Overview

To determine your eligibility for a loan to purchase commercial property, it is crucial to assess your financial health, understand the various types of loans available, and gather the necessary documentation. Additionally, comparing lenders and financing options is essential. Start by evaluating your credit score; this will provide insight into your financial standing.

Furthermore, prepare a comprehensive business plan that outlines your objectives and strategies. Research various lenders to enhance your chances of securing a loan tailored to your specific circumstances. By following these steps, you position yourself favorably in the competitive landscape of commercial loans.

Introduction

Navigating the world of commercial property financing can indeed be a daunting task, particularly given the myriad of loan options available in 2025. Understanding the nuances of various loan types, eligibility requirements, and the necessary documentation is crucial for anyone contemplating this significant investment.

However, the real challenge lies in determining whether one can secure a loan for such a venture. What steps must be taken to assess eligibility? How can potential borrowers position themselves for success in a competitive lending landscape? These are essential questions that will guide your journey through the financing process.

Understand Commercial Property Loans

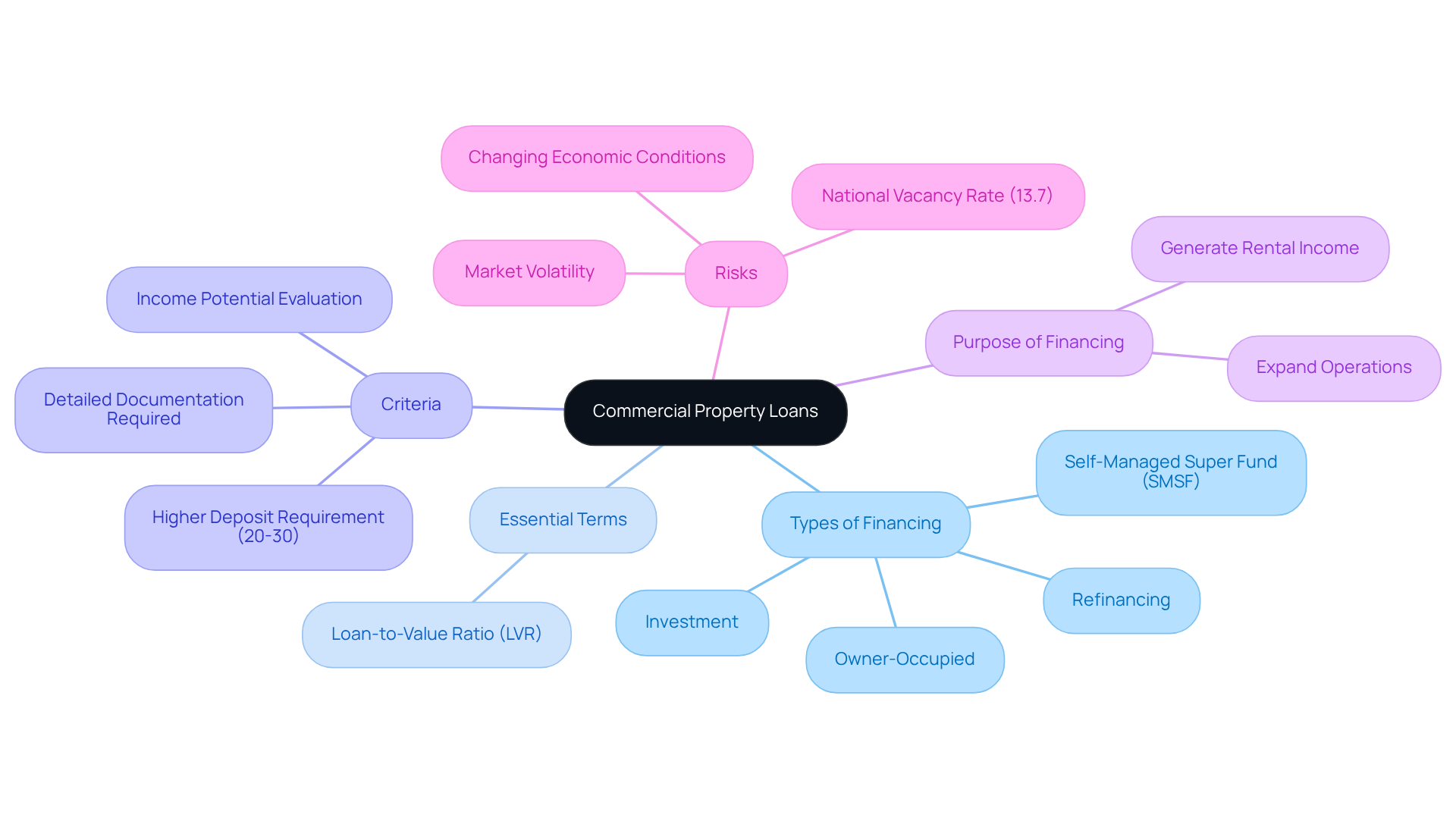

Familiarize yourself with the diverse types of commercial property financing available in 2025, including owner-occupied, investment, and Self-Managed Super Fund (SMSF) options, as well as refinancing choices, to explore if I can get a loan to buy a commercial property. Each type serves distinct purposes and has unique eligibility criteria.

Understand essential terms like Loan-to-Value Ratio (LVR), crucial in determining how much you can borrow against the value of the property. A lower LVR often leads to better financing terms, as lenders perceive lower risk.

Investigate the specific criteria and characteristics of commercial financing in contrast to residential financing. For instance, commercial financing typically necessitates a higher deposit, often between 20-30% of the purchase price, and evaluates the income potential of the property rather than solely the borrower's financial status.

Consider the purpose of the financing and how it aligns with your business objectives, especially if you are asking, can I get a loan to buy a commercial property? Whether you're looking to generate rental income or expand your operations, understanding your objectives will guide your financing decisions. Working with Finance Story provides access to a comprehensive suite of lenders, including high street banks and innovative private lending panels, tailored to your specific circumstances.

Review potential risks associated with commercial property investments, such as market volatility and changing economic conditions. For example, the national vacancy rate for CBD office properties is currently around 13.7%, indicating potential challenges in certain sectors. Being aware of these factors can help you make informed investment choices. Furthermore, case studies have shown that understanding these risks can lead to improved decision-making in securing business financing.

Verify Eligibility Requirements

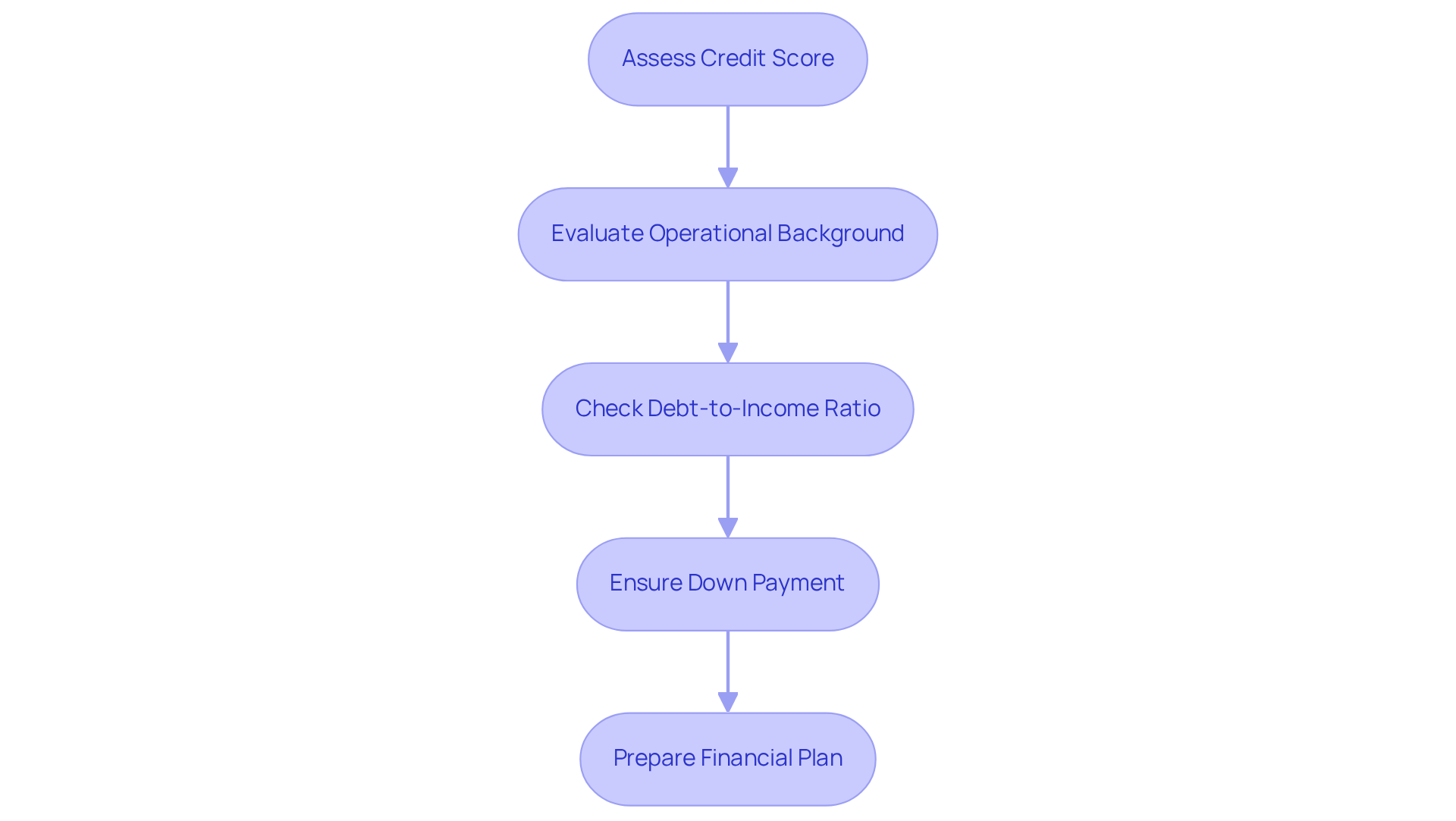

Start by assessing your credit score, aiming for a minimum of 680, as this is often the threshold for loan eligibility. A higher score can significantly enhance your chances of approval. Next, evaluate your company's operational background—financial institutions typically prefer businesses that have been active for at least 2 to 5 years. This timeframe demonstrates stability and experience, both crucial for securing financing. Additionally, assess your debt-to-income ratio, ensuring it remains below 40%. A lower ratio signifies better financial health and increases your appeal to lenders. Make sure you can provide a sufficient down payment, generally ranging from 20% to 30% of the property's value. A larger deposit not only boosts your chances of approval but can also secure more favorable financing terms. Finally, prepare a clear plan outlining how the loan will be utilized. This plan should detail your operational strategy and financial forecasts, showcasing your enterprise's potential for success and repayment capability. By collaborating with Finance Story, you can develop refined and highly customized proposals to present to financial institutions, which can clarify whether you can get a loan to buy a commercial property, thereby increasing your chances of securing the appropriate funding for your investment.

Gather Required Documentation

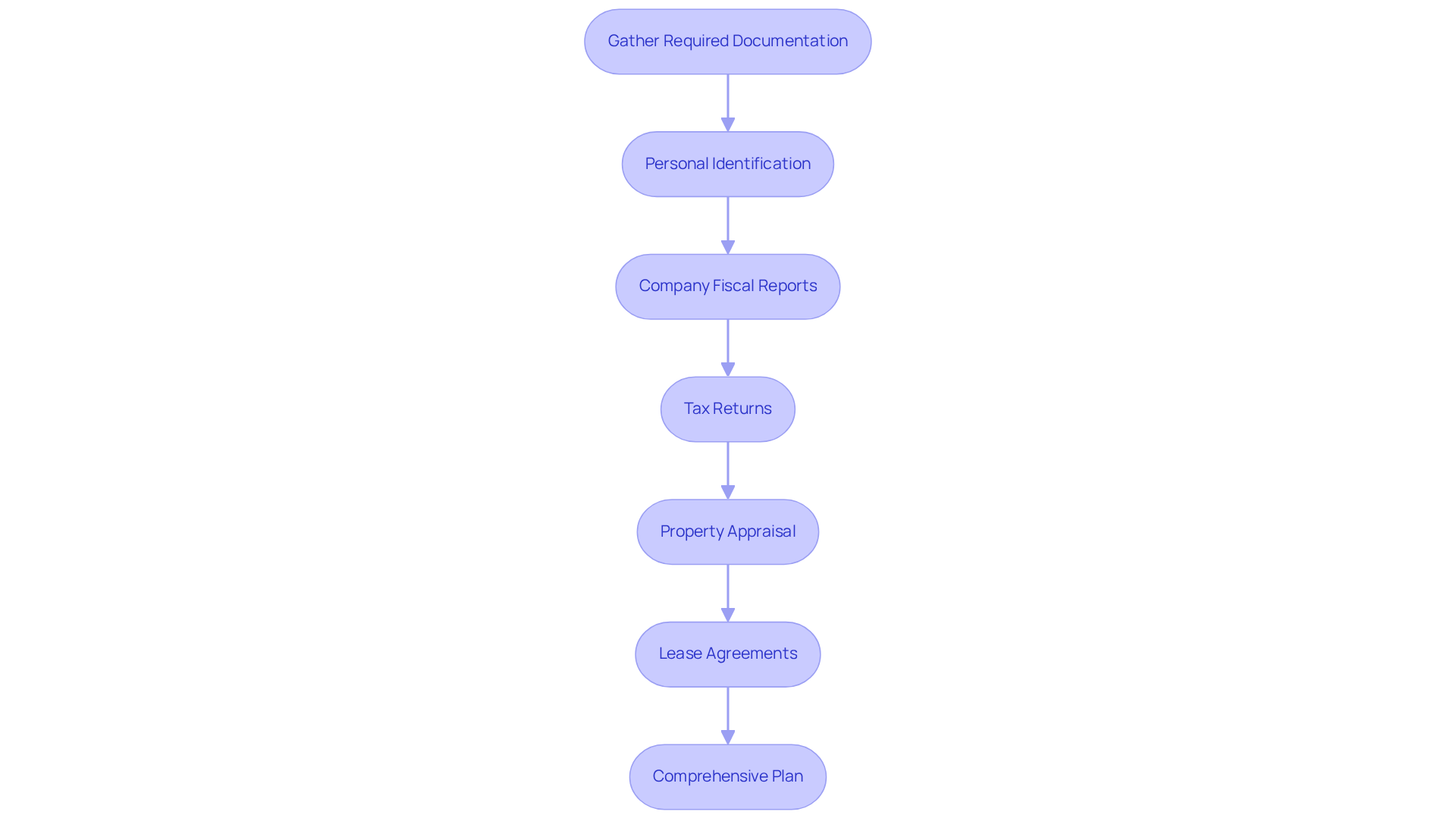

When considering if I can get a loan to buy a commercial property, securing financing for your investment requires meticulous preparation of the right documentation. Start by gathering personal identification documents, such as a driver's license or passport, to verify your identity. Next, collect detailed company fiscal reports, including profit and loss statements and balance sheets for the past two to three years. These documents provide lenders with critical insights into your company's economic status and operational performance.

In addition, gather tax returns for both personal and professional income. These are essential for illustrating your financial history and demonstrating adherence to tax responsibilities. Furthermore, obtain a property appraisal and any relevant lease agreements, which help establish the property's value and potential income generation.

Compile a comprehensive plan that outlines your goals, strategies, and projected cash flow and revenue. A well-organized strategic plan is crucial, as it showcases your understanding of the market and your intentions for utilizing the funding effectively, which raises the question: can I get a loan to buy a commercial property?

As we move into 2025, creditors are increasingly emphasizing the importance of precise fiscal reports in credit requests. Data indicates that 59% of small enterprises reported being in fair or poor economic condition, underscoring the necessity for thorough documentation to enhance approval chances. Moreover, case studies reveal that companies providing clear monetary statements and detailed plans are more likely to secure the funding they need, as lenders rely on these documents to assess risk and potential return on investment.

Evaluate Financial Health and Loan Terms

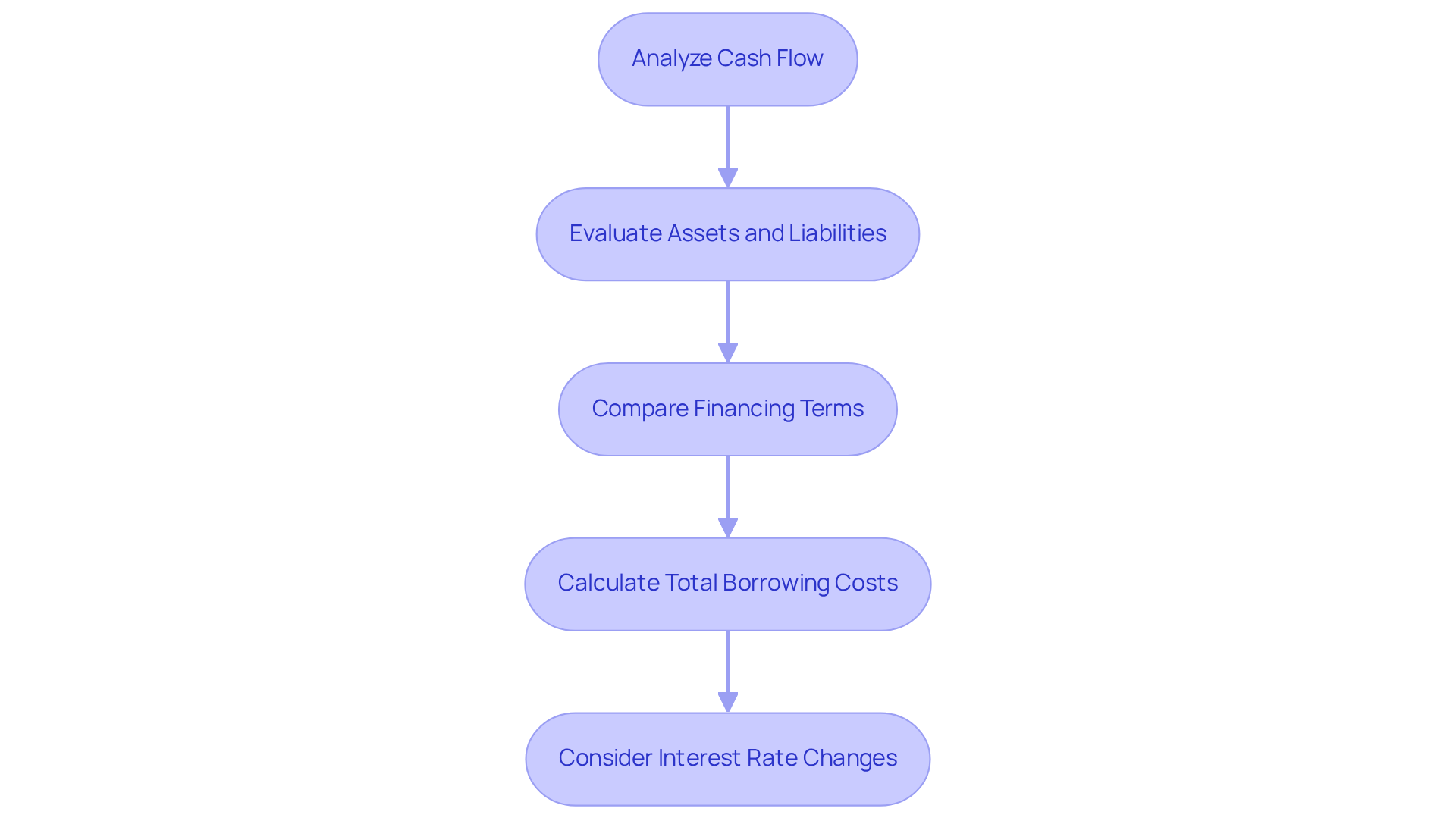

Conduct a thorough analysis of your enterprise's cash flow to confirm its ability to support loan repayments. Understanding your cash flow is essential, as it reflects your enterprise's operational efficiency and economic stability. At Finance Story, we specialize in crafting refined and highly tailored business cases that assist you in effectively presenting your financial situation to lenders, ensuring you meet their heightened expectations.

Examine your existing liabilities and assets to gain a clear understanding of your overall financial health. This evaluation helps in recognizing potential risks and ensures you are fully aware of your financial responsibilities before seeking credit. Our expertise in customized financing proposals means we can guide you through this process, helping you understand how your financial health influences your financing options.

Compare different financing terms, including fixed versus variable rates and repayment durations, to grasp their potential effects on your finances. Fixed rates offer stability, while variable rates may present lower initial costs but come with the risk of fluctuations. With access to a full suite of lenders, including high street banks and innovative private lending panels, we can help you find the best terms suited to your circumstances.

Calculate the overall expense of borrowing, including interest and charges, to understand the complete financial obligation involved. This calculation is crucial for budgeting and ensuring that the loan aligns with your financial objectives. Our team can assist you in analyzing these costs to ensure clarity in your budgeting.

Consider potential changes in interest rates and their implications for your repayments over time. With rising interest rates, it's vital to evaluate how these changes could impact your cash flow and overall financial strategy. Understanding these dynamics is essential, and our insights can help you navigate the intricacies of repayment criteria effectively.

Compare Lenders and Financing Options

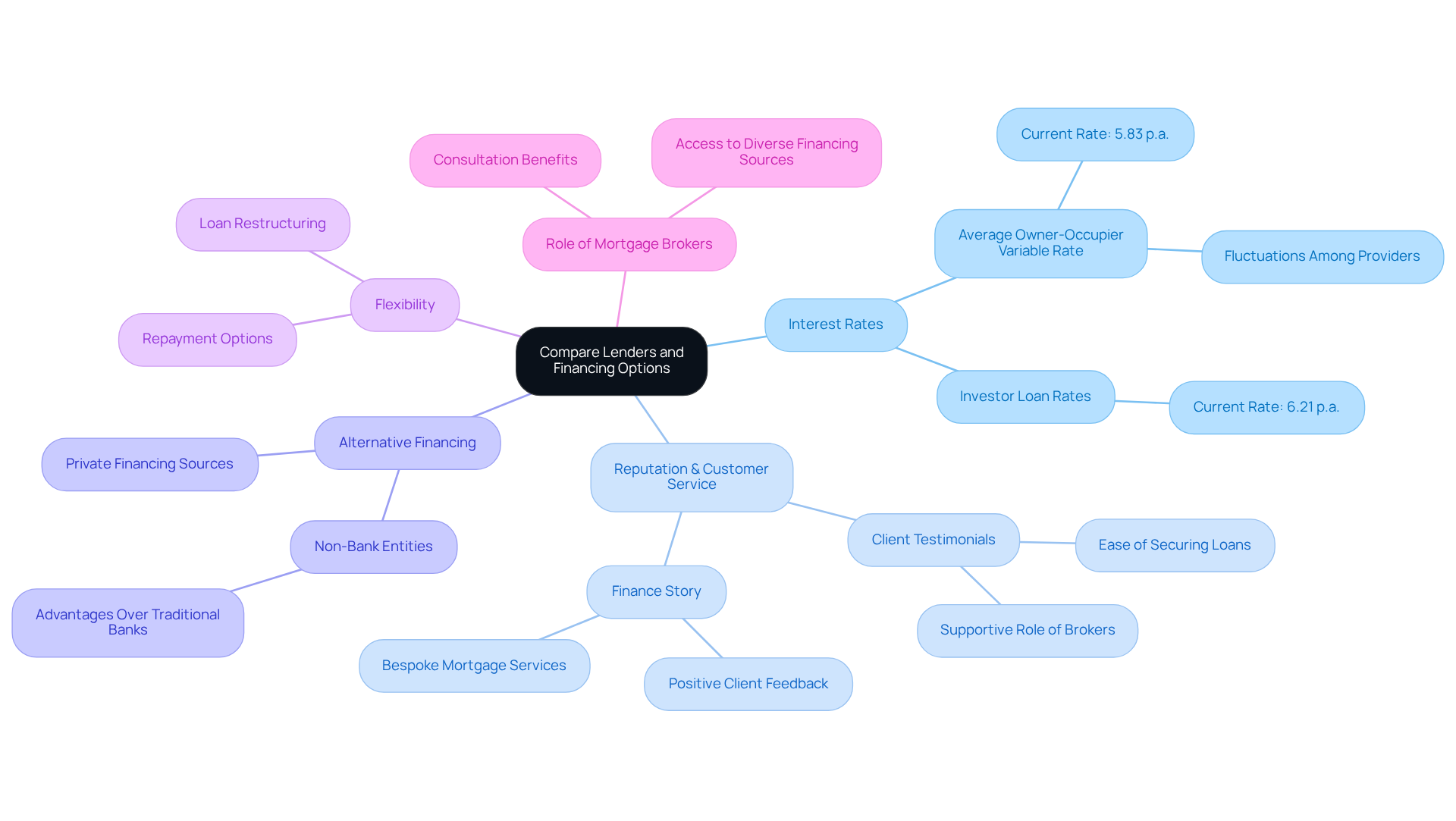

Conduct thorough research on various financial institutions to compare interest rates, fees, and borrowing terms. In 2025, the average interest rate for owner-occupier variable loans stands at approximately 5.83% per year, with significant fluctuations possible among providers. This context is crucial for potential borrowers as they consider their financing options.

Assess the reputation and customer service of financial institutions by examining reviews and testimonials. A strong reputation often indicates reliability and support—essential factors in financing decisions. Finance Story, recognized for its bespoke mortgage services, has garnered positive feedback from clients, underscoring their ability to assist in navigating financing journeys.

Investigate diverse funding alternatives, including private financing sources or non-bank entities, which may offer more advantageous conditions. These options can provide greater flexibility compared to traditional banks. Finance Story boasts access to a comprehensive portfolio of private, boutique commercial investors, ensuring clients have a variety of choices to discuss.

Evaluate the flexibility of lenders regarding repayment options and loan restructuring. Lenders that offer adaptable terms can better accommodate your financial situation over time. Finance Story specializes in creating polished and highly individualized business cases to present to banks, thereby enhancing the likelihood of securing the necessary funds.

Consult with a mortgage broker to determine if you can get a loan to buy a commercial property and gain insights into the best available options tailored to your specific needs. Brokers can leverage their knowledge and access to a varied collection of financing sources to assist you in answering the question of how can I get a loan to buy a commercial property. Additionally, consider case studies that highlight positive client experiences with lenders, reinforcing the importance of customer service and reputation. As Natasha B. from VIC noted, working with Finance Story alleviated her constant worry, showcasing the supportive role of a knowledgeable broker in the financing process.

Conclusion

Understanding the intricacies of securing a loan for commercial property is essential for prospective investors. Familiarizing oneself with the various types of commercial property loans, verifying eligibility requirements, gathering necessary documentation, evaluating financial health, and comparing lenders are critical steps that enable individuals to navigate the financing landscape more effectively. Each of these steps plays a crucial role in determining not only the feasibility of obtaining a loan but also the overall success of the investment.

Key insights underscore the importance of:

- Maintaining a solid credit score

- Possessing a comprehensive understanding of loan terms

- Developing a well-prepared business plan

Furthermore, recognizing the potential risks associated with commercial investments, such as market volatility, is vital for informed decision-making. By taking these factors into account, prospective borrowers can significantly enhance their chances of securing favorable financing options tailored to their unique circumstances.

Ultimately, the journey to obtaining a commercial property loan transcends mere eligibility criteria; it embodies strategic planning and informed decision-making. Engaging with knowledgeable professionals, like those at Finance Story, can provide invaluable support in navigating this complex process. As the commercial property financing landscape evolves, staying informed and proactive will empower investors to make sound financial choices that align with their business objectives.