Overview

This article delineates five essential steps for accurately calculating your business loan's Loan-to-Value Ratio (LVR). It encompasses:

- Determining the loan amount

- Assessing property value

- Applying the LVR formula

By underscoring the significance of maintaining a lower LVR for securing better financing terms, the article presents practical strategies for improvement. It reinforces the notion that comprehending and calculating LVR is vital for obtaining favorable loan conditions. Are you ready to take control of your financing options?

Introduction

In the intricate landscape of property financing, understanding the Loan-to-Value Ratio (LVR) is crucial for borrowers seeking favorable loan terms. This essential metric not only influences lenders' risk assessments but also directly affects the approval process and interest rates tied to loans.

As property values fluctuate, knowing how to calculate and interpret LVR effectively empowers individuals and businesses to make informed financial decisions. Are you aware of how LVR impacts your financing options?

From gathering essential financial documents to implementing strategies for enhancing LVR, this article explores the nuances of this critical ratio. We offer insights and expert guidance to help you navigate the complexities of securing financing in both residential and commercial markets.

Understand Loan-to-Value Ratio (LVR)

The Loan-to-Value Ratio (LVR) serves as a crucial financial indicator for financial institutions, assessing the risk associated with credit in relation to the value of the financed asset. This ratio is calculated by dividing the borrowed amount by the appraised property value and multiplying by 100 to express it as a percentage. For example, borrowing $400,000 for a property valued at $500,000 results in an LVR of (400,000 / 500,000) x 100 = 80%.

A lower LVR signifies reduced risk for lenders, often resulting in more favorable terms and interest rates. In Australia, the average LVR for residential mortgages typically hovers around 80%, requiring a 20% deposit from borrowers. This benchmark is vital, as it directly affects credit approval conditions and borrowing capacity. As noted by the Australian Bureau of Statistics, "Comprehending the different kinds of home financing and interest rate trends can assist you in making knowledgeable choices when selecting a mortgage."

Grasping the business loan LVR is essential for anyone pursuing financing, especially in the realm of commercial property investments. Finance Story specializes in crafting polished, individualized business cases for banks, enabling small business owners to secure tailored financing solutions. We provide access to a comprehensive array of lenders, including high street banks and innovative private lending panels, crucial for both purchasing and refinancing commercial properties such as warehouses, retail spaces, factories, and hospitality ventures. This expertise is vital, as it not only influences financing terms but also significantly impacts eligibility. For instance, borrowers with a business loan LVR below 80% may qualify for lower interest rates, whereas those with higher business loan LVR ratios might encounter stricter lending criteria.

Real-world examples illustrate the impact of LVR on credit approval. A borrower with a business loan LVR of 90% may face challenges in securing financing compared to one with a business loan LVR of 70%, underscoring the importance of maintaining a lower ratio. Furthermore, current trends reveal that lenders are increasingly scrutinizing business loan LVRs, making it imperative for borrowers to fully understand this metric. By 2025, the average business loan LVR for commercial financing is expected to align closely with that of residential financing, emphasizing the significance of this ratio across various funding types.

In summary, the Loan-to-Value Ratio is a foundational concept in mortgage lending, influencing everything from loan approval to interest rates. By recognizing its importance and leveraging the expertise of Finance Story, along with our access to diverse funding sources, borrowers can make informed decisions that align with their financial objectives.

Calculate Your LVR Using the Formula

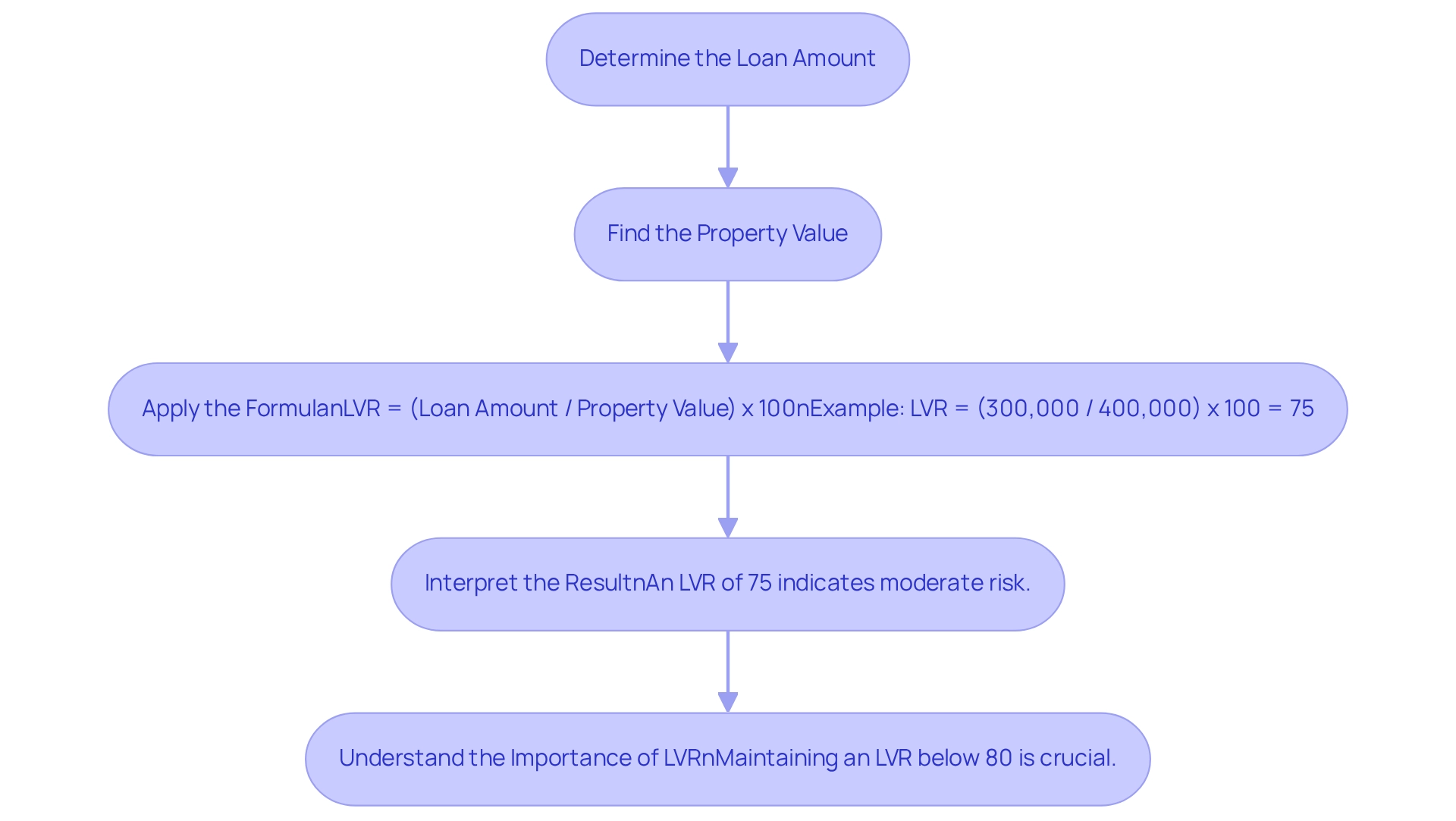

Calculating your Loan-to-Value Ratio (LVR) is essential for making informed financial decisions. Use the following formula:

LVR = (Loan Amount / Property Value) x 100

- Determine the Loan Amount: This is the total amount you intend to borrow.

- Find the Property Value: This can be either the purchase price or the appraised value of the property.

- Apply the Formula: For instance, if you are borrowing $300,000 for a property valued at $400,000, the calculation would be:

- LVR = (300,000 / 400,000) x 100 = 75%.

- Interpret the Result: An LVR of 75% indicates that you are borrowing 75% of the property's value, which lenders generally view as a moderate risk.

Understanding LVR is crucial, particularly in the current Australian market where property values are significant. As of 2025, the average property value in Australia is approximately $800,000, leading to an average borrowing amount of around $640,000 for many applicants. To avoid an LVR exceeding 80%, it is advisable to save at least 20% of the purchase price.

However, many Australians struggle with LVR calculations. A recent survey revealed that only 40% of respondents fully understand how to calculate their LVR, highlighting the need for clear guidance. For businesses, calculating the business loan LVR is equally important. For example, a small enterprise acquiring a commercial property valued at $1 million with financing of $750,000 would also have an LVR of 75%. This calculation is vital for assessing financing options and understanding potential risks. Proper financial planning can help maintain an LVR below 80%, thereby avoiding additional costs and risks associated with higher ratios. As Finance Story focuses on developing customized business cases for obtaining financing, understanding the business loan LVR can greatly influence your capability to refinance and secure favorable terms. Companies that meticulously organize their finances frequently obtain improved borrowing terms, as demonstrated in several case studies.

In summary, determining your LVR precisely is an essential step in the borrowing application process, ensuring you are well-informed and ready to make wise monetary choices. As the RBA warns, if monetary policy is eased too much too soon, disinflation could stall, and inflation may settle above the midpoint of the target range, potentially impacting property values and financing conditions. Furthermore, Fitch Ratings has affirmed Australia's 'AAA' standing with a stable outlook, underscoring the importance of understanding LVR in a stable economic environment.

Gather Required Financial Documents

Before applying for a loan, gathering the following financial documents is crucial to ensure a smooth application process:

- Proof of Income: Include recent pay stubs, tax returns, or comprehensive business statements to demonstrate your earning capacity.

- Bank Statements: Provide at least three months of both personal and business bank statements to illustrate your cash flow and economic stability.

- Credit Report: A current credit report is essential to demonstrate your creditworthiness and economic responsibility.

- Asset Documentation: Gather details on any assets you possess, such as property deeds or investment statements, to provide a complete view of your economic situation.

- Liabilities: Create a thorough inventory of existing debts, including credit cards, loans, and mortgages, to give creditors insight into your obligations.

- Business Plan: If relevant, include a comprehensive business plan that outlines your monetary projections and objectives, demonstrating your strategic approach to growth.

Having these documents prepared not only aids a smoother application process for a business loan LVR but also allows lenders to accurately evaluate your economic wellbeing. Client testimonials consistently emphasize how Finance Story's assistance in organizing these documents has made obtaining financing simpler and more efficient. As one satisfied client noted, "We are finished with the constant worry. Once again, thank you so much for being a part of our journey." This underscores the importance of establishing robust, long-lasting connections with partners like Finance Story, who comprehend business requirements and offer customized solutions even in difficult situations.

Interpret Your LVR Results

Interpreting your Loan-to-Value Ratio (LVR) results is crucial for understanding your loan application’s potential outcomes:

- LVR Below 80%: This range is generally regarded as low risk, often qualifying borrowers for more favorable interest rates and loan terms. Lenders view this as a sign of financial stability, which can enhance your negotiating power. With Finance Story's expertise in creating polished and individualized business cases, you can present a compelling proposal that aligns with these favorable conditions.

- An LVR of a business loan between 80% and 90% is typically classified as moderate risk. Borrowers may be required to pay Lenders Mortgage Insurance (LMI), which protects the lender in case of default. This extra expense can affect your overall borrowing capacity. Comprehending these implications is where Finance Story can assist you in structuring your funding proposal to mitigate risks and enhance your financial strategy.

- A business loan LVR above 90% is regarded as high risk for financial institutions, resulting in elevated interest rates and more stringent borrowing conditions. Borrowers in this category may face challenges in securing favorable terms, as lenders perceive a greater risk of default. Finance Story specializes in refinancing and securing customized business financing, assisting you in navigating these challenges efficiently.

Comprehending these limits enables you to plan effectively for your financial application. For instance, lowering your business loan LVR can improve your chances of approval and enhance your options for better financing solutions. Finance Story offers access to a full range of lenders, including high street banks and innovative private lending panels, to suit your specific circumstances, whether you are purchasing a warehouse, retail premise, factory, or hospitality venture.

By being aware of these dynamics, you can better position yourself in the competitive lending landscape. As mentioned by a Home Loans Expert at ANZ, "Generally speaking, the higher your LVR, the more LMI will cost," highlighting the significance of comprehending your LVR in relation to affordability.

Improve Your LVR for Better Loan Options

To enhance your Loan-to-Value Ratio (LVR) and improve your loan options, consider implementing the following strategies:

- Increase Your Deposit: A larger deposit directly decreases the borrowed amount, effectively lowering your LVR. In 2025, the average deposit amount for home loans in Australia is around 25%, but aiming for a higher percentage can yield better loan terms.

- Pay Down Existing Debt: Reducing your overall debt not only enhances your economic profile but also lowers your LVR. Refinancers typically request to borrow 52% of their home's value, so minimizing existing liabilities can enhance your borrowing capacity. Research indicates that effective debt reduction strategies can lead to a significant enhancement in business loan LVR, making it a vital step in your money management.

- Increase Property Value: Investing in property improvements can significantly boost its market value, thereby improving your LVR. For instance, a self-employed GP partner successfully secured a mortgage by enhancing their property’s appeal, which positively impacted their LVR. This case illustrates how targeted improvements can lead to favorable outcomes in business loan LVR.

- Shop for better loan terms: Various financial institutions have differing criteria for business loan LVR. By comparing choices, you can discover lenders who provide more advantageous conditions based on your monetary situation. As Eliza Owen, Head of Research at CoreLogic Australia, observes, "Part of the reason that home values have continued to rise in a high interest rate environment is due to a surge and an acute level of net overseas migration..." This emphasizes the significance of comprehending market dynamics when exploring financing options.

- Consider a Co-Borrower: Including a co-borrower with a solid monetary background can improve your likelihood of obtaining funding with more favorable conditions. This strategy can be particularly effective in challenging economic situations.

For personalized support tailored to your specific circumstances, we invite you to book your free personalized 30-minute consultation with Shane Duffy, Head of Funding Solutions at Finance Story. Discuss your needs and goals, and let us help you navigate the complexities of securing a loan effectively. Implementing these strategies can significantly enhance your borrowing capacity and financial flexibility.

Conclusion

Understanding the Loan-to-Value Ratio (LVR) is essential for anyone navigating the property financing landscape. This critical metric not only influences loan approval and interest rates but also reflects a borrower's financial stability and risk profile. By accurately calculating LVR and interpreting its implications, borrowers can position themselves favorably in the eyes of lenders, thereby enhancing their chances of securing optimal loan terms.

Throughout this article, we have discussed key strategies for managing and improving LVR. Increasing the deposit, paying down existing debt, and enhancing property value are effective methods to achieve a lower LVR, unlocking better financing options. Furthermore, gathering the necessary financial documents and understanding the nuances of LVR thresholds can significantly streamline the loan application process, ensuring applicants are well-prepared and informed.

Ultimately, leveraging the insights provided and seeking expert guidance can empower borrowers to navigate the complexities of financing with confidence. By prioritizing a strong understanding of LVR, individuals and businesses alike can make informed financial decisions that align with their goals, setting the stage for successful property investments and sustainable financial growth.