Overview

The article examines the duration of financing options available for commercial property, highlighting that financing typically spans from 5 to 30 years. This range is significantly influenced by various factors, including:

- Property type

- Borrower creditworthiness

- Prevailing economic conditions

Furthermore, it elaborates on how these elements impact loan terms and repayment periods. Understanding financing options is crucial, as is the preparation of necessary documentation, which can greatly enhance the chances of securing favorable terms.

Introduction

Understanding the intricacies of commercial property financing is essential for any investor aiming to navigate this complex landscape. With varying loan terms, interest rates, and borrower requirements, the duration of financing can significantly impact investment strategies.

But what factors truly determine how long one can finance commercial property? This article delves into the fundamental concepts, key variables, and common challenges that shape the financing journey. It provides valuable insights for informed decision-making in the realm of commercial real estate.

Understand Commercial Property Financing Basics

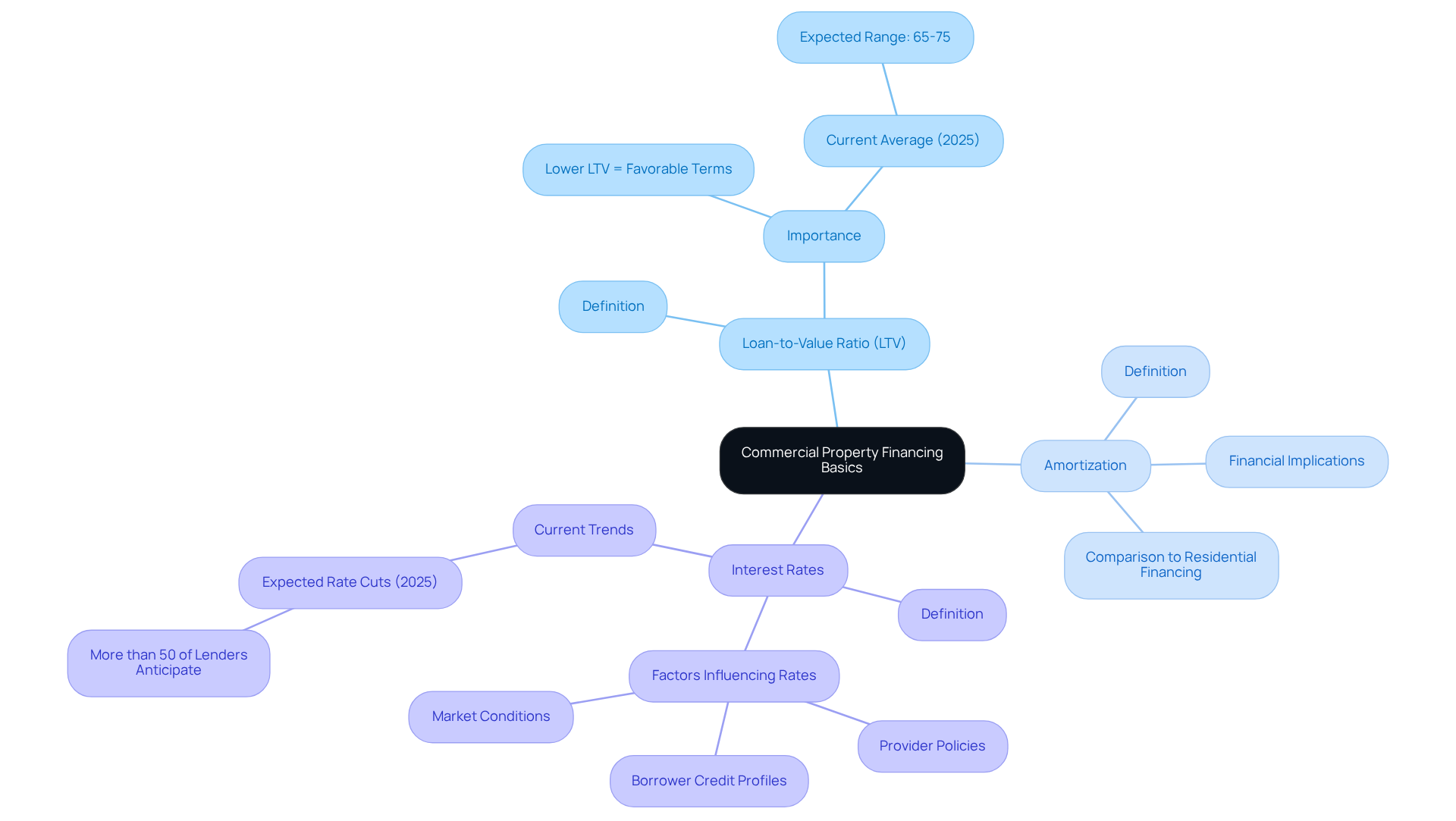

Commercial real estate financing is vital for acquiring or refinancing assets intended for business use, especially when considering how long can you finance commercial property. Unlike residential financing, commercial borrowing raises the question of how long can you finance commercial property, as it generally features shorter terms, typically ranging from 5 to 30 years, and often necessitates a larger down payment. Understanding the following key terms is essential:

-

Loan-to-Value Ratio (LTV): This ratio measures the loan amount against the property's appraised value. A lower LTV can lead to more favorable credit terms, indicating reduced risk for lenders. In 2025, average LTV ratios for commercial property financing are expected to hover around 65-75%, reflecting a cautious lending environment.

-

Amortization: This term denotes the gradual repayment of a debt through scheduled payments. Commercial financing may feature varied amortization schedules compared to residential financing, resulting in different financial implications for borrowers.

-

Interest Rates: Interest rates for commercial loans can fluctuate significantly based on provider policies, borrower credit profiles, and prevailing market conditions. With over fifty percent of surveyed creditors anticipating two additional interest rate reductions in 2025, understanding how these rates are established is crucial for evaluating funding options.

At Finance Story, we excel at crafting polished and highly individualized business cases for presentation to banks, ensuring you secure the right financing for your commercial property investments. We offer access to a comprehensive array of financial institutions, including high street banks and innovative private financing panels, tailored to your specific circumstances. Current trends indicate a stable demand for commercial mortgages despite global uncertainties, with financial institutions increasingly prioritizing quality assets. Notably, 56% of financial institutions express a desire to expand their commercial real estate portfolios, particularly in sectors like industrial and logistics, which are experiencing low vacancy rates. Conversely, the office sector faces challenges, as many lenders adopt a flight-to-quality strategy due to high vacancy rates and declining asset values. As Almas Uddin, Founder and Mortgage Advisor, observes, "Finding the right financial deal for commercial real estate is becoming increasingly complex, especially in the current market landscape."

By grasping these fundamentals and leveraging the expertise of Finance Story, borrowers can navigate the intricacies of commercial real estate funding more effectively and make informed decisions that align with their financial objectives.

Identify Key Factors Affecting Financing Duration

Several critical factors significantly influence how long you can finance commercial property.

-

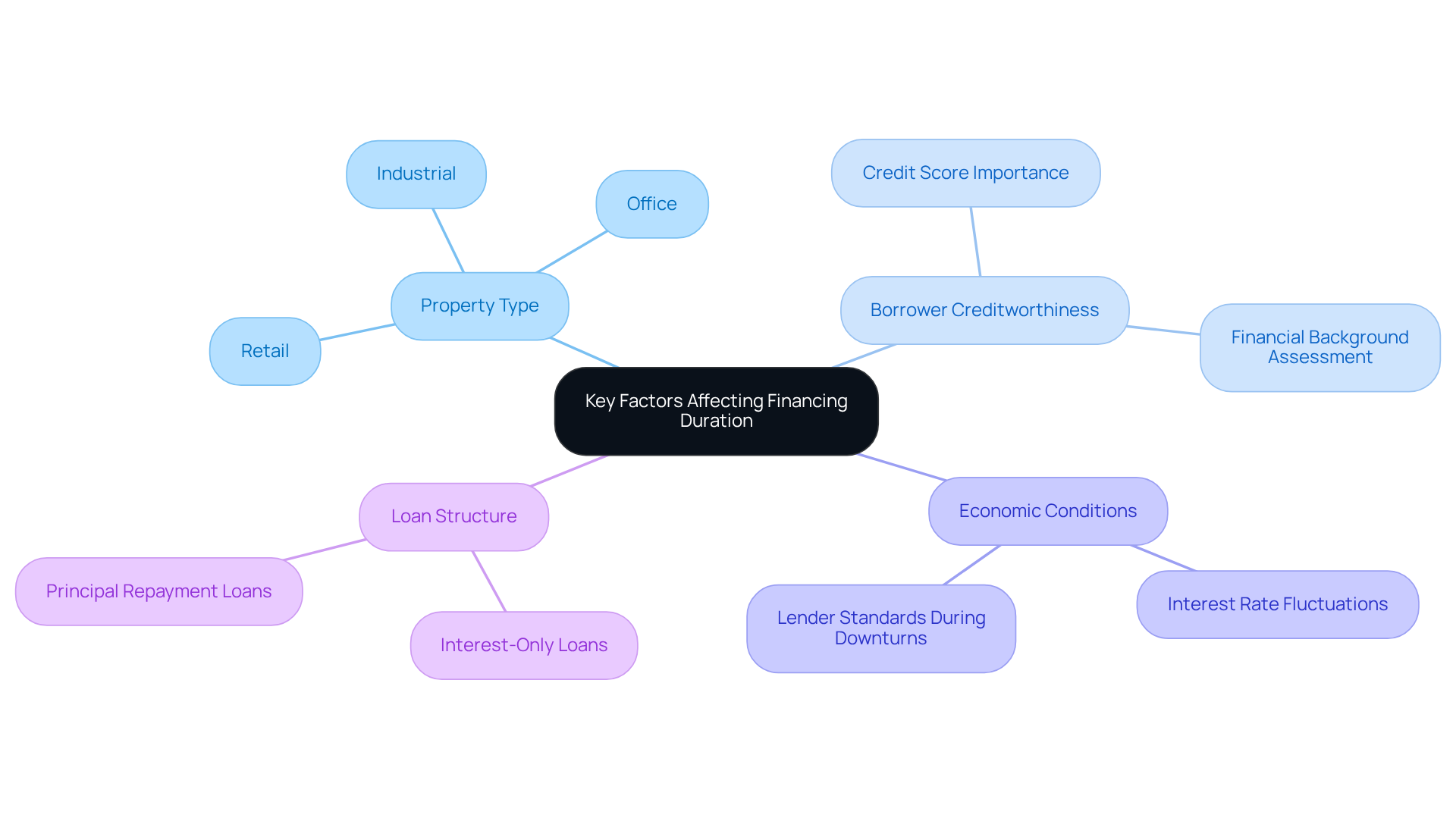

Property Type: The nature of the commercial property—whether retail, office, or industrial—plays a crucial role in determining financing terms. Lenders evaluate the perceived risk and market demand associated with each property type, leading to variations in financing conditions.

-

Borrower Creditworthiness: A strong credit score is essential for securing favorable lending conditions, including extended repayment periods. Lenders meticulously assess a borrower's financial background to gauge risk, directly impacting the duration of the loan.

-

Economic Conditions: The broader economic landscape is pivotal in shaping interest rates and lending practices. During economic downturns, lenders often tighten their standards, which can shorten borrowing periods and complicate funding access.

-

Loan Structure: The specific arrangement of the borrowing—whether it is structured as interest-only or includes principal repayments—also influences the overall duration of funding. A comprehensive understanding of these structures can empower borrowers to make informed decisions.

By grasping these factors, borrowers can effectively navigate their funding options and negotiate terms that align with their financial objectives, such as how long can you finance commercial property.

Evaluate Financing Options and Terms

When evaluating financing options for commercial property, several key factors must be considered:

- Types of Loans: Common financing options include traditional bank loans, SBA loans, and private lender loans. Each type presents distinct advantages and disadvantages. For instance, SBA financing can provide lower interest rates and extended repayment periods, making it appealing for small enterprises. On the other hand, traditional bank financing may have stricter eligibility criteria but can offer quicker access to funds.

- Financing Terms: Understanding the details of financing is crucial. This includes the length of the financing, interest rates, and whether the financing is fixed or variable. Fixed-rate mortgages offer predictability in payments, whereas variable rates may start lower but can increase over time, impacting long-term financial planning.

- Prepayment Penalties: Certain financing options may impose penalties for early repayment. Reviewing these terms is vital, as they can significantly influence your overall financial strategy and cash flow management.

- Fees and Costs: Beyond the interest rate, borrowers should account for additional costs associated with the loan, such as origination fees, appraisal fees, and closing costs. These expenses can substantially increase the overall cost of funding, making it essential to factor them into your decision-making process.

By thoroughly assessing these aspects, borrowers can identify a funding solution that aligns with their specific needs and financial goals, ultimately enhancing their chances of success in commercial real estate investment.

Prepare Necessary Documentation for Application

To successfully apply for a commercial property financing option, it is essential to gather comprehensive documentation that demonstrates your financial stability and business potential. The following documents are crucial:

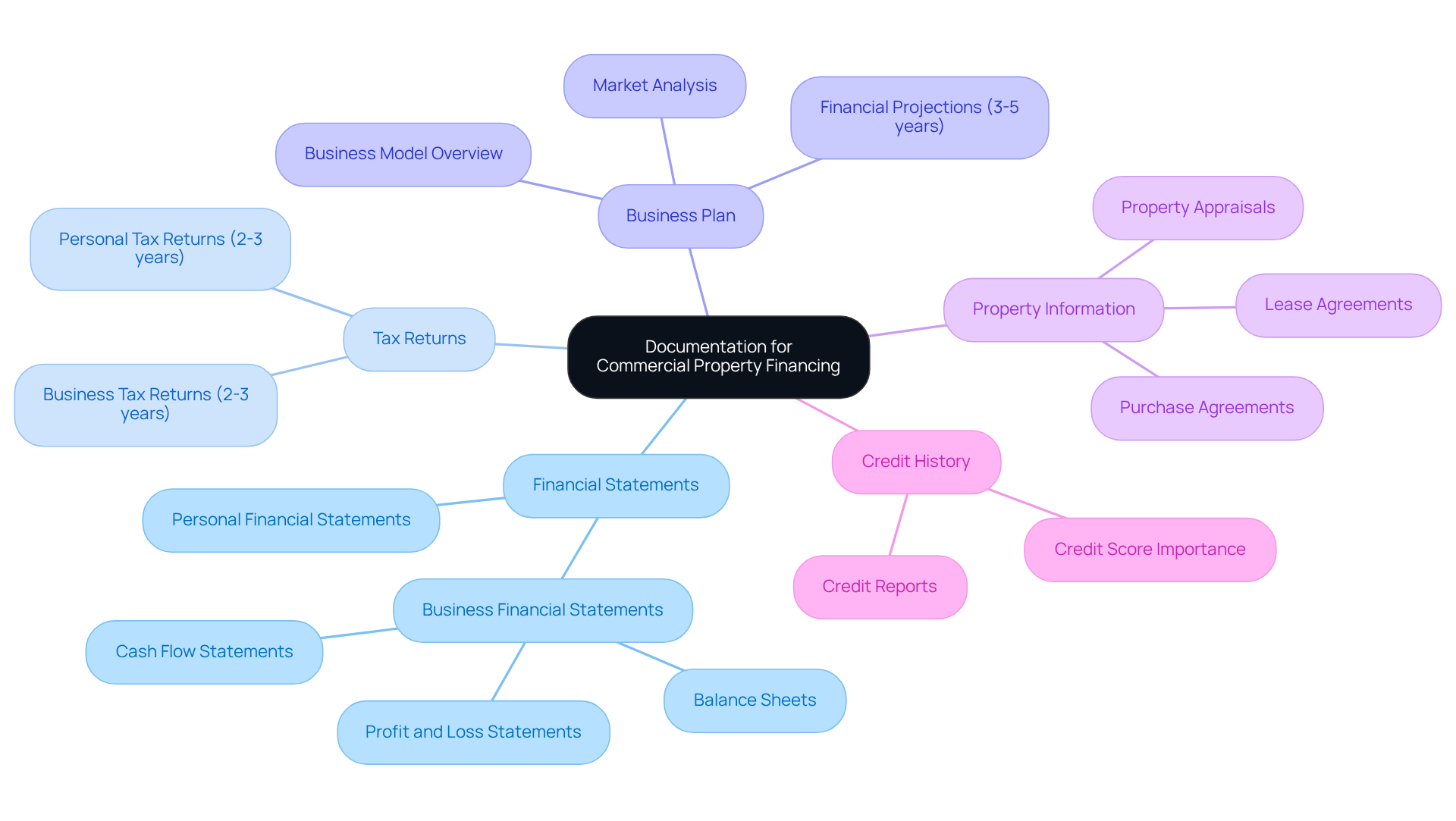

- Personal and Business Financial Statements: Include detailed profit and loss statements, balance sheets, and cash flow statements for both personal and business finances. These documents offer creditors a clear view of your financial well-being and operational effectiveness, which is essential for crafting a refined and personalized funding proposal through Finance Story.

- Tax Returns: Submit personal and business tax returns for the past two to three years. This information aids in establishing your financial history and stability, essential elements in the loan approval process, particularly when engaging with a varied selection of financial institutions available through Finance Story.

- Business Plan: A well-structured business plan is vital. It should outline your business model, market analysis, and realistic financial projections for the next three to five years. An engaging business strategy not only demonstrates your grasp of the market but also emphasizes your business's growth potential, facilitating the evaluation of your application and clarifying your repayment abilities.

- Property Information: Provide detailed information about the property you wish to finance, including purchase agreements, property appraisals, and any lease agreements if applicable. This documentation assists financiers in assessing the asset's worth and its potential as collateral, which is crucial for obtaining the appropriate financing solution.

- Credit History: Be prepared to share your credit history, as financial institutions will assess your creditworthiness. A robust credit score boosts your credibility and raises your likelihood of loan approval, especially when engaging with a comprehensive range of financial institutions, including high street banks and private financing panels.

By preparing these documents in advance, borrowers can streamline the application process and significantly improve their chances of securing financing. According to industry insights, a well-prepared application demonstrates a business's stability and responsible financial management, which are key factors in gaining lender trust. Significantly, fewer than 35% of small business funding applications are approved in full, highlighting the importance of thorough preparation. Additionally, consider refinancing options to meet the evolving needs of your business, as Finance Story specializes in creating tailored loan proposals that can help you navigate this process.

Troubleshoot Common Financing Challenges

When considering how long you can finance commercial property, borrowers often encounter several challenges that they must navigate effectively.

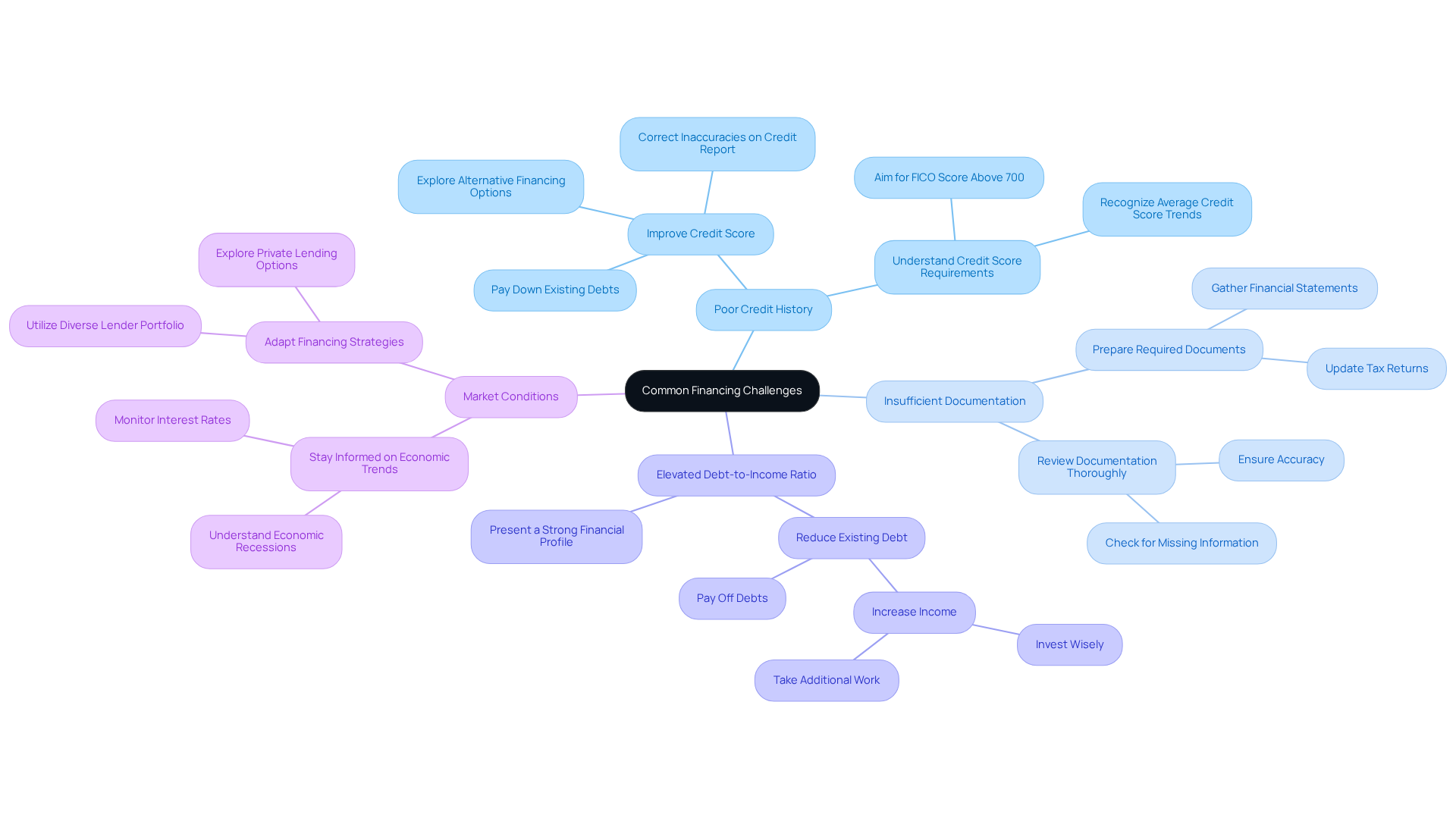

- Poor Credit History: A low credit score can significantly hinder your financing options. As of Q2 2024, the average credit score for mortgage borrowers is 758, underscoring the importance of aiming for a strong score. To improve your credit before applying, focus on strategies such as paying down existing debts, correcting any inaccuracies on your credit report, and exploring alternative financing options that may be more lenient. Chris Horymski notes that a FICO Score above 700 is generally sufficient for a successful mortgage application. At Finance Story, we specialize in developing refined and highly customized business cases to present to financiers, assisting you in overcoming credit challenges.

- Insufficient Documentation: Incomplete or inaccurate documentation can lead to delays in the application process. Common errors include missing financial statements or outdated tax returns. To avoid this, ensure that all required documents are meticulously prepared and organized prior to submission. A careful review can easily rectify these issues. Our team at Finance Story excels at guiding clients through the documentation process, ensuring that everything is in order for a smooth application.

- Elevated Debt-to-Income Ratio: An elevated debt-to-income ratio can signal to creditors that you present a greater risk. To improve this ratio, consider strategies such as paying off existing debts or increasing your income through additional work or investments. This proactive strategy can enhance your appeal to financial institutions. Finance Story understands the nuances of debt management and can provide tailored advice to help you present a stronger financial profile.

- Market Conditions: Economic fluctuations can impact lending practices and availability. Staying informed about current market trends is essential. For example, comprehending how increasing interest rates or economic recessions influence funding can assist you in adapting your strategy accordingly. With access to a comprehensive portfolio of lenders, including high street banks and innovative private lending panels, Finance Story can help you navigate these market challenges effectively.

- Client Testimonial: "I will definitely be recommending your business to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey." - Natasha B, VIC

By recognizing these challenges and implementing targeted strategies, borrowers can significantly enhance their chances of successfully securing financing for commercial properties.

Conclusion

Understanding the nuances of financing commercial property is crucial for any investor aiming to make informed decisions. This article has delved into the various aspects of commercial real estate financing, highlighting the importance of recognizing the unique characteristics that set it apart from residential financing. By grasping these fundamentals, potential borrowers can navigate the complexities of securing funding for their commercial ventures more effectively.

Key factors influencing the duration and terms of financing include:

- Property type

- Borrower creditworthiness

- Economic conditions

- Loan structure

Each of these elements significantly impacts how long one can finance commercial property and the overall cost of borrowing. Furthermore, evaluating financing options, preparing necessary documentation, and troubleshooting common challenges are essential steps in the process that can greatly affect success.

Ultimately, the ability to finance commercial property effectively hinges on a thorough understanding of these factors and a proactive approach to addressing potential challenges. By leveraging expert guidance and being well-prepared, borrowers can enhance their chances of securing financing that aligns with their business goals. The landscape of commercial property financing is evolving, and staying informed about trends and best practices is vital for anyone looking to thrive in this competitive market.