Overview

The article delineates five essential steps for securing business finance loans in Australia. These steps encompass:

- Understanding various loan types

- Gathering necessary documentation

- Accurately completing the application

- Navigating the lender evaluation process

- Effectively managing the loan application

Each step is bolstered by practical advice and insights into the lending landscape, underscoring the significance of thorough preparation and proactive communication with lenders to enhance the likelihood of loan approval.

Introduction

In the dynamic landscape of Australian business finance, comprehending the array of loan options available is essential for companies striving to excel. From traditional term loans that facilitate significant investments to flexible lines of credit that assist in managing cash flow, each financing solution serves a distinct purpose.

With statistics indicating that a considerable percentage of businesses depend on these loans for growth, navigating the intricacies of the lending process can be overwhelming. This article explores the various types of business finance loans, outlines the essential documentation required for applications, and presents strategic steps to enhance approval chances. By doing so, it empowers businesses to make informed financial decisions that align with their growth aspirations.

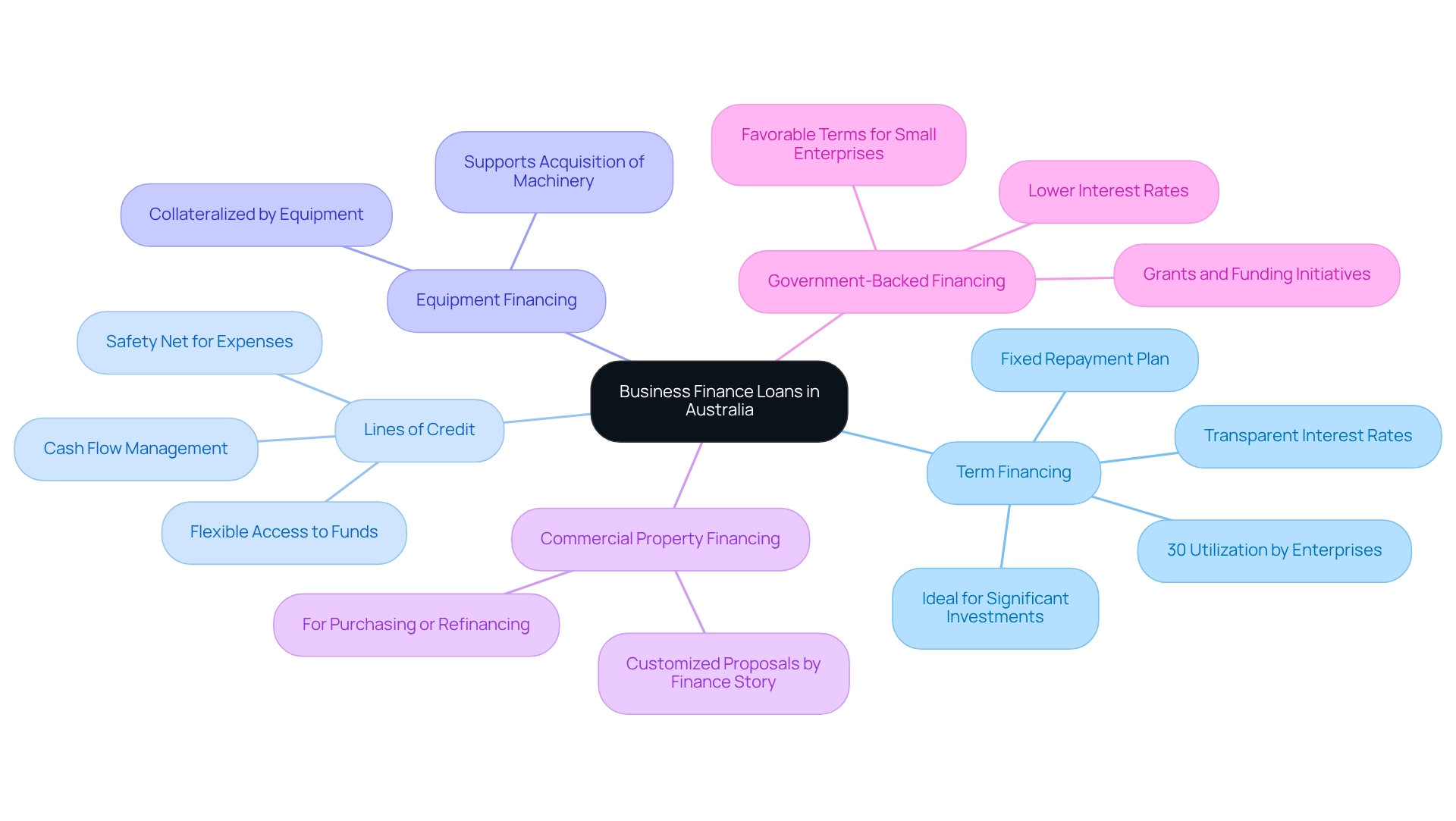

Understand Business Finance Loans in Australia

In Australia, business finance loans Australia provide diverse options, each specifically designed to meet the unique needs of enterprises. The primary categories include:

- Term Financing: These conventional funds feature a fixed repayment plan, making them ideal for significant investments such as equipment or real estate. Recent statistics indicate that approximately 30% of Australian enterprises utilize term financing to support their growth initiatives. Interest rates for these loans vary based on individual circumstances, with no hidden fees or charges, ensuring transparency in the lending process.

- Lines of Credit: This flexible financing option allows enterprises to access funds as needed, making it particularly advantageous for managing cash flow fluctuations. It serves as a safety net for unexpected expenses or opportunities.

- Equipment Financing: Tailored for the acquisition of machinery, these loans often use the equipment itself as collateral, enabling enterprises to secure essential tools without straining their cash flow.

- Commercial Property Financing: Designed for purchasing or refinancing commercial real estate, these funds are vital for companies looking to invest in property to enhance their operations. Finance Story specializes in crafting refined and highly customized proposals for lenders, ensuring that enterprises can secure the appropriate funding for their commercial property investments.

- Government-Backed Financing: Numerous government programs offer these financial options, typically providing lower interest rates and favorable terms, which can significantly benefit small enterprises and startups. Additionally, the Australian government provides grants and funding initiatives to support small businesses and startups, further enhancing business finance loans Australia as financing alternatives.

Understanding these business finance loans Australia options is crucial for enterprises aiming to secure the right funding for growth and expansion. During times of economic uncertainty, expert guidance from Finance Story can help companies navigate the complexities of financing choices, ensuring they make informed decisions aligned with their financial objectives. Access to professional financial advice is essential, as it aids enterprises in identifying suitable financing options and comprehending that rates will be clearly outlined prior to commitment.

Gather Required Documentation and Information

Before applying for a business finance loan, it is essential to gather the following documentation to streamline the application process and enhance your credibility with lenders:

-

Enterprise Strategy: A well-organized enterprise strategy is crucial. It should outline your enterprise model, market analysis, and financial forecasts. A robust enterprise plan can significantly enhance your chances of securing business finance loans in Australia, particularly for startups or ventures seeking substantial growth capital. As emphasized in the case study 'Plans and Loan Applications,' a well-crafted plan can add significant value to your application. At Finance Story, we focus on developing refined and highly customized proposals related to business finance loans Australia to present to banks, ensuring you meet the elevated standards required for obtaining funds.

-

Financial Statements: Prepare profit and loss statements, balance sheets, and cash flow statements for the past two years. Lenders typically require an average of two years of financial statements to evaluate your company's financial health.

-

Tax Returns: Include personal and business tax returns for the last two years. These documents help verify your income and overall financial stability.

-

Identification: Provide personal identification documents, such as a driver's license or passport, to confirm your identity.

-

Bank Statements: Recent bank statements are necessary to demonstrate cash flow and financial stability, which are critical factors in the lending decision.

-

Collateral Documentation: If applicable, include documents related to any assets that can be used as collateral for the loan.

Arranging these documents beforehand not only accelerates the procedure but also places you advantageously in the view of possible lenders for business finance loans Australia. As highlighted by financial specialists, investing time in developing a thorough strategy can clarify your goals and enhance your proposal, making it a valuable pursuit. Chris Reid emphasizes, "While this may not need to be outlandishly comprehensive in size, you may find that putting a reasonable amount of time and effort into your business plan may help clarify things that otherwise may have been overlooked, so it’s a good idea to do so."

Additionally, strategically timing your submission to align with strong financial performance periods can further enhance your chances of approval. It is also recommended to collaborate with a broker, such as those at Finance Story, who can assist you in submitting a single request to the most suitable financier first. Be cautious, however, as applying to multiple financial institutions simultaneously can negatively impact your credit score.

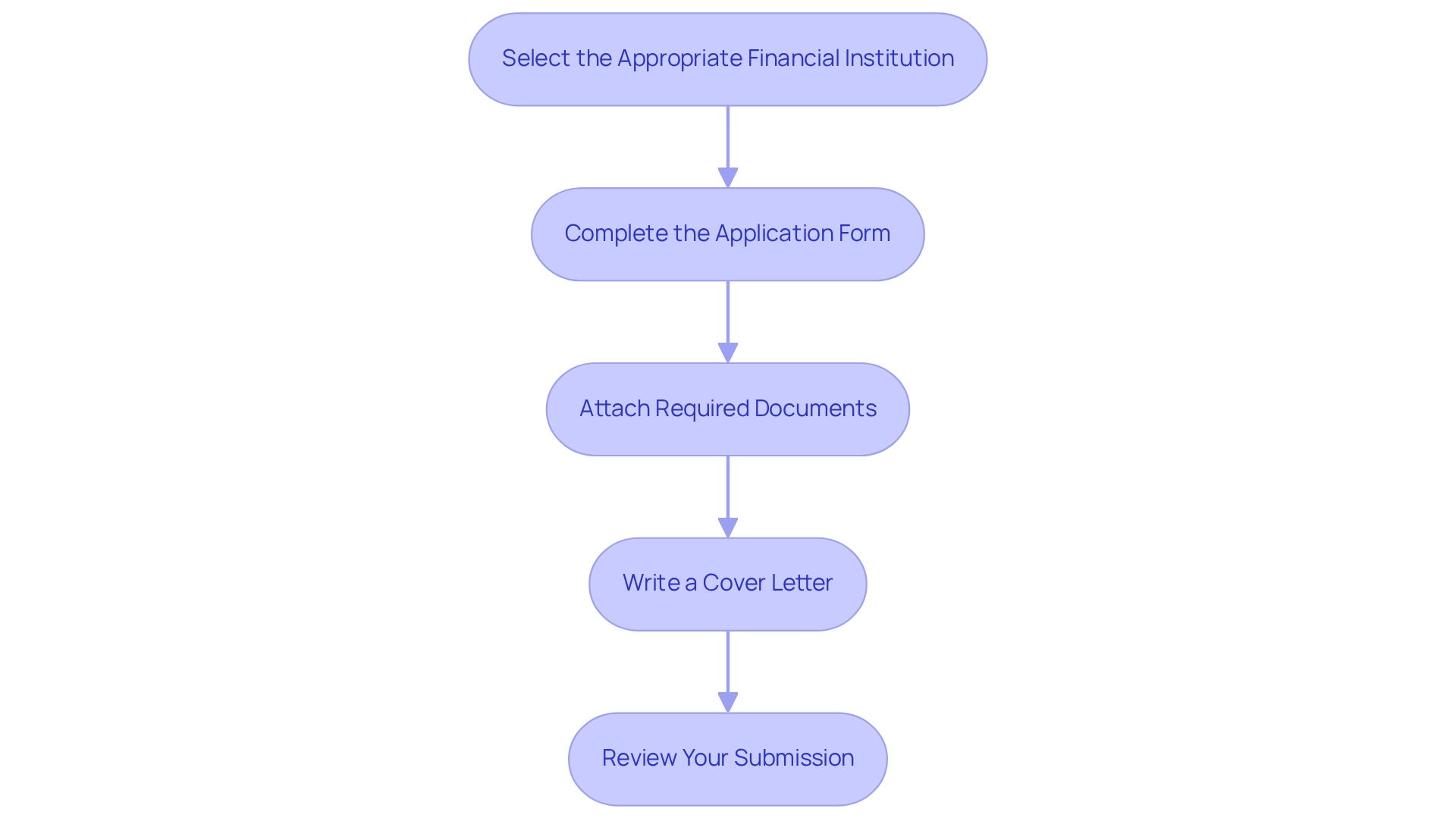

Complete the Business Finance Loan Application

To successfully complete your finance loan application, adhere to the following steps:

- Select the Appropriate Financial Institution: Conduct thorough research to identify an institution that aligns with your business needs and offers favorable terms. When evaluating business finance loans Australia, consider critical factors such as interest rates, fees, and the reputation for customer service. Current trends indicate that small business owners increasingly prefer lenders who provide personalized service and flexible terms.

- Complete the Application Form: Provide accurate and essential information about your business, including its structure, ownership details, and the specific purpose of the loan. Precision in this section is vital; statistics reveal that errors in application forms are a common cause of processing delays, with many applications being rejected due to minor inaccuracies.

- Attach Required Documents: Compile and include all necessary documentation, ensuring that each document is current and accurately reflects your organization’s financial status. This may include financial statements, tax returns, and operational plans.

- Write a Cover Letter: Craft a concise cover letter outlining your business, the purpose of the loan, and your intended use of the funds. This personal touch can significantly enhance your submission, making it more memorable to lenders.

- Review Your Submission: Before sending, meticulously examine your documents for any errors or omissions. A comprehensive evaluation can prevent unnecessary delays and improve your chances of approval.

Finalizing your request with meticulous attention to detail is crucial for a successful loan proposal. To further enhance your chances of securing the right business finance loans in Australia, consider how a personalized consultation can assist you in effectively navigating these steps. We invite you to book your free personalized 30-minute meeting with Shane Duffy, Head of Funding Solutions at Finance Story. Discuss your needs and objectives, from professional to personal, and allow us to begin collaborating with you to create your next chapter. Please select a time that suits you from our live calendar.

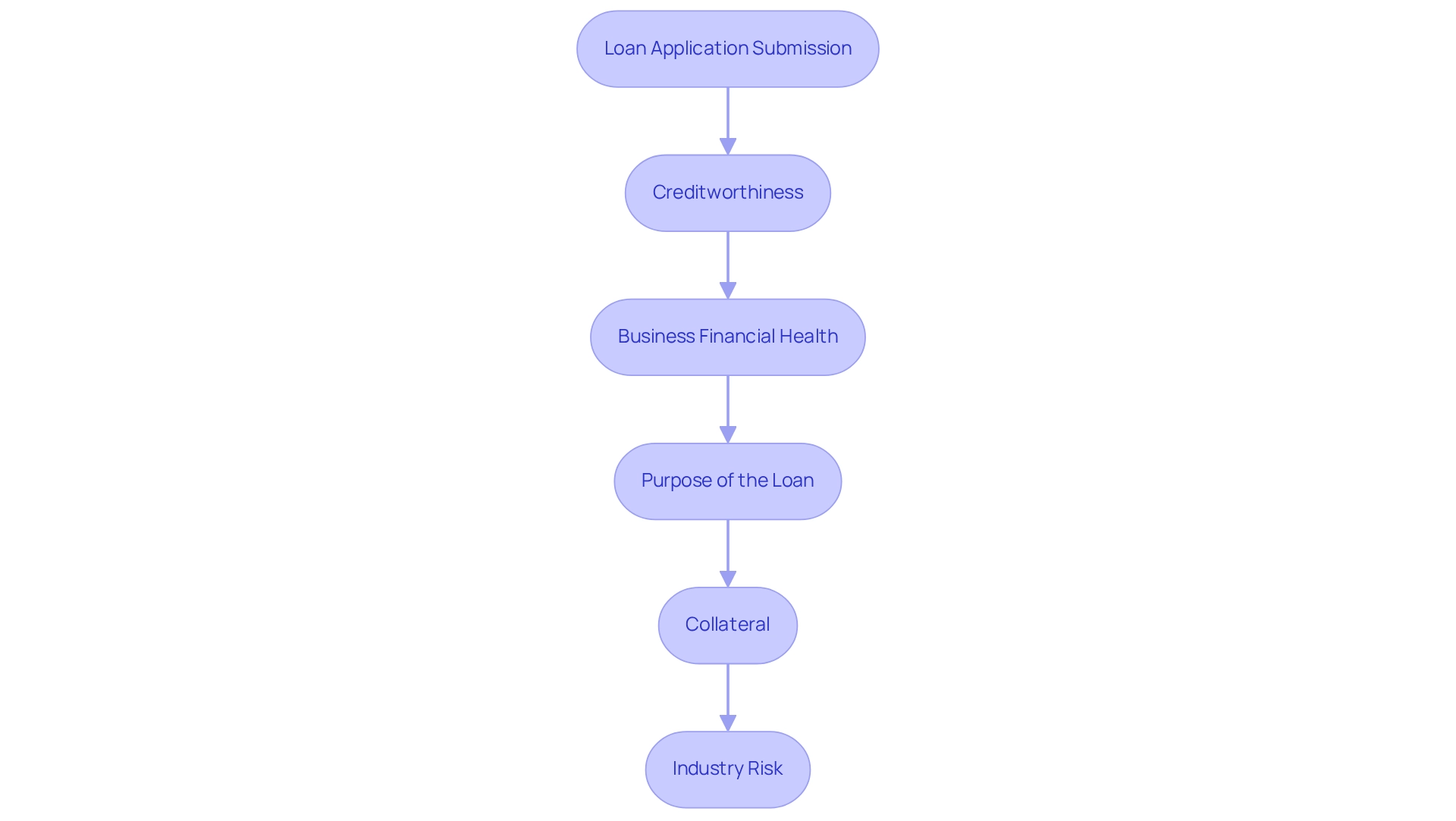

Navigate the Lender Evaluation Process

Upon submitting your application, lenders will evaluate it based on several key criteria:

- Creditworthiness: Lenders will assess both personal and commercial credit scores, as these metrics are essential indicators of financial dependability. Present credit score criteria for commercial financing in Australia generally vary from 600 to 700, depending on the provider. Significantly, numerous non-bank financial providers collaborate with business owners who possess less-than-perfect credit, offering additional options for those concerned about their credit ratings.

- Business Financial Health: A comprehensive assessment of your financial statements and cash flow will be conducted to evaluate your capacity to repay the debt. Many lenders seek consistent cash flow and healthy financial ratios, as these factors significantly influence loan approval. Collaborating with specialists such as Finance Story can assist you in crafting a refined and personalized case that showcases your financial well-being, thereby enhancing your proposal's attractiveness.

- Purpose of the Loan: Lenders aim to understand how the funds will be employed and the expected advantages for your enterprise. A clearly articulated purpose can increase your application’s appeal, particularly when included in a thorough proposal that details the anticipated impact on your organization.

- Collateral: If applicable, the value and type of collateral offered will be evaluated. This may include assets such as property or equipment, which can mitigate the lender's risk.

- Industry Risk: The stability and risk associated with your industry will also be considered. Lenders frequently examine market trends and economic conditions that could affect your company's performance.

Be prepared for potential follow-up questions or requests for additional information during this evaluation phase. Clear communication and prompt responses can facilitate a smoother process. For instance, business owners with outstanding tax debt may still secure loans by demonstrating a consistent repayment history. Certain financial institutions may overlook tax obligations, highlighting the significance of transparency in your financial transactions. As Daigle notes, "At the end of the day, these are the main factors: credit score, solid cash flow, impact of the lending project on the company’s finances, and healthy financial ratios." Understanding these evaluation criteria, along with seeking personalized advice from brokers like Finance Story, who offer access to a full range of lenders including high street banks and private lending panels, can significantly enhance your chances of securing business finance loans Australia for various commercial properties, whether it be a warehouse, retail premise, factory, or hospitality venture. Additionally, if you are looking to refinance, Finance Story can assist in navigating those options to meet the evolving needs of your business.

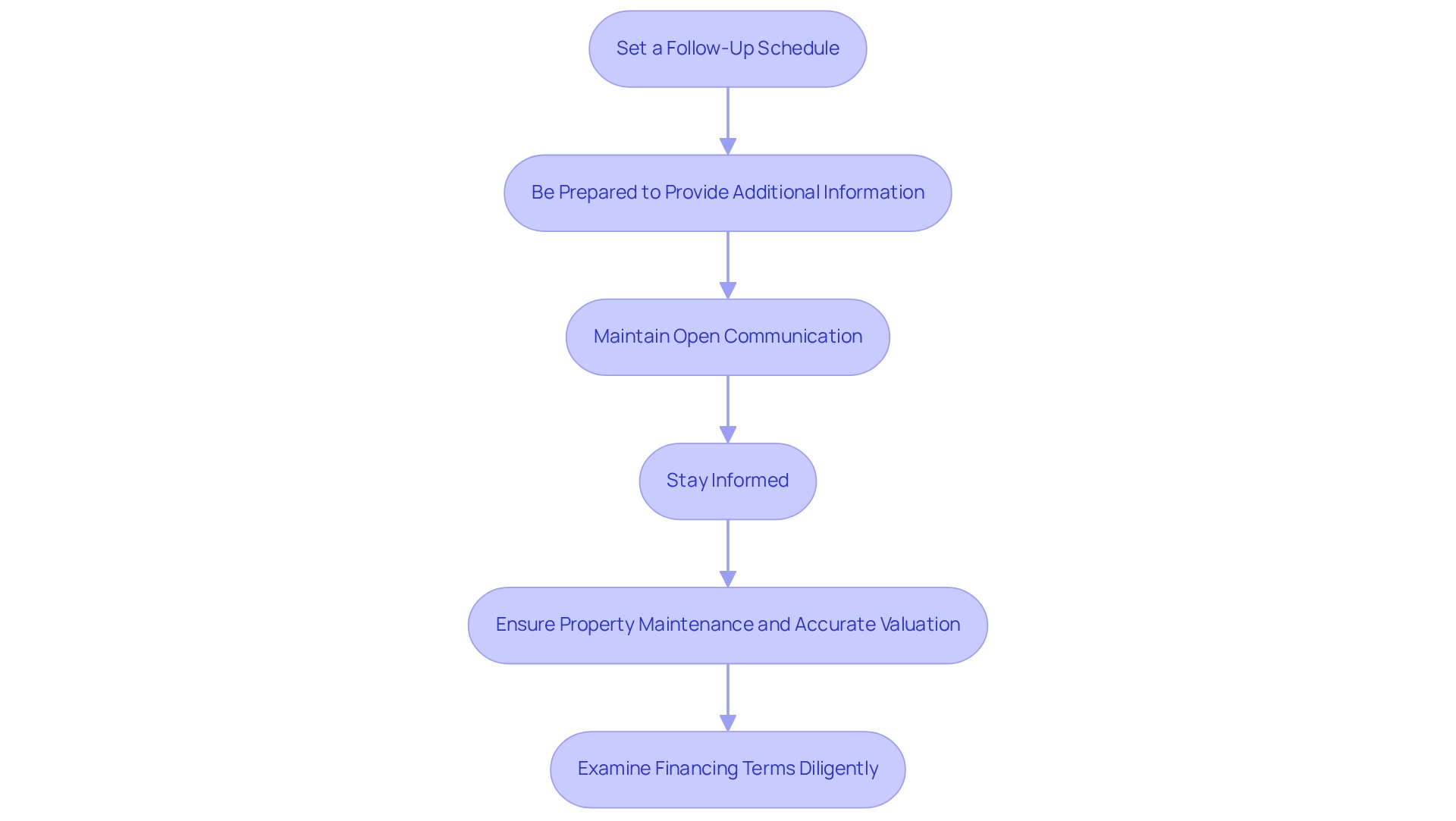

Follow Up and Manage Your Loan Application

Following up on your loan request is vital for ensuring a smooth process and enhancing your chances of approval.

- Set a Follow-Up Schedule: Reach out to your lender within a week of submitting your application to check on its status. This proactive approach demonstrates your interest and dedication, reflecting the expertise that Finance Story offers in crafting customized financing proposals.

- Be Prepared to Provide Additional Information: Lenders may require further documentation or clarification. Being ready to respond promptly can prevent unnecessary delays, as unreported debts can extend the approval process by up to a week. As Ms. Mitchell advises, explaining any unreported debts can significantly impact your approval timeline, highlighting the importance of understanding loan repayment criteria.

- Maintain Open Communication: Keeping lines of communication open with your financial institution fosters rapport and trust. Regular updates can significantly influence the outcome of your application, aligning with Finance Story's commitment to guiding clients through the financing process. With access to a diverse array of financial institutions, including high street banks and private lending groups, you can discover the best match for your needs.

- Stay Informed: Familiarize yourself with the typical timelines for loan processing and approval. For instance, the average financial institution's turnaround time is currently around 27.1 days, which has increased from previous quarters (AFG Mortgage Index FY21 Q3 Report). Understanding these timelines helps manage your expectations effectively. Additionally, knowing that Big 4 banks average 22 days for approvals while non-bank lenders average around 14 days can help you choose a lender that aligns with your urgency for financing.

- Ensure Property Maintenance and Accurate Valuation: Ensuring that the property is well-maintained and accurately valued can help avoid unnecessary delays in the approval process. This crucial step must not be overlooked, particularly when refinancing or obtaining funding for a commercial property investment, such as warehouses, retail spaces, factories, or hospitality projects.

- Examine Financing Terms Diligently: If your request is accepted, take the time to thoroughly assess the financing terms before signing. Ensure they align with your business goals to avoid future complications. By actively managing your loan application and maintaining effective communication with lenders, you can significantly improve your chances of securing business finance loans in Australia necessary for your business growth, leveraging the expertise of Finance Story in navigating the complexities of business loans and refinancing options.

Conclusion

Understanding the various business finance loans available in Australia is vital for companies aiming to thrive in a competitive landscape. From traditional term loans that support significant investments to flexible lines of credit that assist with cash flow management, each financing option presents unique benefits tailored to different business needs. By familiarizing themselves with these options, businesses can strategically select the best loan type to align with their growth aspirations.

The importance of thorough preparation cannot be overstated. Gathering the necessary documentation, including a comprehensive business plan and financial statements, enhances credibility with lenders and streamlines the application process. Furthermore, a well-structured application, complete with accurate information and a personalized cover letter, can significantly improve the chances of approval. It is crucial for businesses to understand the lender evaluation process, which takes into account creditworthiness, financial health, and the intended use of funds.

Finally, actively managing the loan application—including timely follow-ups and clear communication with lenders—is essential for navigating the complexities of obtaining financing. By leveraging expert guidance from professionals like Finance Story, businesses can enhance their understanding of loan options, improve their application process, and ultimately secure the funding necessary for growth and expansion. Making informed financial decisions today will pave the way for a more prosperous tomorrow.