Overview

This article presents a comprehensive five-step process for securing a commercial investment property loan. It begins by:

- Assessing financial situations

- Choosing the right lender

- Preparing the loan application

- Finalizing the closing process

Each step is underpinned by detailed guidance on necessary documentation, the types of loans available, and effective strategies for navigating the lending landscape. Importantly, it emphasizes understanding the unique aspects of commercial financing as distinct from residential options, ensuring that readers are well-equipped to make informed decisions.

Introduction

Navigating the world of commercial investment property loans can indeed be a daunting endeavor, particularly for those who are unfamiliar with the distinct requirements and processes that differentiate them from residential financing. By understanding the nuances of various loan types—from conventional loans to bridge financing—investors can unlock lucrative opportunities.

However, with stricter underwriting criteria and potential pitfalls at every turn, how can investors ensure they secure the right financing to meet their goals? This guide outlines essential steps to demystify the process, empowering investors to confidently pursue their commercial real estate aspirations.

Understand Commercial Investment Property Loans

Business investment financing is specifically designed for acquiring or refinancing business real estate, and it is essential to know how to get a commercial investment property loan, as it differs significantly from residential financing in terms of interest rates, down payment requirements, and financing terms. Key types of commercial investment property loans include:

- Conventional Loans: These traditional loans, typically offered by banks and credit unions, usually require a down payment of 20-30%. They are ideal for established businesses with solid credit histories.

- SBA Financing: Supported by the Small Business Administration, this funding often includes lower down payments and extended repayment terms, making it attainable for small business owners.

- Bridge Loans: These short-term financing solutions are designed to bridge the gap between purchasing a new property and selling an existing one. They are especially beneficial for investors aiming to seize prompt opportunities.

- Hard Money Financing: This asset-based funding, provided by private lenders, comes with higher interest rates but offers quicker approval times, catering to those who require rapid access to capital.

Looking ahead to 2025, average interest rates for business real estate financing are expected to hover around 6.5%, reflecting ongoing economic shifts. Financial specialists emphasize that business financing generally entails stricter underwriting criteria compared to residential financing, potentially leading to increased expenses and more rigorous approval processes. Understanding how to get a commercial investment property loan is crucial for selecting the right financing strategy that aligns with your investment goals.

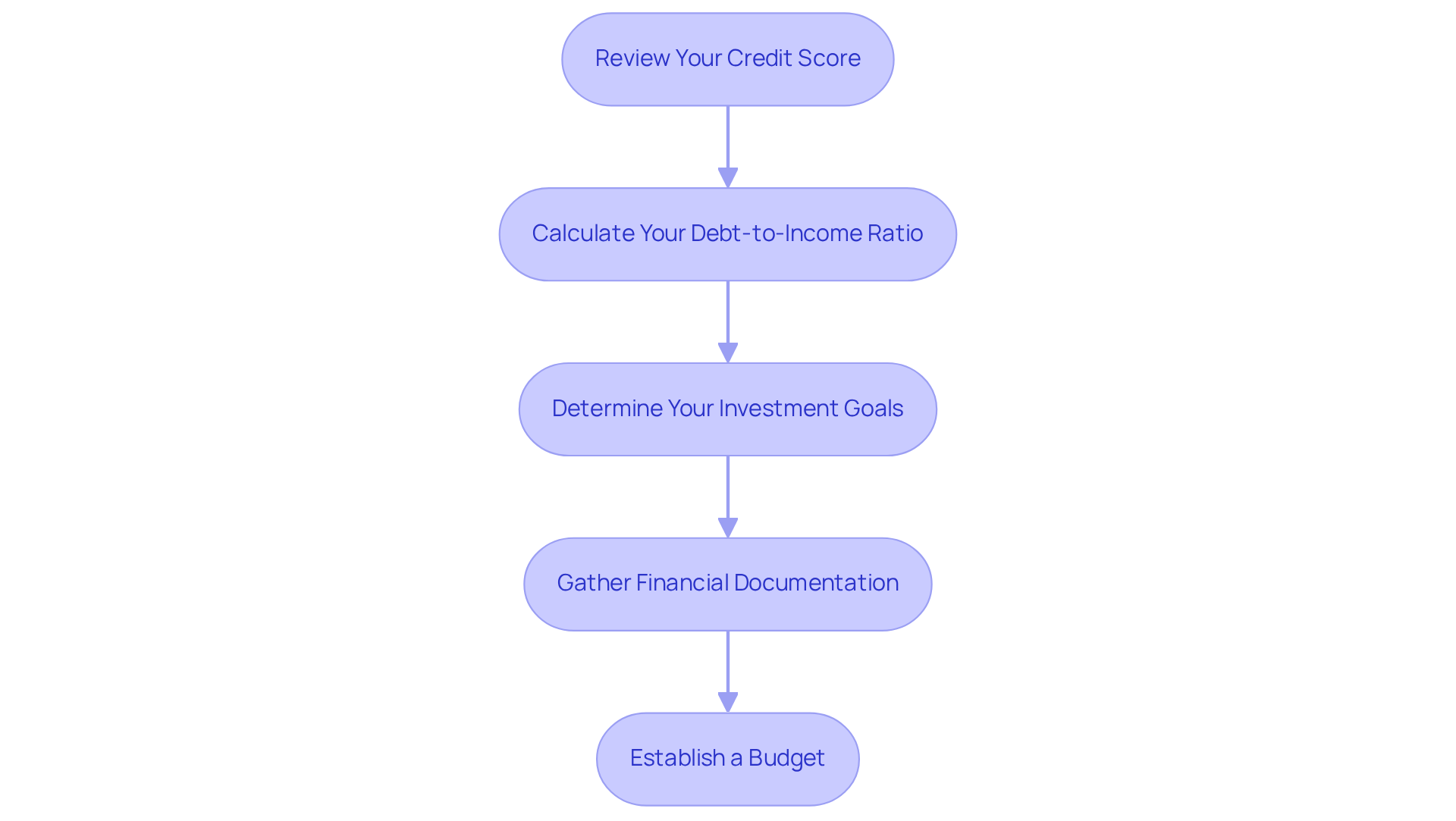

Assess Your Financial Situation and Goals

Before understanding how to get a commercial investment property loan, it is essential to evaluate your financial circumstances thoroughly. Follow these steps to ensure you are well-prepared:

- Review Your Credit Score: A strong credit score, typically above 680, is crucial for obtaining favorable financing terms. Often, a score of 760 is necessary to secure the best rates for business financing.

- Calculate Your Debt-to-Income Ratio: Lenders generally prefer a debt-to-income (DTI) ratio below 43%. This ratio compares your monthly debt payments to your gross monthly income, providing creditors insight into your financial stability.

- Determine Your Investment Goals: Clarify whether you are seeking long-term rental income, capital appreciation, or both. Your investment goals will significantly influence the type of property and financing you pursue. Finance Story can assist you in aligning your investment strategy with suitable financing options.

- Gather Financial Documentation: Prepare comprehensive financial statements, tax returns, and proof of income to present to lenders. This documentation is vital for showcasing your financial stability and ability to repay the debt.

- Establish a Budget: Determine how much you can afford to borrow and what your monthly payments will look like based on various borrowing scenarios. With access to a complete range of financial institutions, Finance Story can help you discover the optimal financing options tailored to your needs.

By following these measures, you can enhance your opportunities for learning how to get a commercial investment property loan that meets your requirements.

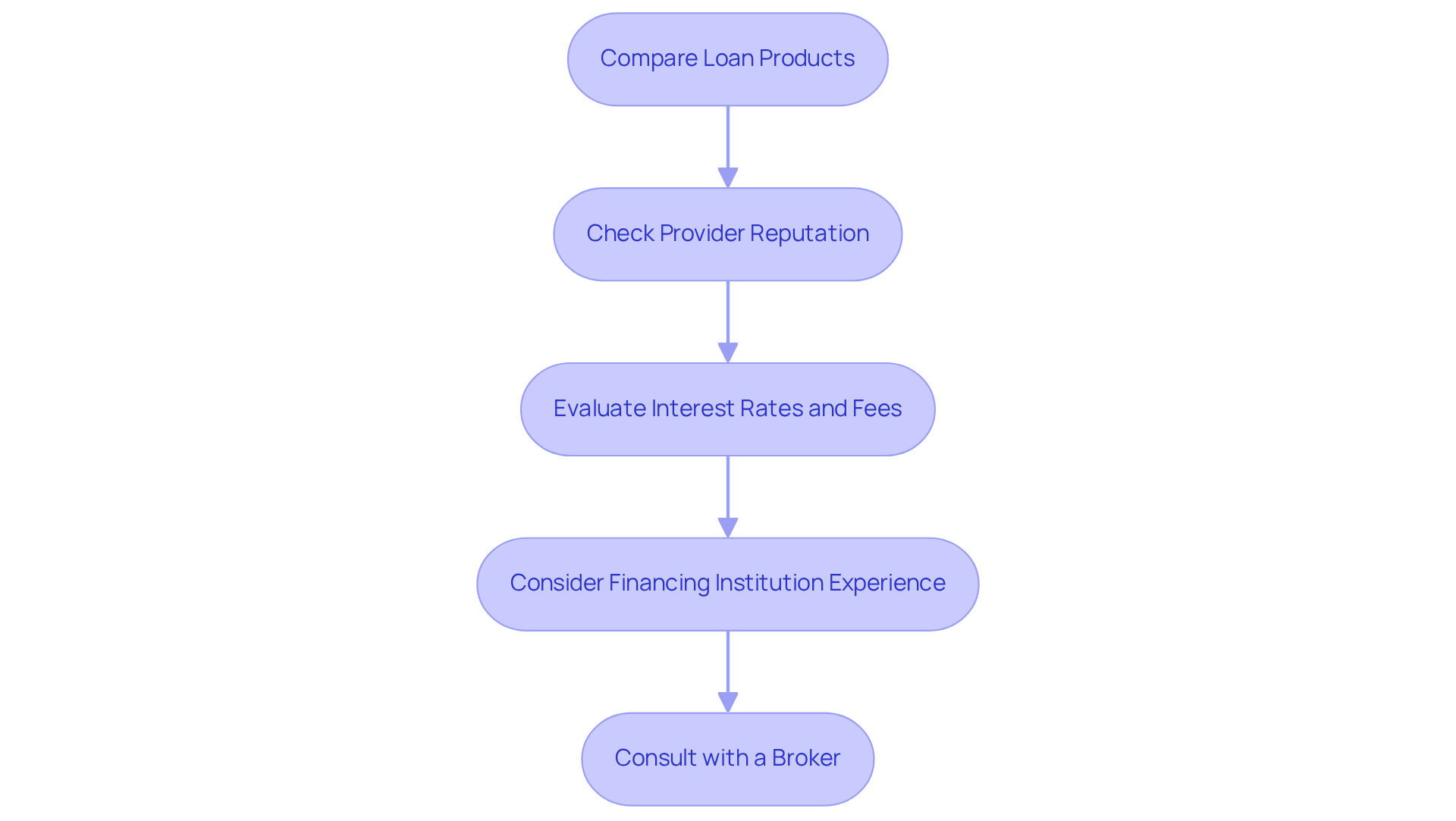

Research and Choose the Right Lender

Selecting the right financial institution is crucial for learning how to get a commercial investment property loan successfully. To guide your decision-making process, consider these essential steps:

- Compare Loan Products: Look for institutions that provide a diverse array of commercial loan products tailored to your unique requirements. This approach ensures you identify options that align with your investment goals.

- Check Provider Reputation: Delve into online reviews and client testimonials to evaluate the reliability and customer service of potential providers. A financial institution's reputation can significantly influence your overall experience.

- Evaluate Interest Rates and Fees: Carefully examine the interest rates, origination fees, and any additional costs tied to each financial institution. Grasping the total cost of borrowing is vital for making an informed choice.

- Consider Financing Institution Experience: Opt for providers who specialize in business loans, as their expertise offers valuable insights into the market and your specific needs. Experienced financiers are better equipped to navigate the complexities of commercial funding.

- Consult with a Broker: Engaging a mortgage broker can streamline the process. Brokers possess access to a wide range of financial institutions and can help you pinpoint the best options based on your financial circumstances and objectives.

By adhering to these steps, you can significantly enhance your chances of understanding how to get a commercial investment property loan that meets your investment needs.

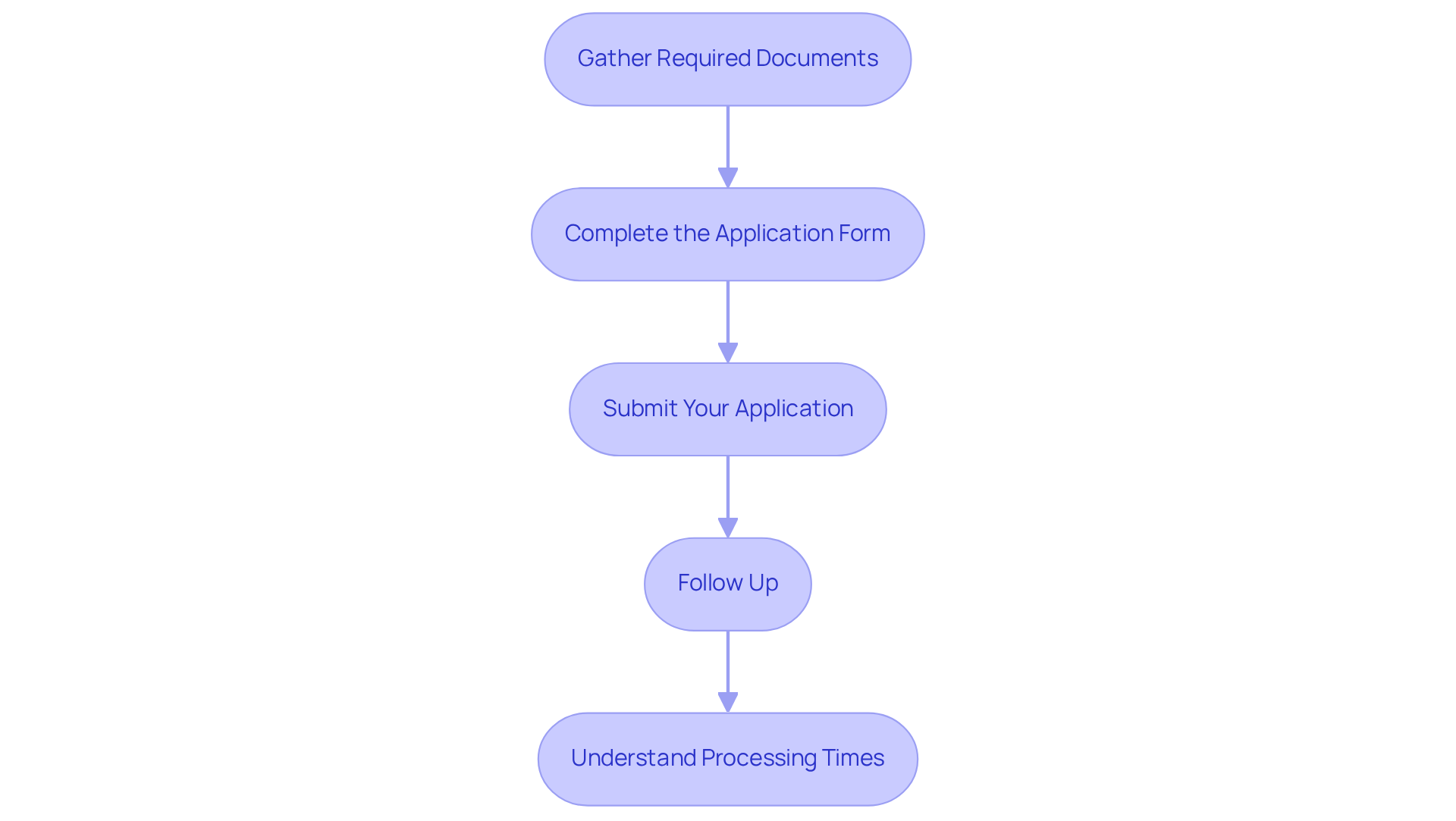

Prepare and Submit Your Loan Application

Once you've chosen a financial institution, the next step is to prepare your loan application. Here’s how to effectively navigate this process:

-

Gather Required Documents: Essential documents typically include:

- Business financial statements, such as profit and loss statements and balance sheets.

- Personal financial statements.

- Tax returns for the last two years.

- A comprehensive business plan outlining your investment strategy.

- Property details, including appraisals and lease agreements if applicable.

-

Complete the Application Form: Accurately fill out the institution's application form, ensuring that all information is current and complete. Attention to detail here can significantly impact your approval chances.

-

Submit Your Application: Submit your application along with all required documentation. Be ready for follow-up inquiries or requests for more details, as financial institutions often seek clarification to speed up the process.

-

Follow Up: After submission, maintain open communication with your financial institution. Regularly check on the status of your application and promptly address any concerns they may have. This proactive approach can help keep your application moving forward.

-

Understand Processing Times: In Australia, the average duration required to handle business financing requests can differ, but it usually spans from a few weeks to several months, depending on the lender and the complexity of your application. Being aware of this timeline can help you plan your investment strategy accordingly.

By adhering to these steps and ensuring you possess all essential documentation, you can simplify the funding application procedure and enhance your likelihood of obtaining financing for your business investment asset.

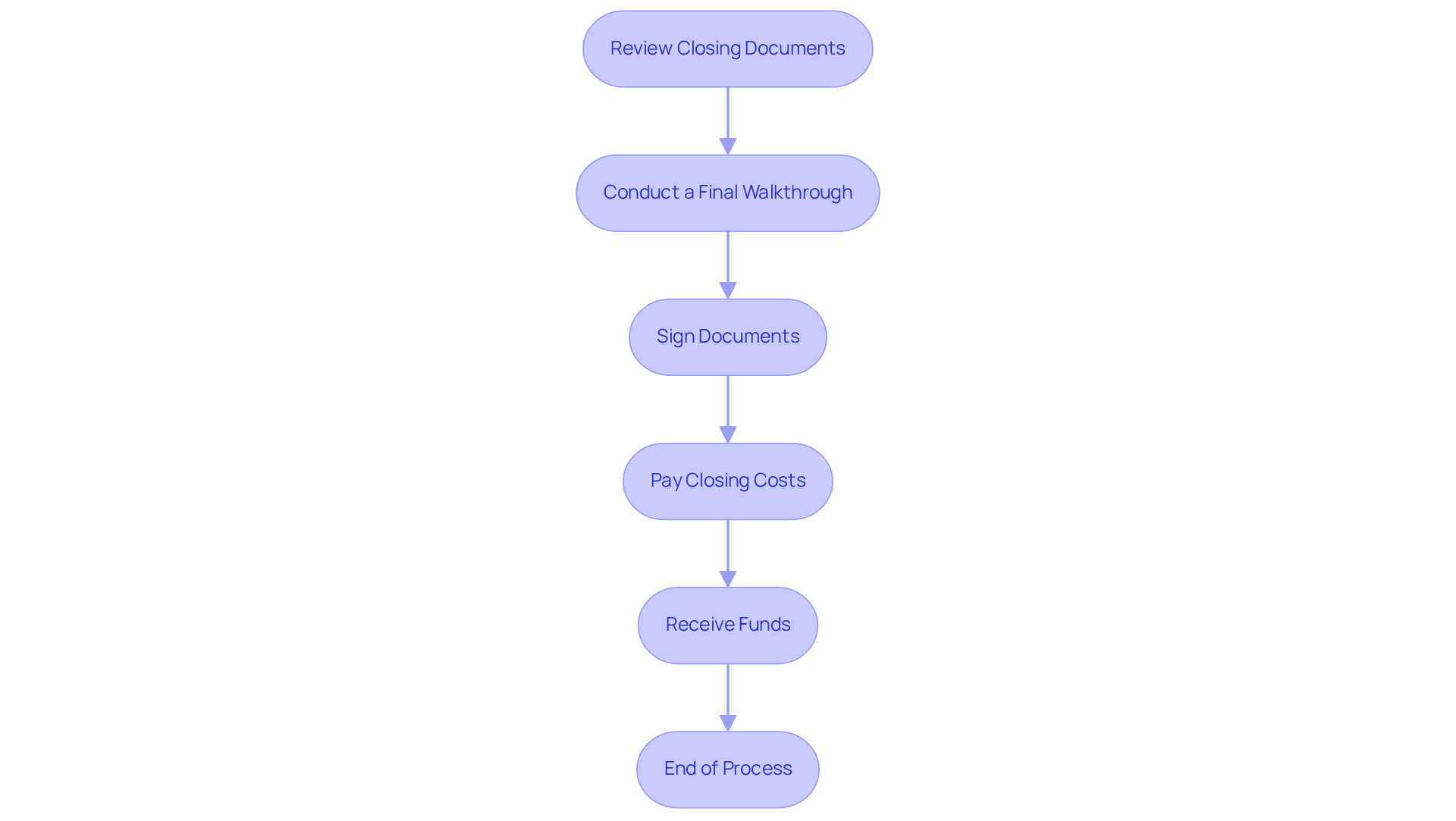

Navigate the Closing Process and Finalize Your Loan

The closing procedure signifies the culmination of understanding how to get a commercial investment property loan. Here’s what to expect:

-

Review Closing Documents: Thoroughly examine all closing documents, including the loan agreement, title insurance, and any additional legal paperwork. This step is crucial as it ensures that all terms are understood and agreed upon. Real estate professionals emphasize that meticulous review can prevent future disputes. Working with experts like Finance Story can help you navigate these documents effectively, ensuring your business case is polished and meets lender expectations.

-

Conduct a Final Walkthrough: If you are buying a real estate asset, perform a final walkthrough to confirm that it meets your expectations and is in the condition agreed upon in the contract. This is an essential step to avoid any surprises post-closing. Furthermore, consider carrying out an environmental evaluation, which is frequently a standard necessity in commercial real estate transactions.

-

Sign Documents: Attend the closing meeting to sign all necessary documents. It’s vital to understand each document before signing, as this will finalize your obligations and rights regarding the property. Having a knowledgeable partner like Finance Story can provide guidance throughout this process, ensuring you are fully informed.

-

Pay Closing Costs: Be prepared to cover closing costs, which typically range from 3% to 6% of the loan amount. These costs may include appraisal fees, title insurance, and attorney fees, which can add up significantly. For instance, on a $200,000 mortgage, closing fees could range from $6,000 to $12,000. Both buyers and sellers typically cover closing costs, but the majority are usually paid by the buyer. Negotiating with financial institutions can also help lower these expenses, and Finance Story can aid in locating the suitable provider for your requirements.

-

Receive Funds: After all documents are signed and payments are made, the financial institution will disburse the funds, officially transferring ownership of the property to you. This final step solidifies your investment and opens the door to potential income generation.

Understanding how to get a commercial investment property loan is also essential; the closing process duration can vary significantly based on the complexity of the transaction and the lender's requirements. Typically, the entire process can take several weeks, especially if additional documentation is needed. Real estate professionals emphasize the importance of reviewing closing documents meticulously to ensure a smooth transaction and avoid future disputes. Partnering with Finance Story ensures you have the expertise needed to navigate this process successfully.

Conclusion

Securing a commercial investment property loan is a pivotal step for any investor aiming to expand their portfolio. This process encompasses a series of well-defined steps, from assessing financial readiness to navigating the complexities of closing the deal. Each stage demands careful consideration and strategic planning to ensure that the selected financing aligns with your investment goals and financial situation.

Key insights from the article underscore the importance of evaluating various types of loans, such as:

- Conventional loans

- SBA financing

- Hard money options

Each type is tailored to specific needs and circumstances. Moreover, the necessity of preparing comprehensive financial documentation and selecting the right lender cannot be overstated. Adhering to these steps can significantly enhance the likelihood of securing favorable financing terms and ultimately lead to successful investment outcomes.

In conclusion, the journey to obtaining a commercial investment property loan transcends a mere financial transaction; it is a strategic endeavor that can profoundly impact long-term financial success. By fully grasping the loan process, assessing personal financial circumstances, and choosing the right lender, investors can position themselves for growth and profitability. Taking informed steps today can unlock lucrative opportunities in the commercial real estate market, making it imperative for potential investors to act decisively and wisely.