Overview

The article outlines five essential steps for successfully securing business loans in Queensland:

- Understanding loan options

- Checking eligibility

- Gathering required documentation

- Completing the application process

- Troubleshooting common application issues

Each step is supported by detailed explanations and strategies. This approach emphasizes the importance of thorough preparation and informed decision-making, ultimately enhancing the chances of loan approval for small enterprises.

Introduction

In Queensland, securing a business loan is a journey filled with both excitement and challenges, especially given the diverse array of financing options available. Entrepreneurs must navigate between secured loans, which require collateral, and unsecured loans, which provide greater accessibility. Understanding the nuances of each type is essential for those looking to drive their business growth.

As the financial landscape evolves, particularly with small and medium enterprises increasingly relying on borrowing, it becomes vital to master eligibility requirements, gather necessary documentation, and navigate the application process. These steps are crucial in ensuring financial success.

This article explores various loan options, eligibility criteria, and best practices, empowering business owners in Queensland to make informed decisions and secure the funding they require.

Understand QLD Business Loan Options

In Queensland, enterprises have access to a diverse array of qld business loans tailored to meet their specific needs. The primary types include:

- Secured Financing: These financial products require collateral, such as property or equipment, which can lead to lower interest rates. However, this also means that assets are at risk if repayments are not maintained.

- Unsecured Loans: Unlike secured loans, these do not require collateral, making them more accessible. However, they typically come with higher interest rates and stricter eligibility criteria, reflecting the increased risk to lenders.

- Company Overdrafts: This service enables companies to withdraw beyond their account balance, offering crucial flexibility for handling cash flow, particularly during uncertain financial times.

- Equipment Financing: Specifically designed for purchasing equipment, this type of loan can be secured against the equipment itself, enabling enterprises to acquire necessary tools without significant upfront costs.

- Government Grants and Loans: Various programs are available to support small enterprises, including grants that do not require repayment, offering a valuable resource for funding without the burden of debt.

Comprehending these choices is essential for selecting the appropriate qld business loans to meet your enterprise's growth and operational requirements. Significantly, as of 2025, the environment for secured and unsecured loans in Queensland reveals a trend where small enterprises increasingly depend on qld business loans to maintain operations. The total outstanding debt held by SMEs continues to rise despite economic challenges, underscoring the importance of informed decision-making when navigating qld business loans.

Finance Story focuses on developing refined and highly customized proposals to present to financiers, ensuring that small enterprise owners can obtain the appropriate funding for their requirements. We offer a full range of lenders, including high street banks and innovative private lending panels, to suit various circumstances. It's crucial to recognize that 50% of women-owned small enterprises had never sought external funding in 2020 or earlier, underscoring a notable demographic that could gain from comprehending these options more thoroughly. As Prime Minister Anthony Albanese stated, "Small enterprises are the backbone of our economy." We must ensure they have access to fair and sustainable financing options. Moreover, small enterprise owners should be mindful of their repayment responsibilities, which generally necessitate a minimum payment of 1/18 of the original balance every 60 days. Comprehending the underwriting process, where lenders evaluate financial risk before providing funding, is also crucial for navigating the lending landscape effectively. Insights from the report titled "Overall SME Lending Landscape" indicate that despite economic challenges, the total outstanding debt held by SMEs has increased, underscoring the continued reliance on borrowing to sustain operations.

Check Eligibility Requirements

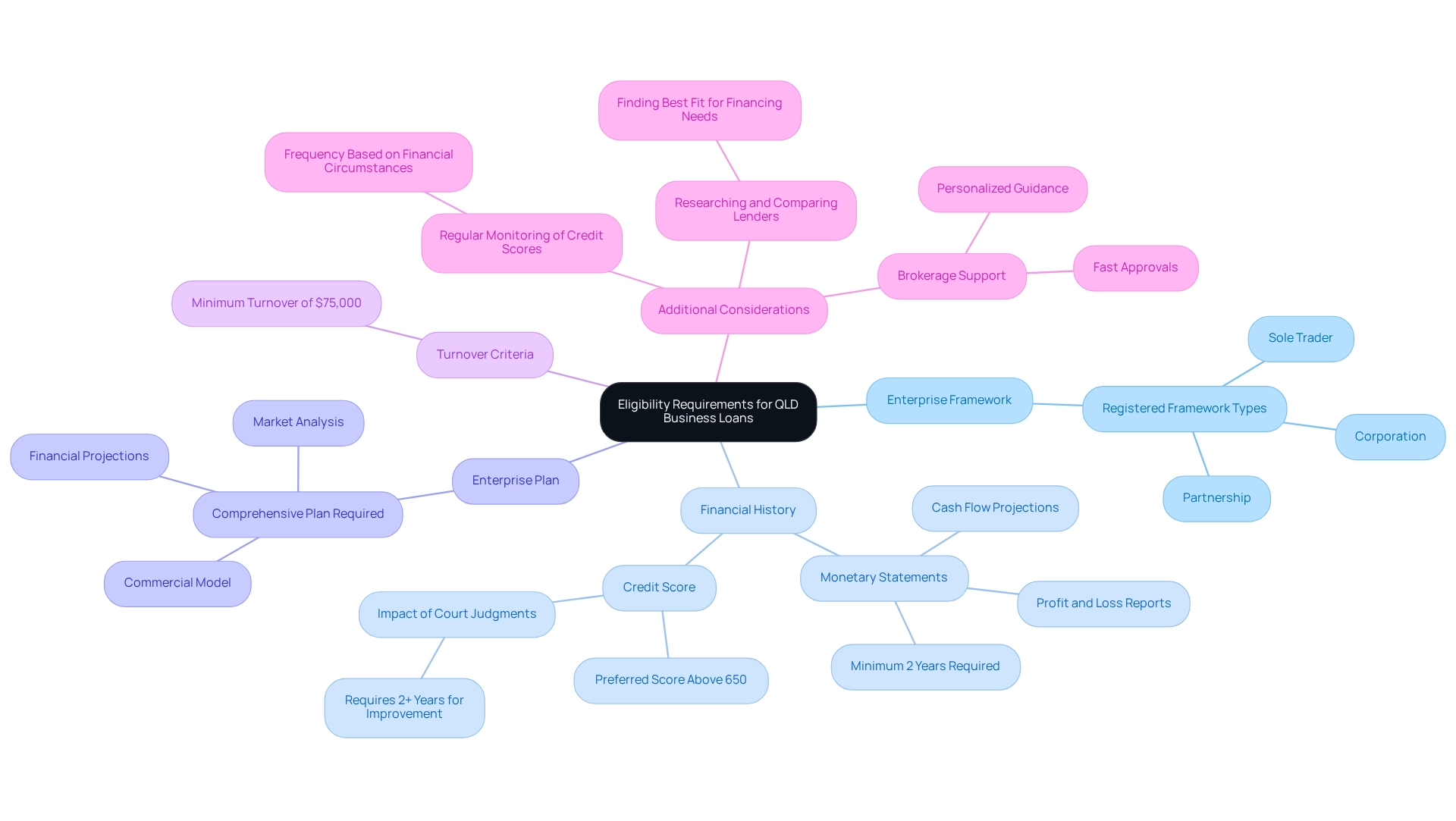

Before seeking qld business loans in Queensland, it is essential to confirm that you satisfy the following eligibility criteria:

-

Enterprise Framework: A registered enterprise framework is necessary, such as a sole trader, partnership, or corporation.

Credit Score: A strong credit score is vital; most lenders prefer a score above 650, as this significantly impacts loan approval chances. It’s important to note that public record impacts from court judgments typically require over two years to show significant improvement, so planning ahead is essential. -

Financial History: Lenders usually request a minimum of two years of monetary statements, including profit and loss reports and cash flow projections, to evaluate your company’s economic health. This is where Finance Story’s expertise in crafting refined and personalized proposals can be invaluable, assisting you in presenting a persuasive monetary history to lenders.

Enterprise Plan: A comprehensive enterprise plan that outlines your commercial model, market analysis, and financial projections is often required to demonstrate your strategic vision. Collaborating with Finance Story can improve your strategy, ensuring it meets the heightened expectations of lenders.

Turnover Criteria: Numerous financial institutions set minimum turnover criteria, typically near $75,000 each year, to verify that your business can manage loan repayments. Understanding these criteria is essential, and Finance Story can provide insights into how to meet them effectively, particularly for those interested in qld business loans.

Furthermore, Finance Story offers access to a full range of lenders, including high street banks and private lending panels, which can cater to various commercial properties such as warehouses, retail premises, factories, and hospitality ventures. By verifying these requirements in advance, you can streamline your application process for qld business loans and enhance your likelihood of securing funding. Consistent tracking of your credit score is also advised, as efficient credit management requires ongoing observation with frequency based on your economic situation. Understanding your financial standing is essential for effective credit management. Additionally, researching and comparing different lenders can lead to more favorable terms and conditions, ensuring you find the best fit for your financing needs. The brokerage emphasizes quick approvals and tailored support for financial applications, which can greatly simplify the process.

Gather Required Documentation

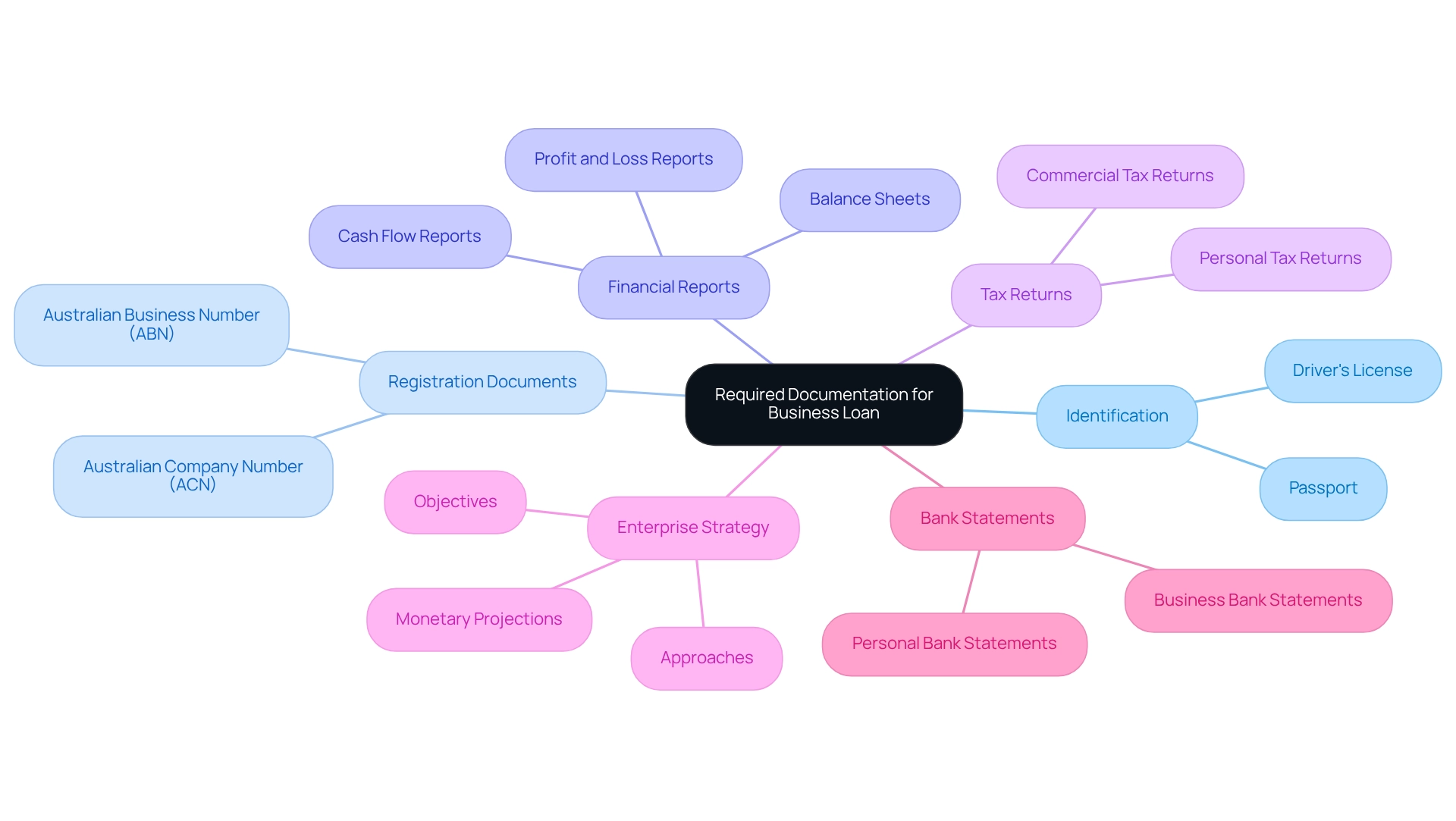

To successfully apply for a business loan in Queensland, it is crucial to gather the following documentation:

- Identification: Personal identification, such as a driver's license or passport, is essential for verifying your identity.

- Registration Documents: Provide proof of your enterprise's legal structure, including your Australian Business Number (ABN) or Australian Company Number (ACN).

- Financial Reports: Gather recent profit and loss reports, balance sheets, and cash flow reports for the last two years to showcase your company's economic well-being.

- Tax Returns: Include personal and commercial tax returns for the prior two years, as these documents reflect your economic history and compliance.

- Enterprise Strategy: A thorough enterprise strategy detailing your objectives, approaches, and monetary projections is essential for lenders to comprehend your vision and potential.

- Bank Statements: Recent bank statements for both personal and professional accounts provide insight into your cash flow and financial management.

Arranging these documents beforehand will simplify the application process, possibly shortening the typical duration required to collect essential paperwork. Furthermore, guaranteeing that all documentation is precise and thorough can greatly improve your chances of a successful application, as rejected financial requests may adversely affect future credit scores. As one expert noted, "Interest rates vary depending on your situation as not all businesses are alike. There are no hidden costs and fees; all details will be listed out clearly before there is any commitment." This emphasizes the significance of comprehending borrowing conditions before applying.

Furthermore, engaging a finance broker like Finance Story can increase the likelihood of qld business loans approval and assist borrowers in securing better rates. Our expertise in creating polished and highly customized cases ensures that your proposal meets the heightened expectations of lenders. By adhering to these best practices, you can navigate the economic landscape more effectively and position your enterprise for success.

Complete the Loan Application Process

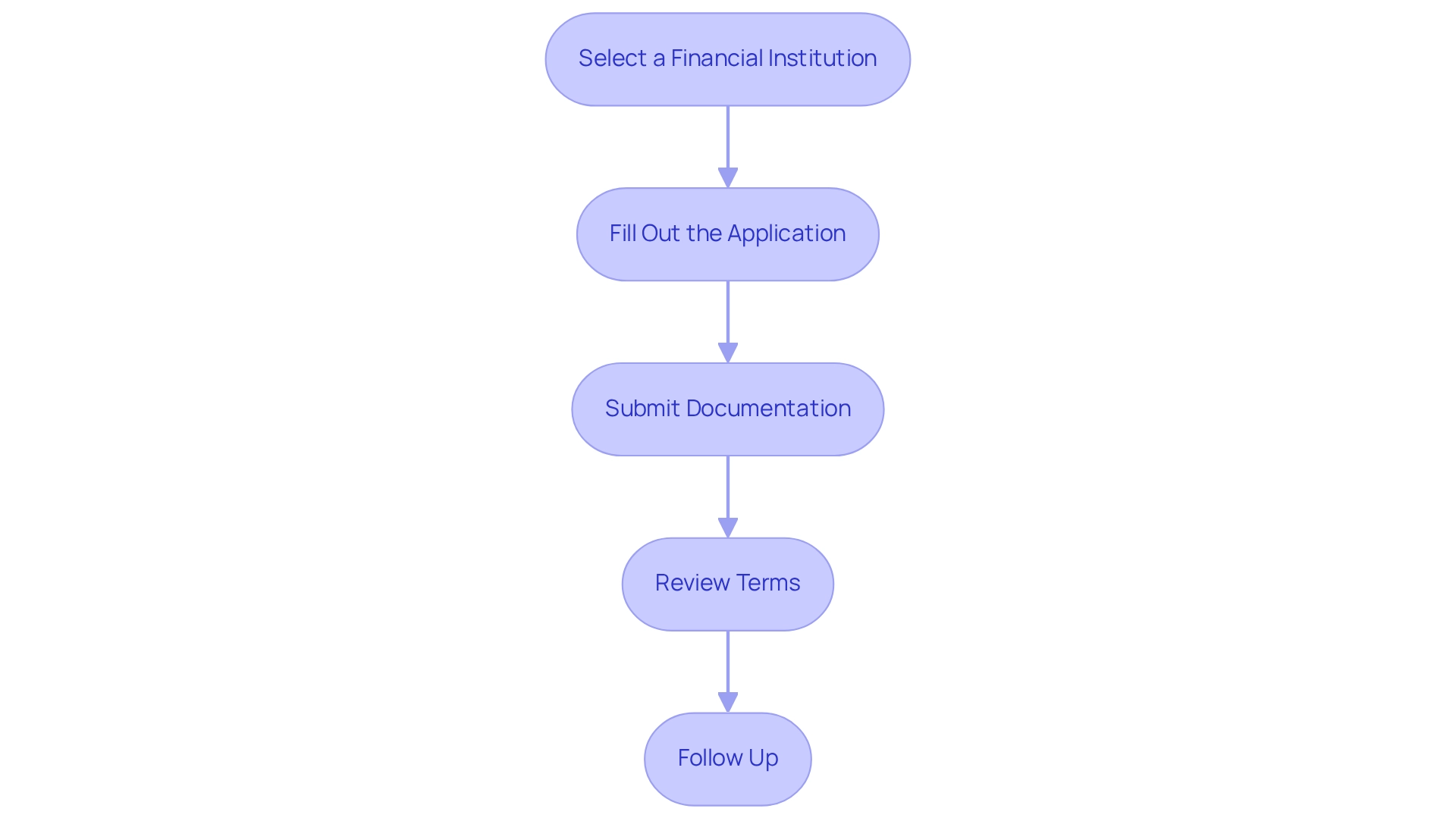

To successfully complete your business loan application in Queensland, follow these essential steps:

-

Select a Financial Institution: Conduct thorough research to identify an organization that aligns with your financial needs and offers favorable terms. Consider factors such as interest rates, fees, and customer service reputation. With the value of new loan commitments for property purchases hitting $20.53 billion in December 2024, choosing the right financial institution for qld business loans is more vital than ever.

-

Fill Out the Application: Accurately complete the provider's application form, ensuring that all information is current and truthful. This step is crucial, as discrepancies can delay the process.

-

Submit Documentation: Collect and include all necessary documents, such as financial statements, business plans, and identification, as outlined by the financial institution. Comprehensive documentation can streamline the approval process.

-

Review Terms: Carefully examine the loan terms, including interest rates, repayment schedules, and any associated fees. Understanding these details will help you make informed decisions about your financing options. As Anna Bligh, CEO of the Australian Banking Association, noted, "This Budget provides extra support to Australians in the short-term whilst at the same time helping to address some of our longer-term challenges," highlighting the importance of adapting your financing strategies in the current economic climate.

-

Follow Up: After submitting your application, proactively follow up with the lender to confirm receipt and inquire about the timeline for a decision. This demonstrates your commitment and can help expedite the process.

To further enhance your financing strategy, consider scheduling a free personalized consultation with Finance Story's Head of Funding Solutions, Shane Duffy. This meeting can offer customized insights into your particular needs and objectives, whether for commercial or home financing. By diligently following these steps and leveraging expert advice, you can significantly enhance your chances of securing qld business loans for your entrepreneurial endeavors. Additionally, comprehending regional differences in lending practices, such as those emphasized in case studies on average credit amounts by state, can further guide your approach and enhance your application strategy.

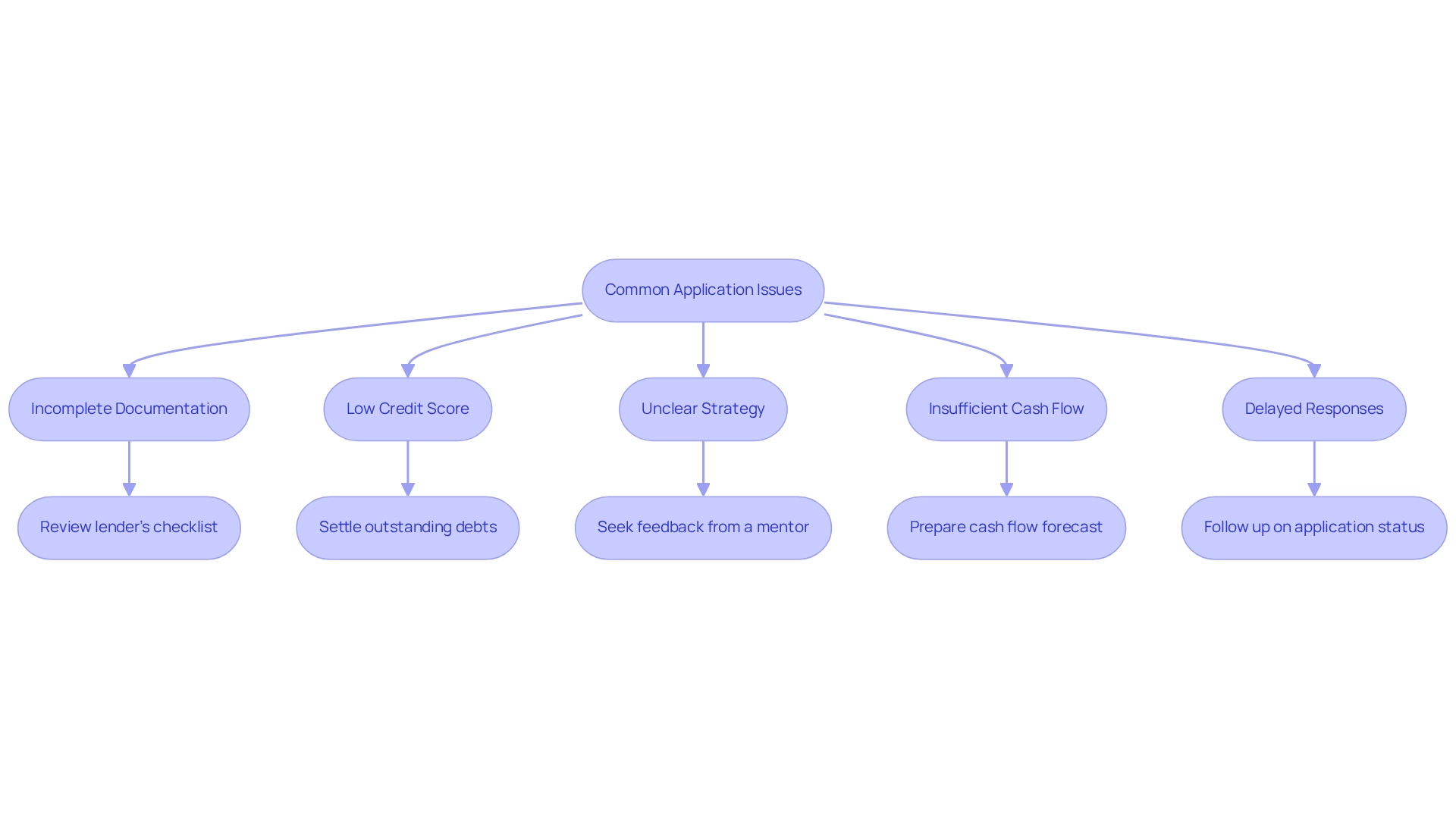

Troubleshoot Common Application Issues

Navigating the qld business loans application process can be challenging for small enterprise owners in Queensland. However, by addressing common issues with effective troubleshooting tips, you can significantly enhance your chances of securing financing:

- Incomplete Documentation: Review the lender's checklist meticulously to ensure all required documents are submitted. Missing paperwork can lead to significant delays in your application. At Finance Story, we specialize in crafting polished and highly individualized business cases to present to banks, ensuring your documentation is both comprehensive and compelling.

- Low Credit Score: A low credit score can impede your application. To improve it, focus on settling outstanding debts and rectifying any inaccuracies on your credit report. This proactive approach can yield better loan terms. As financial advisor Suze Orman wisely states, "When you understand that your self-worth is not determined by your net-worth, then you’ll have financial freedom," underscoring the importance of managing your financial health.

- Unclear Strategy: A well-defined plan is essential. If your strategy lacks clarity, consider seeking constructive feedback from a mentor or consultant. A solid financial strategy can foster trust among creditors. Our expertise at Finance Story can assist you in refining your business case to meet the heightened expectations of financial institutions.

- Insufficient Cash Flow: Demonstrating your capacity to manage repayments is crucial. Prepare a detailed cash flow forecast that outlines your income and expenses, showcasing your financial stability. This becomes especially vital when engaging with a diverse range of financial institutions, including high street banks and innovative private lending panels, as we facilitate at Finance Story.

- Delayed Responses: If you find yourself waiting for feedback from the financial institution, do not hesitate to follow up politely. Inquiring about your application status demonstrates your commitment and can help expedite the process.

Research indicates that approximately 60 percent of sole traders are still operating after four years, highlighting the importance of securing qld business loans to support growth and sustainability. Additionally, consider exploring non-bank lenders that have emerged, offering customized financing and services to SMEs, often leveraging new technologies to assess creditworthiness and expedite access to funds. By proactively addressing these common challenges, you can significantly improve your chances of a successful loan application.

Conclusion

In Queensland, grasping the business loan landscape is crucial for entrepreneurs eager to foster growth. Various options exist, from secured loans that necessitate collateral to unsecured loans that provide easier access, alongside specialized facilities like business overdrafts and equipment financing. Each choice presents unique benefits and challenges. Additionally, government grants offer valuable support without the burden of repayment, underscoring the necessity of informed decision-making in financing.

Securing a loan hinges on meeting eligibility requirements. Lenders typically seek a registered business structure, a robust credit score, and comprehensive financial documentation. A meticulously prepared business plan can significantly elevate approval chances by showcasing the business's strategic vision and financial health.

Gathering the necessary documentation and adhering to a structured application process are vital steps in acquiring funding. Essential documents, such as identification, financial statements, and tax returns, must be meticulously organized. Engaging with lenders and scrutinizing loan terms can clarify conditions and expedite the approval process.

Ultimately, by comprehending loan options, satisfying eligibility criteria, and managing the application process effectively, business owners can enhance their prospects for financial success. Staying informed and adaptable in this evolving landscape is paramount for unlocking the funding required to thrive in today’s competitive market. Proactive preparation and expert guidance can further amplify opportunities for securing the financing essential to propel business growth.