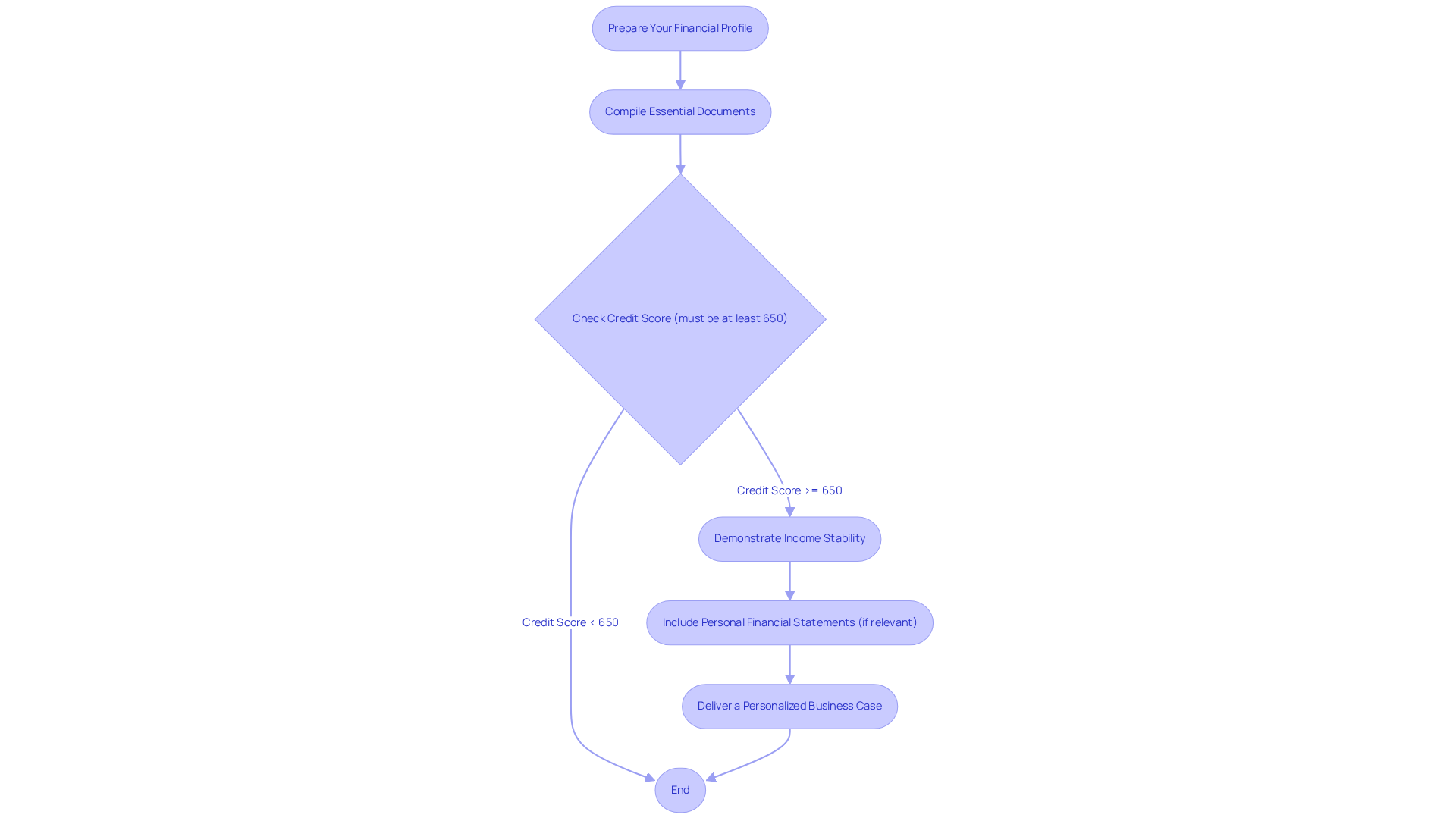

Prepare Your Financial Profile

To effectively prepare your financial profile for a business credit application, begin by compiling essential documents such as:

- Tax returns

- Profit and loss statements

- Balance sheets from the past two years

Lenders typically require a credit score of at least 650, making it crucial to ensure your score is in good standing. At Finance Story, we stress that maintaining a good credit score can greatly affect your chances of obtaining favorable borrowing conditions.

Furthermore, demonstrate income stability by providing documentation of consistent revenue streams. If relevant, include personal financial statements detailing your assets and liabilities. This detailed financial profile not only boosts your credibility but also simplifies the application procedure, improving your likelihood of obtaining favorable credit conditions.

Remember, a well-prepared financial profile is especially crucial for individuals with intricate credit histories, as numerous financial institutions evaluate applications individually. Our expertise in refinancing and securing tailored business loans can help you navigate these requirements effectively.

In addition, delivering a refined and personalized business case to financial institutions can greatly enhance your likelihood of obtaining approval. We collaborate with a variety of financial institutions, including high street banks and private lending groups, to ensure you discover the appropriate funding solution for your property investment.

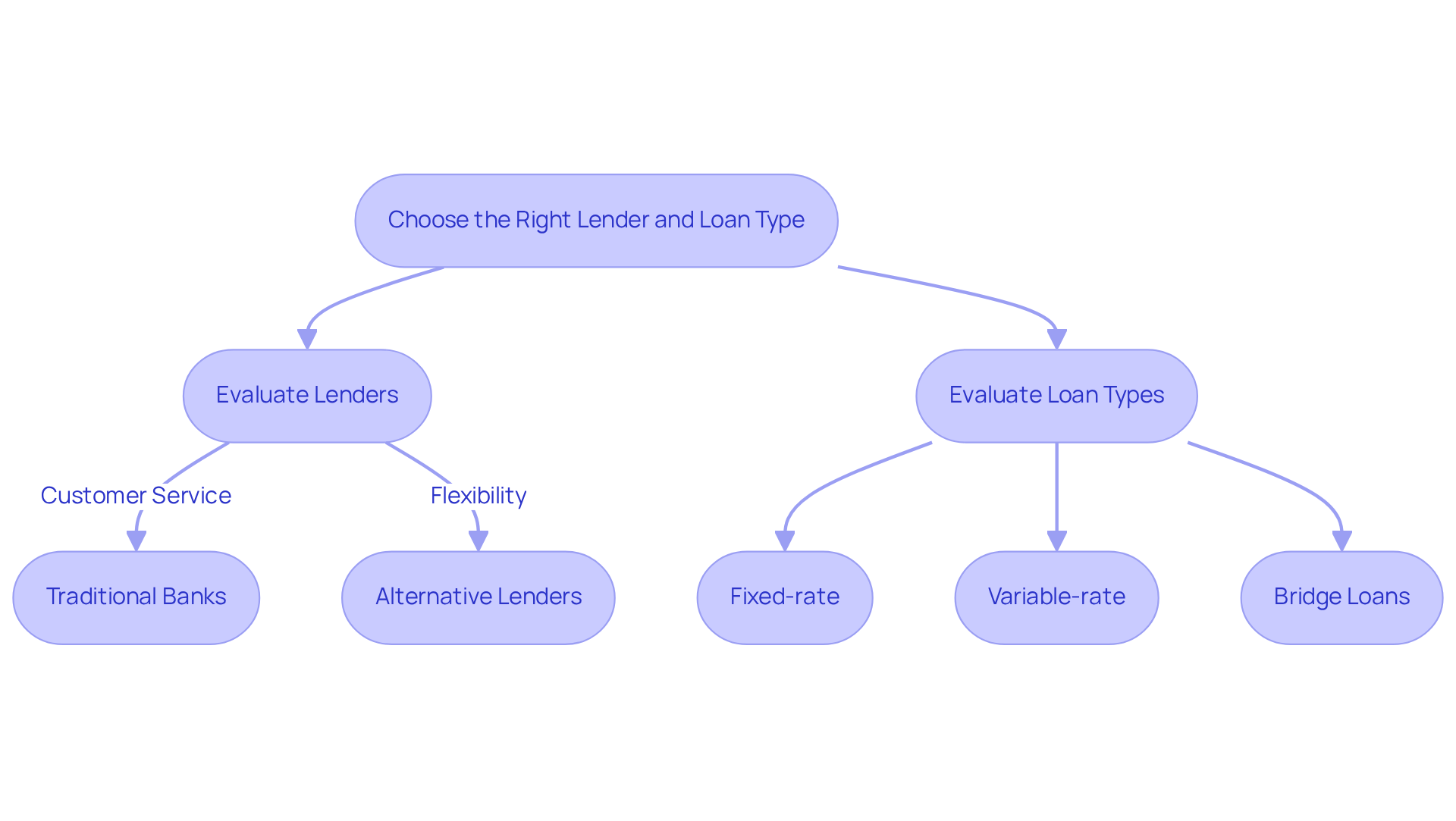

Choose the Right Lender and Loan Type

When selecting a financial institution, consider critical aspects such as their expertise in business financing, the reputation for customer service, and the range of financing products they offer. Have you explored both traditional banks and alternative lenders? Non-bank lenders often provide more flexible terms that may suit your needs better. Evaluate various loan types—fixed-rate, variable-rate, and bridge loans—to identify the best commercial mortgage loan that aligns with your business goals. Furthermore, utilize online comparison tools and consult with a lending advisor to gain valuable insights into the best commercial mortgage loan options available for your specific situation.

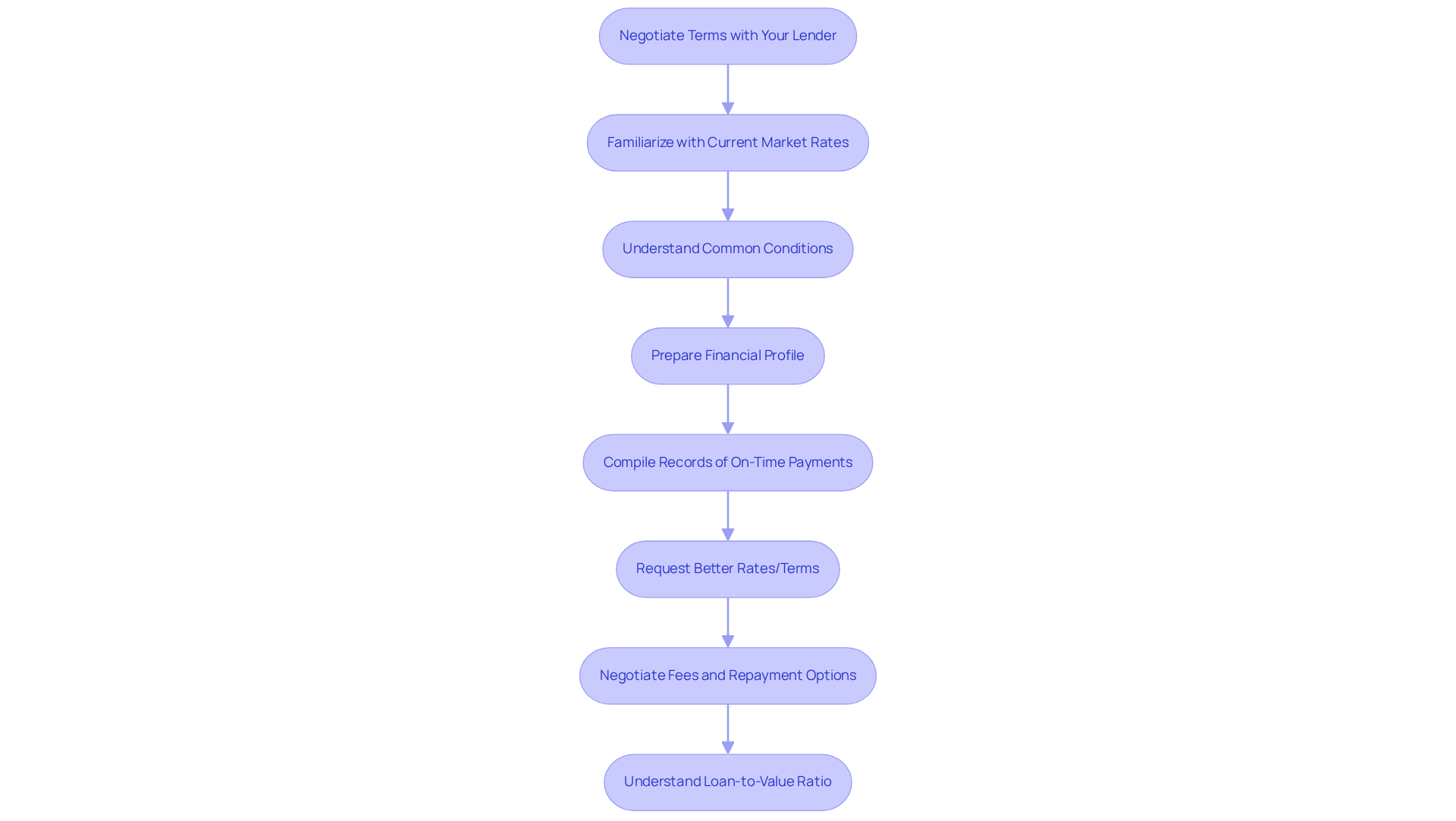

Negotiate Terms with Your Lender

To negotiate terms effectively, it is essential to familiarize yourself with the current market rates for commercial loans in Australia, which, as of July 2025, reflect competitive lending conditions. Understanding the common conditions offered by creditors is crucial, as is preparing to showcase your financial profile, highlighting the strengths of your enterprise and your repayment capacity. At Finance Story, we excel in crafting polished and highly individualized business cases that can significantly enhance your negotiating position with banks.

- Compile records of on-time mortgage payments; this documentation can effectively demonstrate your reliability to the bank.

- Do not hesitate to request better rates or terms; leverage offers from competing lenders as a powerful bargaining tool.

- Furthermore, consider negotiating for reduced fees or more flexible repayment options.

- Understanding your Loan-to-Value Ratio (LVR) is also vital, as lower LVRs typically result in more favorable interest rates.

By implementing these strategies, along with the expertise of Finance Story in securing the best commercial mortgage loan for various commercial properties—such as warehouses, retail premises, factories, and hospitality ventures—you can achieve substantial savings and a more manageable loan structure. Ultimately, this approach will enhance your financial position.

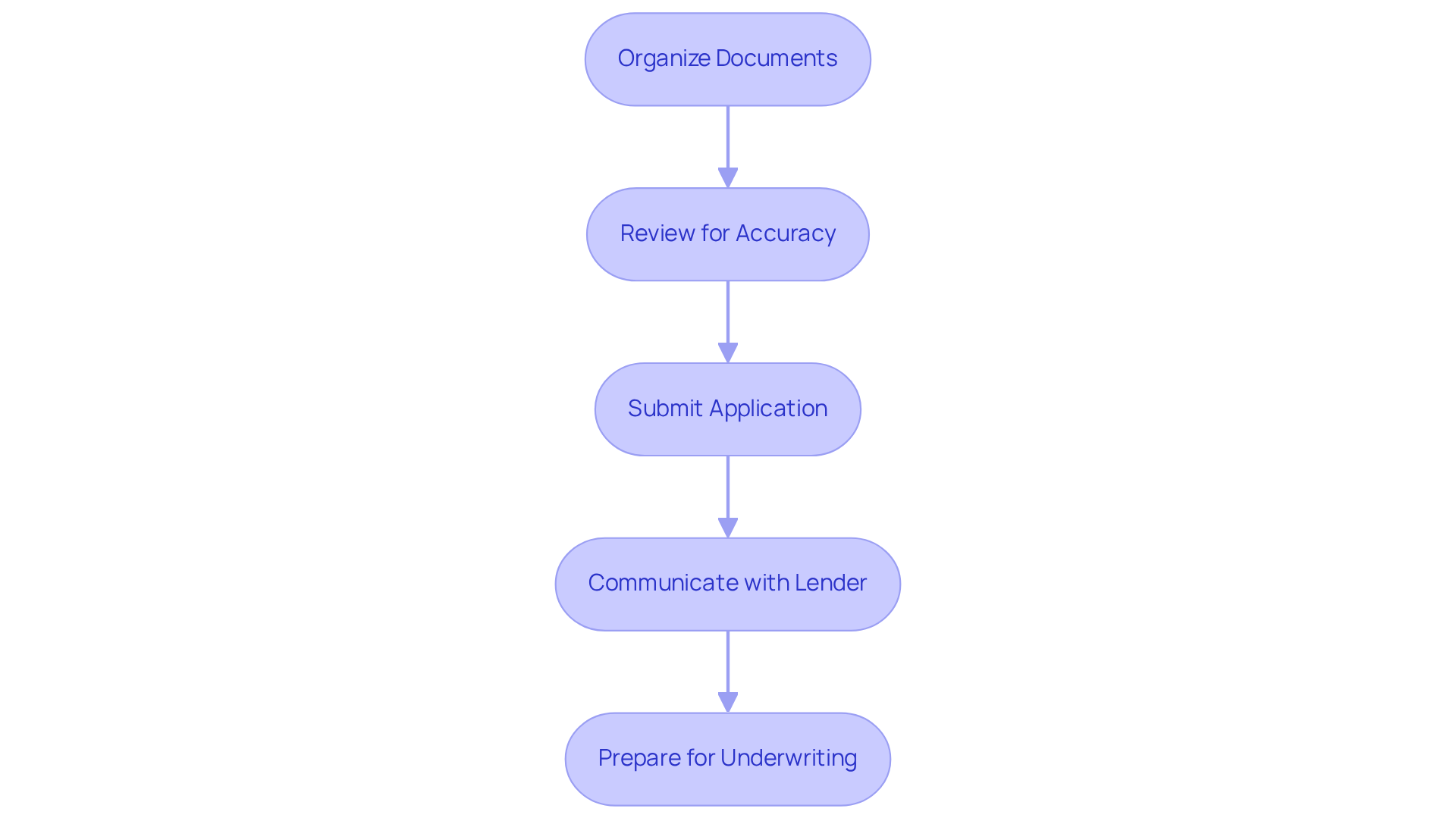

Finalize Your Mortgage Application

Finalizing your mortgage application successfully requires meticulous organization and completion of all necessary documents. This typically includes your financial profile, property specifics, and any additional information requested by the creditor. A thorough review of your application for accuracy and completeness is essential; even minor errors can result in significant delays or outright denials. Once submitted, it is crucial to maintain open communication with your lender to promptly address any questions or requests for further documentation.

At Finance Story, we simplify the process of discussing your next home mortgage. Our personalized assistance allows us to meet with you at a time that fits your busy schedule, helping you identify what matters most regarding your home financing. Prepare for the underwriting process, where the financial institution will evaluate your application in conjunction with the property's value. This stage is critical, as it determines the viability of your loan request. Being well-prepared can significantly enhance your chances of securing favorable terms. By effectively organizing your documents and proactively engaging with your lender, you can navigate the complexities of the mortgage application process with greater ease and confidence.

Conclusion

Securing the best commercial mortgage loan involves a multifaceted process that demands careful consideration and preparation. By comprehensively understanding the types of commercial mortgages available, preparing a robust financial profile, selecting the right lender, negotiating favorable terms, and meticulously finalizing the application, borrowers can significantly enhance their chances of success. Each step is crucial in navigating the complexities of commercial financing, ensuring that businesses can access the capital they need to thrive.

The importance of being informed about current trends, lender preferences, and the specific requirements for commercial loans cannot be overstated. Key insights highlight the necessity of:

- A solid financial profile

- The advantages of exploring various lenders

- The value of negotiation in securing better terms

As the market landscape evolves in 2025, understanding these dynamics empowers borrowers to make strategic decisions that align with their financial goals.

Ultimately, the journey to obtaining a commercial mortgage transcends merely securing funds; it is about laying a strong foundation for future business success. By actively engaging in each step of the process and utilizing available resources, businesses can position themselves for favorable outcomes. Those navigating this landscape should consider seeking expert guidance, tailoring their approach to ensure they are well-equipped to make informed decisions in a competitive lending environment.