Overview

Financing commercial real estate effectively requires a thorough understanding of various loan types, a careful assessment of financing needs, and diligent research into available loan options. It is essential to prepare the necessary documentation and negotiate favorable terms with lenders. This article outlines these critical steps, underscoring the importance of aligning financing options with specific investment goals and financial circumstances. By doing so, investors can significantly enhance their chances of securing favorable terms and achieving successful investments.

Introduction

Navigating the world of commercial real estate financing presents a significant challenge, particularly as the market continues to evolve and new trends emerge. It is essential to grasp the intricacies of various loan types, interest rates, and repayment terms to make informed investment decisions. This guide serves as a comprehensive roadmap, designed to help you identify the best financing options available, ultimately equipping you with the knowledge to align your financial goals with the most suitable funding strategies.

However, with a multitude of choices at your disposal, how can you discern the most advantageous path to securing capital in such a competitive landscape?

Understand Commercial Real Estate Financing Basics

Acquiring or developing properties intended for business use often relies on the best way to finance commercial real estate. Understanding the following key concepts will empower you to make informed financing decisions:

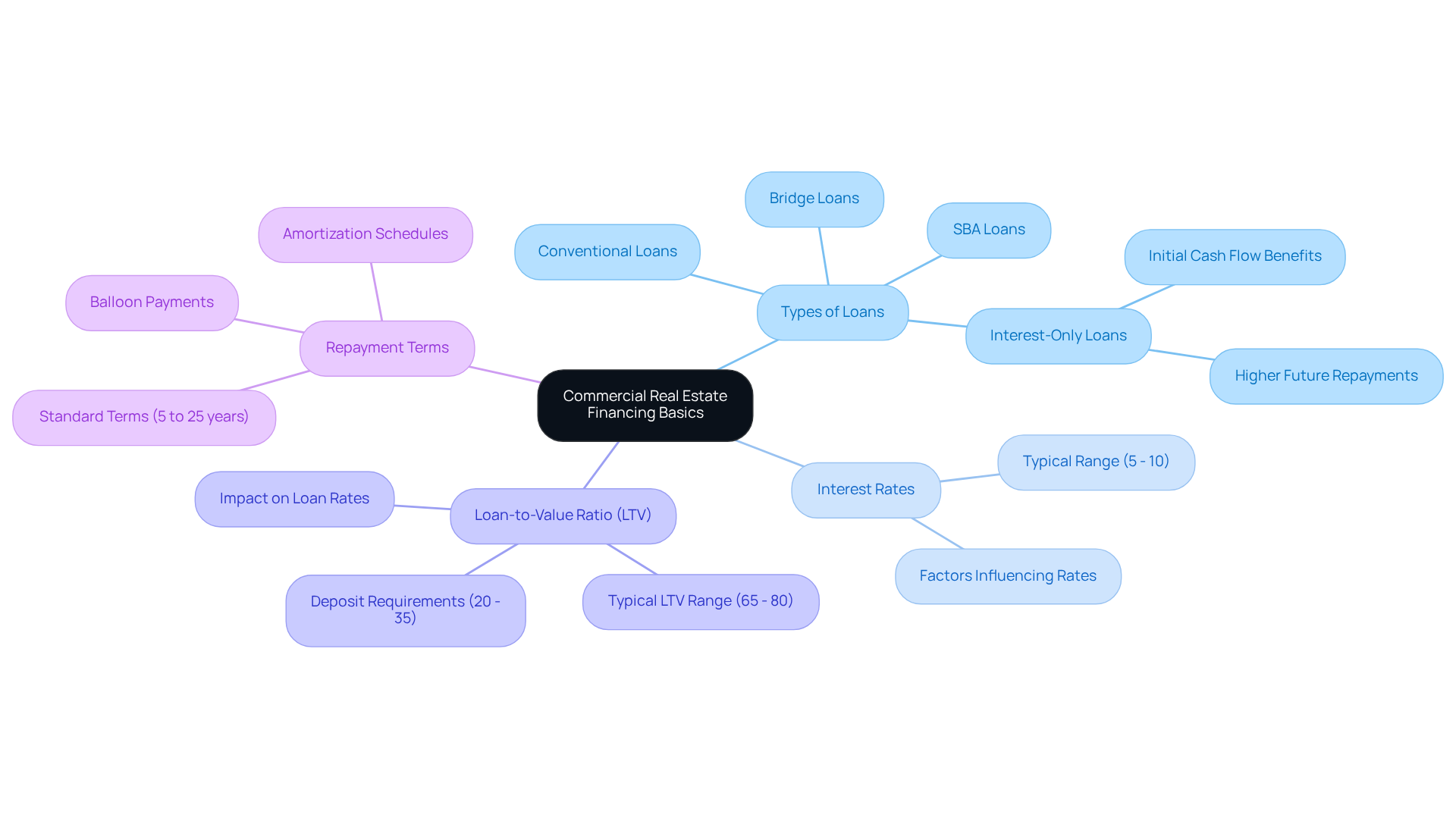

-

Types of Loans: Familiarize yourself with various loan types, including conventional loans, SBA loans, bridge loans, and interest-only loans. Each type has distinct terms and conditions tailored to different investment needs. For instance, interest-only financing permits borrowers to pay solely the interest for a duration of 1 to 5 years, which can improve initial cash flow but may result in increased repayments later.

-

Interest Rates: Average interest rates for commercial real estate financing in 2025 typically range from 5% to 10%, depending on the lender and the borrower's financial profile. Understanding how these rates are determined is crucial, as they significantly impact your overall financing costs.

-

Loan-to-Value Ratio (LTV): The LTV ratio indicates the proportion of the property's value that can be financed through the loan. For commercial properties, lenders often require a lower LTV, typically between 65% and 80%, necessitating a deposit of 20% to 35% of the property's value. A lower LTV is considered less risky, potentially resulting in more advantageous loan rates.

-

Repayment Terms: Different repayment structures, such as amortization schedules and balloon payments, can greatly affect your cash flow. Standard commercial investment loans usually have repayment terms ranging from 5 to 25 years, with balloon payments requiring a final payment on any outstanding principal after the loan term.

By understanding these fundamentals, you will be better prepared to assess your funding options and choose the best way to finance commercial real estate investments.

Identify Your Financing Needs and Goals

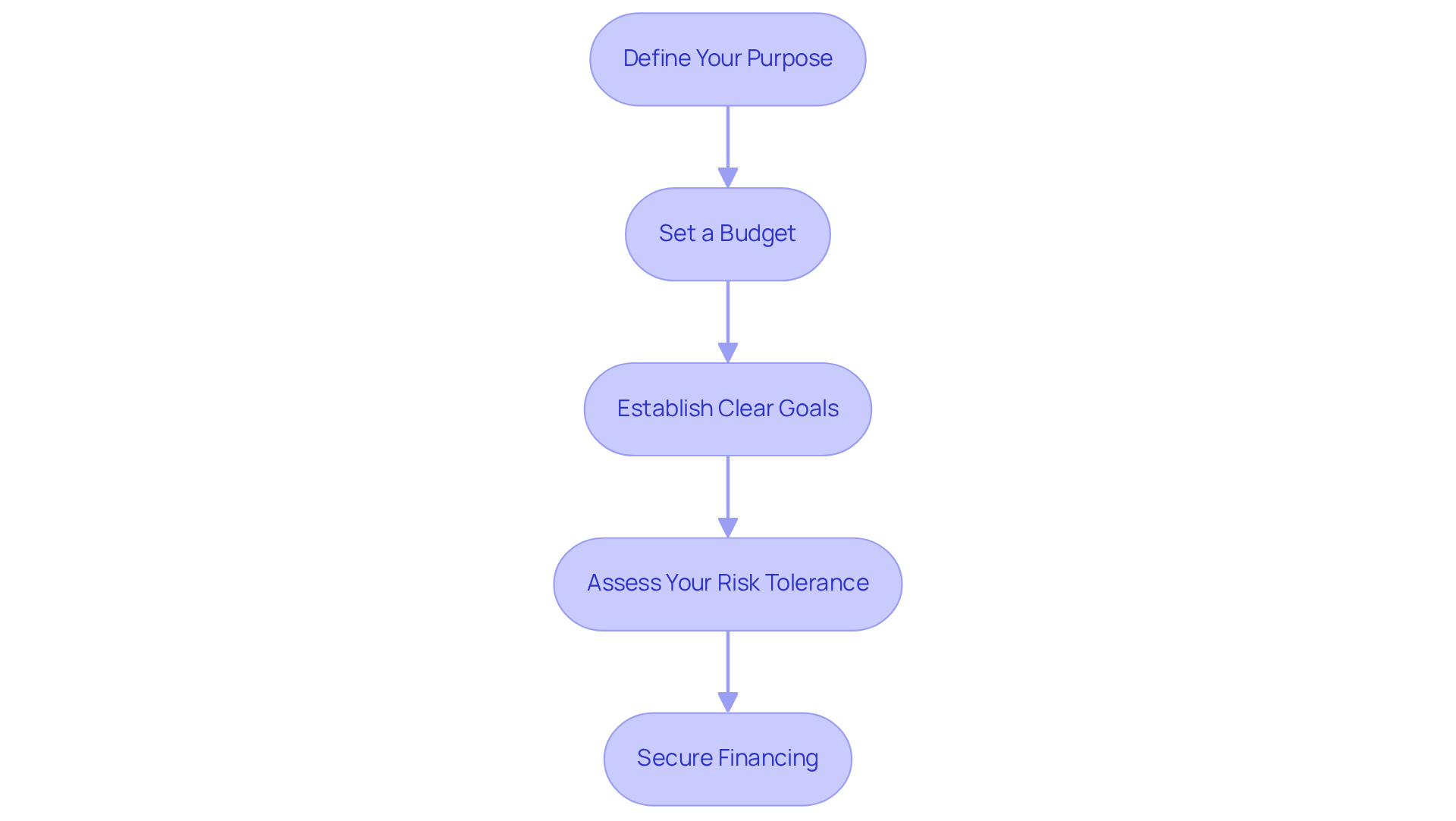

Recognizing your funding requirements and objectives is essential for identifying the best way to finance commercial real estate investments. Start by defining your purpose: Are you acquiring a new property, refinancing an existing mortgage, or funding renovations? Your specific purpose will dictate the type of funding needed, including options for refinancing to adapt to your evolving operational needs.

Next, set a budget. Assess your financial capacity to borrow. Small enterprises typically allocate an average of $663,000 for financing, making it crucial to comprehend your current financial condition and future forecasts.

Establish clear goals. Define your investment objectives, such as expected returns, property appreciation, or cash flow targets. Financial advisors emphasize that having well-defined goals can significantly enhance your investment strategy. Additionally, consider how refinancing can contribute to achieving these objectives.

Finally, assess your risk tolerance. Understand your comfort level with financial risk, as this will influence your choice of loan terms and repayment structures. For instance, businesses with 10-19 employees generate an average annual revenue of $2.16 million, which can inform your risk assessment.

By clarifying your needs and goals, including refinancing options, you position yourself to secure capital that aligns with your commercial real estate ambitions, as this is the best way to finance commercial real estate and ultimately enhances your chances of success in the competitive property market.

Research and Compare Loan Options

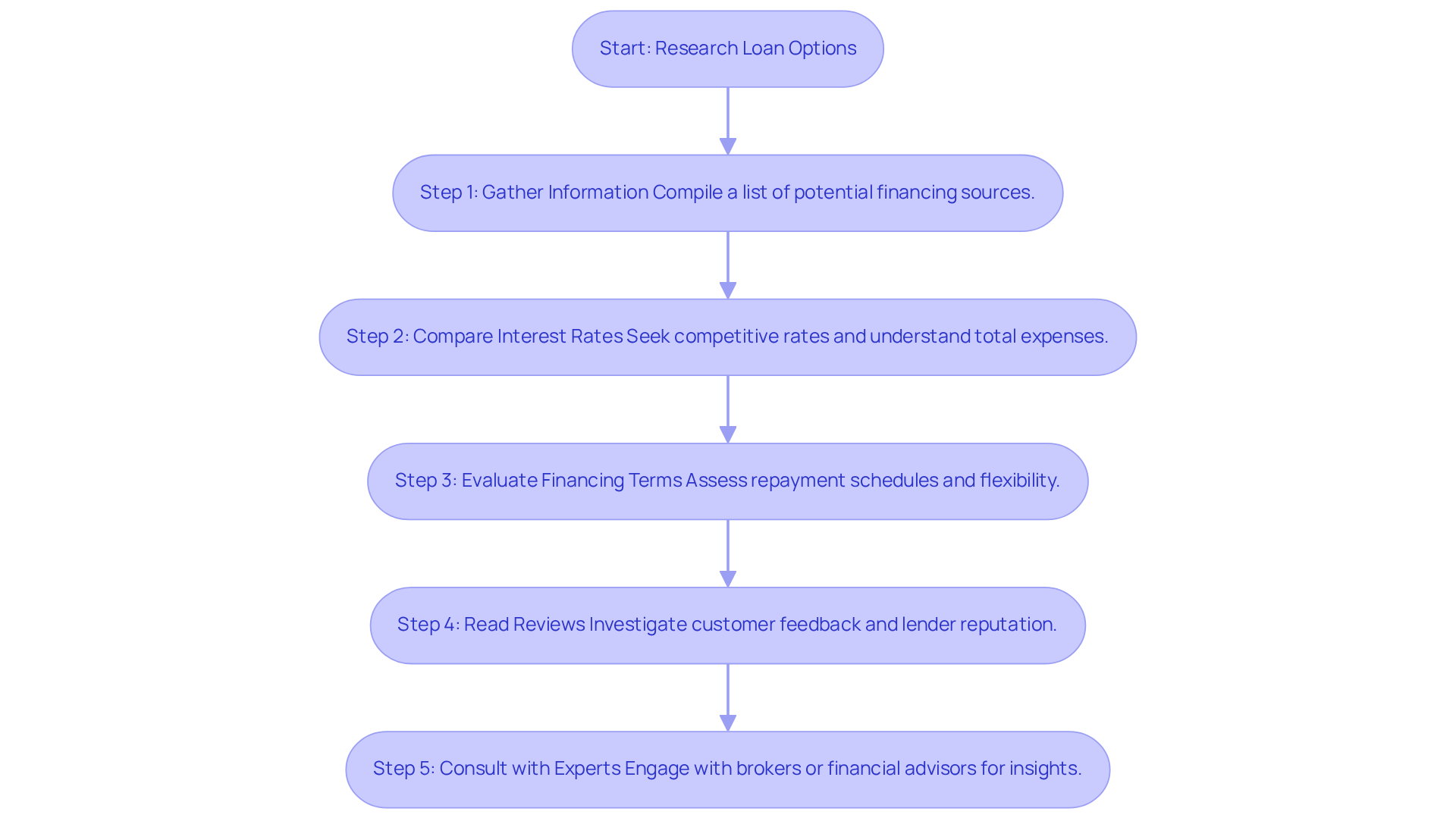

When researching and comparing loan options for commercial real estate financing, consider the following steps:

-

Gather Information: Compile a comprehensive list of potential financing sources, including banks, credit unions, and private entities. Utilize online resources and industry contacts to collect relevant data. Finance Story specializes in creating polished and highly individualized business cases to present to lenders, ensuring you have the best chance of securing the necessary funds for various commercial properties, such as warehouses, retail premises, factories, and hospitality ventures.

-

Compare Interest Rates: Seek competitive interest rates while also considering the total expense of the financing, which includes fees and closing costs. In 2025, average closing expenses for commercial real estate financing can differ greatly, with estimates spanning from 2% to 5% of the amount, making it essential to comprehend these costs for precise comparisons. Working with a knowledgeable broker can help you navigate these complexities and access a full range of lenders available through Finance Story.

-

Evaluate Financing Terms: Assess the conditions of each financing option, including repayment schedules, prepayment penalties, and flexibility for adjustments. This evaluation is essential as it can impact your long-term financial strategy. As highlighted by industry specialists, "Comprehending the subtleties of financing conditions can save borrowers considerable sums throughout the duration of the agreement." Finance Story's expertise in tailored loan proposals ensures that you can find terms that suit your evolving business needs.

-

Read Reviews: Investigate customer feedback and testimonials to assess the provider's reputation and service quality. A lender's track record can provide insights into their reliability and customer service. Finance Story has garnered positive feedback for its bespoke mortgage services, assisting businesses of all sizes in securing funding even in challenging circumstances.

-

Consult with Experts: Engage with mortgage brokers or financial advisors who can offer valuable insights and assist you in navigating the various options available. Their expertise can help you make informed decisions. For instance, broker-arranged financing has demonstrated a lower default rate of 0.6% compared to 0.8% for direct financing, emphasizing the significance of expert guidance in obtaining favorable terms. Finance Story's access to a comprehensive portfolio of private and boutique commercial investors means you have all the choices accessible to discuss with you.

By thoroughly investigating and contrasting funding alternatives, you can identify the best way to finance commercial real estate for your investment. For instance, a small business proprietor who evaluated several funding sources discovered a substantial difference in interest rates and closing expenses, ultimately saving thousands over the duration of their loan.

Prepare Documentation and Strengthen Your Application

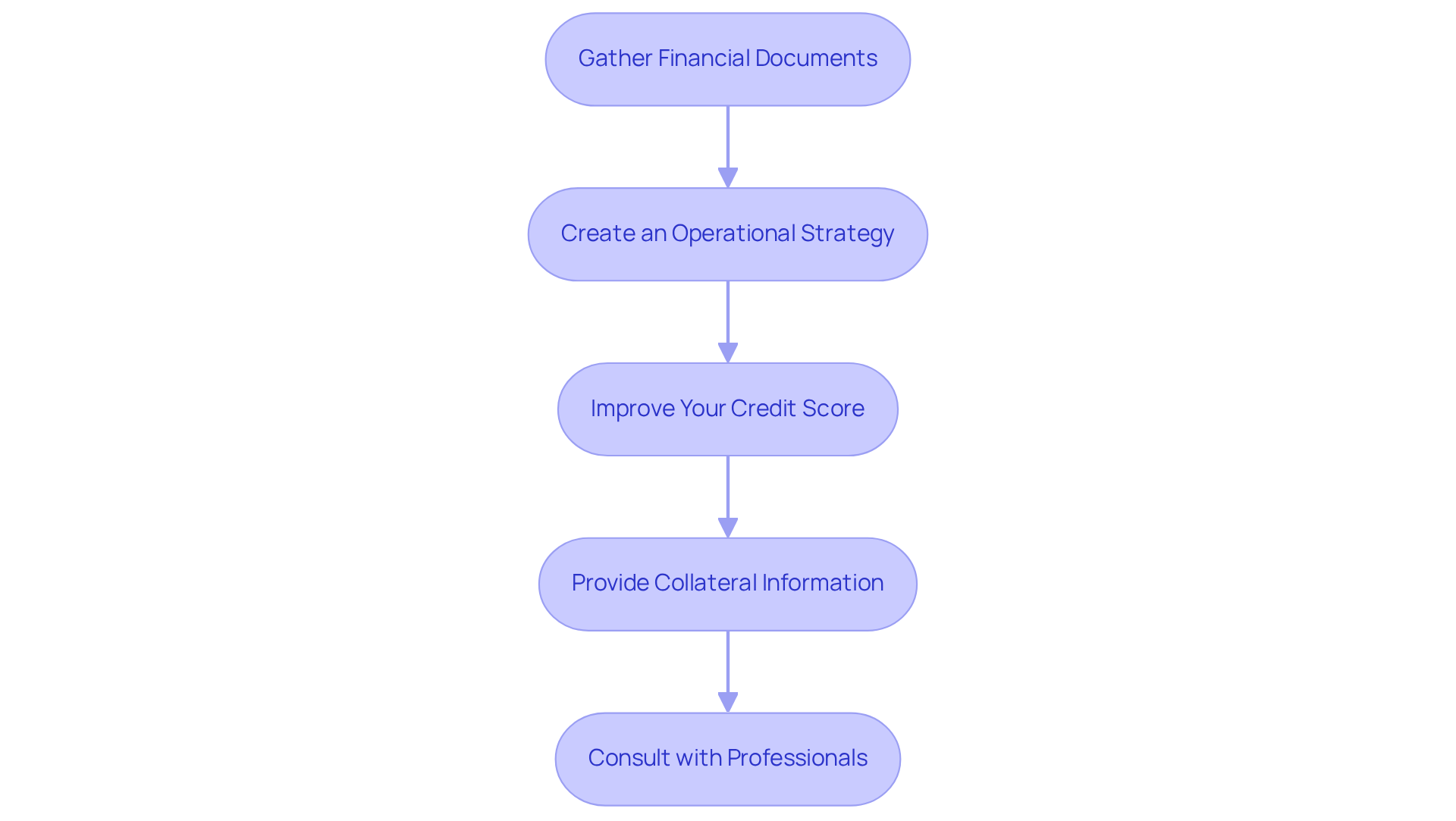

To enhance your application and improve your chances of securing financing, follow these essential steps:

- Gather Financial Documents: Compile key documents such as tax returns, bank statements, profit and loss statements, and balance sheets. These offer creditors a clear view of your financial well-being.

- Create an Operational Strategy: Formulate a comprehensive plan that details your investment approach, anticipated cash flow, and the proposed application of the funds. A well-organized enterprise strategy is essential. In fact, 68% of small venture owners believe access to funding is important for expansion, and a solid plan can greatly affect lender trust.

- Improve Your Credit Score: Review your credit report for accuracy and take proactive steps to enhance your credit score. An elevated credit score can result in improved loan conditions. Small enterprise owners who comprehend their credit scores are 41% more likely to receive approval for bank loans.

- Provide Collateral Information: Prepare documentation related to any collateral you plan to offer, such as property deeds or business assets. This can enhance your application by showcasing your dedication and decreasing financial institution risk.

- Consult with Professionals: Engage with a mortgage broker or financial advisor to review your application and ensure all documentation is complete and accurate. Their expertise can assist you in navigating the complexities of the funding landscape.

By carefully organizing your documentation, you not only boost your credibility with financial institutions but also greatly improve your likelihood of discovering the best way to finance commercial real estate investments.

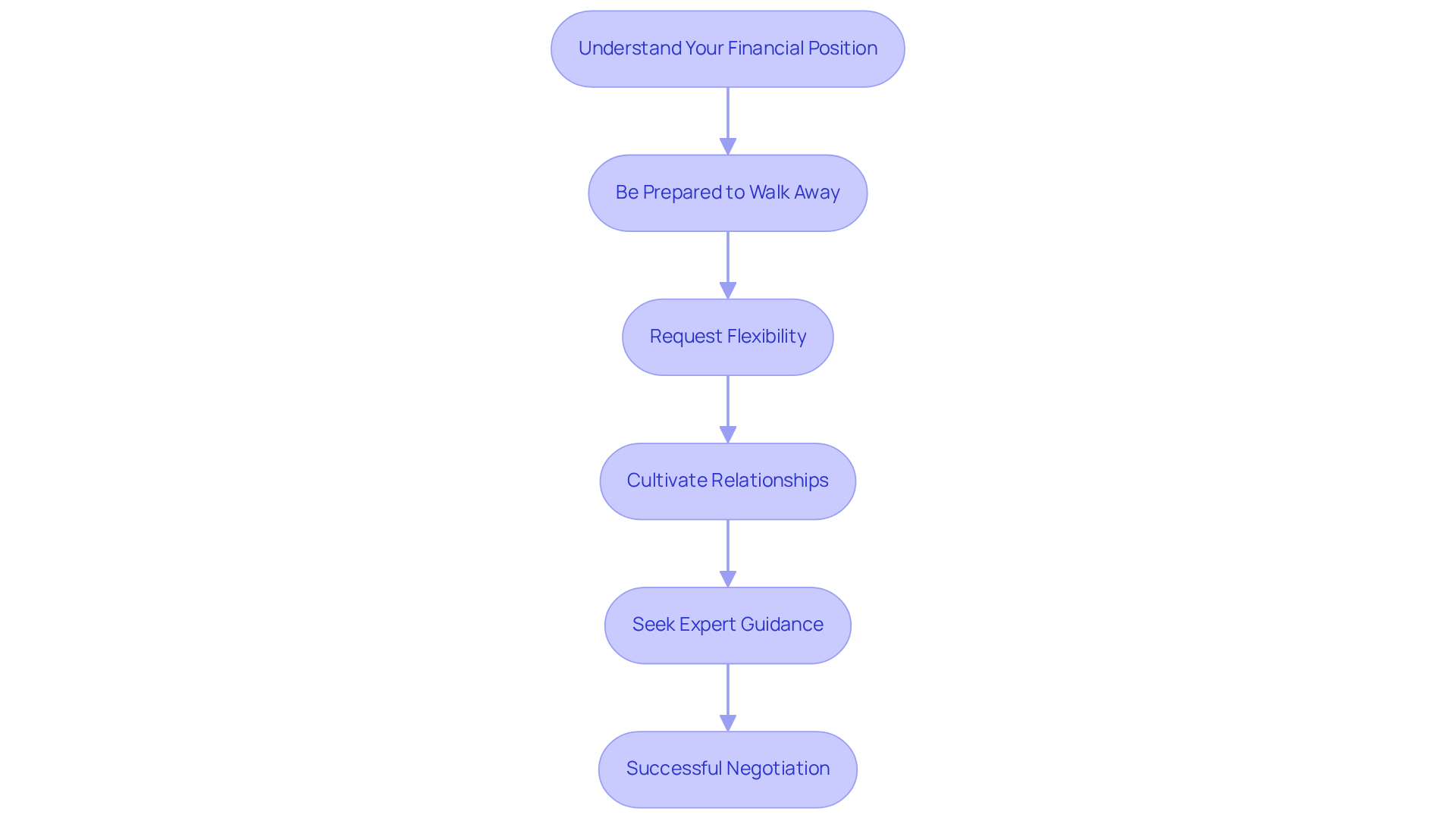

Negotiate Terms with Lenders

To negotiate favorable terms with lenders effectively, implement the following strategies:

-

Understand Your Financial Position: Assess your financial strengths, such as a robust credit score or a well-structured business plan. This knowledge empowers you to leverage your worth during negotiations, potentially leading to better terms.

-

Be Prepared to Walk Away: Demonstrating that you have alternative financing options can strengthen your negotiating position. If financial institutions cannot meet your requirements, being open to exploring other avenues can motivate them to provide more favorable terms.

-

Request Flexibility: Don’t hesitate to ask for flexible repayment options, lower interest rates, or reduced fees. Articulating your needs clearly can open the door to negotiations that better suit your financial situation.

-

Cultivate Relationships: Establishing rapport with financial institutions is crucial. A positive relationship can lead to more favorable terms and conditions, as lenders are often more inclined to work with clients they trust.

-

Seek Expert Guidance: Engaging a mortgage broker or financial advisor can provide valuable insights and support throughout the negotiation process. Their expertise can help you navigate complex financial landscapes and secure the best possible deal.

By employing these strategies, you can enhance your ability to identify the best way to finance commercial real estate that aligns with your objectives while minimizing costs.

Conclusion

Understanding the optimal approach to financing commercial real estate requires a comprehensive strategy that encompasses various financial aspects and strategic planning. By mastering the essentials of loan types, interest rates, and repayment terms, investors can make informed decisions that align with their goals and risk tolerance. This foundational knowledge serves as a springboard for navigating the complexities of commercial financing.

Key insights discussed throughout the article highlight the significance of:

- Identifying specific financing needs and goals

- Thoroughly researching loan options

- Meticulously preparing documentation

- Effectively negotiating terms with lenders

Each of these steps plays a critical role in enhancing the likelihood of securing favorable financing conditions, ultimately leading to successful investment outcomes. By taking the time to assess one’s financial position and exploring all available options, investors can uncover substantial savings and opportunities in their commercial real estate ventures.

Ultimately, the journey to financing commercial real estate transcends merely securing funds; it is about establishing a solid foundation for future growth and success. Investors are encouraged to implement these best practices, remain informed about current trends, and seek expert guidance when necessary. By doing so, they can strategically position themselves in a competitive market, ensuring their investments yield the desired returns while navigating the financial landscape with confidence.