Overview

This article presents five essential steps for financing commercial property development. It emphasizes the importance of:

- Understanding loan types

- Preparing applications

- Selecting the right lender

- Effectively managing the financing process

Success in commercial property financing hinges on a comprehensive understanding of various financing options, eligibility criteria, and strategic planning. By meeting lender expectations, you can secure favorable terms, ensuring a successful venture in the competitive landscape of commercial property development.

Introduction

Navigating the landscape of commercial property development financing is a formidable challenge, particularly as the market evolves and new options arise. Gaining a comprehensive understanding of the various types of loans, eligibility criteria, and documentation requirements is crucial for anyone aiming to invest in income-generating properties. Yet, with a multitude of financing options at their disposal, how can developers effectively select the right path to secure funding that aligns with their project objectives? This article delineates five essential steps designed to empower developers in successfully financing their commercial projects, ensuring they are well-prepared to confront the complexities of real estate investment.

Understand Commercial Property Financing Basics

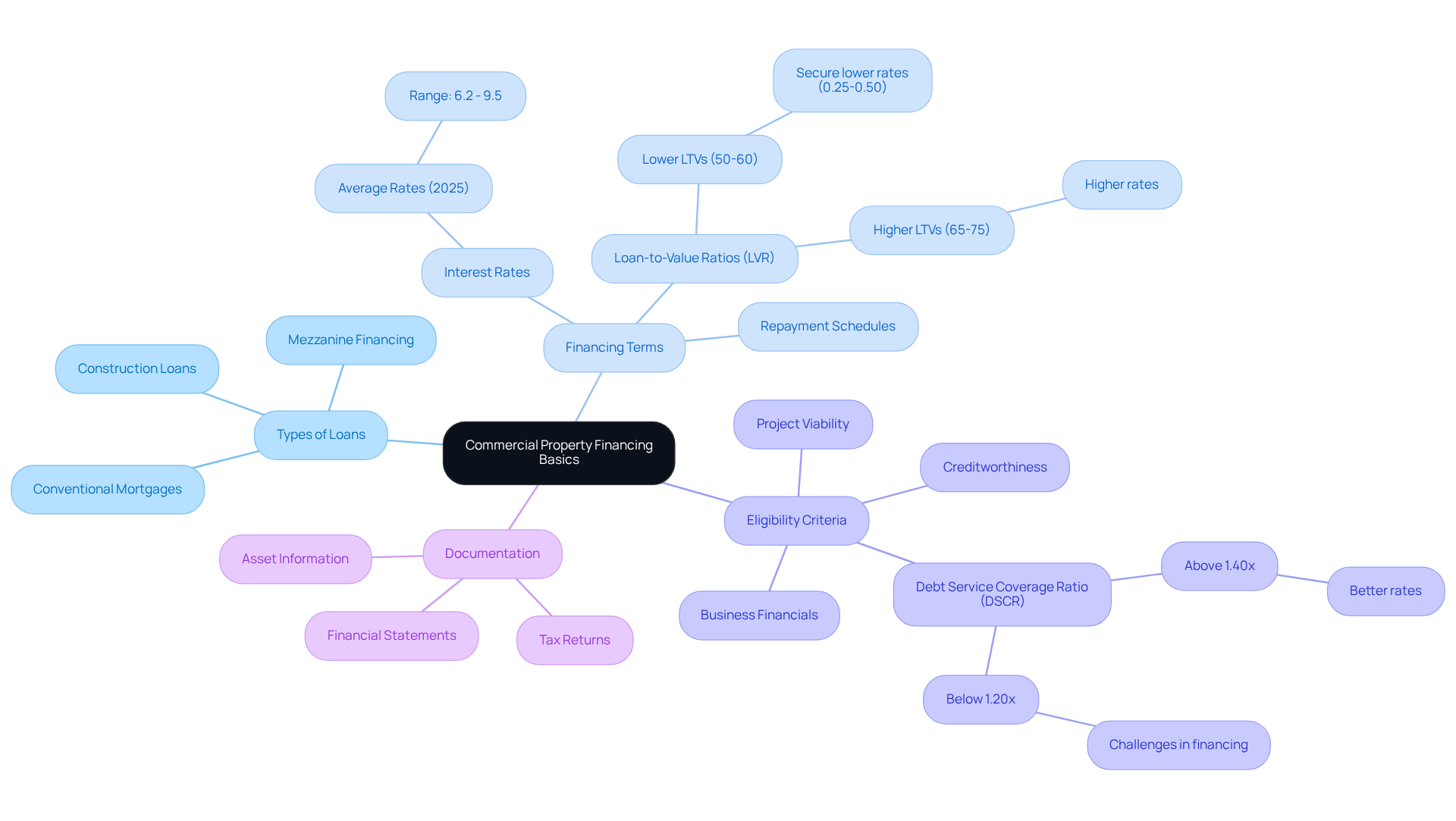

Knowing how to finance commercial property development is crucial for acquiring or developing income-generating properties. By understanding the following key concepts, you will be empowered to navigate this complex landscape effectively:

-

Types of Loans: Familiarize yourself with various loan options, including conventional mortgages, construction loans, and mezzanine financing. Each type serves distinct purposes and comes with unique terms and conditions.

-

Financing Terms: Typical financing terms encompass interest rates, repayment schedules, and loan-to-value ratios (LVR). As of 2025, average interest rates for commercial property loans range from approximately 6.2% to 9.5%, influenced by factors such as property type and borrower creditworthiness. Notably, lower LTVs, particularly in the 50-60% range, can secure rates 0.25-0.50% lower than those at 65-75% LTV.

-

Eligibility Criteria: Lenders assess your creditworthiness, business financials, and the project's viability. A robust credit profile and a well-organized business plan are essential for obtaining favorable funding conditions. Properties with a debt service coverage ratio (DSCR) above 1.40x often qualify for better rates, while those below 1.20x encounter significant challenges in securing financing.

-

Documentation: Be prepared to provide comprehensive documentation, including financial statements, tax returns, and detailed information about the assets. This transparency aids lenders in evaluating the risk associated with your application.

By mastering these fundamentals, you will enhance your ability to understand how to finance commercial property development, positioning yourself for success in this competitive market.

Explore Financing Options for Commercial Property Development

When financing commercial property development, it is essential to consider several options that can significantly impact your project's success:

-

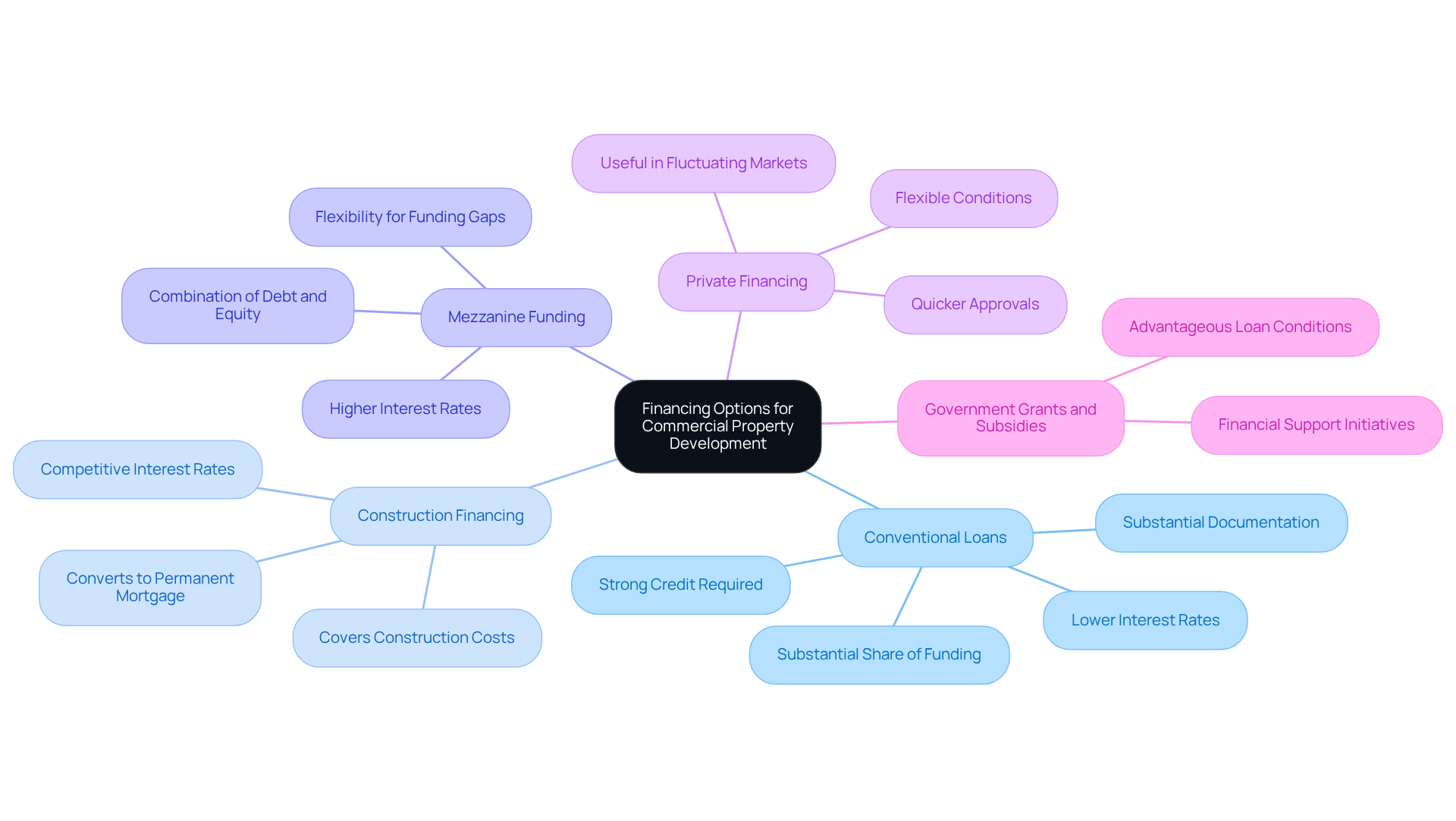

Conventional Loans: Typically offered by banks and credit unions, these loans are favored for their lower interest rates. However, they require strong credit and substantial documentation. In 2025, traditional financing options are expected to continue being a favored selection, with data suggesting that they represent a substantial share of commercial real estate funding.

-

Construction Financing: Specifically tailored for property development, these funds cover construction costs and may convert to a permanent mortgage upon project completion. Average interest rates for construction loans in 2025 are expected to be competitive, making them an attractive option for developers.

-

Mezzanine Funding: This combination of debt and equity support is beneficial for projects requiring additional capital. While it often comes with higher interest rates, its flexibility can be advantageous for developers facing funding gaps.

-

Private Financing: Non-bank institutions may provide more flexible conditions and quicker approvals, making them appropriate for projects that conventional banks might neglect. This option can be particularly useful in a fluctuating market where speed is essential. Finance Story offers access to a varied collection of private lenders, ensuring clients can discover appropriate funding options customized to their requirements.

-

Government Grants and Subsidies: Examining accessible government initiatives that aid commercial development can provide financial support or advantageous loan conditions, improving the overall funding strategy.

By thoroughly assessing these options, developers can understand how to finance commercial property development, allowing them to choose the most appropriate funding method for their projects and ensuring a solid foundation for success. What financing option aligns best with your project's needs?

Prepare Your Application for Financing

To prepare your financing application effectively, follow these essential steps:

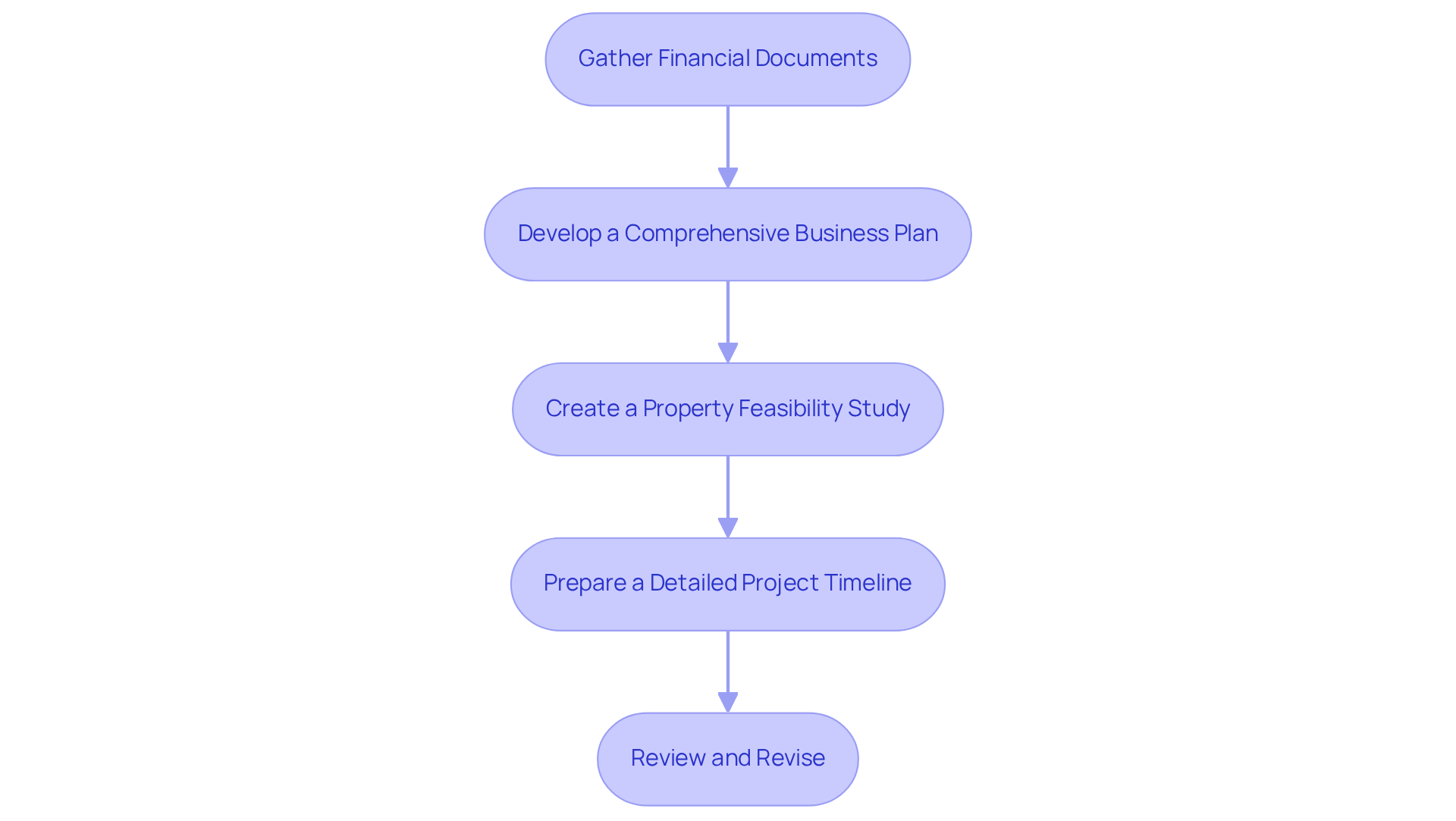

- Gather Financial Documents: Compile your business financial statements, tax returns, and personal financial information. Ensure all documents are current and precise, as financial institutions expect a thorough understanding of your financial situation.

- Develop a Comprehensive Business Plan: Outline your project, including market analysis, financial projections, and a clear strategy for profitability. This plan should illustrate the project's feasibility to prospective financiers, highlighting your expertise and the customized method Finance Story promotes for obtaining funds.

- Create a Property Feasibility Study: Assess the potential of the property, including location, market demand, and projected returns. This research can enhance your application by demonstrating the project's financial stability, which is crucial for fulfilling creditor expectations.

- Prepare a Detailed Project Timeline: Include milestones for construction and development phases, which can assist financiers in comprehending the project's scope and timeline. A well-structured timeline reflects your planning capabilities and commitment to the project.

- Review and Revise: Before submission, review your application for completeness and clarity. Consider seeking feedback from a finance expert or mentor, as knowing how to finance commercial property development can greatly improve your chances of obtaining the required funds for your project.

By carefully preparing your application, you not only align with the expectations of creditors but also utilize the knowledge of Finance Story to understand how to finance commercial property development amid the complexities of funding commercial real estate investments.

Choose the Right Lender for Your Needs

Selecting the right institution for commercial asset funding is crucial for securing favorable conditions and a streamlined application process. Consider the following key factors to guide your decision:

-

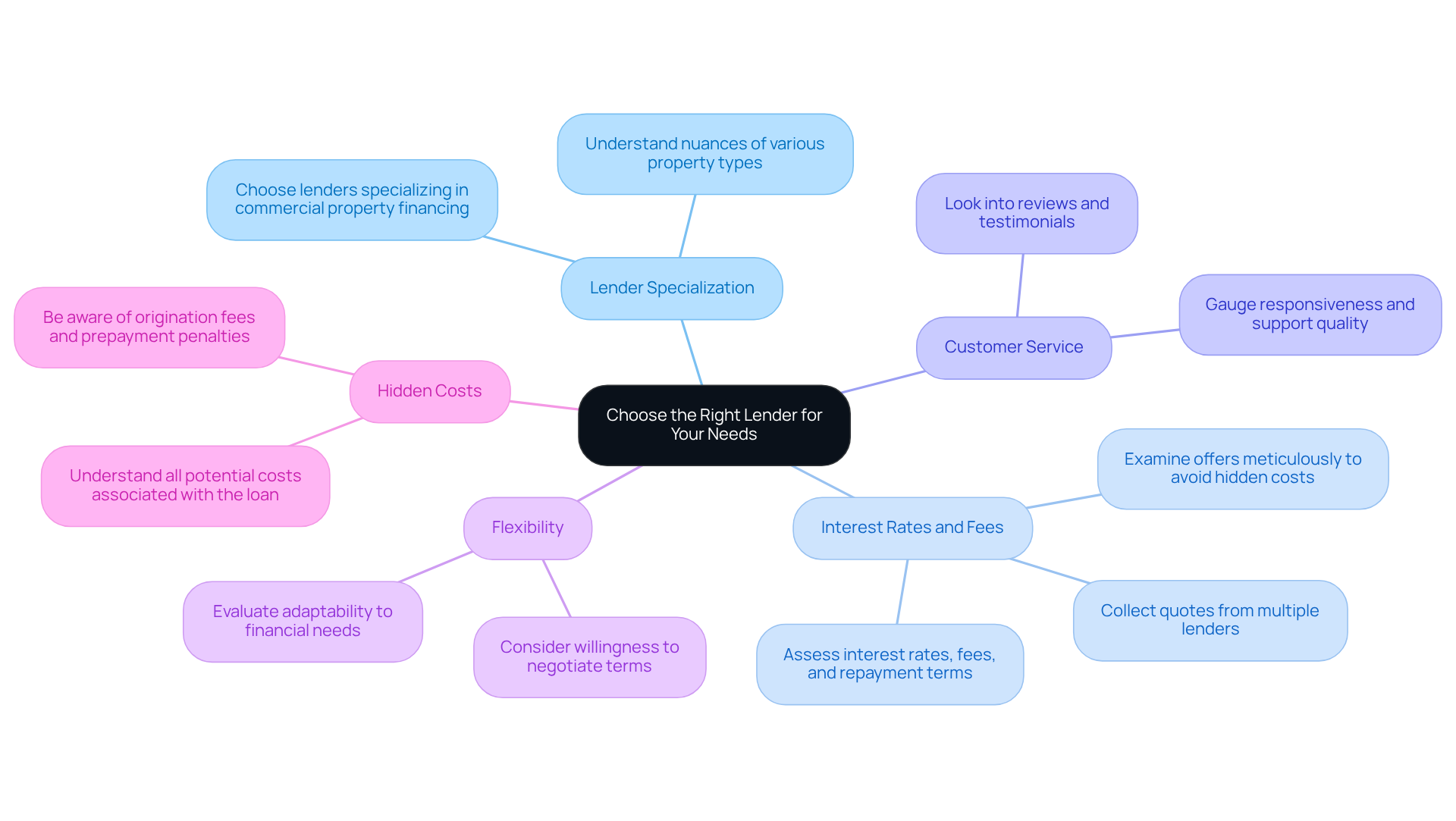

Assess Lender Specialization: Choose lenders who specialize in commercial property financing. Their expertise can lead to better financing terms and a more efficient application experience. Institutions with a strong background in business financing often understand the nuances of various property types, significantly influencing your funding options.

-

Compare Interest Rates and Fees: Collect quotes from multiple lenders to assess interest rates, fees, and repayment terms. This comparison is essential, as even minor differences in rates can result in substantial savings over the financing period. In 2025, average fees associated with commercial property loans can vary greatly, making it vital to examine each offer meticulously.

-

Evaluate Customer Service: Look into reviews and testimonials to gauge the quality of customer service. A provider known for their responsiveness can facilitate the funding process, ensuring you receive timely assistance and guidance throughout.

-

Consider Flexibility: Some lenders may offer more flexible terms or show a willingness to negotiate. Evaluate how adaptable they are to your specific financial needs, as this flexibility can be a significant advantage in securing the right funding.

-

Check for Hidden Costs: Be diligent in understanding all potential costs associated with the loan, including origination fees, prepayment penalties, and other charges. Clarity in these areas is crucial to avoid unforeseen expenses that could affect your financial planning.

By thoughtfully selecting a financial institution that aligns with your needs, you can secure funding that effectively supports how to finance commercial property development goals.

Manage the Financing Process Effectively

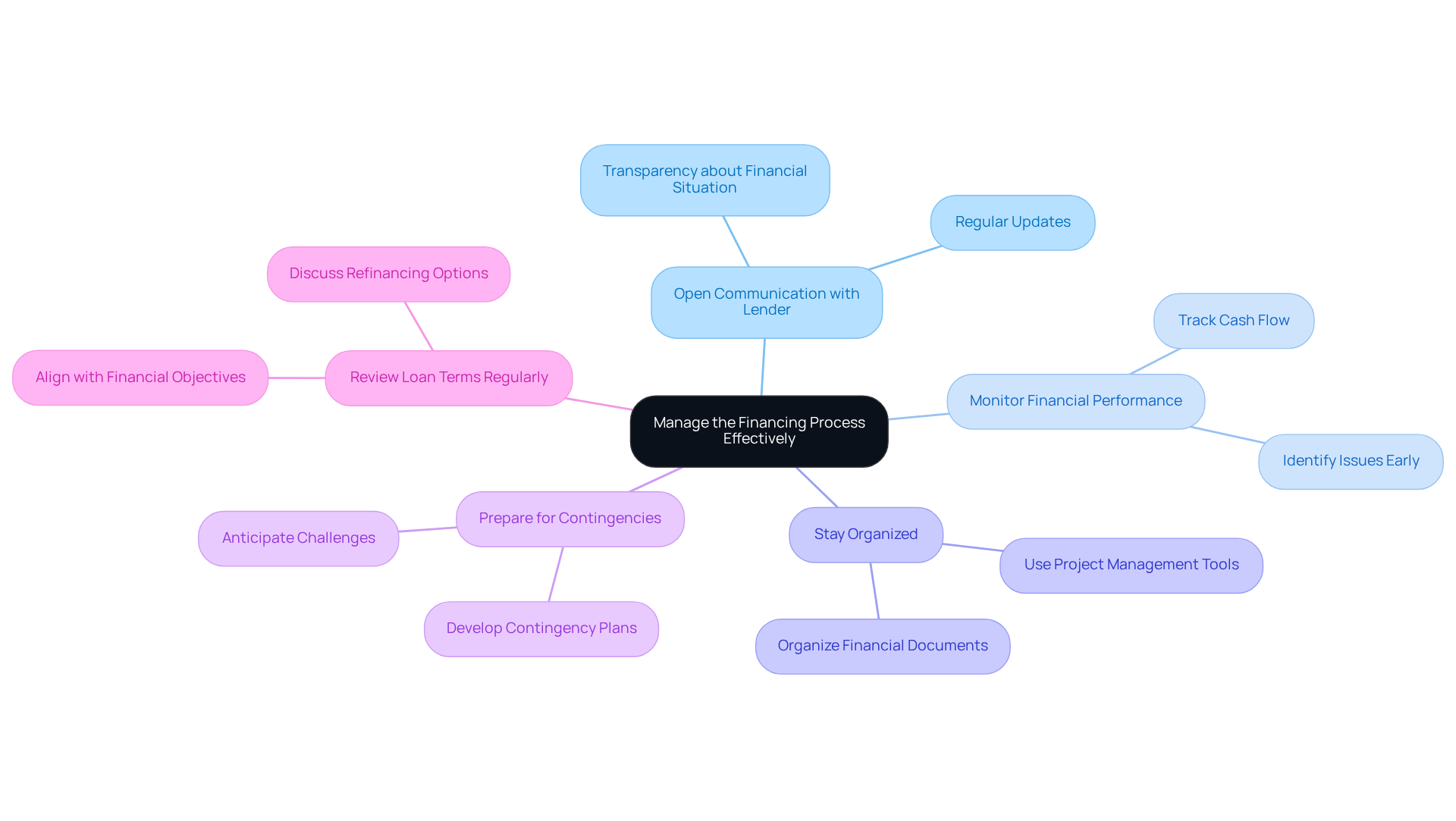

To manage the financing process effectively, consider the following strategies:

- Maintain Open Communication with Your Lender: Regularly update your lender on project progress and any changes to your financial situation. This openness encourages a beneficial connection and enables more seamless exchanges, essential for managing the intricacies of funding.

- Monitor Financial Performance: Keep track of your project's financial metrics, including cash flow, expenses, and profitability. Regular monitoring can help identify potential issues early, allowing for timely interventions that can prevent larger problems down the line.

- Stay Organized: Utilize project management tools to keep all financial documents, contracts, and correspondence organized. This organization streamlines communication and reduces the risk of errors, ensuring that all parties are on the same page regarding project details.

- Prepare for Contingencies: Anticipate potential challenges that may arise during the financing process, such as delays or unexpected costs. Having a contingency plan in place can help you navigate these issues without derailing your project, ensuring that you remain on track to meet your financial goals.

- Review Loan Terms Regularly: As your project progresses, revisit your loan terms to ensure they still align with your financial objectives. If necessary, discuss options for refinancing or adjusting terms with your lender to better suit your evolving needs.

By effectively managing how to finance commercial property development, you can significantly enhance the likelihood of success in your endeavors.

Conclusion

Understanding how to finance commercial property development is essential for anyone looking to embark on this lucrative journey. Mastering the various financing options, eligibility criteria, and application processes equips developers with the tools needed to secure the necessary funding effectively. By navigating this complex landscape with confidence, developers can position themselves for success in a competitive market.

Throughout this article, key insights have been provided, including the importance of familiarizing oneself with different types of loans, such as:

- Conventional

- Construction

- Mezzanine financing

The significance of preparing a comprehensive business plan and maintaining open communication with lenders cannot be overstated. Furthermore, recognizing the value of selecting the right lender and managing the financing process diligently ensures a smoother pathway to achieving development goals.

Ultimately, the journey of financing commercial property development is not just about securing funds; it is about building a solid foundation for future success. By applying the strategies outlined in this guide, developers can enhance their chances of obtaining favorable financing terms and navigating the complexities of the commercial real estate landscape. Taking proactive steps today will pave the way for sustainable growth and profitability in the future.