Overview

This article delineates five essential steps for effectively financing commercial property.

- It emphasizes the importance of understanding financing options available to investors.

- Next, it prompts readers to assess their financial readiness, ensuring they are well-prepared for the journey ahead.

- Furthermore, the article guides readers through navigating the application process, detailing what to expect at each stage.

- In addition, it highlights the significance of reviewing loan terms carefully, including various loan types, interest rates, and repayment terms.

- Each step is supported by comprehensive explanations, underscoring the necessity of thorough documentation.

This approach enables potential investors to make informed decisions that align with their financial objectives.

Introduction

Navigating the intricacies of commercial property financing can pose significant challenges for many investors. With a plethora of loan types, interest rates, and repayment terms to consider, making informed decisions is essential for achieving success in this competitive market. This article explores the crucial steps for effectively financing commercial real estate, empowering readers with the knowledge necessary to navigate the complexities of securing funding.

What key factors can determine the success or failure of a commercial property investment, and how can one ensure they are financially prepared to seize the right opportunities?

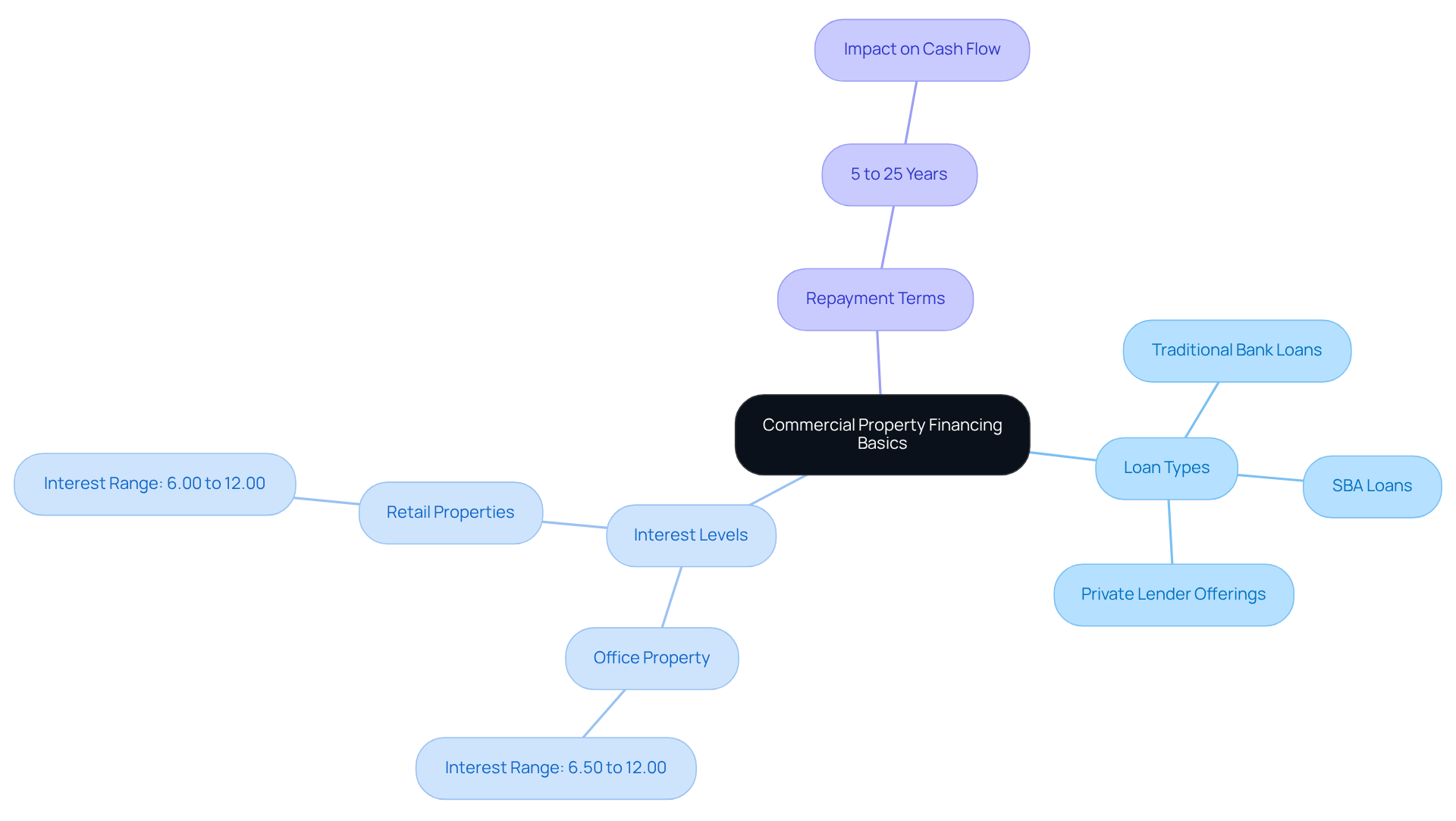

Understand Commercial Property Financing Basics

Understanding how to pay for commercial property is essential for making informed investment choices. Commercial property loans differ from residential loans in several key aspects:

-

Loan Types: Familiarize yourself with various financing options, including traditional bank loans, SBA loans, and private lender offerings. Each type has unique requirements and advantages tailored to different borrower needs. At Finance Story, we specialize in creating polished and highly individualized business cases to present to banks, ensuring you secure the right financing for your commercial investment.

-

Interest Levels: Interest levels for commercial loans generally range from 5.45% to 15%, influenced by elements such as asset type, location, and borrower creditworthiness. For instance, office property interest percentages can range from 6.50% to 12.00%, while retail properties may experience figures between 6.00% and 12.00%. Understanding the distinction between fixed and variable pricing is crucial, as fixed pricing ensures stability while variable pricing may present lower initial expenses but involves future unpredictability.

-

Repayment Terms: Commercial loans typically feature repayment terms between 5 to 25 years, impacting your cash flow and overall financial strategy. Shorter terms may lead to higher monthly payments, while longer terms can provide lower payments but potentially higher total interest costs. Additionally, the loan-to-value (LTV) ratio plays a significant role in determining interest rates; higher LTV ratios can result in increased rates due to the associated risk. Working with Finance Story gives you access to a full suite of lenders, including high street banks and innovative private lending panels, to find the best refinancing options for your evolving business needs.

By understanding these foundational elements, you will be better equipped to navigate the complexities of how to pay for commercial property and make strategic choices that align with your investment objectives. Consulting with qualified professionals, like those at Finance Story, is also recommended to ensure you are making informed choices in the current economic landscape.

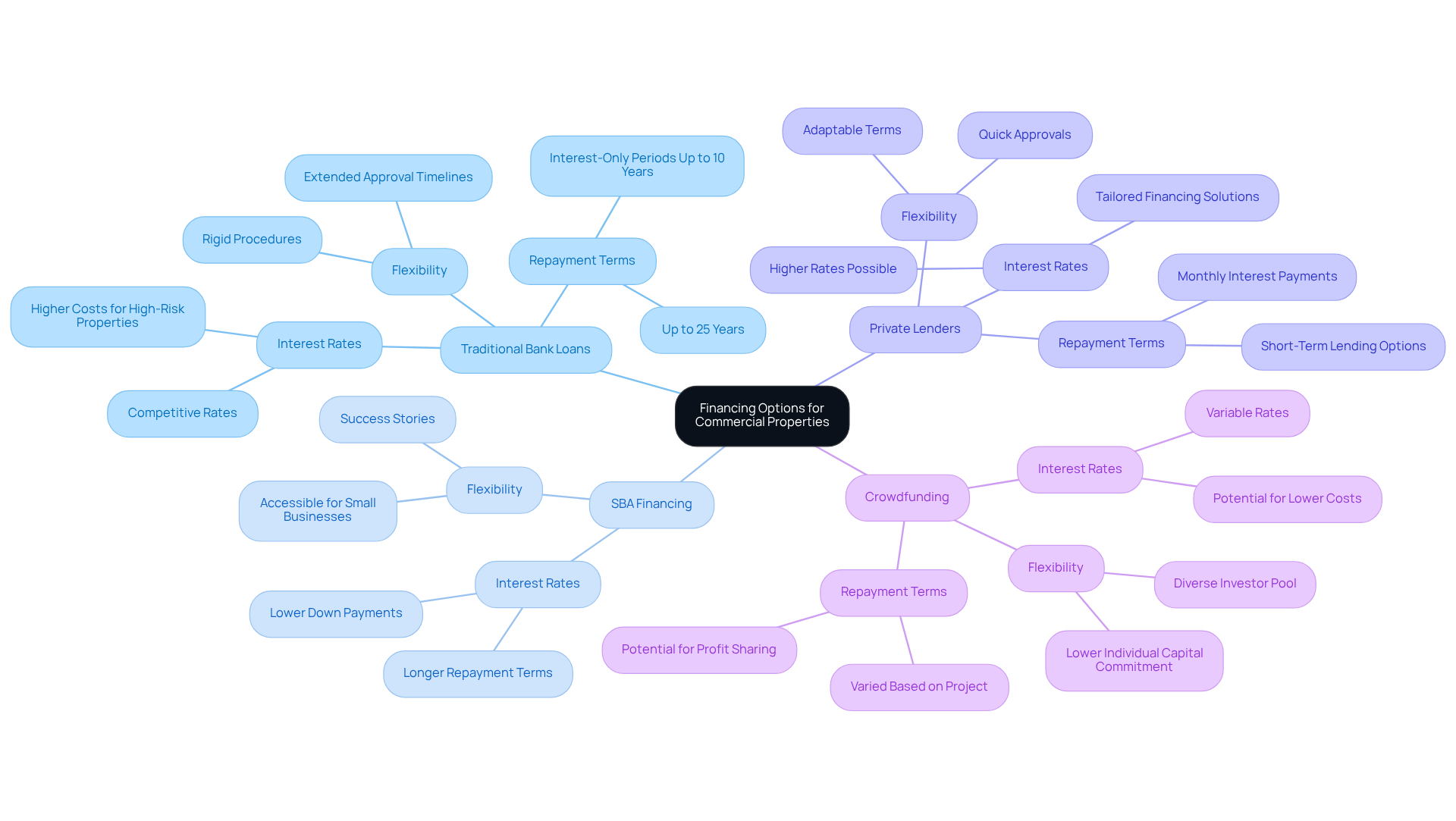

Explore Financing Options for Commercial Properties

Investigating how to pay for commercial property is essential for making informed investment choices. Here are the primary avenues available:

-

Traditional Bank Loans: These loans typically offer competitive interest rates, making them an attractive choice for many borrowers. However, they often come with stringent qualification criteria, which can be a barrier for some applicants. Banks may lend up to 70% of an asset's value, depending on the borrower's financial condition and the specific type of asset.

-

SBA Financing: Supported by the Small Business Administration, SBA financing is especially advantageous for small businesses. They feature lower down payments and longer repayment terms, making them accessible for those looking to invest in commercial real estate. Success stories are plentiful, as numerous small business owners utilize these financial resources to acquire properties that improve their operational capabilities.

-

Private Lenders: For those with unique financing needs, private lenders offer more flexible terms and quicker approvals compared to traditional banks. This can be especially advantageous in competitive markets where timing is critical. Non-bank lenders, for instance, can approve loans in days, allowing borrowers to seize opportunities without the delays often associated with conventional lending processes.

-

Crowdfunding: A developing choice, crowdfunding allows numerous investors to combine resources for real estate acquisitions. This approach can be particularly beneficial for smaller projects, allowing investors to diversify their portfolios without committing significant capital individually.

When assessing these choices, consider how to pay for commercial property, your financial circumstances, the type of asset you wish to obtain, and your long-term investment objectives. Comprehending current trends, such as the rising popularity of SBA financing among small enterprises, can also assist your decision-making process efficiently.

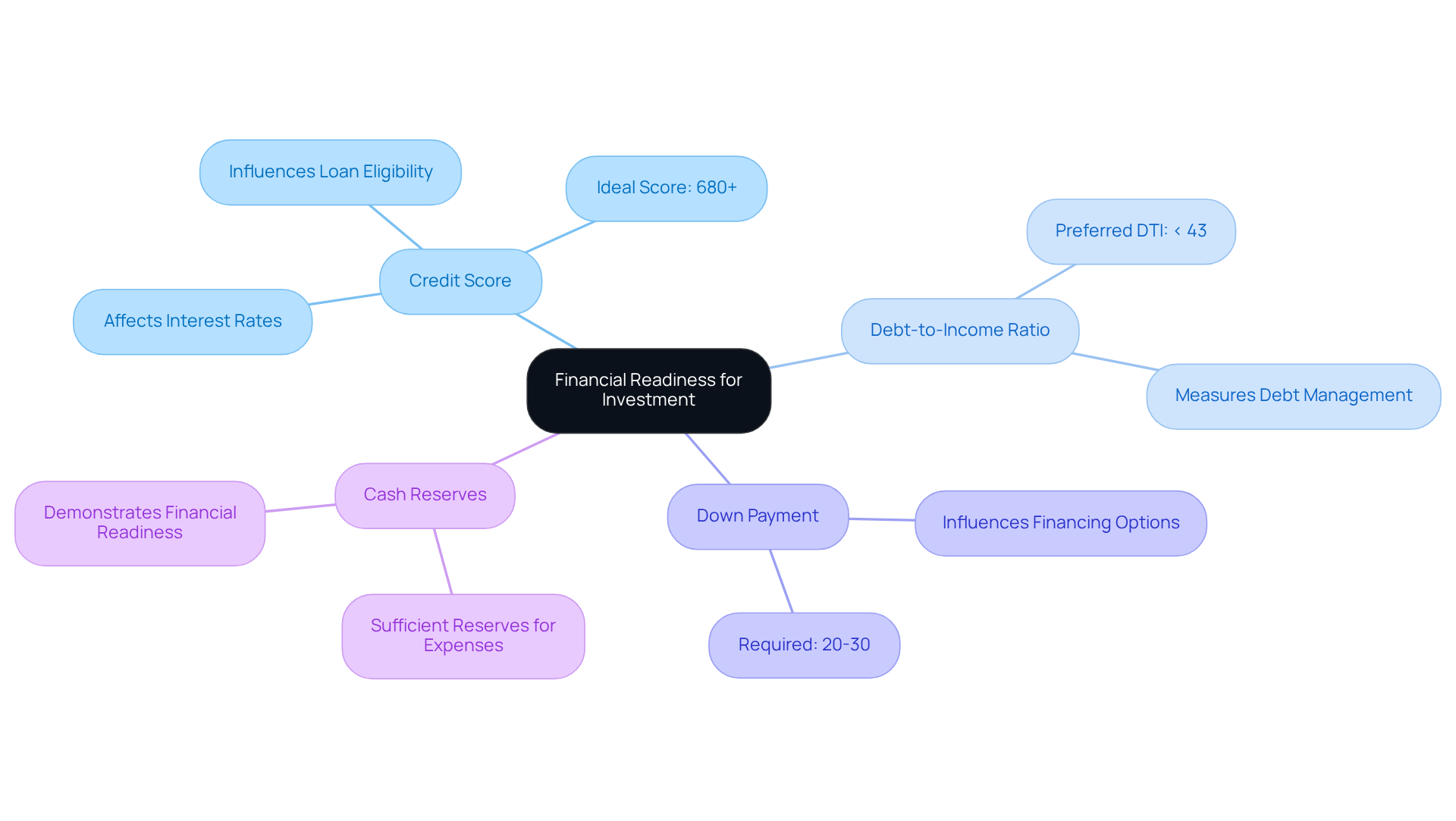

Assess Your Financial Readiness for Investment

Before seeking financing for commercial property, it is essential to evaluate your financial readiness through several key factors:

-

Credit Score: Your credit score plays a pivotal role in determining loan eligibility and interest rates. Aiming for a score of 680 or higher can unlock improved funding options, as lenders often view this as a benchmark for creditworthiness.

-

Debt-to-Income Ratio: Assess your debt-to-income (DTI) ratio, which measures your monthly debt payments against your gross monthly income. A DTI ratio below 43% is generally preferred by lenders, indicating that you can manage additional debt responsibly.

-

Down Payment: Consider how much you can allocate for a down payment. Most commercial loans usually necessitate a down payment of 20-30% of the asset's value, which can greatly influence your financing alternatives.

-

Cash Reserves: Ensure you have sufficient cash reserves to manage unforeseen expenses and ongoing real estate costs, such as maintenance and taxes. Having a financial cushion not only offers peace of mind but also shows lenders that you are ready for the obligations of homeownership.

Furthermore, explore the refinancing choices offered by Finance Story, which can assist you in modifying your financial arrangements as your business develops. By thoroughly assessing these elements of your financial circumstances and utilizing Finance Story's expertise in crafting refined and customized proposals, along with access to a varied portfolio of private lenders and traditional financial institutions, you can approach lenders with assurance. This proactive approach significantly improves your likelihood of understanding how to pay for commercial property investment with advantageous funding.

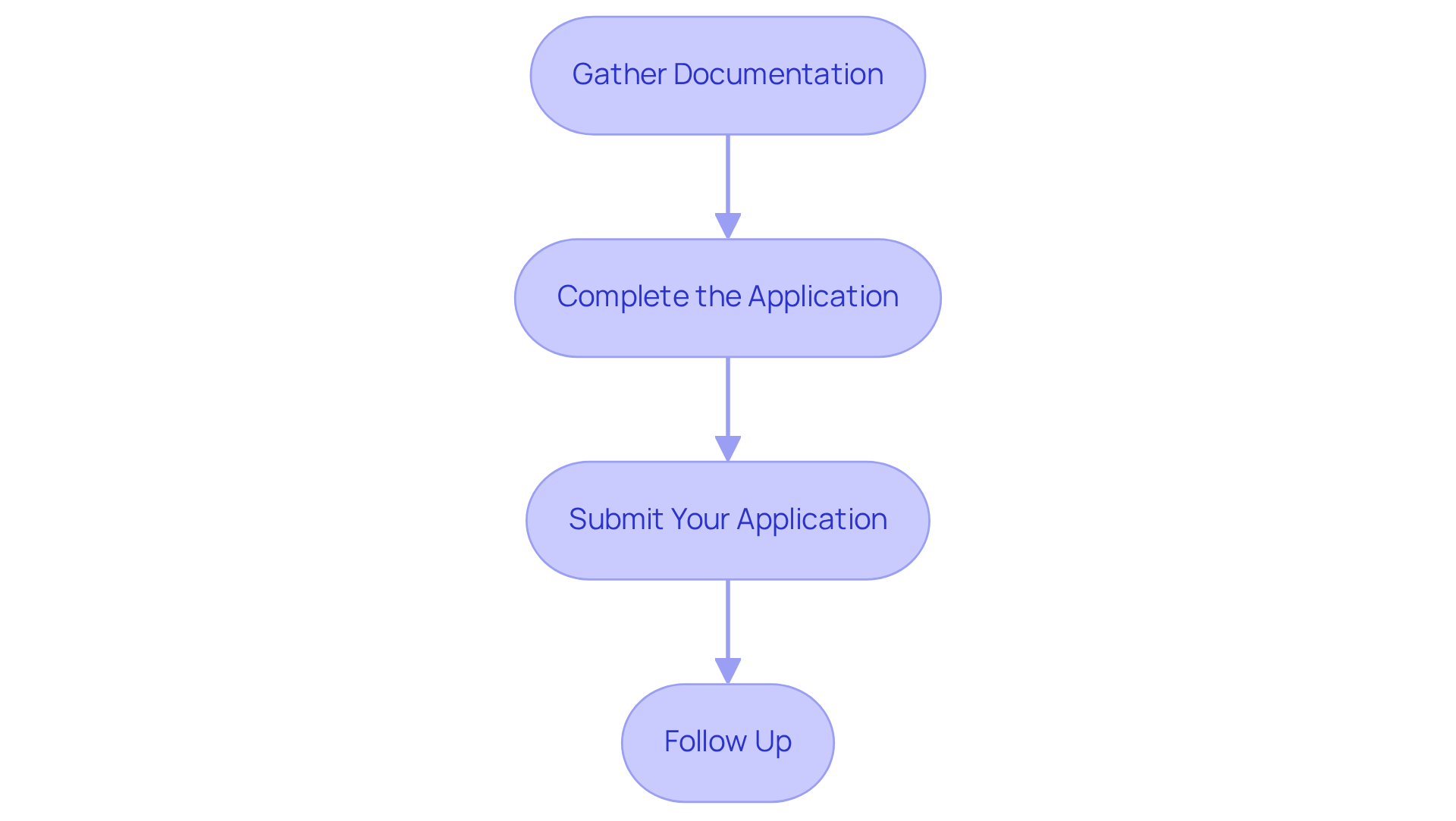

Navigate the Application Process for Financing

With your funding options identified and your financial readiness assessed, it’s time to navigate the application process. Follow these essential steps:

- Gather Documentation: Prepare necessary documents, including tax returns, financial statements, and business plans. Lenders require this information to evaluate your application effectively.

- Complete the Application: Fill out the financial application accurately, ensuring all information is complete and truthful. Incomplete applications can lead to delays or denials.

- Submit Your Application: Submit your application along with the required documentation to your chosen lender. At Finance Story, we specialize in creating tailored business cases to present to banks, significantly increasing your chances of approval. Be prepared for follow-up questions or requests for additional information.

- Follow Up: After submission, maintain communication with your lender to stay updated on your application status and address any concerns promptly. With access to a full suite of lenders, including high street banks and innovative private lending panels, Finance Story is here to support you throughout this process.

By following these steps, you can navigate the application process more effectively and enhance your chances of understanding how to pay for commercial property—be it a warehouse, retail premise, factory, or hospitality venture.

Review Loan Terms and Conditions Carefully

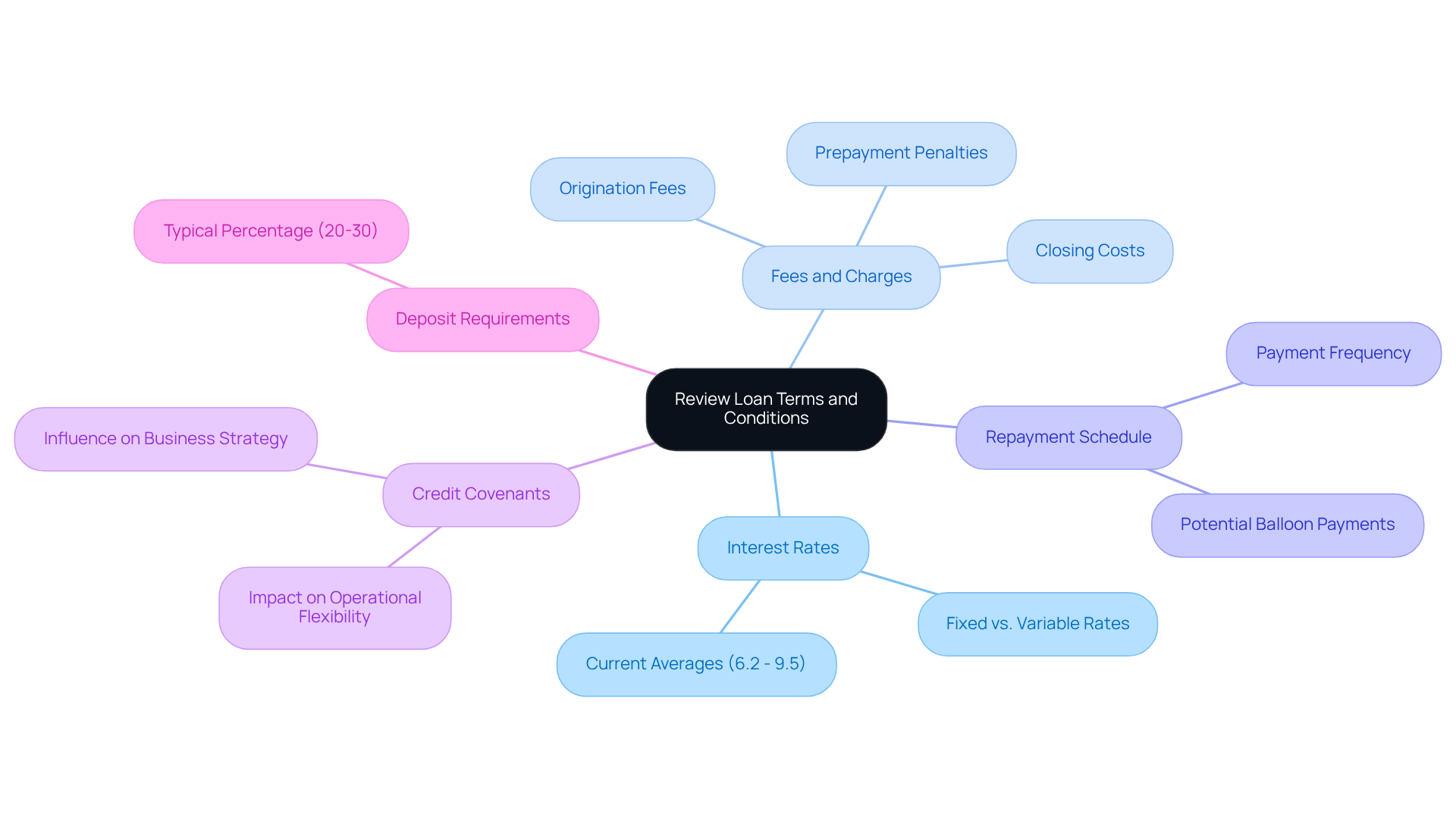

Upon receiving loan offers, it is crucial to meticulously review the terms and conditions. Key areas to focus on include:

-

Interest Rates: Determine whether the rates are fixed or variable. Fixed rates offer consistency, while variable rates may fluctuate, impacting your payments over time. As of 2025, average commercial property financing rates in Australia range from 6.2% to 9.5%, influenced by factors such as lender policies and property type.

-

Fees and Charges: Be vigilant for hidden fees that can inflate your overall costs. Common examples include origination fees, prepayment penalties, and closing costs, all of which can significantly affect your financial outlay.

-

Repayment Schedule: Familiarize yourself with the repayment schedule, including payment frequency and any potential balloon payments. Understanding these details is essential for effective cash flow management.

-

Credit Covenants: Scrutinize any covenants or conditions associated with the credit. These stipulations can affect your operational flexibility and overall business strategy.

-

Deposit Requirements: Most lenders necessitate at least a 20 to 30 percent deposit for commercial financing. This is a critical consideration when reviewing loan terms, as it impacts your initial financial commitment.

By carefully examining these elements, you can make a well-informed decision on how to pay for commercial property that aligns with your investment objectives and financial strategy.

Conclusion

Understanding how to finance commercial property is crucial for making informed investment decisions. By mastering the fundamentals of commercial financing, investors can effectively navigate the complexities of loans, interest rates, and repayment terms. This expertise empowers individuals to choose financing options that align with their investment objectives and financial readiness.

The article highlights several key aspects of commercial property financing, including the various types of loans available—such as traditional bank loans, SBA financing, and private lenders. It also stresses the importance of evaluating one's financial health through critical factors like credit score and debt-to-income ratio. Furthermore, the article underscores the necessity of thoroughly reviewing loan terms and conditions to avoid unexpected costs and ensure a robust financial strategy.

Ultimately, dedicating time to understand and assess the financing landscape for commercial properties can lead to more informed investment choices. As the market evolves, staying updated on financing options and best practices is essential for success. Engaging with professionals, such as those at Finance Story, can provide valuable insights and tailored support, significantly enhancing the likelihood of securing advantageous funding for commercial property investments.