Overview

When considering a loan for purchasing commercial property, it is essential to assess your financing needs, understand the various types of loans available, and evaluate your financial situation and creditworthiness.

Begin by defining the purpose of your purchase. What are your goals?

Next, explore different financing options, such as:

- Conventional loans

- SBA programs

- Bridge financing

to find the best fit for your needs.

Additionally, preparing the necessary documentation can significantly enhance your chances of securing the right loan.

By following these essential steps, you can navigate the loan process with confidence.

Introduction

In the dynamic realm of commercial real estate, securing the right financing stands as a daunting yet crucial endeavor for business owners. With a multitude of loan options available, understanding the nuances of commercial property loans is essential for making informed decisions that align with specific business objectives.

- From conventional loans to SBA offerings and bridge financing, each type serves distinct purposes and caters to unique needs.

- As the commercial landscape evolves, so too do the strategies for navigating the complexities of loan applications and financial assessments.

This article delves into the fundamentals of commercial property loans, guiding readers through the essential steps to:

- Identify financing needs

- Explore diverse loan types

- Successfully navigate the application process

Ultimately, this empowers them to secure the funding necessary for their ventures.

Understand the Basics of Commercial Property Loans

When exploring commercial property financing options, it's essential to consider what kind of loan to buy commercial property, as these options serve as customized solutions for acquiring, refinancing, or improving commercial real estate. Unlike residential mortgages, these financial products showcase distinct characteristics in structure, terms, and requirements. Key elements include:

- Financing Types: Common options encompass conventional financing, SBA financing, and bridge financing, each tailored to specific needs and scenarios. Finance Story focuses on crafting refined and uniquely tailored proposals to present to lenders, ensuring you obtain the appropriate funding for your commercial property, whether it be a warehouse, retail location, factory, or hospitality endeavor.

- Interest Rates: Typically higher than those for residential mortgages, interest rates reflect the heightened risk associated with commercial properties and can vary based on lender guidelines and borrower credit status. Understanding these elements is vital for small enterprise proprietors aiming to navigate the funding landscape effectively, particularly in determining what kind of loan to buy commercial property, as commercial credits generally feature shorter durations, spanning from 5 to 20 years, with amortization periods that can extend up to 30 years, providing flexibility in repayment. This adaptability is essential for accommodating the evolving needs of your business.

- Down Payments: Borrowers should anticipate larger down payments, typically ranging from 20% to 30% of the purchase price, depending on the lender and loan type. Partnering with Finance Story grants you access to a comprehensive suite of lenders, including high street banks and innovative private lending panels, to secure the best terms for your situation.

Recent trends indicate a shift in the commercial real estate landscape, with leaders encouraged to adopt proactive strategies in anticipation of market recovery. As of 2025, approximately $64 billion in outstanding mortgage balances held by life insurance companies are set to mature, underscoring their significant role in the commercial mortgage market. This maturation presents both challenges and opportunities for small business owners seeking funding. Furthermore, the commitment of six states and 41 cities to enforce Building Performance Standards by the end of 2024 highlights an increasing regulatory trend that could influence the funding environment for commercial real estate. Additionally, Deloitte notes that almost two-thirds of office structures in the UK are rated below the necessary B grade, emphasizing the importance of asset ratings in funding and investment strategies. Understanding these fundamentals equips you to navigate the complexities of securing what kind of loan to buy commercial property for your real estate needs.

Identify Your Financing Needs and Goals

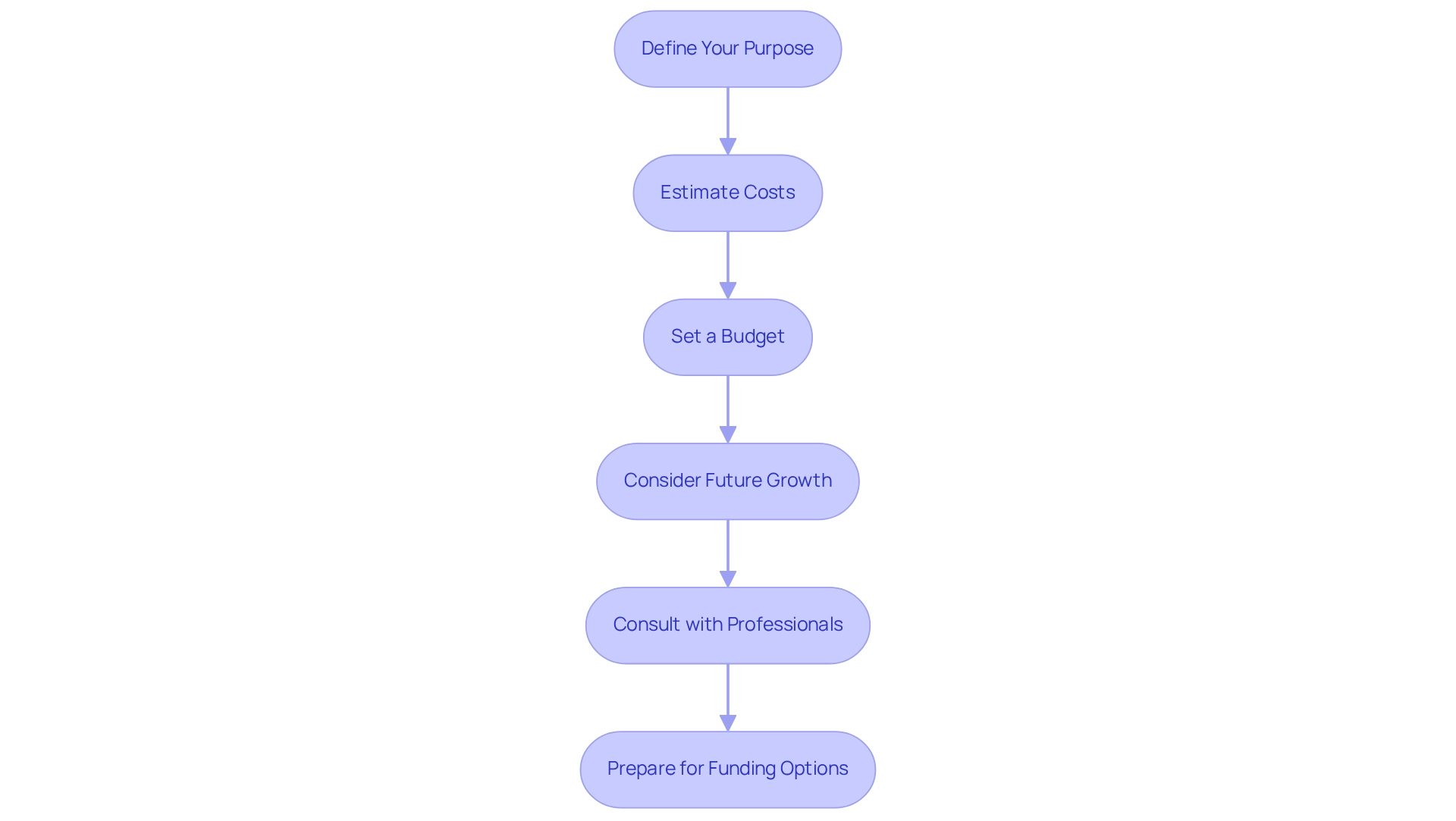

To effectively determine your funding requirements and objectives for commercial real estate financing, follow these essential steps:

-

Define Your Purpose: Determine whether you are acquiring the asset for investment, expansion, or operational use. A clear purpose will significantly influence what kind of loan to buy commercial property.

Estimate Costs: Calculate the total expenses related to the purchase, including the asset price, renovation costs, and ongoing operational expenses. This comprehensive assessment will help you ascertain the necessary financing amount. Keep in mind that if the appraisal indicates the asset is valued lower than the agreement, additional owner equity may be necessary.

Set a Budget: Establish a budget that encompasses not only the desired loan amount but also additional expenses such as closing fees, insurance, and real estate taxes. This holistic view ensures you are financially prepared.

-

Consider Future Growth: Reflect on your long-term business objectives. Will the property support your anticipated growth? This foresight can influence what kind of loan to buy commercial property and its terms. The pandemic has greatly impacted small enterprises, with a reported 9.6% closure rate in the leisure and hospitality sector, resulting in a 41.1% reduction in employees. Understanding these challenges can help you plan more effectively.

-

Consult with Professionals: Engage with financial advisors or mortgage brokers who can offer tailored insights based on your unique situation. Their expertise can help clarify what kind of loan to buy commercial property and guide you toward the best available funding options. At Finance Story, we focus on crafting refined and highly tailored cases to present to lenders, ensuring you obtain the appropriate funding for your commercial asset. We work with a full range of lenders, including high street banks and private lending panels, to meet your specific needs. Additionally, we can assist with refinancing options to adapt to your evolving business requirements. Arrange your complimentary tailored consultation with our Head of Funding Solutions, Shane Duffy, to explore your requirements and aspirations, and allow us to assist you in crafting your next chapter.

By distinctly recognizing your monetary needs and objectives, you will be more prepared to navigate the various funding options accessible, ensuring a more strategic method to obtaining support for your commercial assets.

Explore Different Types of Commercial Property Loans

When examining funding alternatives for commercial real estate in 2025, it's essential to comprehend the various categories of credit available:

- Conventional Credit: Typically offered by banks and credit unions, these options require a robust credit score and a substantial down payment. They are ideal for established enterprises with strong financial records, providing competitive interest rates.

- SBA Programs: The Small Business Administration offers initiatives like the 7(a) and 504 options, aimed at assisting small enterprises in obtaining capital under advantageous conditions. These financial agreements often feature lower down payments and longer repayment periods, making them an appealing choice for many entrepreneurs. In 2025, roughly 30% of small enterprises are utilizing SBA funding, highlighting its popularity and effectiveness in promoting business expansion.

- Bridge Financing: These short-term funds provide prompt capital while awaiting permanent support or the sale of another asset. They are especially beneficial for rapid purchases but generally entail elevated interest rates, rendering them a temporary solution for urgent monetary needs.

- Hard Money Loans: Backed by real estate, these asset-based credits are typically offered by private lenders. They are easier to qualify for than conventional credit options but carry higher costs and shorter durations, making them suitable for investors needing quick access to funds.

- Construction Financing: Specifically tailored for funding the construction of new structures, these options are usually short-term and transition to permanent support once the project is completed. They are crucial for companies aiming to grow or establish new facilities, and understanding what kind of loan to buy commercial property is vital for making informed choices regarding your investment. Moreover, numerous small enterprises are seeking funding for operational costs, with 58% citing this as a reason for borrowing. Additionally, customers utilizing flexible financing services observe repayment rates increase by 30% on average, underscoring the significance of adaptable repayment options. As 77% of small enterprise owners prefer to apply for funding online or through mobile applications, ensuring a seamless digital application process is crucial.

At Finance Story, we provide access to a comprehensive range of lenders, including high street banks and innovative private lending panels, ensuring you find the right financing solution tailored to your needs. With our expertise in developing refined and tailored proposals, we can assist you in selecting the optimal financing option that aligns with your objectives and financial circumstances. As noted by Lendio, rates can be as low as 9% for other purposes, offering additional context on financing costs and choices available to small business owners.

Assess Your Financial Situation and Creditworthiness

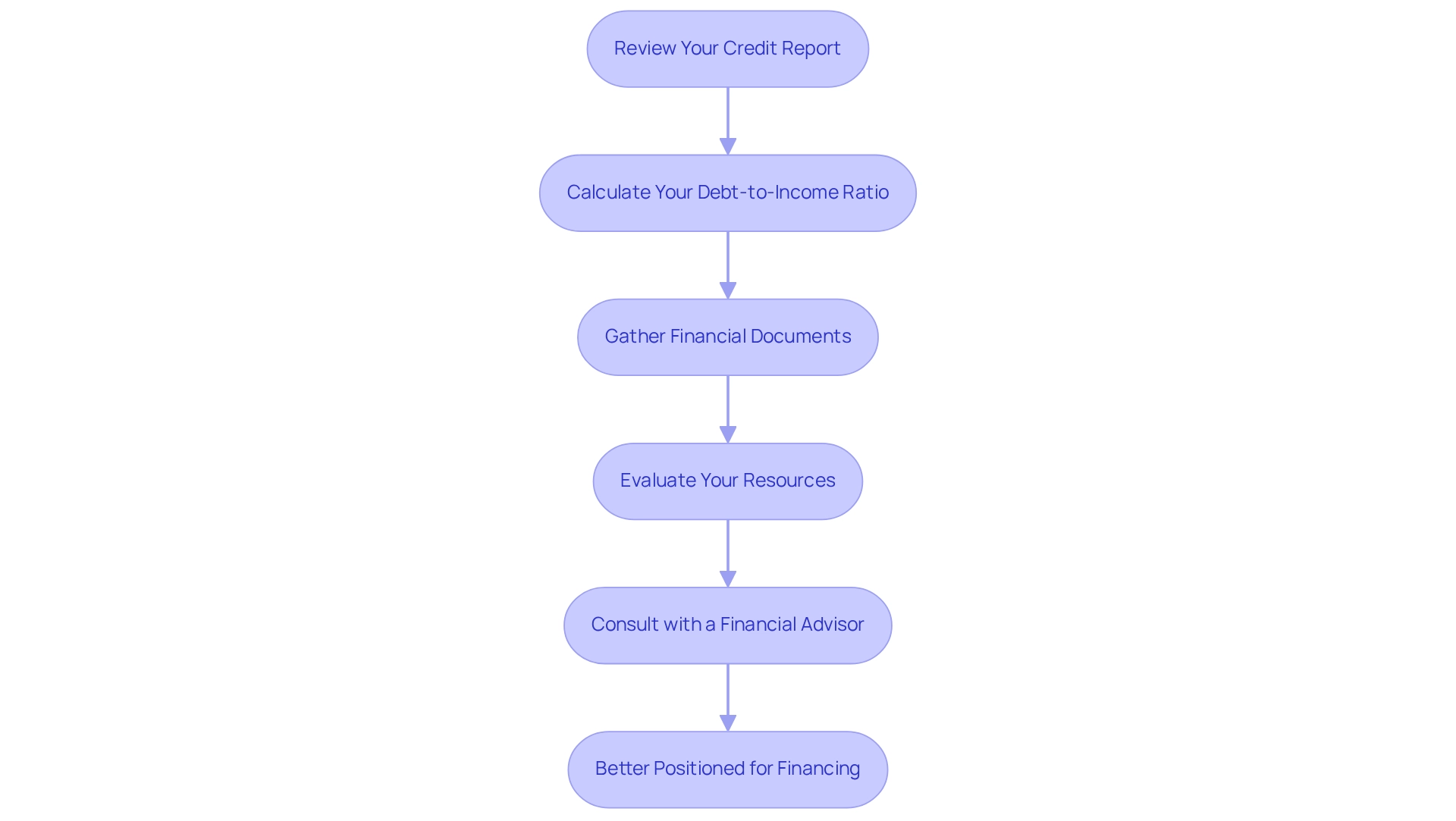

Before applying for a commercial property mortgage, assessing your financial situation and creditworthiness is essential.

Review Your Credit Report: Start by obtaining a copy of your credit report from major credit bureaus. It's crucial to check for errors and understand your credit score, as this will significantly influence your borrowing choices.

Calculate Your Debt-to-Income Ratio: This ratio compares your monthly debt payments to your gross monthly income. A lower ratio signifies improved financial well-being and enhances your likelihood of credit approval.

Gather Financial Documents: Prepare necessary documentation, including tax returns, bank statements, and financial statements for your enterprise. Lenders will require these to evaluate your financial stability.

Evaluate Your Resources: Analyze your resources, including cash reserves and real estate equity, as these can be utilized to obtain improved financing conditions. For leasehold businesses, it's important to note that you cannot borrow against commercial property. Thus, utilizing the equity in any owned property or cash savings can be crucial for acquiring financing.

Consult with a Financial Advisor: A financial advisor can offer tailored guidance on enhancing your financial position and preparing for the application process. Their expertise can assist you in crafting a refined funding proposal that satisfies lenders' expectations, ensuring you obtain the best financing options available.

By thoroughly evaluating your financial circumstances and creditworthiness, you will be better positioned to secure the financing you require.

Navigate the Loan Application Process

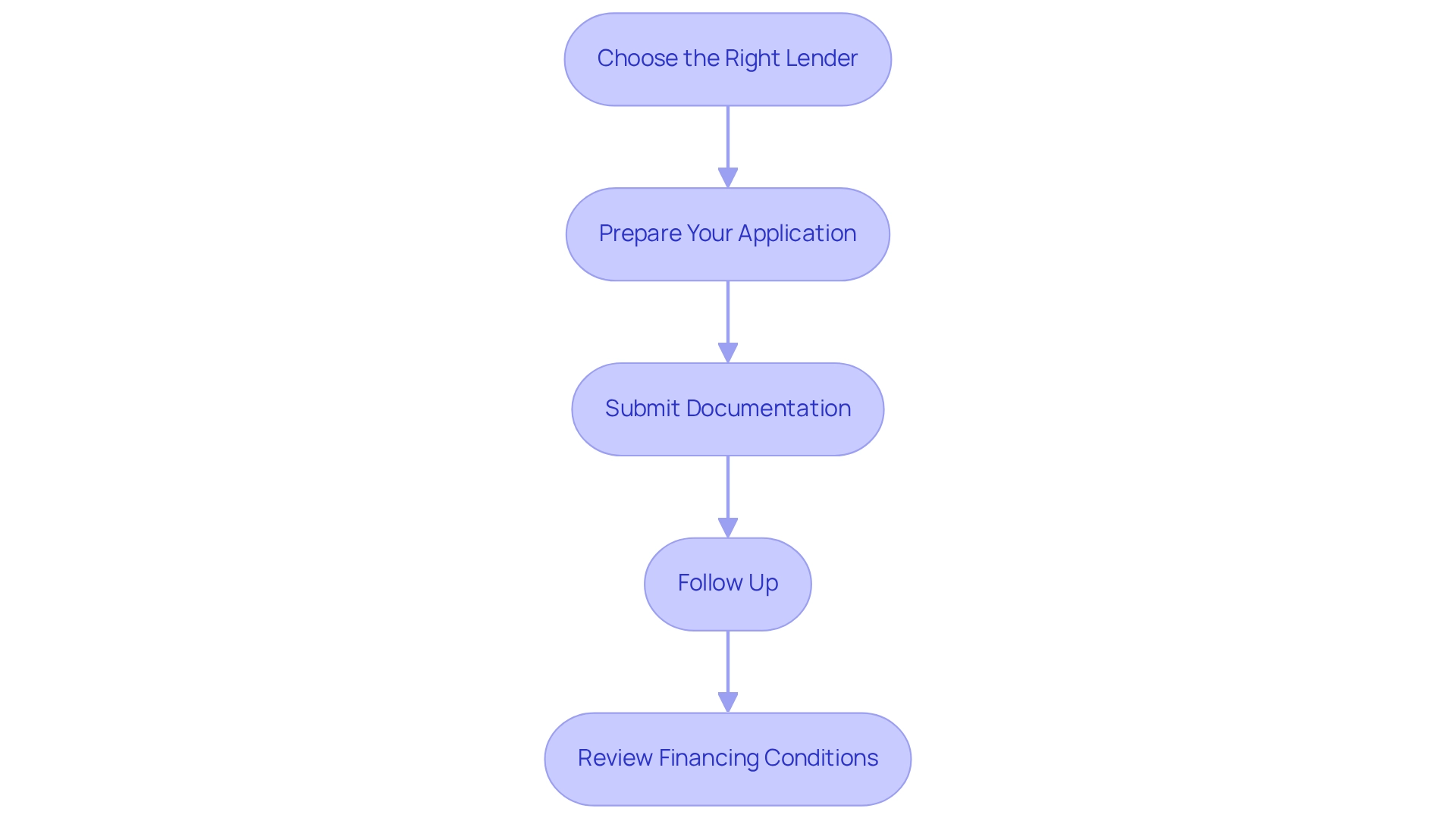

To successfully navigate the borrowing application process, follow these essential steps:

- Choose the Right Lender: Investigate and compare lenders based on their financing options, interest rates, and customer service. Consider collaborating with a mortgage broker for expert guidance. At Finance Story, we provide access to a comprehensive suite of lenders, including high street banks and innovative private lending panels, ensuring you find the right fit for your needs.

- Prepare Your Application: Accurately complete the application form, providing all necessary information. Be prepared to clarify your enterprise strategy and how the funds will be utilized. Our expertise in creating polished and individualized business cases can assist you in presenting a compelling proposal to lenders.

- Submit Documentation: Alongside your application, submit all necessary documentation, including financial statements, tax returns, and any additional information requested by the lender. Understanding the repayment criteria is crucial, and we can support you throughout this process to ensure you meet all requirements.

- Follow Up: After submission, maintain communication with your lender. Be proactive in providing any additional information they may request to expedite the process. Our team is here to support you every step of the way.

- Review Financing Conditions: Once approved, carefully examine the financing terms before signing. Ensure you understand the interest rate, repayment plan, and any fees associated with the borrowing. If you have questions or need clarification regarding what kind of loan to buy commercial property, don’t hesitate to reach out to us.

By following these steps, you can navigate the loan application process with confidence and secure the financing needed for your commercial property. To further enhance your chances of success, schedule your free personalized consultation with Shane Duffy, our Head of Funding Solutions, to discuss tailored financial strategies that align with your business goals.

Conclusion

Securing the right financing for commercial properties is a pivotal step for business owners striving to excel in a competitive landscape. By grasping the fundamentals of commercial property loans—including various types such as conventional loans, SBA loans, and bridge loans—business owners can make informed decisions that align with their distinct needs and objectives.

Identifying specific financing needs is essential in this journey. Clearly defining the purpose of the property, estimating associated costs, and contemplating future growth can significantly influence the loan selection process. Furthermore, assessing one’s financial situation and creditworthiness establishes a solid foundation for successful loan applications, clarifying available options and enhancing the likelihood of approval.

Navigating the loan application process demands diligence and strategic planning. Selecting the right lender, crafting a compelling application, and maintaining open communication can foster a smoother experience. With expert guidance from professionals, such as those at Finance Story, business owners can adeptly maneuver through these complexities and secure the necessary funding for their ventures.

Ultimately, understanding and leveraging the intricacies of commercial property loans empowers business owners not only to secure financing but also to position themselves for future growth and success. Now is the time to take proactive steps toward achieving financial goals in the ever-evolving commercial real estate market.