Overview

To determine the required deposit for a commercial property loan, it is essential to consider the property's value, the lender's loan-to-value ratio (LVR), and the type of financing needed. Typically, a deposit ranging from 20% to 35% is required. Understanding these factors is crucial for accurate financial planning and securing favorable loan conditions. Furthermore, one's creditworthiness and the specifics of the asset play a significant role in this process. By grasping these elements, you can position yourself for success in obtaining the financing you need.

Introduction

Navigating the world of commercial property financing can indeed be a daunting task, particularly when it comes to grasping the substantial deposits required for loans. Unlike traditional home mortgages, which often feature lower down payment thresholds, commercial loans typically demand a significant upfront investment, ranging from 20% to 35% of the property’s value. This guide meticulously explores the crucial steps for determining the necessary deposit, illuminating the factors that influence these amounts and providing insights into the calculation process.

With so much at stake, how can potential borrowers ensure they are adequately prepared to meet these financial demands and secure the best possible terms for their investment?

Understand Commercial Property Loans

Business real estate financing options present tailored solutions for purchasing, refinancing, or developing commercial properties. Unlike home financing, which typically features lower down payment requirements and extended terms, business financing generally requires a commercial property loan deposit that is a more substantial upfront investment, often ranging from 20% to 35% of the property's value. Understanding the various categories of commercial financing—such as investment financing, owner-occupied financing, and construction financing—is vital for effective financial planning. Each type of credit comes with distinct terms, interest rates, and funding prerequisites that can significantly influence your overall financing strategy.

For example, investment loans may demand a larger initial payment due to the perceived risks associated with investment assets. Conversely, owner-occupied loans often provide more favorable conditions, reflecting the reduced risk for lenders. Furthermore, lenders may assess factors such as the asset's location and prevailing market conditions, which can further affect requirement levels. As the real estate landscape evolves, staying informed about these dynamics is essential for securing optimal financing options.

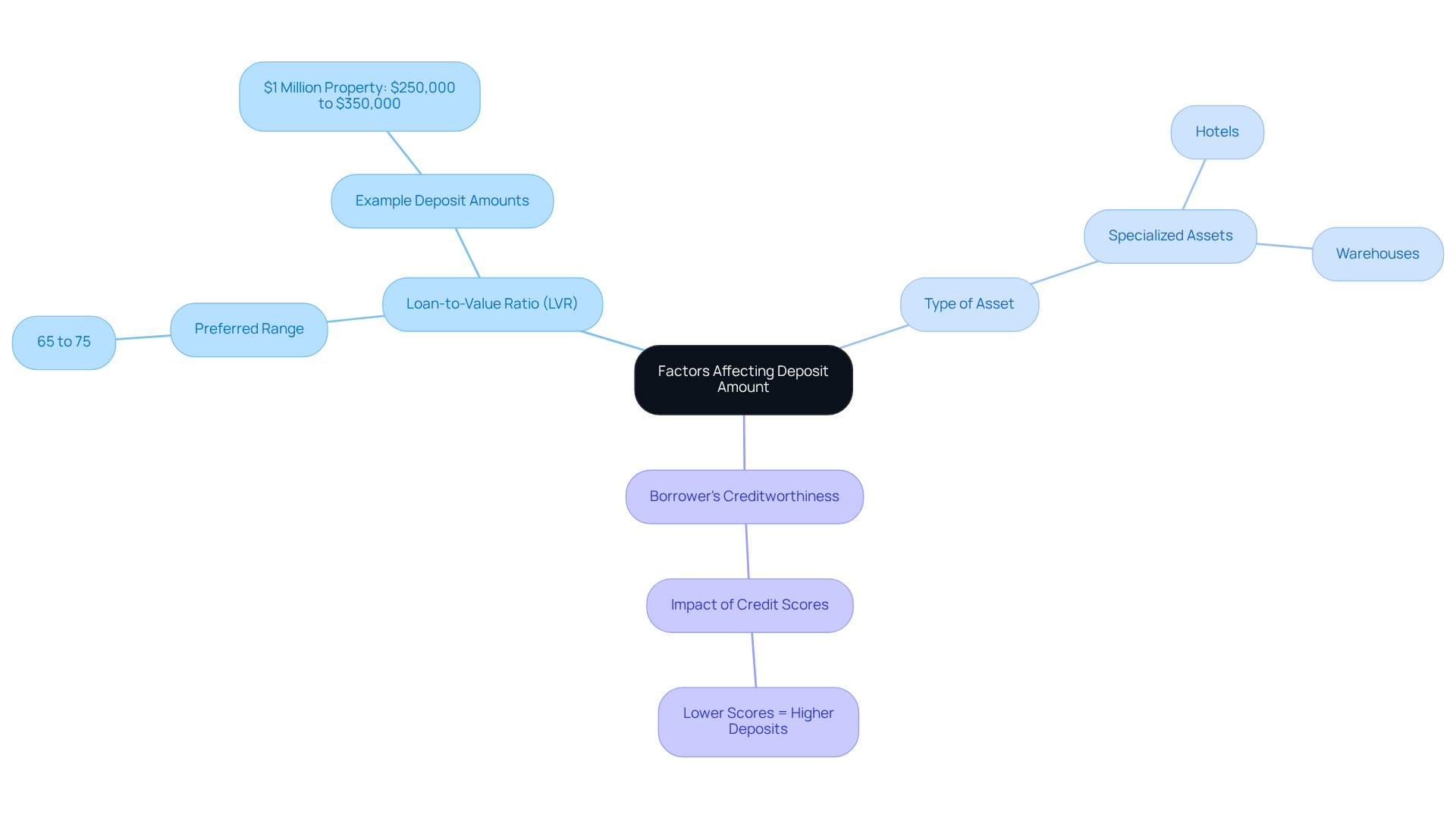

Identify Factors Affecting Deposit Amount

The commercial property loan deposit required is influenced by several crucial factors, with the loan-to-value ratio (LVR) standing out as the most significant. Lenders generally prefer an LVR between 65% and 75% for commercial real estate, indicating that a commercial property loan deposit required is approximately 25% to 35%. For instance, when acquiring a real estate asset valued at $1 million, a commercial property loan deposit required would necessitate an upfront payment ranging from $250,000 to $350,000 under these circumstances.

Moreover, the type of asset plays a pivotal role in determining the commercial property loan deposit required upfront. Specialized assets, such as hotels or warehouses, often come with unique risks that may compel lenders to impose higher upfront payment demands. Your creditworthiness is another critical factor; borrowers with lower credit scores or less favorable financial histories may encounter requests for a larger deposit, as a commercial property loan deposit required by lenders aims to mitigate potential risks.

Looking ahead to 2025, trends indicate that the average LVR for business properties in Australia remains consistent with historical preferences, hovering around 70%. This stability suggests that while lenders exercise caution, they are also receptive to financing opportunities, especially for borrowers who demonstrate strong financial profiles. Financial specialists emphasize that understanding the LVR is essential for navigating business financing, as it directly impacts borrowing conditions and overall costs. A lower LVR can lead to more favorable financing terms, including reduced interest rates and lower mortgage insurance premiums, making it a crucial consideration for prospective borrowers.

Calculate Your Required Deposit

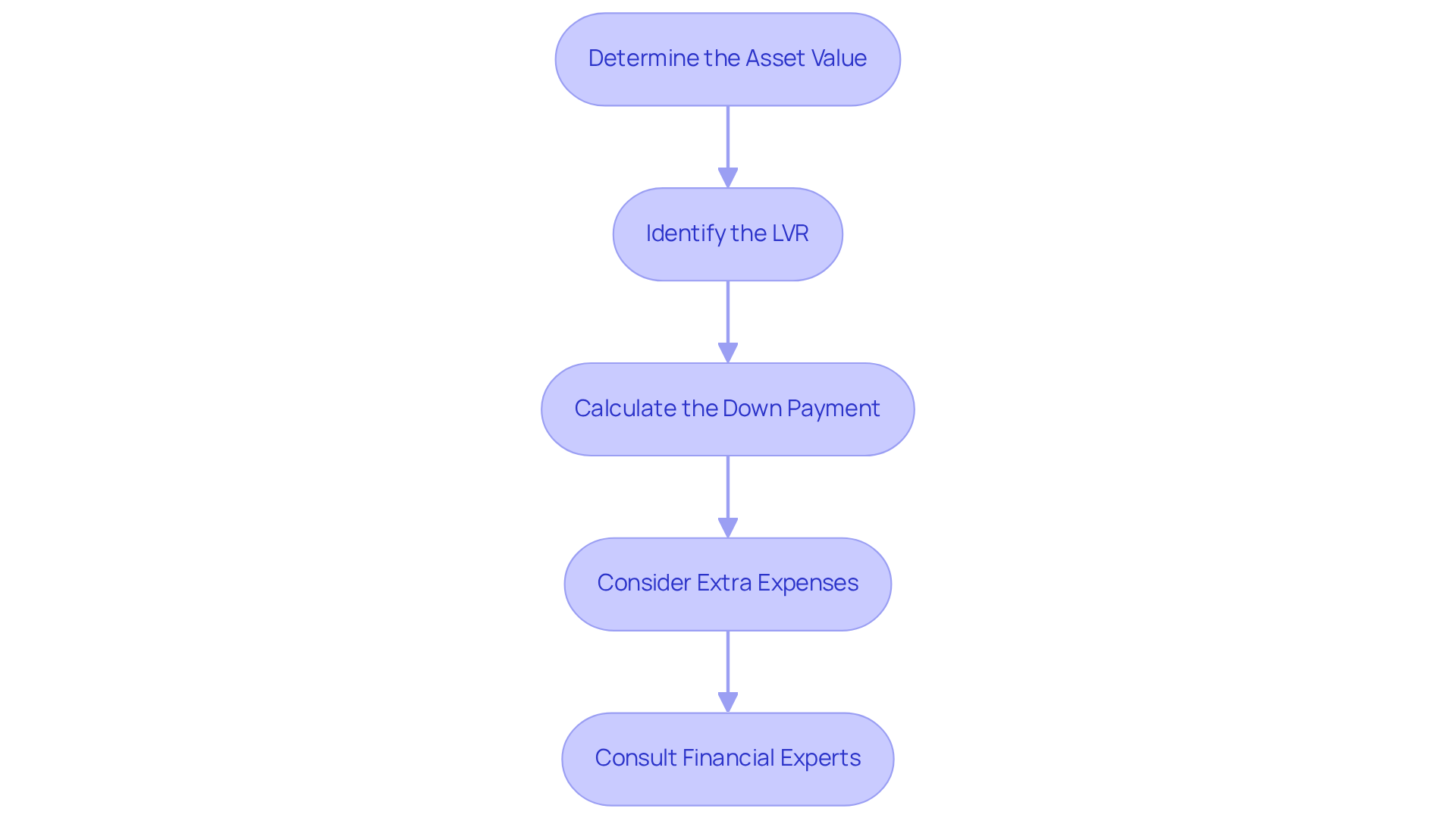

Calculating the commercial property loan deposit required is essential for successful financial planning. Follow these steps to ensure you make informed decisions:

-

Determine the Asset Value: Begin by identifying the purchase price of the commercial asset you are interested in. For instance, if the asset is valued at $1,000,000, this will serve as your base figure.

-

Identify the LVR: Based on the lender's requirements and the type of asset, ascertain the Loan-to-Value Ratio (LVR). Typically, lenders indicate that a commercial property loan deposit required is between 20-30% for business properties, though this can vary. For standard non-specialized commercial assets, a common payment is approximately 65%-70%. If the lender permits a maximum LVR of 70%, a commercial property loan deposit required will be a 30% upfront payment.

-

Calculate the Down Payment: Multiply the asset value by the necessary down payment percentage. Using the previous example:

- Deposit = Property Value x (1 - LVR)

- Deposit = $1,000,000 x (1 - 0.70) = $300,000.

-

Consider Extra Expenses: It is crucial to include additional expenses such as stamp duty, legal fees, and inspection costs, which may require further funds beyond the initial payment. These costs can significantly impact your overall financial strategy, so accounting for them early in the process is essential.

-

Consult Financial Experts: Engaging with financial specialists, like those at Finance Story, can provide valuable insights into determining asset value and understanding the nuances of deposit calculations based on current market conditions. Finance Story focuses on developing personalized business cases to assist you in obtaining the appropriate financing for your real estate investment or refinancing your current credit. By leveraging expert advice from Finance Story, you can navigate the complexities of business lending more effectively. Schedule your free personalized consultation with our Head of Funding Solutions, Shane Duffy, to discuss your needs and goals.

Prepare Documentation for Loan Application

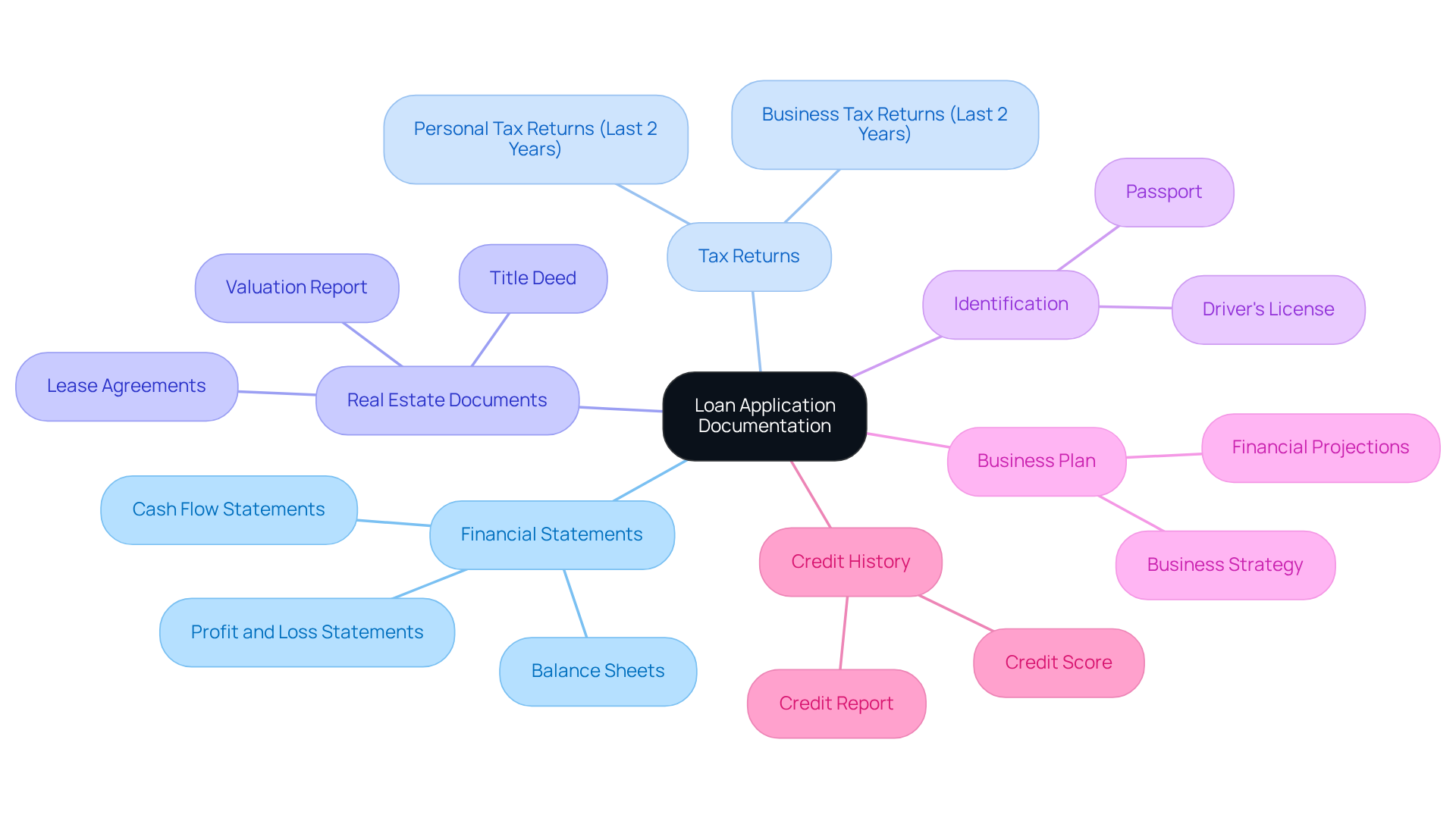

When seeking financing for a commercial real estate venture, collecting the appropriate documents is crucial to bolster your application. Key documents typically required include:

- Financial Statements: Submit your business's financial statements for the past two years, including profit and loss statements and balance sheets. These documents provide lenders with a clear picture of your financial health and operational performance.

- Tax Returns: Include personal and business tax returns for the last two years. This information demonstrates income stability and compliance with tax obligations, which are crucial for assessing your creditworthiness.

- Real Estate Documents: If acquiring a specific asset, include the title deed, valuation report, and any existing lease agreements. These documents confirm ownership and evaluate the asset's market value, which affects financing conditions.

- Identification: Prepare copies of your identification, such as a driver's license or passport, to verify your identity. This step is necessary for compliance with lender requirements.

- Business Plan: If applicable, a well-structured business plan outlining your business strategy and how the property will contribute to your growth can significantly enhance your application. Lenders appreciate understanding your long-term vision and financial projections.

- Credit History: Be ready to provide information about your credit history, as lenders will evaluate your creditworthiness based on this data. A strong credit profile can result in more advantageous borrowing conditions.

Statistics show that numerous lenders in Australia demand a comprehensive collection of documents, including financial statements and tax returns, to evaluate credit applications effectively. For instance, common documentation includes the latest financial statements prepared by a qualified accountant, which are essential for demonstrating your business's financial stability. By ensuring that you have these documents organized and readily available, you can streamline the application process and improve your chances of securing the financing you need.

Consult Financial Experts for Tailored Advice

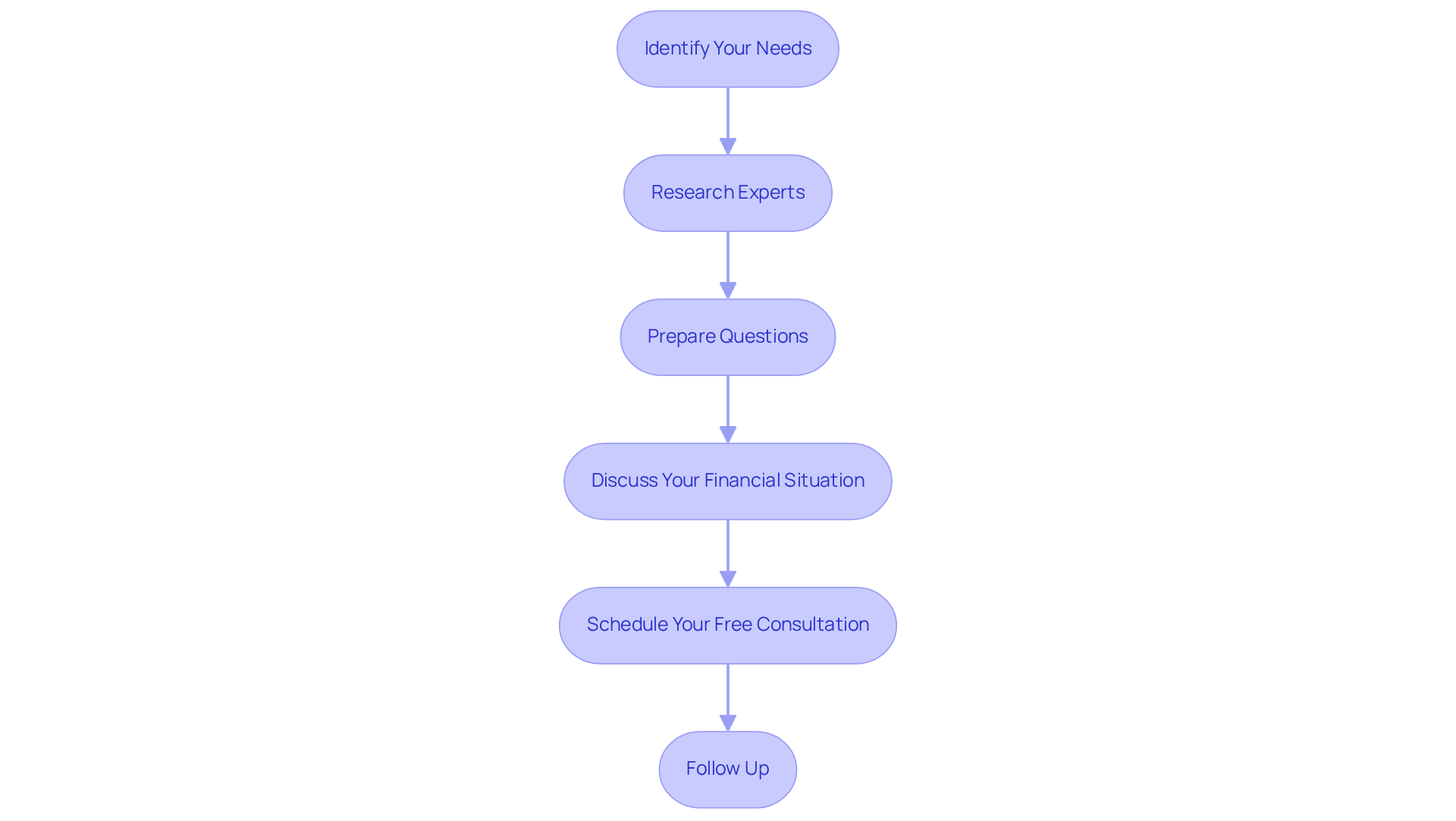

Engaging with financial experts can provide invaluable insights tailored to your specific circumstances. To maximize your success, consider these essential steps:

- Identify Your Needs: Clearly define your financial objectives and the type of business real estate you wish to acquire. Understanding these objectives will guide the consultation process effectively.

- Research Experts: Seek out financial consultants or mortgage brokers with proven experience in commercial property financing. Verify their credentials and review client testimonials to ensure they possess a solid track record.

- Prepare Questions: Before your meeting, compile a list of queries regarding the commercial property loan deposit required, financing conditions, and potential lenders. This preparation will help you extract maximum value from your consultation.

- Discuss Your Financial Situation: Be transparent about your financial history, credit score, and any challenges you may face. This openness allows the expert to provide tailored advice that addresses your unique circumstances.

- Schedule Your Free Personalized Consultation: Book your free 30-minute meeting with Finance Story's Head of Funding Solutions, Shane Duffy. Discuss your needs and goals, and let us start working with you to create your next chapter.

- Follow Up: After the consultation, reach out with any additional questions and thoughtfully evaluate their suggestions before moving forward with your application.

Statistics indicate that 56% of lenders wish to expand their real estate exposures, highlighting a positive lending atmosphere for business financing applications. This trend underscores the importance of collaborating with Finance Story, which offers a comprehensive range of lenders to suit your circumstances, whether you are looking to purchase a warehouse, retail premise, factory, or hospitality venture. As financial expert Andrew McCasker notes, "The domestic banks sit on strong balance sheets and there has been a significant amount of capital raised in the private credit sector." By leveraging the expertise of Finance Story and building strong, long-term relationships, you can navigate the complexities of commercial property loans and refinancing more effectively.

Conclusion

Understanding the intricacies of commercial property loan deposits is crucial for anyone looking to invest in real estate. This article outlines essential steps and considerations that can significantly impact the amount of deposit required, emphasizing the need for thorough preparation and informed decision-making. By grasping the various types of loans and the factors influencing deposit amounts, potential borrowers can navigate the complexities of commercial financing with greater confidence.

Key insights include:

- The importance of the loan-to-value ratio (LVR)

- The specific type of asset being financed

- The borrower's creditworthiness

Each of these elements plays a vital role in determining the upfront investment needed, which can range from 20% to 35% of the property value. Furthermore, it is necessary to calculate not only the deposit but also additional costs associated with the purchase to ensure a comprehensive financial strategy.

In conclusion, engaging with financial experts provides tailored advice that enhances the likelihood of securing favorable loan conditions. As the lending landscape evolves, staying informed and prepared is paramount for success in commercial property investments. Prospective borrowers are encouraged to take proactive steps, such as consulting with specialists and understanding market trends, to position themselves advantageously in the competitive realm of commercial real estate financing.