Overview

This article outlines five essential steps to secure a business investment property loan:

- Defining objectives

- Determining the loan amount

- Choosing the right loan type

- Preparing the loan application

- Engaging with lenders to negotiate terms

Each step is supported by detailed guidance on assessing financial needs, selecting appropriate loan options, and effectively presenting oneself to lenders. This ensures that potential borrowers are well-prepared to navigate the complexities of obtaining financing for their investment properties.

Introduction

Securing a business investment property loan represents a pivotal step in achieving financial goals and expanding real estate portfolios. Understanding the nuances of this process empowers investors, enhancing their ability to navigate the complexities of the market. However, with various loan types, documentation requirements, and negotiation strategies, many potential borrowers often feel overwhelmed.

How can one effectively streamline this journey to ensure a successful investment outcome?

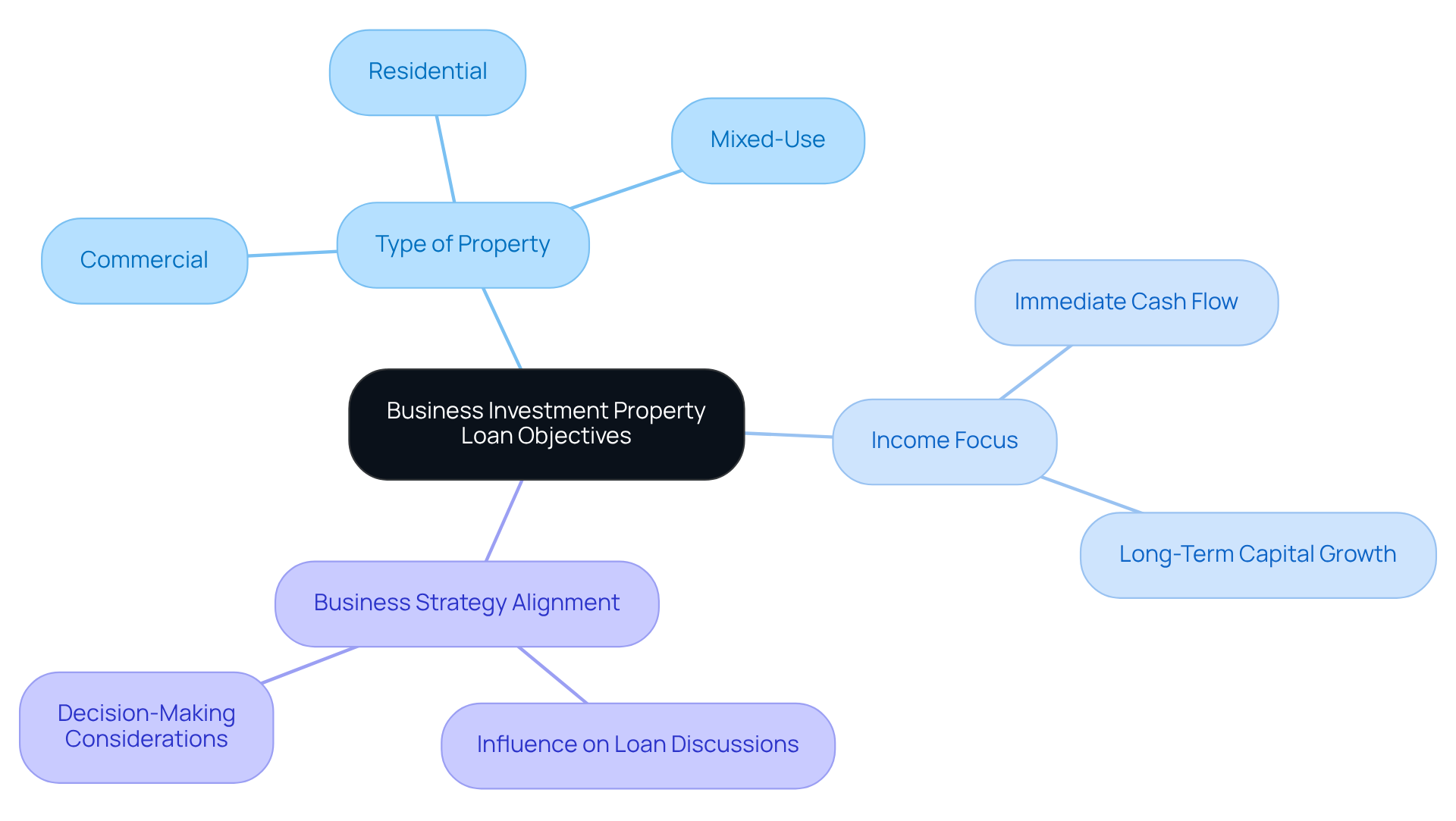

Define Your Objectives for a Business Investment Property Loan

To effectively secure a commercial financing loan, it is crucial to begin by clearly defining your specific objectives. Consider these pivotal questions:

- What type of property are you interested in—commercial, residential, or mixed-use?

- Are you aiming for immediate cash flow through rental income, or is your focus on long-term capital growth?

- How does this investment align with your overall business strategy?

Documenting these objectives is vital, as they will steer your loan application and discussions with lenders. For instance, if your primary objective is to generate rental income, prioritizing assets in high-demand rental areas becomes imperative. In 2025, the average rental income for commercial real estate is projected to significantly exceed that of residential units, making strategic location selection even more critical.

Furthermore, establishing clear financial objectives not only aids in securing funding but also enhances your ability to navigate the complexities of the real estate market. As financial consultants emphasize, having well-defined goals is foundational to successful real estate ventures, enabling you to make informed decisions that align with your financial aspirations.

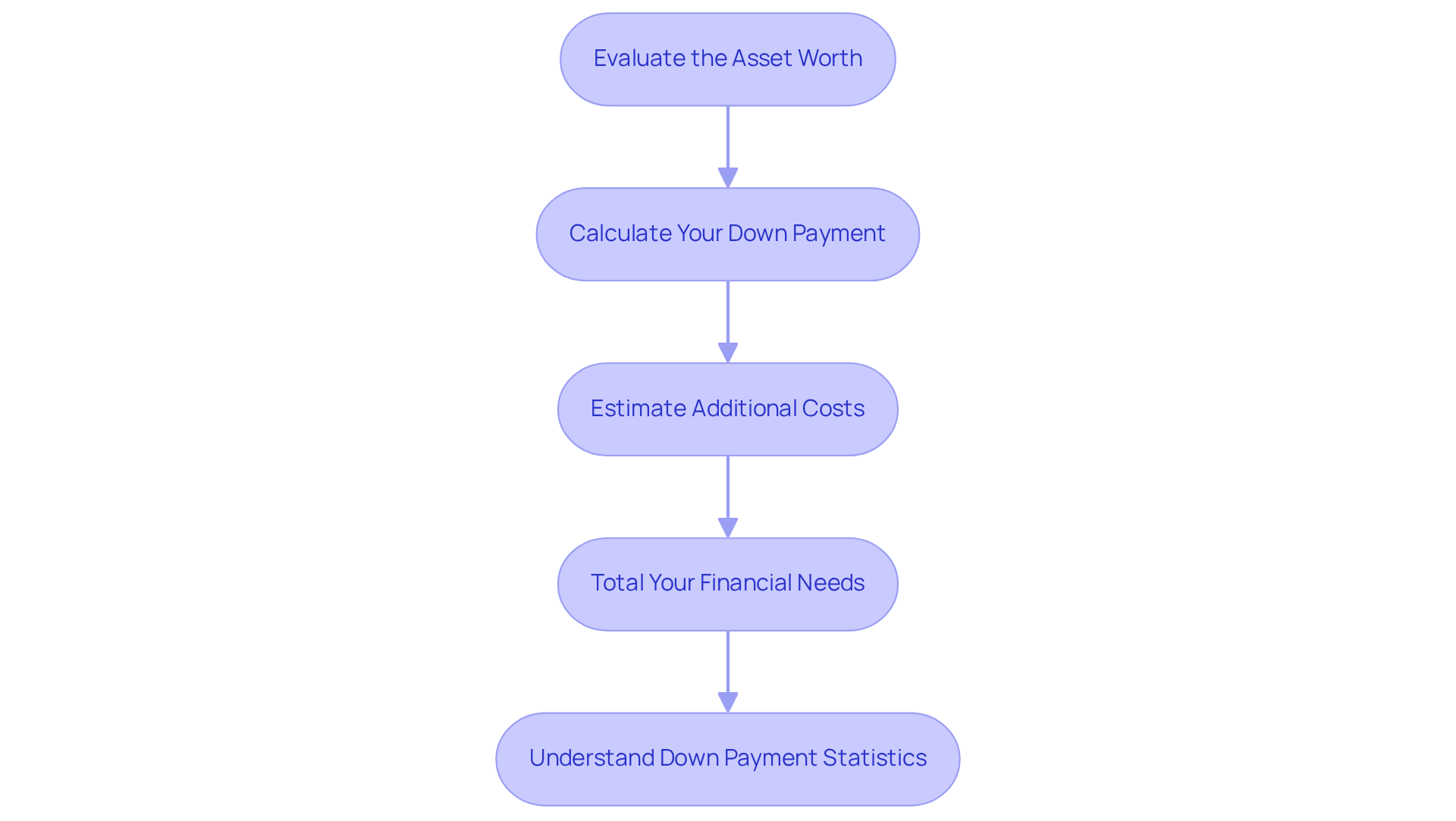

Determine the Loan Amount You Need

To determine the loan amount needed for a business investment property, follow these essential steps:

- Evaluate the Asset Worth: Conduct thorough market research to identify the average price of comparable assets in your desired area, such as warehouses or retail premises. This foundational step ensures you have a realistic understanding of the investment landscape.

- Calculate Your Down Payment: Most lenders require a down payment ranging from 20% to 30% of the asset's value. For instance, if the asset is assessed at $500,000, a 20% down payment would total $100,000. This initial investment is crucial for securing favorable business investment property loan terms, especially when dealing with lenders who appreciate well-prepared proposals.

- Estimate Additional Costs: Consider extra expenses like closing fees, land taxes, and insurance, which can collectively total 5-10% of the asset's value. Being aware of these costs helps you prepare for the total financial commitment and aligns with the expectations of lenders regarding comprehensive financial planning.

- Total Your Financial Needs: Combine the down payment and estimated additional costs to determine the total amount you need to borrow. This thorough calculation provides a clear objective when approaching lenders for a business investment property loan, ensuring you are well-prepared to present a refined proposal that meets their criteria.

- Understand Down Payment Statistics: It's important to note that down payment requirements can vary significantly based on the type of asset and lender policies. For commercial financing options, the typical down payment frequently corresponds with the 20-30% range, but some creditors may provide alternatives with reduced criteria, particularly for established enterprises. Understanding these nuances can enhance your negotiation position when securing financing.

By adhering to these steps and utilizing the complete array of lenders accessible through Finance Story, you can successfully navigate the intricacies of obtaining a commercial financing arrangement, ensuring you are equipped with the essential financial knowledge to make informed decisions.

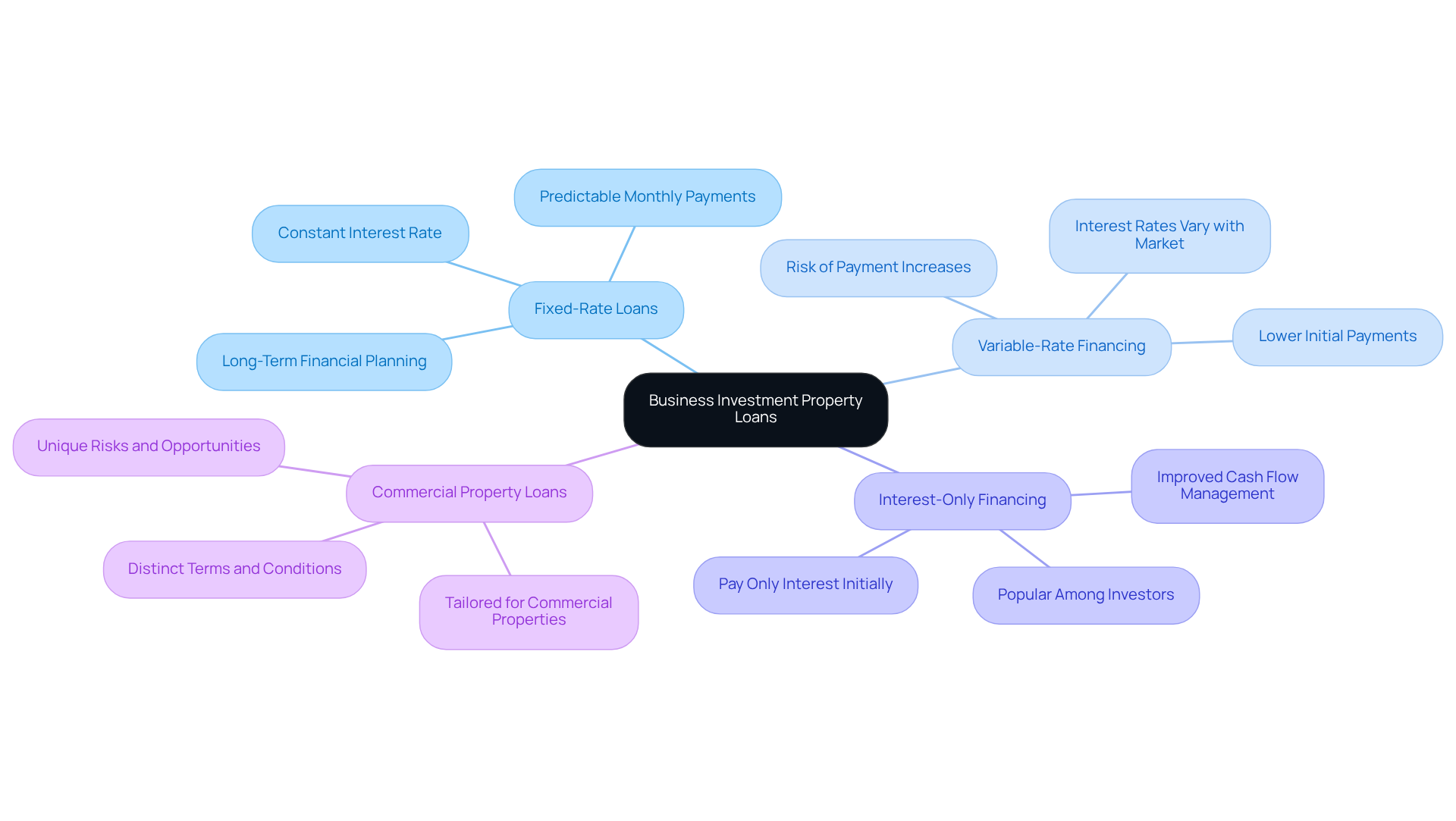

Choose the Right Type of Business Investment Property Loan

When considering financing for a business investment property, evaluating the following loan types is essential:

- Fixed-Rate Loans: These loans maintain a constant interest rate throughout the term, offering predictable monthly payments. This stability can be particularly beneficial for long-term financial planning.

- Variable-Rate Financing: With these arrangements, interest rates vary according to market conditions. While they may start with lower initial payments, there is a risk of increases over time, which could impact cash flow.

- Interest-Only Financing: These arrangements permit borrowers to pay solely the interest for a designated period, greatly assisting cash flow management during the early phases of investment. This option is popular among investors looking to maximize their liquidity early on.

Commercial Property Loans, a form of business investment property loan, are tailored specifically for purchasing commercial properties and often come with distinct terms and conditions compared to residential loans, reflecting the unique risks and opportunities associated with commercial real estate.

At Finance Story, we offer a comprehensive range of mainstream and private options for building homes, ensuring you have access to the best funding solutions for your circumstances. Furthermore, we specialize in refinancing options, allowing you to adapt your financing as your business evolves.

Evaluate each alternative thoughtfully concerning your financial circumstances and goals. For instance, if you intend to sell the asset within a few years, an interest-only financing option could offer the flexibility required to manage cash flow efficiently during that time.

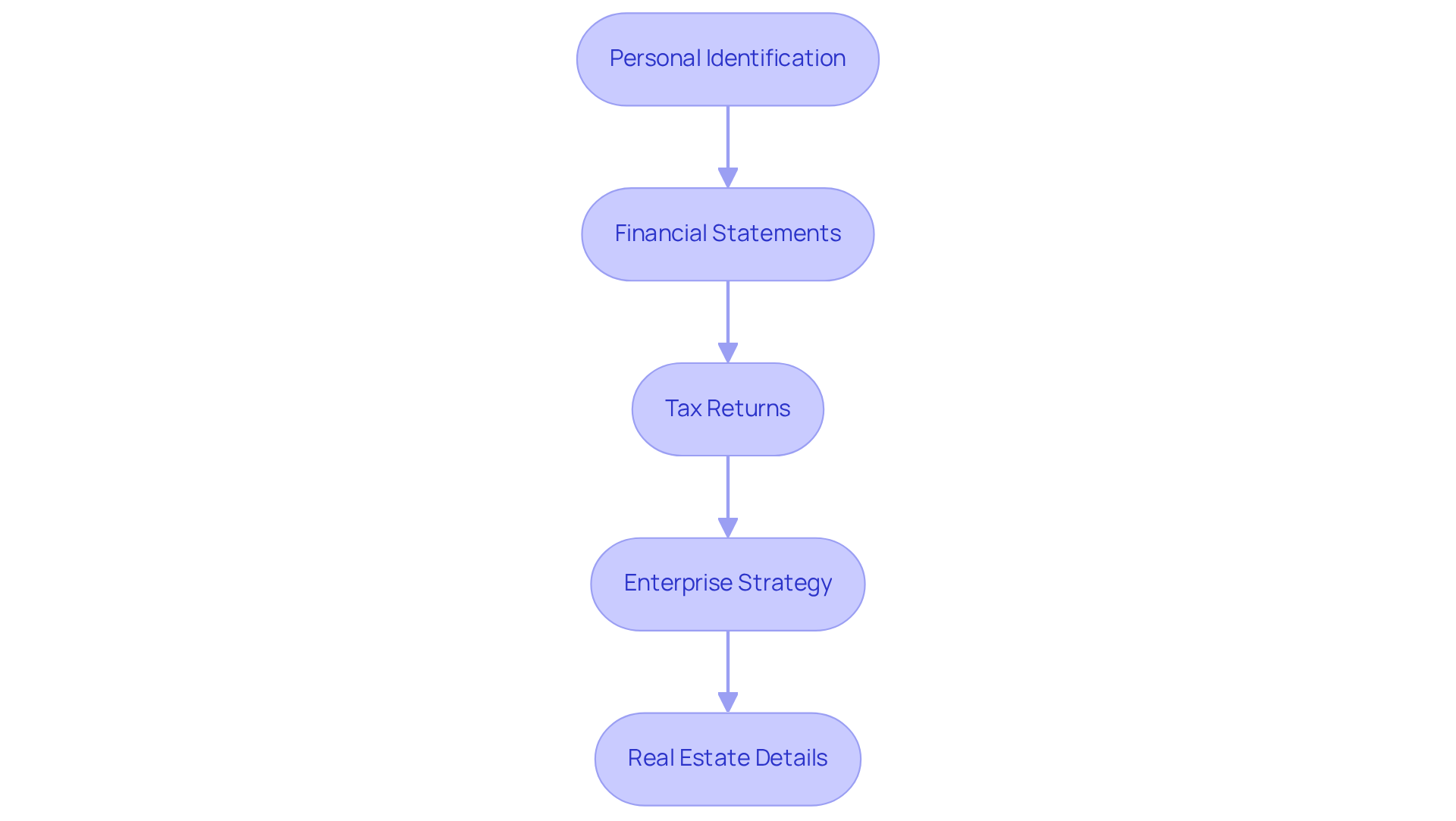

Prepare Your Loan Application and Required Documentation

To prepare your loan application for a business investment property, it is crucial to gather the following essential documents:

- Personal Identification: Include a government-issued ID and proof of address to verify your identity.

- Financial Statements: Provide recent bank statements, profit and loss statements, and balance sheets for your enterprise to demonstrate financial health.

- Tax Returns: Submit personal and company tax returns for the last two years, as these documents reflect your income and financial stability.

- Enterprise Strategy: Create a comprehensive enterprise strategy that details your funding approach and clarifies how the asset fits with your overall operational framework.

- Real Estate Details: Gather extensive information regarding the asset you plan to acquire, including its location, estimated value, and potential rental income.

Ensure that all documents are current and accurately represent your financial situation. A well-organized application not only streamlines the review process but also creates a favorable impression on lenders, thereby increasing your chances of securing a business investment property loan.

Engage with Lenders and Negotiate Terms

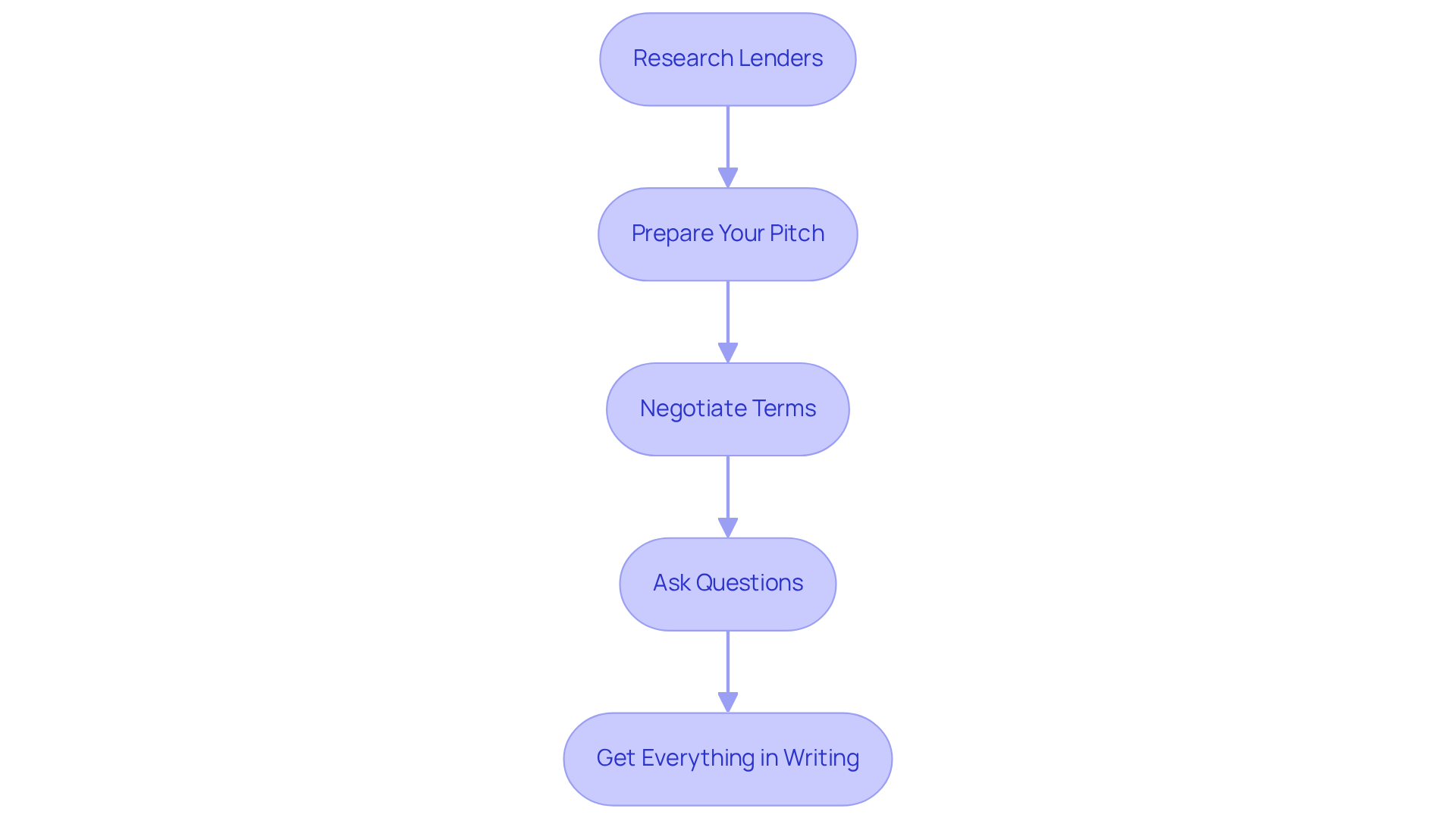

When engaging with lenders for business investment property loans, it is essential to follow these steps:

-

Research Lenders: Begin by comparing various lenders and their proposals, focusing on those that specialize in commercial financing. Finance Story offers access to a comprehensive suite of lenders, including high street banks and innovative private lending panels. This ensures you identify the best options tailored to your specific circumstances.

-

Prepare Your Pitch: Clearly articulate your investment goals and explain how the funding will help achieve these objectives. Highlight your financial stability and present a polished, individualized business case to instill confidence in potential lenders. At Finance Story, we excel in creating compelling proposals that meet the elevated expectations of banks regarding business investment property loans.

-

Negotiate Terms: Don’t hesitate to negotiate interest rates, repayment terms, and associated fees. Leverage competing offers to strengthen your negotiating position. Statistics show that borrowers who negotiate can secure improved terms, potentially saving over $165 monthly in repayments on a standard 30-year mortgage due to a mere 40 basis point difference.

-

Ask Questions: Inquire about any hidden fees, penalties for early repayment, and the flexibility of terms. A thorough understanding of the full scope of the financial agreement is crucial to avoid unexpected costs. Understanding repayment criteria is vital for effective financial planning.

-

Get Everything in Writing: Once you finalize an agreement on terms, ensure that all details are documented in the contract. This protects both parties and clarifies expectations.

Successful negotiation can lead to significant savings and a financing structure that aligns more closely with your financial strategy. As noted by Finance Story, "A well-prepared borrower is often more successful in securing favorable loan terms.

Conclusion

Defining clear objectives stands as the cornerstone of securing a business investment property loan. By understanding the type of property desired, the expected financial outcomes, and how this investment aligns with the broader business strategy, potential borrowers can navigate the loan application process more effectively. This foundational step not only prepares one for discussions with lenders but also sets the stage for informed decision-making throughout the investment journey.

Throughout this article, essential steps have been outlined to guide readers in successfully obtaining a business investment property loan. These steps include:

- Determining the required loan amount

- Understanding various loan types

- Preparing a thorough application

- Effectively engaging with lenders

Each stage plays a critical role in securing favorable financing. By meticulously evaluating financial needs and leveraging negotiation strategies, borrowers can enhance their chances of success and optimize their investment outcomes.

Ultimately, the journey to securing a business investment property loan is multifaceted and necessitates careful planning and execution. By taking the time to clarify objectives, gather necessary documentation, and engage thoughtfully with lenders, individuals can position themselves for success in the competitive real estate market. Embracing these steps not only leads to better financial decisions but also empowers investors to achieve their long-term goals in property investment.