Overview

This article presents five essential steps to secure a commercial rental property loan, designed to empower you with the knowledge necessary for successful financing.

- First, it’s crucial to understand the different loan types available.

- Next, gathering the required documentation is vital; this includes maintaining strong financial records that can significantly impact your application.

- Completing the application process is the third step, where attention to detail can make a substantial difference.

- Following this, navigating the evaluation and approval stages requires diligence and patience.

- Finally, finalizing loan terms is where you can leverage your understanding to negotiate favorable conditions.

Each step is supported by detailed explanations of necessary actions and considerations, such as the importance of pre-approval and the potential for negotiating terms. By following these guidelines, you will be well-prepared to secure the financing you need.

Introduction

Navigating the world of commercial rental property loans can indeed be daunting. The unique criteria and processes that distinguish these loans from traditional mortgages require careful consideration. Understanding the various types of loans available, along with the specific documentation and eligibility requirements, is crucial for any business looking to invest in real estate. Many potential borrowers find themselves overwhelmed by the complexities of the application and approval process. What essential steps can transform this daunting experience into a successful acquisition of commercial financing?

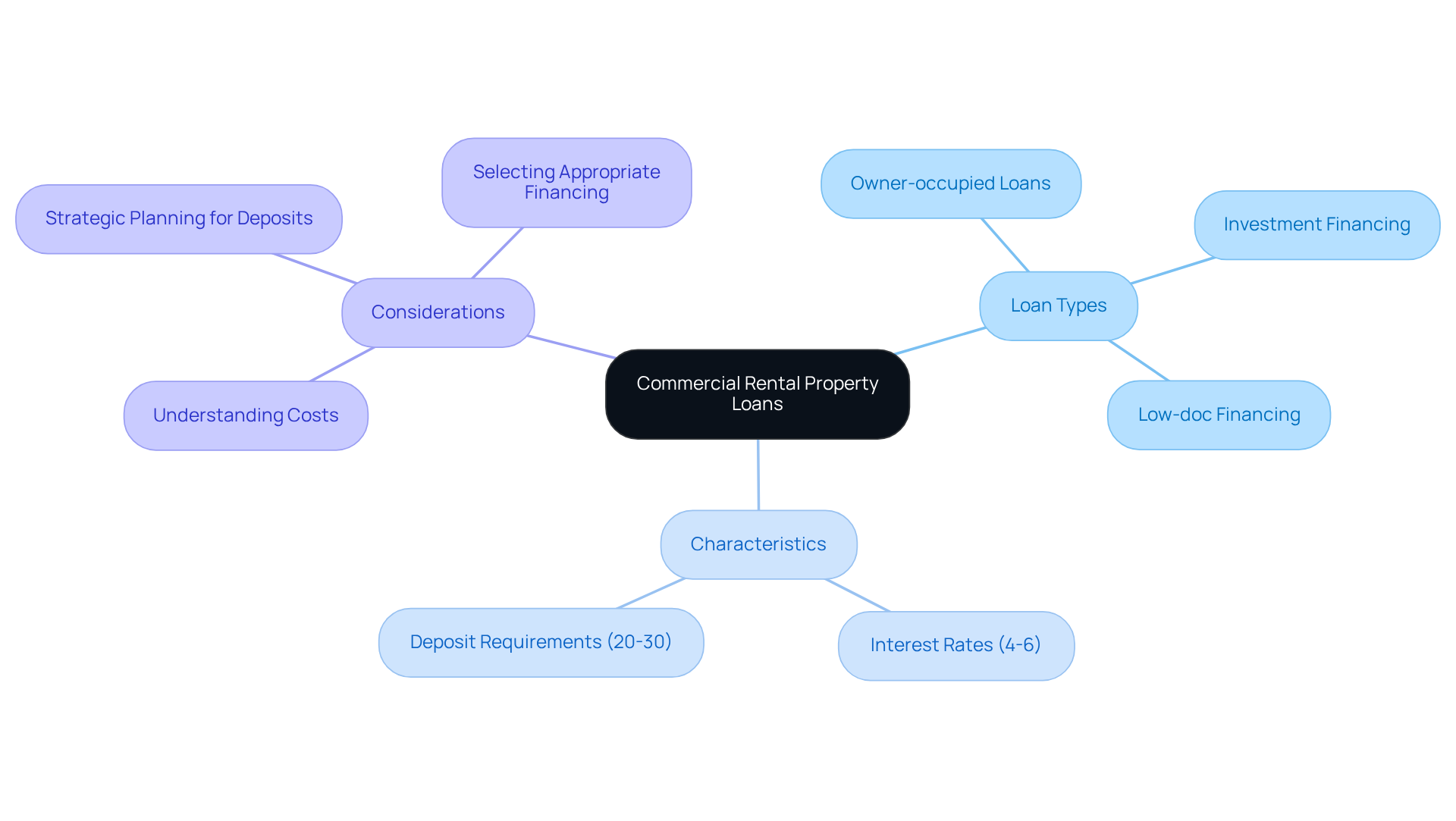

Understand Commercial Rental Property Loans

Commercial rental property loan options represent tailored solutions specifically designed for acquiring or refinancing assets intended for business operations. Unlike residential mortgages, these credits exhibit distinct characteristics, including varied terms, interest rates, and eligibility criteria. In 2025, average interest rates for commercial rental real estate financing typically range from 4% to 6%, contingent upon the lender and the borrower's financial profile.

Potential borrowers must familiarize themselves with the diverse types of commercial loans available, such as:

- Owner-occupied loans: These loans are utilized to purchase properties where the borrower will conduct business operations, often providing more favorable terms.

- Investment financing: Specifically created for acquiring assets aimed at generating rental revenue, these arrangements may entail more stringent criteria.

- Low-doc financing: These financial products necessitate minimal documentation, catering to self-employed individuals or those with non-traditional income sources.

Understanding the usual deposit requirements is crucial, as they generally vary from 20% to 30% of the asset's value. This upfront investment is vital for devising a successful investment strategy.

Successful examples of financing through a commercial rental property loan include enterprises that have leveraged these funding options to expand their operations or acquire additional assets, resulting in enhanced revenue streams. Financial consultants frequently emphasize the importance of selecting the appropriate type of commercial financing to align with organizational objectives, highlighting that a well-structured financial product can significantly improve cash flow and investment returns.

In summary, navigating the landscape of a commercial rental property loan involves recognizing the various types of loans available, comprehending the associated costs, and strategically planning for the required deposits. By doing so, borrowers can effectively position themselves for success in their commercial real estate investments.

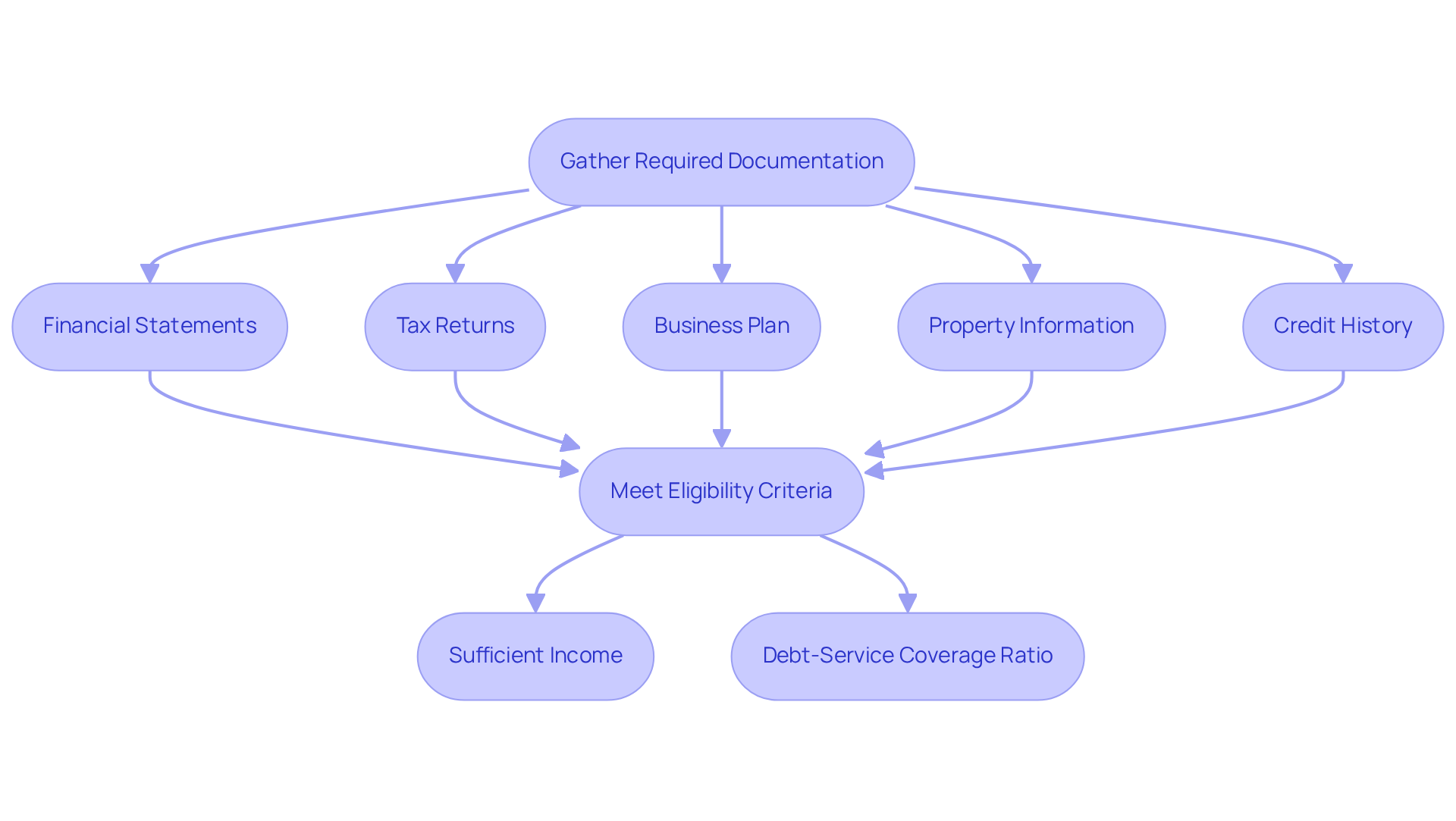

Gather Required Documentation and Meet Eligibility Criteria

To successfully apply for a commercial rental property loan, it is essential to compile the necessary documentation, which includes:

- Financial Statements: Recent profit and loss statements, balance sheets, and cash flow statements are vital for demonstrating your business's financial health.

- Tax Returns: Lenders generally request personal and corporate tax returns for the past two years to evaluate your financial history.

- Business Plan: A comprehensive business plan outlining your model and detailing how the asset will generate income is crucial for convincing financiers of your investment strategy.

- Property Information: Provide specific details about the property, including its location, type, and intended use, to assist evaluators in assessing its potential.

- Credit History: A strong credit profile is essential; financial institutions will examine your credit score and repayment history. Typically, a minimum credit score of 660 is necessary, with some financial institutions favoring scores of 680 or above.

Meeting these eligibility criteria involves demonstrating sufficient income to cover repayments, typically requiring a debt-service coverage ratio of at least 1.25. Furthermore, financial institutions will evaluate your business feasibility and operational reliability, making it essential to provide a robust business plan and financial records.

Complete the Loan Application Process

The loan application process for securing a commercial rental property loan typically involves several key steps:

-

Select a Financial Institution: Conduct thorough research to identify an organization that specializes in commercial financing tailored to your specific needs. Choosing the right financier can significantly impact your funding experience and outcomes. Consider factors such as the provider's approval rates, customer service, and flexibility in financing terms. At Finance Story, we provide access to a comprehensive range of lenders, including high street banks and innovative private lending panels, ensuring you find the best fit for your situation.

-

Pre-Approval: Securing pre-approval is a vital step that enables you to assess your borrowing capacity. This not only strengthens your negotiating position but also clarifies the amount you can realistically obtain. Financial experts stress that pre-approval can expedite the process and enhance your credibility with sellers. As Janet Gershen-Siegel notes, "Pre-approval can significantly improve your chances of securing the financing you need." At Finance Story, we excel in crafting refined and personalized cases to present to banks, thereby increasing your chances of successful pre-approval.

-

Submit Application: Complete the loan application form with precision and submit it alongside all required documentation. This may include financial statements, business plans, and property details, which are essential for the lender's evaluation. Our team at Finance Story is here to assist you throughout this process, ensuring that your application is both comprehensive and compelling.

-

Follow Up: Maintain open communication with your lender throughout the process. Regular follow-ups can help address any additional requests for information or clarification, ensuring that your application remains on track. Our experts at Finance Story are committed to supporting you at every stage, ensuring your needs are met promptly.

-

Examine Financing Proposals: Once you receive financing proposals, take the time to meticulously review the terms, interest rates, and associated fees. Understanding these details is crucial for making an informed decision that aligns with your financial objectives. With our expertise in refinancing and customized financial solutions, we can assist you in navigating these offers effectively.

In Australia, the typical duration for commercial financing approval can vary, but many financial institutions aim to deliver decisions within 10 working days for straightforward applications. Success stories abound for those who have secured pre-approval, as it often leads to quicker financing and a smoother transaction process. Notably, only 48% of small enterprises have their financing needs met, underscoring the importance of careful selection of financial institutions and pre-approval. By following these steps and leveraging the expertise of Finance Story, you can significantly enhance your chances of securing the right commercial loan for your property investment. Schedule your free personalized consultation with our Head of Funding Solutions, Shane Duffy, to discuss your needs and goals.

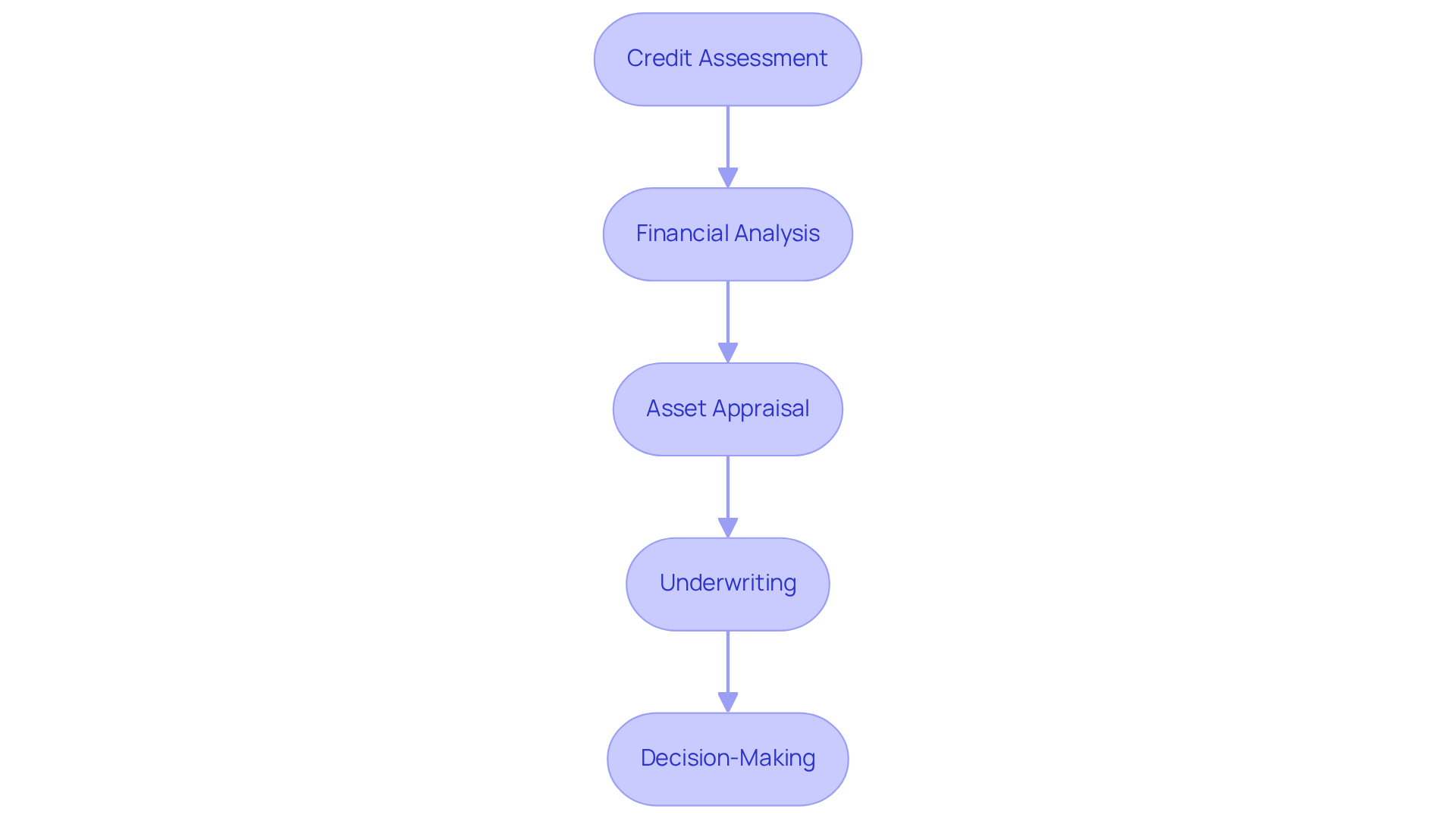

Navigate the Loan Evaluation and Approval Process

Upon submitting your application, the lender will initiate a thorough evaluation process, typically encompassing several key stages:

-

Credit Assessment: Lenders will scrutinize your credit history and score, which are critical indicators of your reliability as a borrower. A credit score of 650 or above is generally preferred to enhance approval chances.

-

Financial Analysis: Your financial statements, including year-end balance sheets and income statements, will be analyzed in the context of your business plan to support your application for a commercial rental property loan. This assessment ensures that you possess the financial capacity to meet repayment obligations for a commercial rental property loan, with cash flow being a primary focus during this evaluation.

-

Asset Appraisal: An appraisal will be conducted to ascertain the market value of the asset related to the commercial rental property loan. This step is vital, as securing a commercial rental property loan usually necessitates a down payment of at least 20%, and the appraisal process often requires more time than that for residential units.

-

Underwriting: This final review stage involves verifying all submitted information. The underwriting process for a commercial rental property loan is rigorous, requiring a comprehensive understanding of your business's financial health and the property’s income-generating potential. Anticipate this phase to require several days to weeks, as financiers evaluate various elements related to the commercial rental property loan, including collateral and the overall risk linked to the financing.

-

Decision-Making: After finishing the underwriting process, the financial institution will evaluate the advantages and disadvantages of your application, taking into account elements like management's comprehension of financial statements and the competitive environment. This organized method guarantees that only credits with a high chance of repayment are authorized, which protects the interests of both the lender and borrower, particularly in the context of a commercial rental property loan.

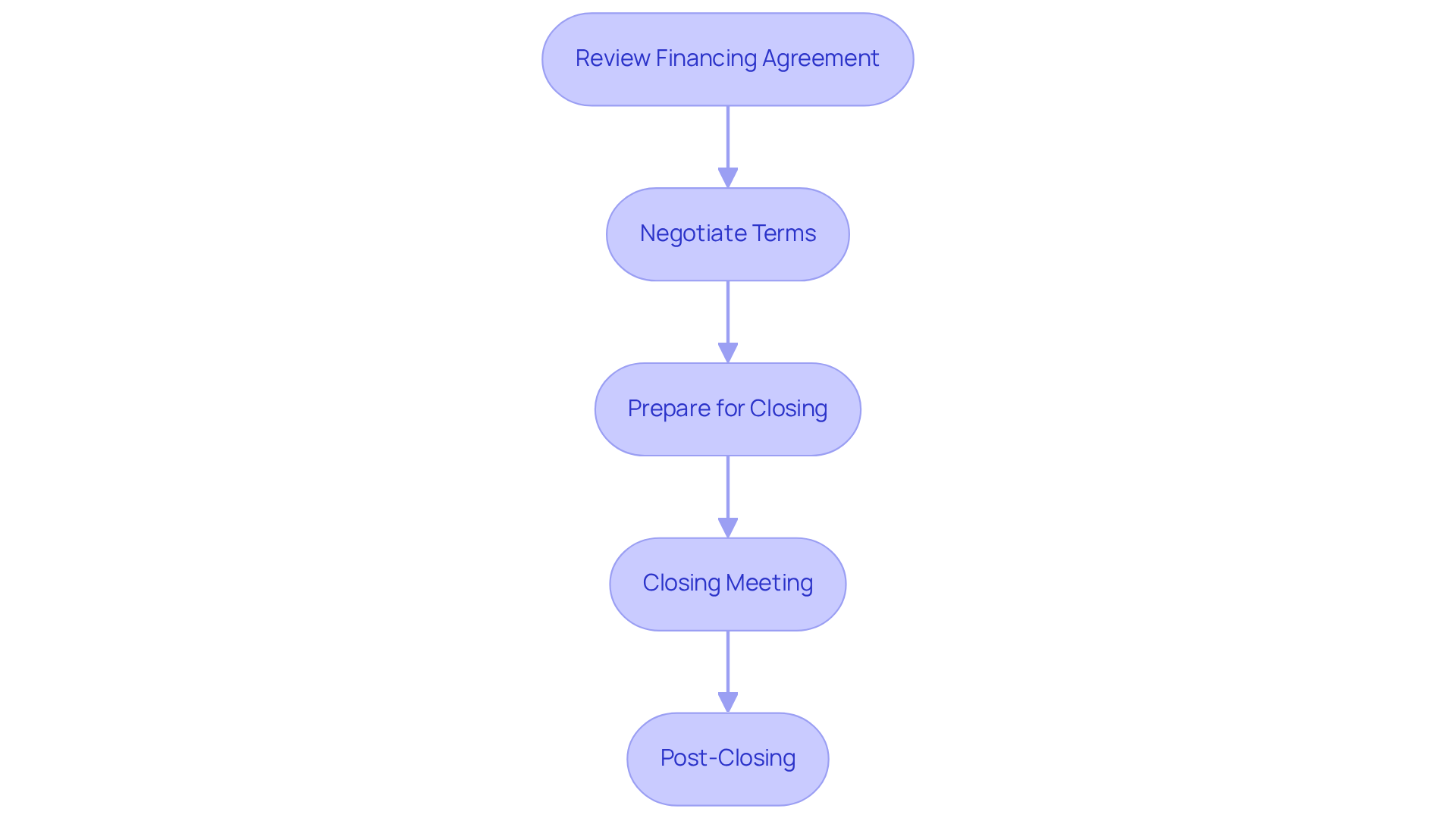

Finalize Loan Terms and Prepare for Closing

Once your commercial rental property loan is approved, it becomes essential to finalize the terms and prepare for closing effectively.

-

Review Financing Agreement: Thoroughly examine the financing agreement. Focus on interest rates, repayment terms, and any associated fees. Understanding these elements is vital for long-term financial planning when considering a commercial rental property loan.

-

Negotiate Terms: Are you aware that you can negotiate terms with your lender? Evidence indicates that borrowers who actively participate in negotiations for a commercial rental property loan often secure more advantageous borrowing terms, potentially saving thousands throughout the duration of their agreement.

-

Prepare for Closing: Gather all necessary documents for closing, including proof of insurance and identification. Being well-prepared can streamline the process and prevent delays.

-

Closing Meeting: Attend the closing meeting to sign the financing documents and finalize the transaction. Ensure you fully understand all terms of the commercial rental property loan before signing, as this is a critical step in the process.

-

Post-Closing: After closing, keep all documents organized and maintain open communication with your lender regarding repayment schedules. This proactive approach can help you manage your loan effectively and address any issues that may arise.

Conclusion

Securing a commercial rental property loan is a multifaceted process that demands careful planning and a solid understanding of various financial instruments. By grasping the distinct types of loans available, the necessary documentation, and the detailed steps involved in the application and approval process, potential borrowers can significantly enhance their chances of success in commercial real estate investments.

Key insights highlight the importance of:

- Selecting the right financial institution

- Gathering comprehensive documentation

- Maintaining effective communication throughout the application process

Furthermore, understanding the evaluation criteria set by lenders and being prepared for negotiations can lead to more favorable loan terms. These considerations not only facilitate a smoother borrowing experience but also ensure that the chosen financing aligns with the borrower’s long-term business objectives.

Ultimately, the journey to securing a commercial rental property loan transcends mere financing; it is about strategically positioning oneself for growth and success in the competitive landscape of commercial real estate. By following the outlined steps and embracing thorough preparation, borrowers can unlock the potential for increased revenue and sustainable business development. Taking action now to educate oneself on these processes can lead to informed decisions that pave the way for future financial prosperity.