Overview

Selecting the right commercial loan broker in Australia is crucial for your business's financial health. To make an informed choice, consider key criteria:

- Experience

- Licensing

- Reputation

- Communication skills

- Fee structure

These elements are not just formalities; they ensure that your broker can adeptly navigate the lending landscape. Furthermore, a knowledgeable broker will provide tailored financing options, ultimately increasing your chances of securing favorable loan terms. By understanding these factors, you position your business for success in the competitive finance market.

Introduction

In the intricate world of commercial financing, the role of a loan broker stands as a pivotal asset for businesses navigating the complexities of securing funding. These professionals act as essential intermediaries, connecting borrowers with a diverse array of lenders and tailoring financing solutions that align with specific business needs. With their expertise, brokers simplify the loan application process and enhance the likelihood of favorable terms, providing insights into the ever-evolving lending landscape.

As organizations strive to capitalize on market opportunities, understanding how to select and collaborate with a commercial loan broker can significantly impact their financial health and growth trajectory.

Understand the Role of a Commercial Loan Broker

A commercial loan broker Australia serves as a vital intermediary between companies seeking funding and financiers. Their primary responsibilities encompass assessing your financial needs, identifying suitable loan products, and facilitating the application process.

With Finance Story's extensive access to a diverse selection of lenders—ranging from boutique lenders and private investors to mainstream banks—intermediaries can present multiple customized options that align with your specific requirements. This breadth of access is crucial, especially in a competitive market where securing advantageous terms can significantly impact your company's financial health.

Furthermore, intermediaries offer invaluable insights into the lending landscape, helping you navigate complex terms and conditions. For example, examining the comparison rate for a $150,000 mortgage over 25 years can highlight the variations in financing products, empowering you to make informed decisions.

The role of commercial financing intermediaries becomes increasingly important as they help businesses capitalize on market opportunities through improved options for acquisitions, refinancing, and equity release. Finance Story prioritizes crafting refined and uniquely tailored proposals for banks, ensuring you have the best chance to secure the appropriate funding, with the understanding that a commercial loan broker Australia plays a crucial role for businesses aiming to secure funding efficiently.

Their expertise not only streamlines the loan application process but also increases the likelihood of obtaining favorable loan terms, ultimately fostering your business's growth and financial stability. Additionally, verifying that your financial representative possesses the necessary qualifications, such as a Certificate IV in Finance and Mortgage Broking, assures you of receiving quality service and better outcomes. This underscores the evolving landscape and the critical role that intermediaries play in navigating it.

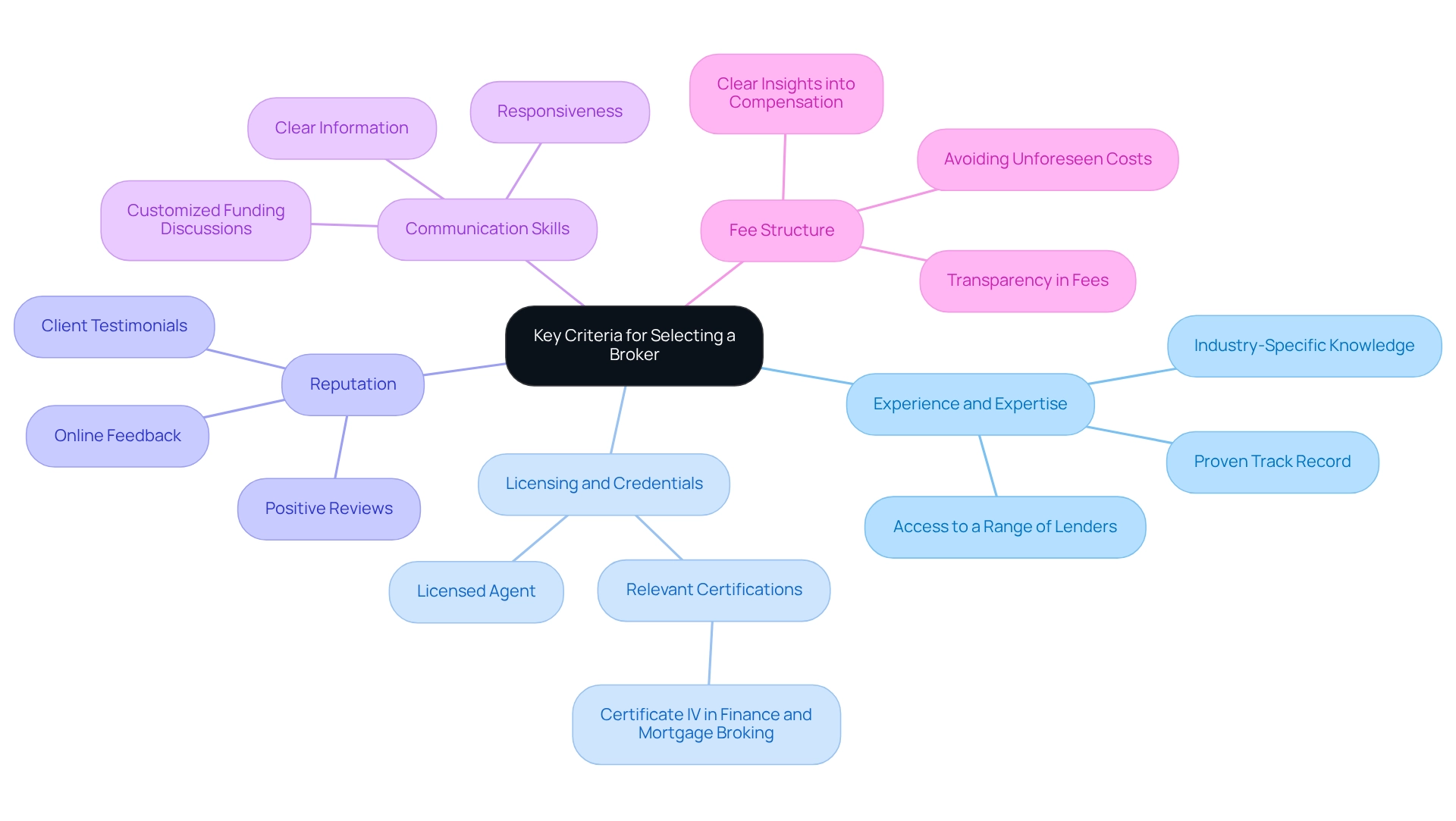

Identify Key Criteria for Selecting a Broker

When selecting a commercial loan broker Australia, it is crucial to consider the following key criteria:

- Experience and expertise: Seek a commercial loan broker Australia with a proven track record in commercial lending. Their experience within your specific industry can provide a significant advantage. Finance Story excels in crafting polished and highly individualized business cases, ensuring that your loan proposal meets the elevated expectations of lenders. Moreover, a commercial loan broker Australia offers access to a comprehensive range of lenders, thereby expanding your financing options.

- Licensing and Credentials: Confirm that the agent is licensed and holds relevant certifications, such as a Certificate IV in Finance and Mortgage Broking. This ensures they are equipped to navigate the complexities of commercial financing.

- Reputation: Assess the firm's reputation by reviewing client testimonials and online feedback. An agent with positive reviews, like Finance Story—a commercial loan broker Australia known for its tailored mortgage services and innovative funding solutions—is likely to deliver superior service. Clients have expressed their gratitude for the support received, highlighting the agent's commitment to their funding journey.

- Communication Skills: Choose an agent who communicates information clearly and is responsive to your inquiries. Effective communication is vital for a seamless lending process, especially when discussing customized funding options that align with your evolving business needs. A straightforward and clear approach can significantly enhance your experience.

- Fee Structure: Grasp how the intermediary is compensated. Seek transparency in their fee structure to avoid unforeseen costs. A reliable intermediary will provide clear insights into their fees, ensuring you remain well-informed throughout the financing journey.

Evaluate Potential Brokers: Questions to Ask

When meeting with potential brokers, it is crucial to ask the right questions to ensure they align with your financial goals and can effectively support your needs. Consider the following inquiries:

- What is your experience with commercial financing and refinancing? Understanding their specific experience with a commercial loan broker Australia for loans similar to your requirements, including refinancing options, can help gauge their expertise. Finance Story specializes in creating polished and highly individualized business cases to present to banks, ensuring you have the best chance of securing the right financing.

- How many lenders do you work with? An agent with a diverse network can offer a broader selection of options and possibly obtain better rates for you. At Finance Story, we offer access to a comprehensive suite of lenders, including high street banks and innovative private lending panels, tailored to meet your unique circumstances.

- Can you provide references from past clients? Interacting with former clients can provide valuable insights into the agent's reliability and service quality, acting as a trust indicator. As highlighted in client testimonials, Finance Story has been recognized for its bespoke mortgage services and ability to find solutions even in challenging circumstances.

- What is your fee structure? Clarifying how they charge for their services, including any upfront fees, is essential for understanding the total cost of working with them. Transparency in fees is crucial for effective financial planning.

- How do you stay updated on market trends and loan repayment criteria? A knowledgeable agent should be well-informed about current market conditions and lending practices, which can significantly affect your funding alternatives. Comprehending commercial credit and its advantages is essential for aiding your funding choices, and professionals like those at Finance Story are committed to remaining informed about market trends to offer you the best guidance.

By posing these inquiries, you can better evaluate a financial advisor's suitability and ensure they are prepared to assist you in navigating the complexities of commercial financing. Furthermore, selecting a commercial loan broker Australia who understands the Australian commercial lending sphere can further align with your financial goals. As noted by mortgage consultant Brian Warner, "My new client was amazed by the speed of the approval process and, with funds secured, could quickly turn their focus back to their business and continue growing." This demonstrates the advantages of collaborating with an effective intermediary.

Assess the Broker's Network and Financing Options

Assessing a lender's network and the funding alternatives they offer is essential for obtaining the best services from a commercial loan broker Australia. Here are key factors to consider:

- Diversity of Lenders: An intermediary with access to a broad spectrum of lenders, including traditional banks and alternative financiers, can provide more customized solutions. This diversity is essential, especially in a fluctuating market where different lenders may have varying appetites for risk. Finance Story, for instance, provides access to a full suite of lenders, including high street banks and innovative private lending panels, ensuring that clients can find the right fit for their specific needs.

- Types of Credit Available: Ensure that the intermediary can facilitate the specific type of funding you require, whether it’s for commercial property acquisition, enterprise expansion, or equipment funding. Brokers such as Finance Story, a commercial loan broker Australia, focus on developing refined and highly customized business proposals to present to banks, addressing various client requirements with an extensive array of funding options, including commercial property arrangements for warehouses, retail spaces, factories, and hospitality projects.

- Negotiation Skills and Turnaround Time: Inquire about the agent's negotiation abilities with lenders and the usual turnaround period for approvals and funding. Robust negotiation abilities can greatly affect the terms and rates you obtain, possibly resulting in more advantageous funding conditions. A specialist's knowledge in customizing funding proposals can be transformative in obtaining the most favorable rates, while effective procedures can accelerate your monetary requirements, which is especially crucial in competitive markets where timing can be essential.

- Post-Loan Support: Consider whether the intermediary provides ongoing assistance after securing the loan. This assistance can be invaluable for managing your funding effectively and ensuring that you remain on track with your financial goals.

For instance, a self-employed GP partner recently faced challenges in securing a mortgage due to a lack of a two-year employment history. By utilizing an agent's extensive network, they were able to find a lender willing to accept a letter from their practice accountant instead of the usual two years of accounts, resulting in a successful mortgage approval with favorable terms. This case emphasizes the significance of an intermediary's capability to handle intricate scenarios and obtain various lending alternatives.

In the present market, where property values have risen to a record £373,000 despite increases in the Bank of England rates, small business proprietors should be especially aware of how these economic circumstances may affect their funding choices. Grasping these dynamics can assist in making informed choices when choosing a financial intermediary and obtaining credit.

Finalize Your Choice: Next Steps After Selection

After selecting a commercial loan broker, it is essential to take the following steps to ensure a smooth financing process:

- Schedule a Consultation: Arrange a detailed meeting with your financial advisor to discuss your specific financing needs and objectives. At Finance Story, you can book a free personalized 30-minute consultation with Shane Duffy, the Head of Funding Solutions, to explore tailored financial strategies that align with your goals.

- Prepare Documentation: Collect all necessary financial documents, including tax returns, financial statements, and business plans. This preparation is crucial as it simplifies the application procedure and enhances your agent's ability to assist you effectively.

- Set Clear Goals: Clearly express your funding objectives and any particular criteria for borrowing. This clarity assists your financial advisor in customizing options that best suit your requirements, ensuring you obtain the most appropriate financing solutions.

- Review Financing Choices: Collaborate with your broker to assess the financing options presented. Ensure these align with your business objectives and financial strategy. Remember, the majority of new home mortgages in Australia are variable, and with expectations of further cash rate reductions in 2025, it is vital to consider how these factors may influence your financing choices.

- Submit the Application: Once you have chosen a financing option that meets your criteria, your broker will assist you in completing and submitting the application to the lender. Note that applications submitted via email are no longer accepted, so ensure you follow the current submission guidelines.

By following these steps, you can improve your chances of obtaining favorable financing terms and streamline the overall process. A case study titled "Efficiency in Securing Credit" illustrates that clients who prepare thoroughly experience a more efficient credit acquisition process, significantly reducing the time required to obtain funds. As noted by Smartfinn Advisors, "A commercial mortgage loan broker provides access to a wider range of lenders and loan products compared to a single bank," emphasizing the value of engaging a broker in your financing journey.

Conclusion

Navigating the complexities of commercial financing can be a daunting task; however, partnering with a skilled loan broker can make all the difference. These professionals serve as crucial intermediaries, offering access to a wide variety of lending options and insights into the ever-changing financial landscape. By understanding the role of a commercial loan broker and the criteria for selecting one, businesses can significantly enhance their chances of securing favorable loan terms that align with their specific needs.

Choosing the right broker involves evaluating their:

- experience

- licensing

- reputation

- communication skills

- fee structure

Engaging in meaningful discussions with potential brokers through targeted questions can further clarify their capabilities and ensure they are well-equipped to assist in achieving financial goals. Furthermore, assessing a broker's network and the types of financing options available is vital, as it can lead to more customized solutions that fit unique business circumstances.

Once a broker is selected, taking proactive steps such as:

- scheduling consultations

- preparing necessary documentation

- clearly defining financing goals

can streamline the loan application process. This collaborative approach not only increases the likelihood of securing favorable terms but also fosters a productive partnership that supports ongoing business growth.

Ultimately, the journey through commercial financing is one that can be optimized by leveraging the expertise of a knowledgeable broker. As businesses strive to capitalize on opportunities in a competitive market, the importance of selecting the right broker cannot be overstated. With the right support, businesses can navigate the financing landscape with confidence, paving the way for a prosperous future.