Overview

This article presents a structured approach to securing SMSF financing for businesses, highlighting the critical need to understand SMSF loans, establish a self-managed super fund, and develop a robust investment strategy. It offers a comprehensive step-by-step guide for applying for financing, addressing potential challenges along the way. Furthermore, it underscores the benefits of leveraging superannuation for commercial real estate investments, thereby enhancing financial control and maximizing potential returns.

Introduction

In the realm of investment, Self-Managed Super Funds (SMSFs) have emerged as a powerful tool for individuals seeking to take control of their financial future. By enabling the borrowing of funds for commercial property investments, SMSFs not only offer enticing tax advantages but also provide a unique opportunity for diversification and enhanced returns. However, navigating the complexities of SMSF loans can be daunting, particularly for those unfamiliar with the regulatory landscape.

From establishing a fund to developing a robust investment strategy and successfully applying for financing, understanding the intricacies of SMSFs is essential for business owners aiming for growth and expansion. This article delves into the essential steps and strategies to leverage SMSFs effectively, ensuring compliance and maximizing potential returns in the dynamic world of commercial property investment.

Understand SMSF Loans and Their Benefits

SMSF financing empowers individuals to leverage their superannuation for acquiring commercial real estate, including office buildings, warehouses, and retail spaces. These loans offer several compelling advantages:

- Tax Advantages: Significant tax benefits arise from these loans, as income generated from acquisitions is taxed at a reduced rate within the superannuation fund. This can lead to considerable savings over time, enhancing overall returns on your assets.

- Control Over Assets: Borrowing through a self-managed super fund grants you greater control over your financial decisions, enabling you to tailor your portfolio in alignment with your specific financial objectives and risk appetite.

- Diversification: These loans encourage diversification of your asset portfolio, which is crucial for mitigating risks associated with reliance on a single asset class. This strategy can bolster stability and potential gains.

- Possibility for Greater Gains: Investing in commercial real estate through your self-managed super fund can yield higher returns compared to traditional financial avenues. Recent trends indicate that self-managed superannuation funds have thrived, with over 65 percent of these funds operating for more than a decade, showcasing their resilience and effectiveness in capitalizing on market opportunities.

Finance Story is dedicated to assisting you in navigating the complexities of self-managed superannuation fund commercial real estate ventures. We provide expert guidance to ensure compliance with regulations and help you find the right lender for your commercial investment property. Understanding these advantages is essential for business owners contemplating SMSF financing as a strategic avenue for growth and expansion. BOOK A CHAT to explore how we can support you.

Establish Your Self-Managed Super Fund

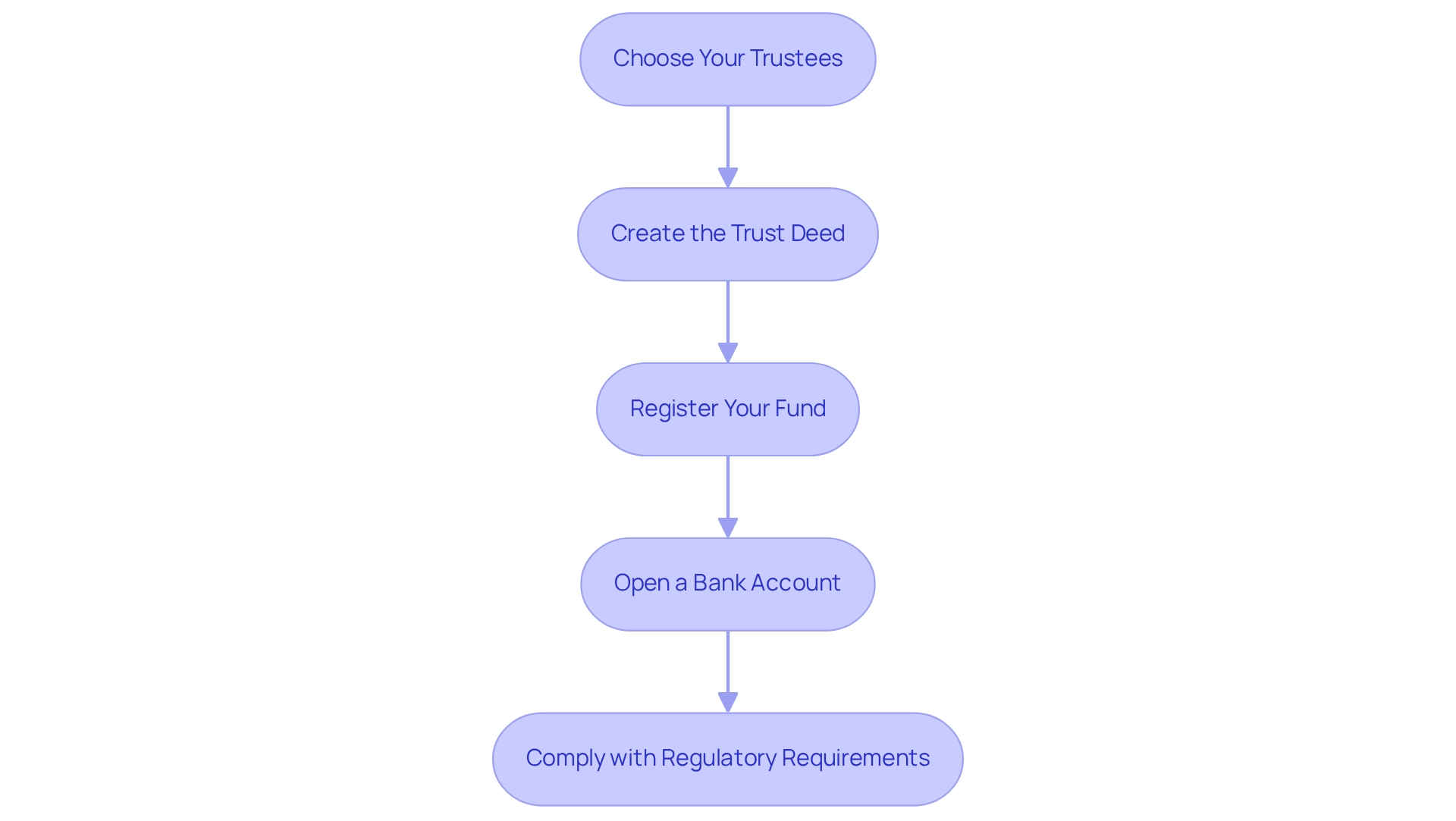

To establish your Self-Managed Superannuation Fund in 2025, follow these essential steps:

- Choose Your Trustees: Decide if your self-managed super fund will operate with individual trustees or a corporate trustee. Each option has distinct legal responsibilities and implications that should align with your financial objectives.

- Create the Trust Deed: Draft a comprehensive trust deed that outlines the operational rules of your self-managed super fund. This document must comply with current superannuation laws and regulations to ensure adherence.

- Register Your Self-Managed Superannuation Fund: Register your self-managed superannuation fund with the Australian Taxation Office (ATO) to obtain an Australian Business Number (ABN) and a Tax File Number (TFN), both of which are crucial for tax purposes.

- Open a Bank Account: Establish a dedicated bank account for your self-managed superannuation fund. This will facilitate the management of its funds and transactions, ensuring a clear financial separation from personal accounts.

- Comply with Regulatory Requirements: Ensure adherence to all compliance obligations, including conducting annual audits and fulfilling reporting requirements, to maintain the integrity and legality of your self-managed superannuation fund.

Completing these steps is vital for the effective operation of your self-managed superannuation fund and for accessing SMSF financing, particularly for commercial real estate ventures, which have fewer restrictions compared to residential real estate. Finance Story can assist you in building a solid case and ensuring compliance with regulations, helping you locate the appropriate lender for your commercial real estate.

Develop an Investment Strategy for Your SMSF

Developing an effective financial plan for your SMSF financing is essential for achieving your financial objectives. Here are five essential steps to guide you:

- Define Your Goals: Begin by clearly outlining your financial objectives. Are you aiming for capital growth, income generation, or a combination of both? Specific goals will significantly influence your financial decisions.

Assess Risk Tolerance: Understanding your risk appetite is crucial. How much risk are you willing to accept? This assessment will impact the types of assets that align with your comfort level. Current trends indicate that average risk tolerance levels for SMSF investors in Australia are evolving, with many seeking balanced approaches to mitigate potential losses. - Diversify Investments: A diversified portfolio is key to reducing risk. Plan to spread your investments across various asset categories, including real estate, stocks, and fixed income. This strategy not only enhances potential returns but also provides protection against market volatility.

- Document Your Strategy: Writing down your financial plan is essential. Include the types of assets you intend to invest in and the rationale behind your choices. This documentation serves as a guide for your self-managed super fund, illustrating to lenders your organized approach to managing assets through SMSF financing.

Review Regularly: The economic landscape is dynamic; therefore, it’s vital to frequently assess and refresh your asset strategy. Adjustments may be necessary to reflect changes in market conditions or personal circumstances, ensuring your approach remains aligned with your objectives.

A well-organized financial strategy not only directs your fund's financial decisions but also builds trust among lenders regarding your fiscal management skills. By adhering to these steps, you can position your fund for success in achieving your financial goals.

Apply for SMSF Financing: Step-by-Step Process

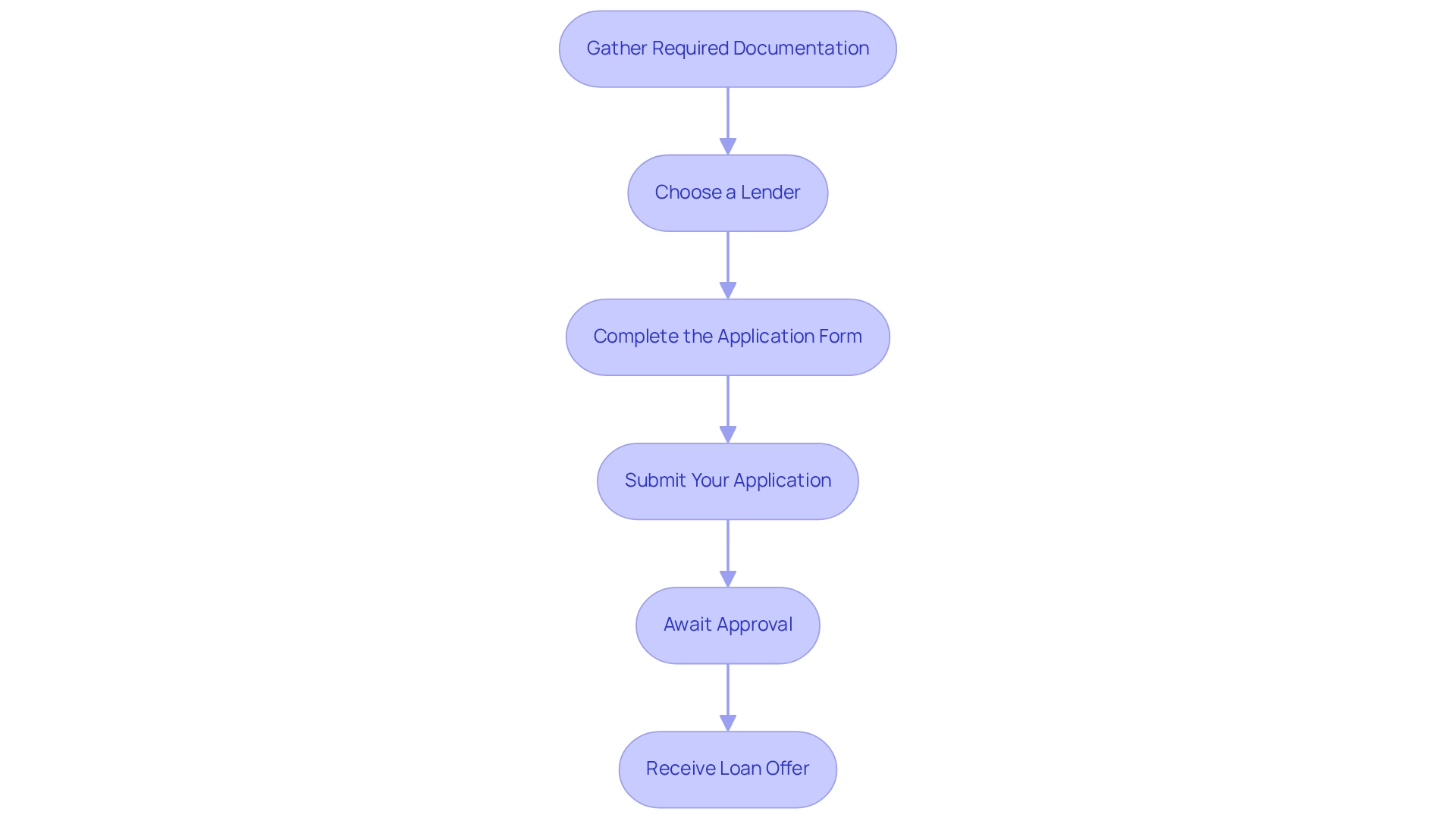

To successfully apply for SMSF financing for commercial property investments, follow these structured steps:

-

Gather Required Documentation: Assemble essential documents, including your self-managed superannuation fund trust deed, account statements, and investment strategy. This foundational paperwork is crucial for a smooth application process.

-

Choose a Lender: Conduct thorough research to identify lenders focusing on self-managed superannuation fund loans. Evaluate their terms, interest rates, and fees to find the best fit for your financial needs. Given the current self-managed superannuation fund lending market, characterized by fewer mainstream participants and elevated interest expenses, meticulous choice is essential.

-

Complete the Application Form: Accurately fill out the lender's application form, ensuring all requested information about your self-managed super fund and the intended investment is provided. Attention to detail here can prevent delays.

-

Submit Your Application: Forward your completed application along with the gathered documentation to the lender for review. Ensure that everything is in order to facilitate a swift assessment.

-

Await Approval: The lender will assess your application, which may involve a real estate or asset valuation. Be prepared to respond to any additional inquiries they may have during this stage. Notably, the typical processing duration for self-managed superannuation fund loans can frequently require 4 to 6 weeks due to their intricacy, so strategize appropriately to prevent issues in your financial arrangements.

-

Receive Loan Offer: Upon approval, carefully review the loan offer, paying close attention to the terms and conditions before accepting. Expert advice can greatly simplify the property loan process for self-managed super funds and improve the chances of success.

By following these steps, you can simplify the SMSF financing application process, significantly enhancing your chances of success. To further assist you, schedule your free personalized consultation with Finance Story's Head of Funding Solutions, Shane Duffy. Discuss your needs and objectives, and allow us to assist you in navigating the superannuation fund landscape effectively. As Simon Conolly, Senior Manager in our Business Services team, remarked, "It’s hard to overlook the significant alterations made to the superannuation system in July 2007," emphasizing the importance of remaining knowledgeable about the changing landscape of self-managed super funds.

Navigate Challenges in the SMSF Loan Application

Navigating the SMSF financing loan application process can present several challenges. Here’s how to effectively address them:

- Understanding Lender Requirements: Lenders have distinct criteria for SMSF loans, which can vary significantly. Familiarizing yourself with these requirements is crucial to prevent delays in your application.

- Asset Valuation Challenges: A frequent obstacle emerges when asset valuations do not meet expectations. Be prepared to negotiate with lenders or explore alternative properties that meet valuation standards.

- Compliance Concerns: Ensuring your self-managed super fund adheres to all regulatory requirements is vital. Regular audits and meticulous documentation can help mitigate complications during the application process, safeguarding against potential breaches. Finance Story can help you build a solid argument and ensure adherence to regulations, which is essential for a successful application.

- Monetary Condition of Your Fund: Lenders will examine the economic stability of your fund. Keeping accurate monetary records and ensuring your fund is well-capitalized are crucial steps to improve your application’s viability.

- Seek Professional Advice: If challenges arise, consulting with a financial advisor or mortgage broker specializing in self-managed super fund loans can be invaluable. Their expertise can guide you through complex situations and improve your chances of securing SMSF financing.

By proactively addressing these challenges, you can significantly enhance your likelihood of a successful SMSF financing loan application. Utilizing SMSFs for commercial real estate investments offers benefits such as tax advantages and investment flexibility, which can be pivotal in your decision-making process. Furthermore, strategic considerations regarding the property's long-term value and ease of selling or transitioning into a pension should not be overlooked. As the landscape of SMSF establishments evolves, particularly with New South Wales accounting for 36.9% of new SMSFs, understanding these dynamics can further inform your approach.

Conclusion

Self-Managed Super Funds (SMSFs) offer a compelling opportunity for individuals eager to take control of their financial future through strategic investments in commercial properties. By leveraging SMSF loans, investors can unlock significant tax advantages, enhance control over their investments, and diversify their portfolios to mitigate risks. Establishing an SMSF requires careful planning, including:

- Selecting trustees

- Drafting a compliant trust deed

- Adhering to regulatory requirements

Each step lays the groundwork for successful property investment.

Developing a robust investment strategy is equally crucial. This strategy guides SMSF members in:

- Defining their goals

- Assessing risk tolerance

- Ensuring diversification across asset classes

Such a strategic approach positions the SMSF for potential higher returns while instilling confidence in lenders regarding the fund's management capabilities.

The application process for SMSF financing can be intricate, necessitating:

- Thorough documentation

- Careful lender selection

- A keen understanding of lender requirements

By addressing common challenges—such as property valuation issues and compliance concerns—investors can significantly improve their chances of securing financing. Additionally, seeking professional guidance can streamline the process, ensuring all regulatory obligations are met.

In summary, navigating the SMSF landscape demands diligence and informed decision-making. However, the benefits of utilizing SMSFs for commercial property investments are substantial. With the right strategy and support, business owners can effectively leverage SMSFs to foster growth and expand their investment horizons, paving the way for a prosperous financial future.