Overview

The article "5 Steps to Secure a Commercial Real Estate Loan Australia" presents a systematic approach for acquiring financing for commercial properties. It underscores the significance of thorough preparation, meticulous documentation, and customized proposals. Essential steps include:

- Gathering necessary documents

- Crafting a compelling loan proposal

- Effectively navigating potential challenges

Each of these elements is vital for increasing the likelihood of loan approval in a competitive market.

Introduction

Navigating the landscape of commercial real estate loans in Australia can be a daunting task, especially given the diverse options and stringent requirements involved. Understanding the nuances of these loans is essential for anyone looking to invest in properties that drive business operations, from office buildings to retail spaces. As the market evolves, how can prospective borrowers effectively secure the financing they need while overcoming common challenges? This guide outlines five crucial steps that will empower readers to approach their commercial real estate loan applications with confidence and clarity.

Understand Commercial Real Estate Loans

A commercial real estate loan in Australia serves a crucial role in supporting properties utilized for business operations, including office buildings, retail spaces, and industrial facilities. Unlike residential financing, these transactions typically necessitate a larger down payment, often between 20% and 30% of the property's value. As we look toward 2025, a variety of commercial loan options are available, each tailored to meet specific needs:

- Traditional Bank Loans: Offered by major banks, these loans generally feature competitive interest rates but come with stringent qualification criteria. Banks often cap the Loan to Value Ratio (LVR) at 65%, requiring a substantial deposit for approval.

- SBA Financing: Backed by the Small Business Administration, these funds are specifically designed for small enterprises, frequently providing advantageous terms and reduced down payment requirements.

- Bridge Financing: These short-term funds deliver prompt capital, acting as a temporary solution until a more permanent financing option is secured. They are particularly beneficial for investors eager to seize time-sensitive opportunities. Finance Story specializes in crafting refined and highly tailored business cases to present to financiers, ensuring clients can secure the appropriate bridge funding for their needs.

- Hard Money Financing: Provided by private investors, these asset-based options typically carry higher interest rates and shorter durations, making them suitable for borrowers who may not meet conventional funding criteria.

In 2025, the average down payment for specialized properties, such as those with more than three units, can range from 25% to 30%. For properties valued up to $1 million, banks may consider an LVR of up to 75%, allowing for a 25% deposit. Successful financing examples underscore the importance of selecting the right type of credit; for instance, a client who utilized a bridge funding option was able to swiftly secure a prime retail location, demonstrating the efficacy of this financing method in a competitive market. Understanding these diverse options is essential for making informed decisions about a commercial real estate loan in Australia. Collaborating with Finance Story ensures you have access to a comprehensive array of financing solutions tailored to your specific circumstances.

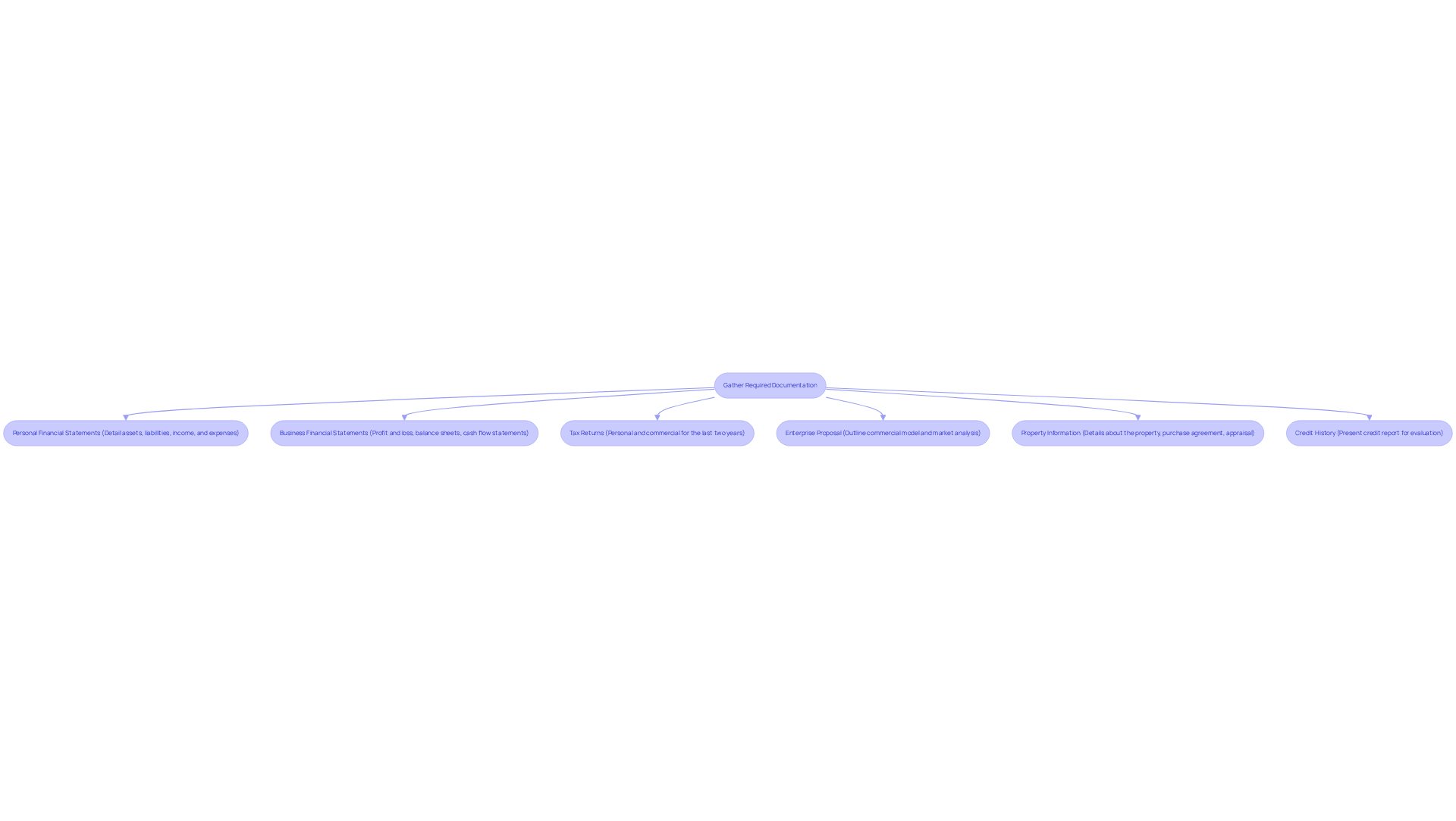

Gather Required Documentation and Information

To effectively apply for a commercial real estate loan in Australia, it is crucial to collect several key documents that showcase your financial stability and the feasibility of your enterprise. The following items are essential for a comprehensive application:

- Personal Financial Statements: These should detail your assets, liabilities, income, and expenses, providing a clear picture of your financial health.

- Business Financial Statements: Include profit and loss statements, balance sheets, and cash flow statements for the past two years. These documents assist lenders in evaluating your company's performance and financial stability.

- Tax Returns: Submit both personal and commercial tax returns for the last two years. This information is vital for verifying income and financial history.

- Enterprise Proposal: Outline your commercial model, market analysis, and the intended use of the loan. A well-structured business plan can significantly enhance your application for a commercial real estate loan in Australia by demonstrating your strategic approach to growth.

- Property Information: Provide details about the property you wish to purchase, including the purchase agreement, property appraisal, and any lease agreements if applicable. This information assists financiers in assessing the investment's potential.

- Credit History: Be prepared to present your credit report, as financial institutions will evaluate your creditworthiness based on your credit history.

Arranging these documents beforehand will simplify the process, facilitating lenders in assessing your commercial real estate loan application in Australia. In 2025, the average time to gather such documentation can vary, but being proactive can significantly reduce delays. Financial consultants stress that comprehensive preparation of personal and professional financial statements is essential for successful credit applications, as these documents establish the basis for your financial story.

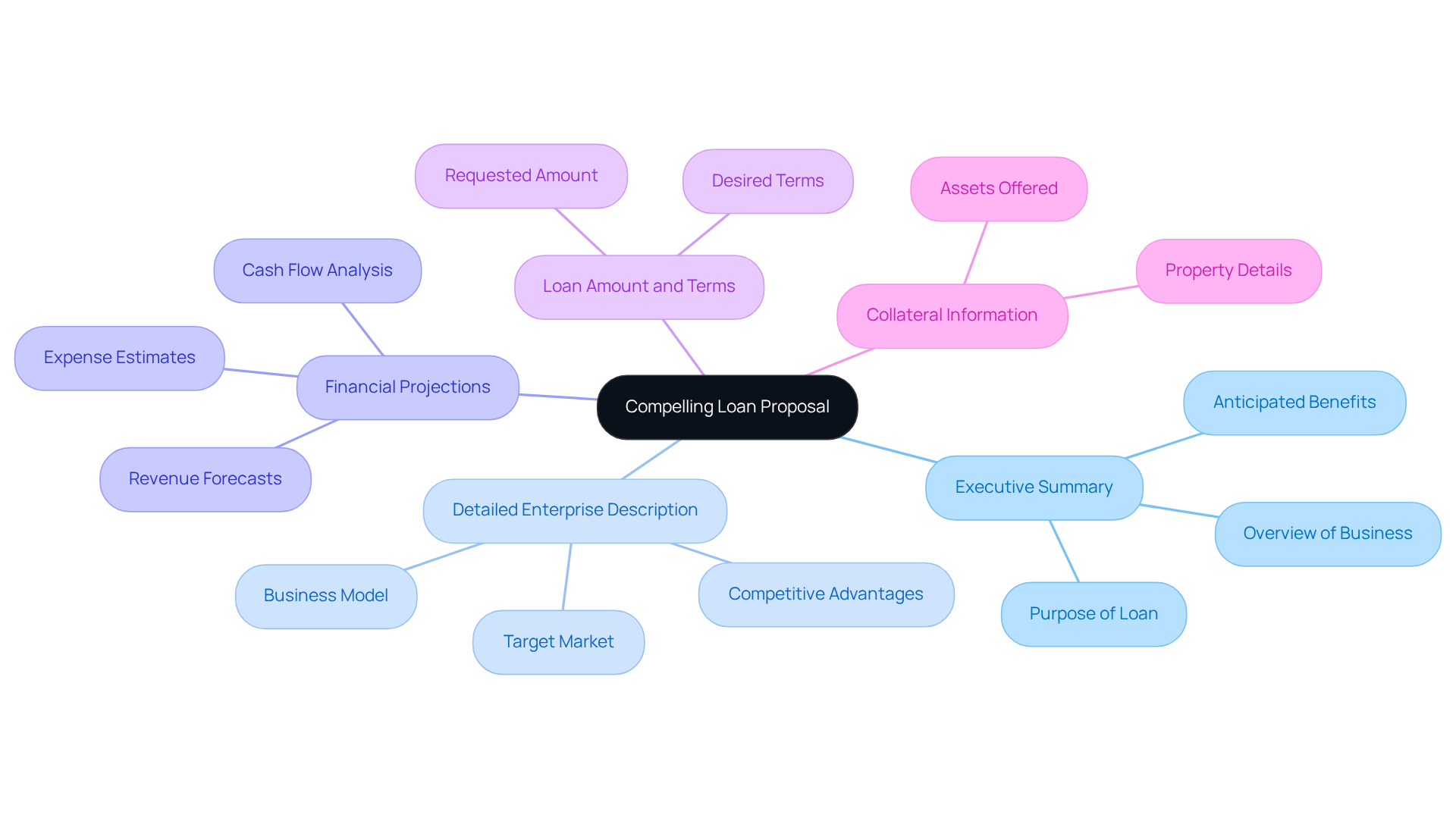

Craft a Compelling Loan Proposal

A compelling loan proposal must encompass several key elements to effectively communicate your business needs and secure financing:

-

Executive Summary: Begin with a concise overview of your business, outlining the purpose of the loan and its anticipated benefits to your operations. This section sets the tone and captures the lender's interest.

-

Detailed Enterprise Description: Offer an in-depth explanation of your model, target market, and competitive advantages. Highlight what differentiates your business in the current market landscape, particularly in light of the increasing demand for business credit driven by a robust labor market and rising wages.

-

Financial Projections: Present realistic forecasts for revenue, expenses, and cash flow over the next three to five years. Given that the typical new owner-occupier mortgage in Australia is approximately $642,121, financial institutions will value well-supported economic data that demonstrates your capacity to manage repayment obligations effectively.

-

Loan Amount and Terms: Clearly specify the amount you are requesting and the terms you are seeking. This clarity assists financiers in evaluating your proposal against their borrowing standards, which is essential in a competitive market where financial commitments for residences reached 127,108 in the recent quarter.

-

Collateral Information: Detail the property or assets you are offering as security for the credit. This information is vital, especially as the portion of income required to service new mortgages has risen significantly, with many Australians now needing over 50% of their income for repayments.

Ensure that your proposal is clear, concise, and devoid of jargon. Customizing it to the specific needs of the creditor can significantly improve your chances of approval, particularly in a financial environment where private credit is gaining traction for its favorable risk-return balance.

Submit Your Loan Application Effectively

To effectively submit your loan application, adhere to these essential steps:

- Choose the Right Provider: Conduct thorough research to identify institutions that specialize in a commercial real estate loan in Australia tailored to your specific requirements. Look for those with a strong track record and positive client testimonials. At Finance Story, we provide access to a comprehensive panel of financiers, including boutique institutions, private investors, and mainstream banks, ensuring you find the right fit for your needs.

- Complete the Application Form: Accurately fill out the financial institution's application form, ensuring all information aligns with your supporting documentation. This attention to detail can prevent processing delays.

- Attach Required Documents: Include all necessary documentation as specified by the lender. Common requirements may encompass financial statements, operational plans, and property details. Our expertise in developing refined and tailored business cases can assist you in efficiently showcasing your information, thereby improving your submission.

- Review Your Submission: Before sending, meticulously examine your document for errors or omissions. A well-prepared submission significantly enhances your chances of approval. Understanding the loan repayment criteria and ensuring your submission meets these standards is crucial.

- Follow Up: After sending your request, proactively follow up with the financial institution to confirm receipt and inquire about the anticipated processing timeline. This demonstrates your dedication and helps keep your submission on track.

In 2025, the average approval rate for requests related to commercial real estate loan Australia remains strong at approximately 70%, indicating financial institutions' continued support for enterprises. By being organized and proactive throughout this process, you can enhance your likelihood of securing the financing you need. For instance, a successful case study might involve a small business that carefully selected a lender known for its favorable terms and robust support for commercial clients, ultimately leading to a smooth approval process with the assistance of Finance Story's tailored services.

Navigate Challenges During the Application Process

Navigating the financing request process can present several challenges that require careful preparation. Key issues to consider include:

- Credit Issues: A low credit score can hinder your chances of securing a loan. To improve your score before applying, focus on paying down existing debts and correcting any inaccuracies on your credit report. This proactive approach can significantly enhance your eligibility.

- Insufficient Documentation: Ensure that all required documents are complete and accurate. Incomplete applications can lead to delays or outright denials, which can be detrimental to your financing timeline.

- Creditor Requirements: Various financial institutions have differing standards for credit approval. Be ready to adjust your proposal or documentation according to the input you receive from financiers; this adaptability can enhance your chances of success.

- Market Conditions: Economic fluctuations can significantly impact lending decisions. Staying informed about current market trends is crucial; being flexible with your loan terms may also be necessary to align with lender expectations.

By anticipating these challenges and preparing accordingly, you can navigate the application process for a commercial real estate loan in Australia more effectively, thereby increasing your chances of securing the financing you need for your commercial property investment.

Conclusion

Securing a commercial real estate loan in Australia demands a strategic approach, highlighting the importance of understanding the diverse financing options available and the steps needed to present a compelling application. By comprehending the nuances of various loan types—from traditional bank loans to bridge financing—borrowers empower themselves to make informed decisions that align with their business objectives.

Crucial elements of a successful loan application include:

- Gathering essential documentation

- Crafting a detailed proposal

- Effectively submitting the application to the appropriate financial institution

Each step, from preparing personal and business financial statements to clearly outlining the intended use of the funds, is vital in demonstrating the investment's viability and the borrower's capacity for repayment.

Navigating the challenges of the loan application process is integral to achieving success. By proactively addressing credit issues, ensuring comprehensive documentation, and adapting to lender requirements, prospective borrowers can significantly enhance their chances of approval. The commercial real estate landscape in Australia is evolving; thus, understanding these dynamics is crucial for anyone seeking financing in this sector. Embracing these practices not only facilitates access to necessary funds but also positions businesses for growth and success in an increasingly competitive market.