Overview

This article delineates five essential steps for effectively utilizing a business loans finder, underscoring the critical roles of preparation, navigation, comparison, and troubleshooting throughout the loan application process. It elaborates on how meticulous documentation and informed decision-making can markedly improve the likelihood of securing advantageous financing, ultimately empowering entrepreneurs to realize their business aspirations.

Introduction

In the competitive landscape of business financing, finding the right loan can often feel like navigating a maze. A business loans finder emerges as a vital tool for entrepreneurs, simplifying the search for tailored financing solutions that align with specific needs. By efficiently connecting business owners with a diverse array of lenders, this digital resource not only saves time but also enhances the likelihood of securing favorable terms.

As small businesses increasingly recognize the importance of capital in driving growth, understanding how to leverage these tools effectively becomes paramount. Furthermore, with insights into preparing essential financial documentation, navigating loan options, and troubleshooting common application challenges, this guide aims to equip business owners with the knowledge needed to make informed financial decisions and ultimately thrive in their ventures.

Understand the Purpose of a Business Loans Finder

A business loans finder serves as an essential online tool for entrepreneurs seeking tailored funding options. By supplying specific information about your business and financial needs, this tool effectively connects you with a comprehensive array of financial institutions, including major banks and innovative private financing groups, that offer funding aligned with your criteria. This is especially beneficial for those who may not have the time or resources to conduct thorough research on various lenders.

The business loans finder simplifies the process, allowing users to compare various financial products and terms all in one convenient location. This not only streamlines decision-making but also enhances the likelihood of securing favorable financing alternatives, including refinancing existing debts. In fact, studies show that access to capital significantly increases success rates for small enterprises, creating a positive cycle of funding and growth.

As small business owners increasingly turn to online funding finders, understanding how to utilize these tools effectively can lead to more informed financial decisions and improved outcomes. Notably, companies generating $10 million or more have seen a 6.6% increase, underscoring the importance of obtaining funding for expansion. Moreover, disparities in access to funding persist, as evidenced by the challenges faced by women-owned businesses in securing financing.

With the average small business funding amount hovering around $663,000, utilizing a business loans finder becomes crucial for identifying suitable funding options that can support growth, whether for warehouses, retail locations, factories, or hospitality projects. At Finance Story, we specialize in crafting refined and highly personalized proposals to present to lenders, ensuring you have the best opportunity to secure the right funding for your commercial property investments and refinances.

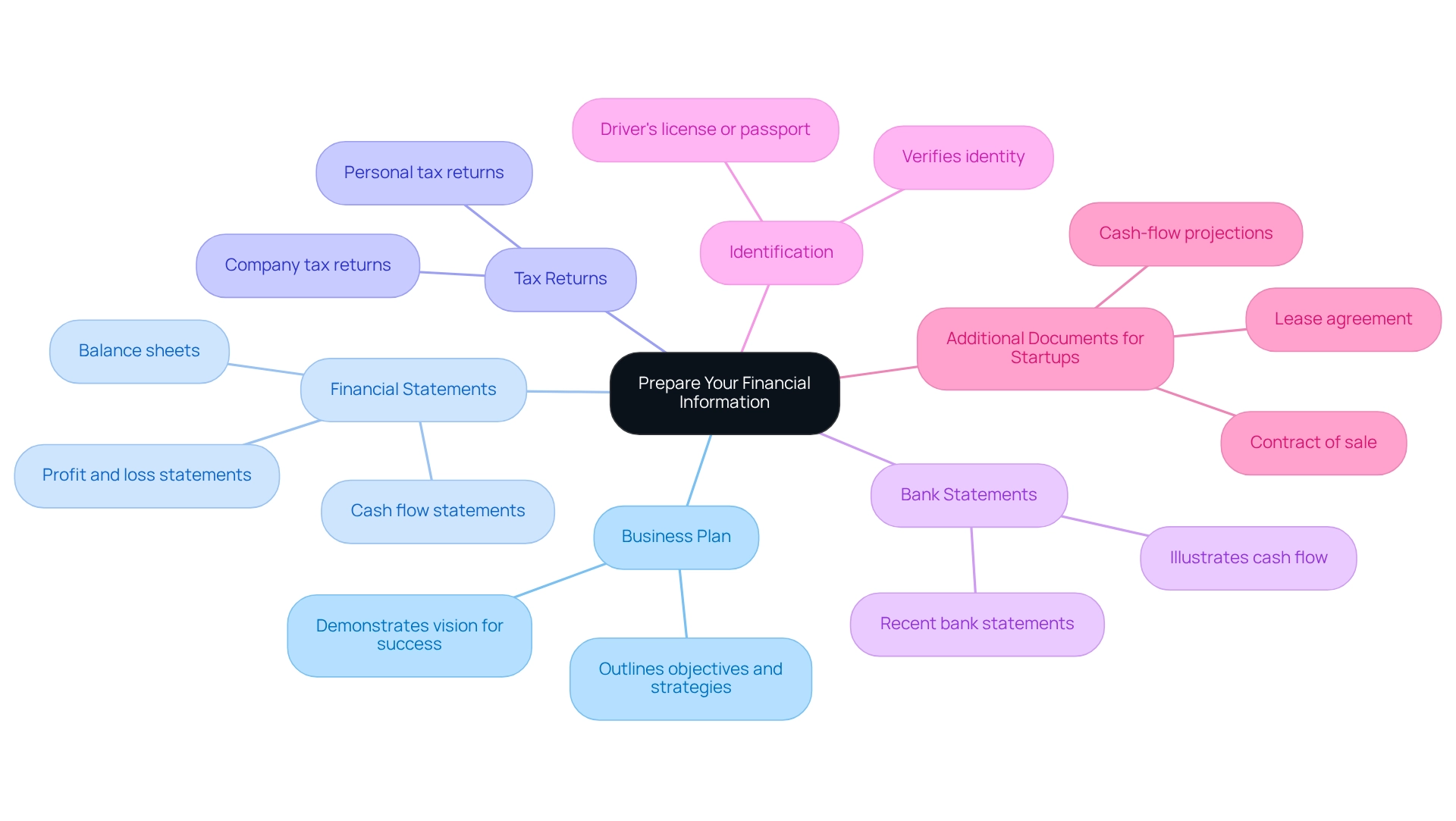

Prepare Your Financial Information and Documentation

To effectively utilize a business loans finder, it is essential to prepare all required monetary documents beforehand. This preparation simplifies your application process and significantly improves your chances of approval. The essential documents include:

- Business Plan: A comprehensive outline detailing your business objectives, strategies, and financial forecasts. A strong plan is crucial, as it demonstrates to lenders that you possess a clear vision and strategy for success.

- Financial Statements: Provide profit and loss statements, balance sheets, and cash flow statements for the past two years. These documents offer a glimpse into your company's economic status and performance.

- Tax Returns: Include personal and company tax returns for the past two years to showcase your stability and adherence to tax responsibilities.

- Bank Statements: Recent bank statements are vital for illustrating your cash flow and spending patterns, providing creditors with insight into your financial management.

- Identification: Include personal identification documents, such as a driver's license or passport, to verify your identity and establish credibility.

- Additional Documents for Startups: If your enterprise has been operating for less than 12 months, consider including cash-flow projections, a contract of sale, and a lease agreement to bolster your application.

Preparing these documents not only streamlines the application process but also enhances your position with prospective financiers found through a business loans finder. Statistics reveal that companies with well-structured financial records have a considerably greater opportunity of securing funding, as creditors are more inclined to endorse requests that clearly illustrate financial feasibility. Significantly, large banks have a low approval rate of 13.8% for small enterprises, whereas smaller banks offer a more favorable rate of 19%. Additionally, non-bank financing has an approval rate of nearly 25%. By investing time in preparing these documents, you position your venture for success in obtaining the necessary funding. As the group at Capital Bank states, "we strive diligently to support as many small enterprises as possible, offering adaptable financing options to our clients.

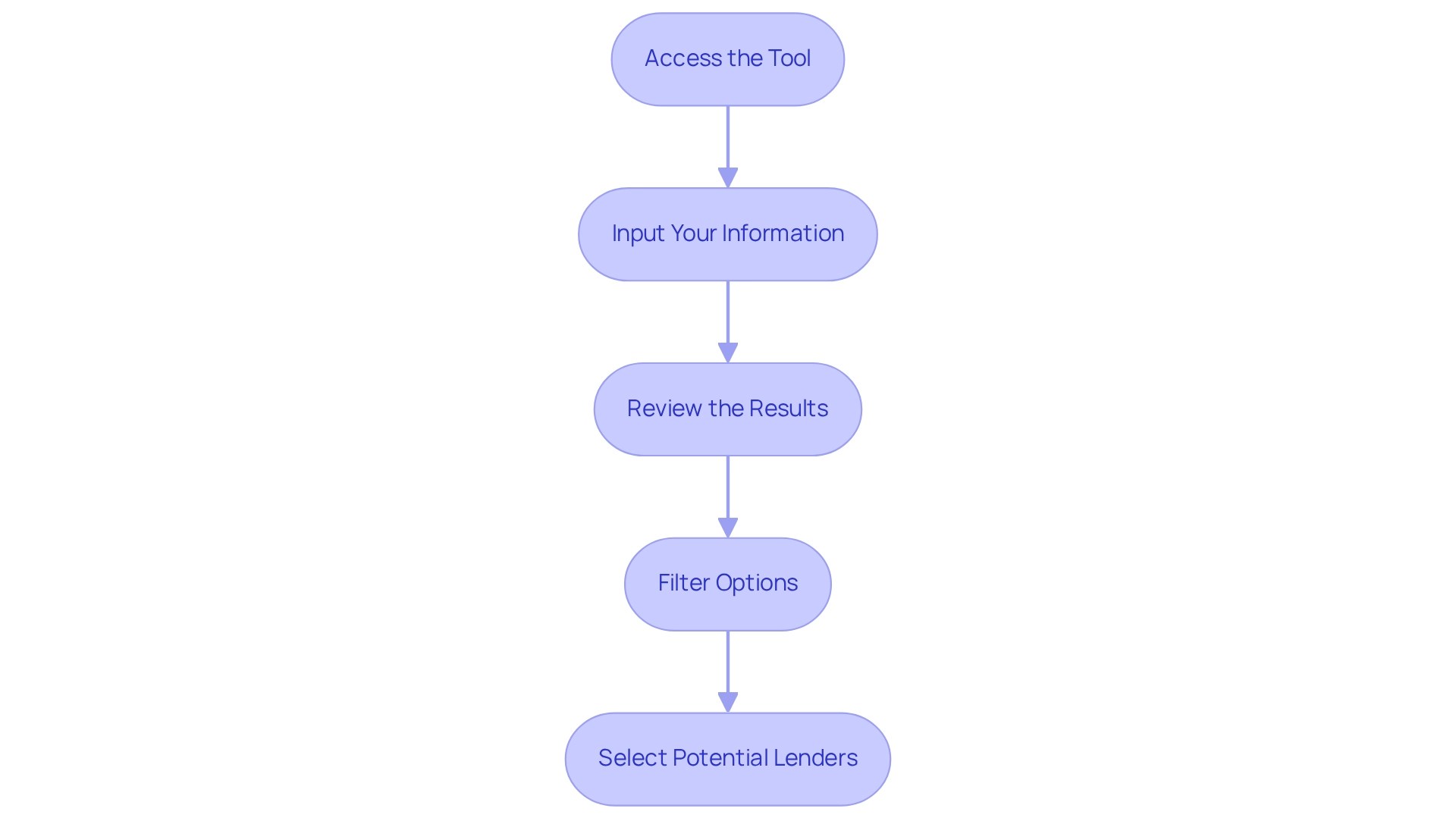

Navigate the Business Loans Finder Tool

To efficiently navigate a business loans finder, follow these streamlined steps:

-

Access the Tool: Start by visiting a reputable financing finder website that consolidates various lenders. Investing in small enterprises is crucial, as it drives innovation and sustainable economic development.

-

Input Your Information: Carefully fill out the required fields, including your business type, desired funding amount, financing purpose, and relevant financial details. Remember, crafting a well-defined and personalized case can significantly enhance your chances of securing the right funding.

-

Review the Results: Upon submission, meticulously examine the list of financial institutions and borrowing options. Pay close attention to key factors such as interest rates, repayment terms, and any associated fees to make informed comparisons. Notably, businesses that leverage adaptable financing servicing options often experience a substantial increase in repayment rates.

-

Filter Options: Use filtering features to narrow down your results based on specific criteria, such as loan type or provider reputation, ensuring you identify the most suitable business loans finder options. Partnering with a broker like Finance Story can provide access to a comprehensive range of financial institutions, including high street banks and private lending panels, enhancing your ability to discover tailored solutions for various commercial properties, whether it involves a warehouse, retail location, factory, or hospitality business.

-

Select Potential Lenders: Identify several lenders that present the most favorable terms and conditions aligned with your needs. The typical amount requested by small enterprises hovers around £10,000, indicating a strong inclination for smaller financing to meet their operational requirements. Understanding the repayment obligations for business funding is essential to ensure you choose a financial option that aligns with your financial capabilities.

By adhering to these steps, you can effectively utilize the funding finder tool to uncover financing alternatives that resonate with your business objectives.

Compare Loan Options and Understand Terms

Once you have compiled a list of potential financing options using a business loans finder, the next step is to conduct a thorough comparison. Here’s how to effectively evaluate your choices:

- Interest Rates: Examine both fixed and variable interest rates. Fixed rates offer stability, remaining constant throughout the financing term, while variable rates can fluctuate based on market conditions, potentially impacting your overall repayment amount.

- Borrowing Conditions: Comprehend the length of the borrowing period, as this will affect your monthly payments. Shorter financing terms typically result in higher monthly payments but lower total interest costs, making them a viable option for businesses looking to minimize long-term expenses.

- Fees: Be vigilant about additional fees that may apply, such as application fees, ongoing service fees, or penalties for early repayment. These costs can significantly affect the total expense of the loan, so it’s crucial to factor them into your decision-making process.

- Repayment Flexibility: Investigate whether the financial institution provides flexible repayment options. Features such as the capability to make additional payments or modify payment schedules can offer valuable economic breathing space, particularly during variable business cycles.

- Creditor Reputation: Investigate the creditor’s reputation by examining customer feedback and evaluating their service ratings. An individual or institution with a strong track record of customer satisfaction can be a reliable partner in your financial journey.

- Current Interest Rates: As of 2025, the average interest rates for small enterprise financing are crucial to consider, as they can vary significantly based on the lender and the type of financing.

- Understanding Factor Rates: Be aware that factor rates do not provide an annual cost of borrowing, complicating comparisons of financing. This is an important aspect to consider when evaluating your options.

- Economic Context: According to Dr. Pratiti Chatterjee, the hospitality sector is experiencing dwindling profit margins, and households face tight budget constraints, which can impact borrowing decisions. This context is crucial for grasping the present lending environment, and by leveraging a business loans finder to thoughtfully evaluate these elements, you can choose a financial product that not only fulfills your immediate monetary requirements but also corresponds with your long-term objectives. With Finance Story's expertise in creating polished and customized financial cases, you can navigate the lending landscape effectively, ensuring that you secure the right financing solution tailored to your commercial property investment or refinance needs.

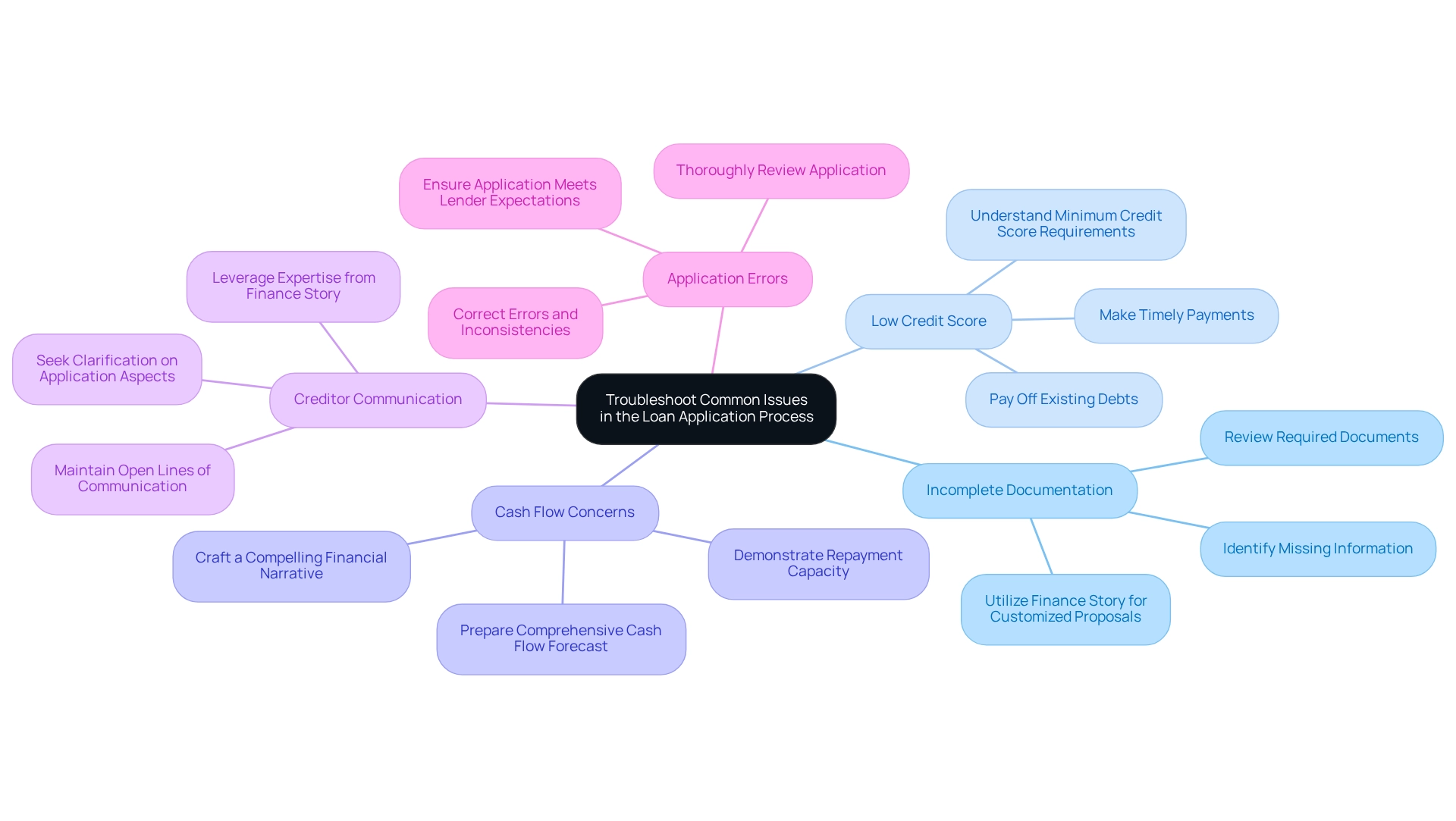

Troubleshoot Common Issues in the Loan Application Process

Navigating the financing application process can present several challenges. Here’s how to effectively troubleshoot common issues:

- Incomplete Documentation: Ensure that all required documents are submitted. Carefully review your application to identify any missing information that could delay processing. At Finance Story, we focus on developing refined and highly customized proposals to present to financiers, simplifying this process.

- Low Credit Score: If your application is denied due to a low credit score, take steps to improve it. Focus on paying off existing debts and making timely payments to enhance your creditworthiness before reapplying. The minimum credit rating for SBA financing typically begins at 680, with some financial institutions demanding even higher scores. It's important to note that a business with a solid credit score but lower revenue may still face challenges in securing a loan.

- Cash Flow Concerns: If creditors raise concerns about your cash flow, prepare a comprehensive cash flow forecast. This document can demonstrate your capacity to handle repayments and assure creditors of your economic stability. Our team at Finance Story can assist you in crafting a compelling financial narrative that effectively addresses these concerns.

- Creditor Communication: Maintain open lines of communication with your creditor. If you have questions or need clarification on any aspect of the application, don’t hesitate to reach out for assistance. Our expertise in navigating financial institution expectations can provide you with valuable insights.

- Application Errors: Thoroughly review your application for any errors or inconsistencies. Even minor mistakes can lead to delays or outright denials, so attention to detail is crucial. Working with Finance Story ensures that your application is polished and meets the heightened expectations of lenders.

By proactively tackling these frequent problems, you can greatly enhance your likelihood of being identified by a business loans finder. Statistics show that many small enterprise credit requests are rejected due to excessive debt (44%) and inadequate collateral (33%), highlighting the significance of submitting a robust application. Additionally, with the entire application process now being 100% online, ensuring accuracy and completeness has never been more critical. As Goldman Sachs observes, 70% of small enterprise loans are supplied by banks with under $250 billion in assets, emphasizing the competitive environment of loan approvals. Furthermore, referencing the case study titled "Reasons Why Business Loans Are Declined" can provide concrete examples of the challenges faced by businesses, enhancing the overall credibility of the advice.

At Finance Story, we utilize a business loans finder to work with a diverse range of lenders, including high street banks and innovative private lending panels, to help you secure the right financing for various commercial properties, whether it be a warehouse, retail space, factory, or hospitality venture.

Conclusion

Securing the right financing is an essential step for entrepreneurs aiming to expand their businesses. A business loans finder emerges as an invaluable resource in this endeavor. By efficiently connecting business owners with a diverse array of lenders, this tool simplifies the often daunting process of identifying tailored loan options. Understanding how to leverage this technology, alongside preparing essential financial documentation, can significantly enhance the likelihood of obtaining favorable terms, ultimately driving business success.

The importance of thorough preparation and informed decision-making cannot be overstated. By compiling comprehensive financial documents and skillfully navigating the loan finder tool, business owners can effectively compare various loan options and discern the terms that best align with their needs. This proactive approach streamlines the application process and positions businesses to make strategic financial choices that resonate with their growth objectives.

In a competitive lending landscape, addressing common application challenges is vital. Recognizing potential pitfalls—such as incomplete documentation or low credit scores—and actively troubleshooting these issues can markedly improve entrepreneurs' chances of loan approval. Equipped with the right tools and knowledge, small businesses can unlock the necessary capital for expansion, fostering a cycle of growth and innovation that benefits not just individual ventures but the broader economy as well. Embracing these strategies empowers business owners to navigate their financial paths with confidence and clarity.