Overview

This article outlines five essential steps for successfully borrowing for commercial property.

- It emphasizes the importance of understanding financing basics, which lays the groundwork for informed decision-making.

- Next, preparing financial documents and a robust business plan is crucial; a well-structured business plan significantly increases the chances of loan approval.

- Furthermore, evaluating lenders is vital; comparing interest rates and terms from multiple sources ensures that you secure the best financing options.

- The process continues with negotiating loan terms, where understanding the nuances can lead to more favorable conditions.

- Finally, finalizing the loan application is the last step, ensuring all documents are in order and submitted correctly.

Each step is supported by practical strategies and insights, reinforcing the importance of thorough preparation and informed choices in the borrowing process.

Introduction

Navigating the world of commercial property financing can indeed be daunting, particularly given the myriad of options available today. For any investor aiming to make informed decisions, understanding the nuances of various loan types, interest rates, and repayment terms is essential. However, with so many factors at play, how can one ensure they not only secure the best financing but also position themselves for long-term success in a competitive market? This guide outlines five crucial steps designed to empower borrowers to master the commercial lending landscape and achieve their investment goals.

Understand Commercial Property Financing Basics

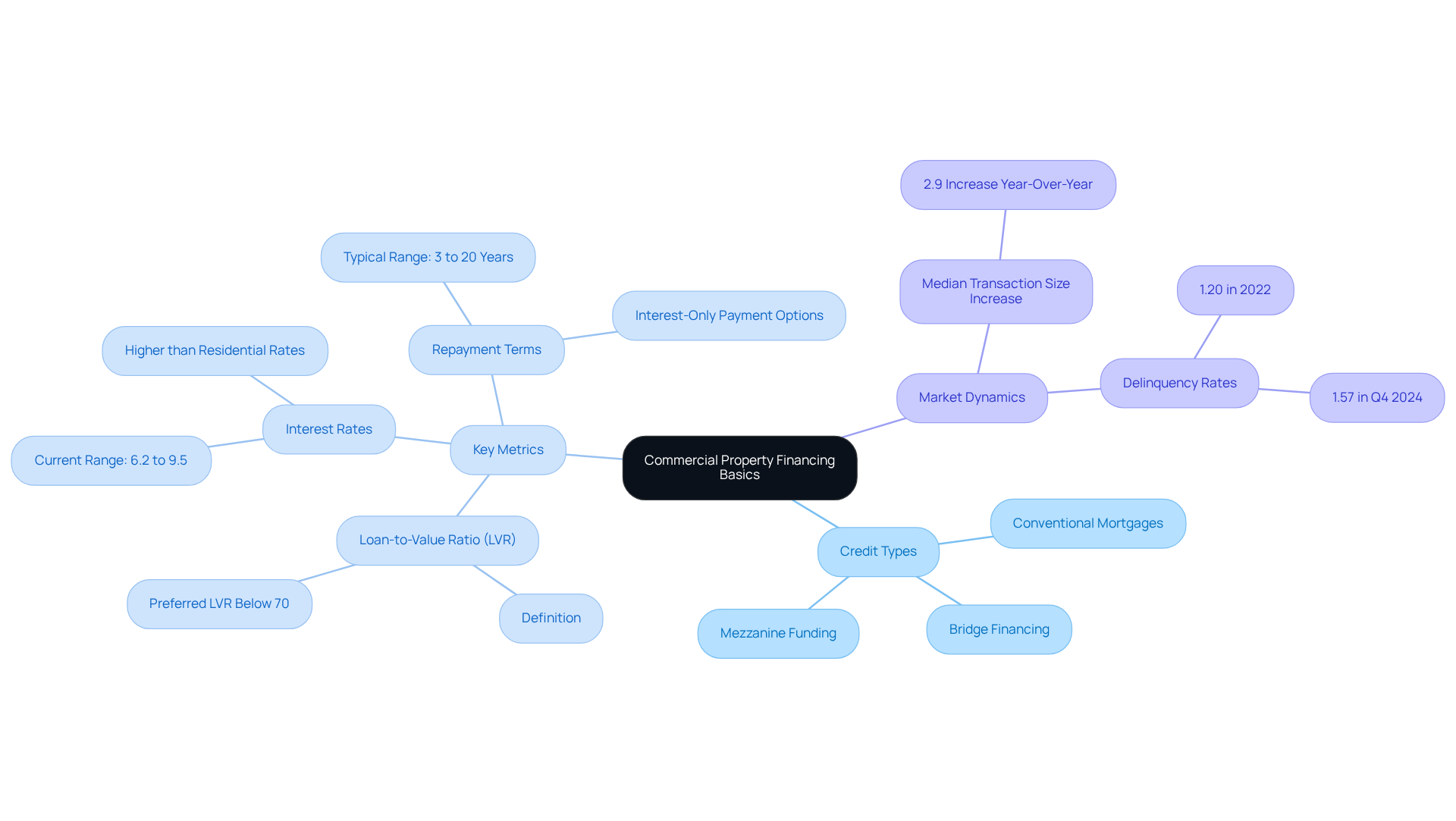

Various credit types, including conventional mortgages, bridge financing, and mezzanine funding, are involved in borrowing for commercial property. Mastering key terms is vital for navigating this intricate landscape:

- Loan-to-Value Ratio (LVR): This essential metric indicates the proportion of the loan relative to the property's value. As we look ahead to 2025, most lenders will favor an LVR below 70% for commercial real estate, with lower ratios signifying reduced risk and potentially more favorable interest rates.

- Interest Rates: Typically, commercial financing carries higher interest rates compared to residential financing, reflecting the elevated risk associated with these investments. As of mid-2025, interest rates for commercial real estate financing range from 6.2% to 9.5%, influenced by factors such as asset type and location.

- Repayment Terms: These terms can vary significantly, generally spanning from 3 to 20 years. Numerous loans provide options for interest-only payments, which can be advantageous for cash flow management during the initial investment phase.

By familiarizing yourself with these fundamentals, you can make informed decisions within the commercial lending landscape. For example, a recent case showcased a commercial real estate investor securing financing with a 75% LVR for a mixed-use development, illustrating the practical application of these concepts in real-world scenarios. Moreover, the median transaction size for mixed-use and other commercial property types increased by 2.9% from the same period last year, further underscoring the market's dynamics. Understanding the intricacies of LVR and its implications on credit terms is crucial for optimizing financing strategies in today's competitive market.

Prepare Your Financial Documents and Business Plan

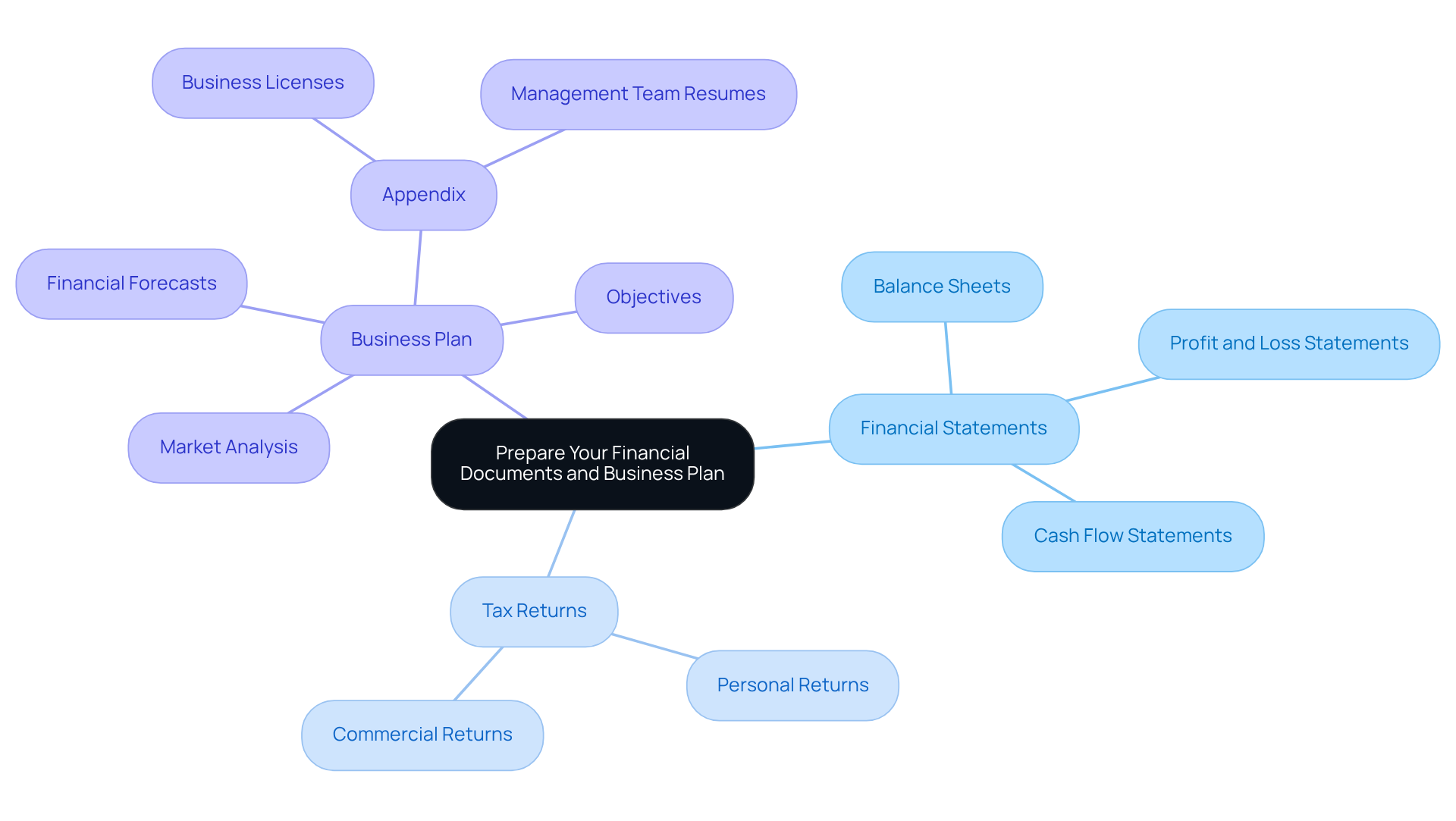

To effectively prepare for your loan application, it is crucial to gather the following essential documents:

- Financial Statements: Include comprehensive balance sheets, profit and loss statements, and cash flow statements for the past two years. These documents provide financiers with a clear picture of your financial health and operational performance.

- Tax Returns: Submit both personal and commercial tax returns for the last two years. This information assists lenders in assessing your financial stability and compliance with tax obligations.

- Plan: Create a comprehensive plan that outlines your objectives, market analysis, and financial forecasts. This plan should clearly articulate how the loan will be utilized to drive growth and enhance profitability. Furthermore, ensure to include an appendix with supporting documents such as business licenses and management team resumes.

Ensure that all documents are current and accurately reflect your financial situation. Offering truthful financial projections and comprehensive market analysis is vital in showcasing transparency to financiers. A thoroughly prepared application not only demonstrates your dedication but also instills trust in financial institutions regarding your capability to repay the debt. Statistics indicate that a well-structured business plan significantly increases the likelihood of loan approval, making it a vital component of your application process. Remember, financial institutions assess proposals based on the 'five Cs': Character, Capacity, Capital, Conditions, and Collateral, which are crucial in their decision-making process.

Evaluate Lenders and Compare Loan Options

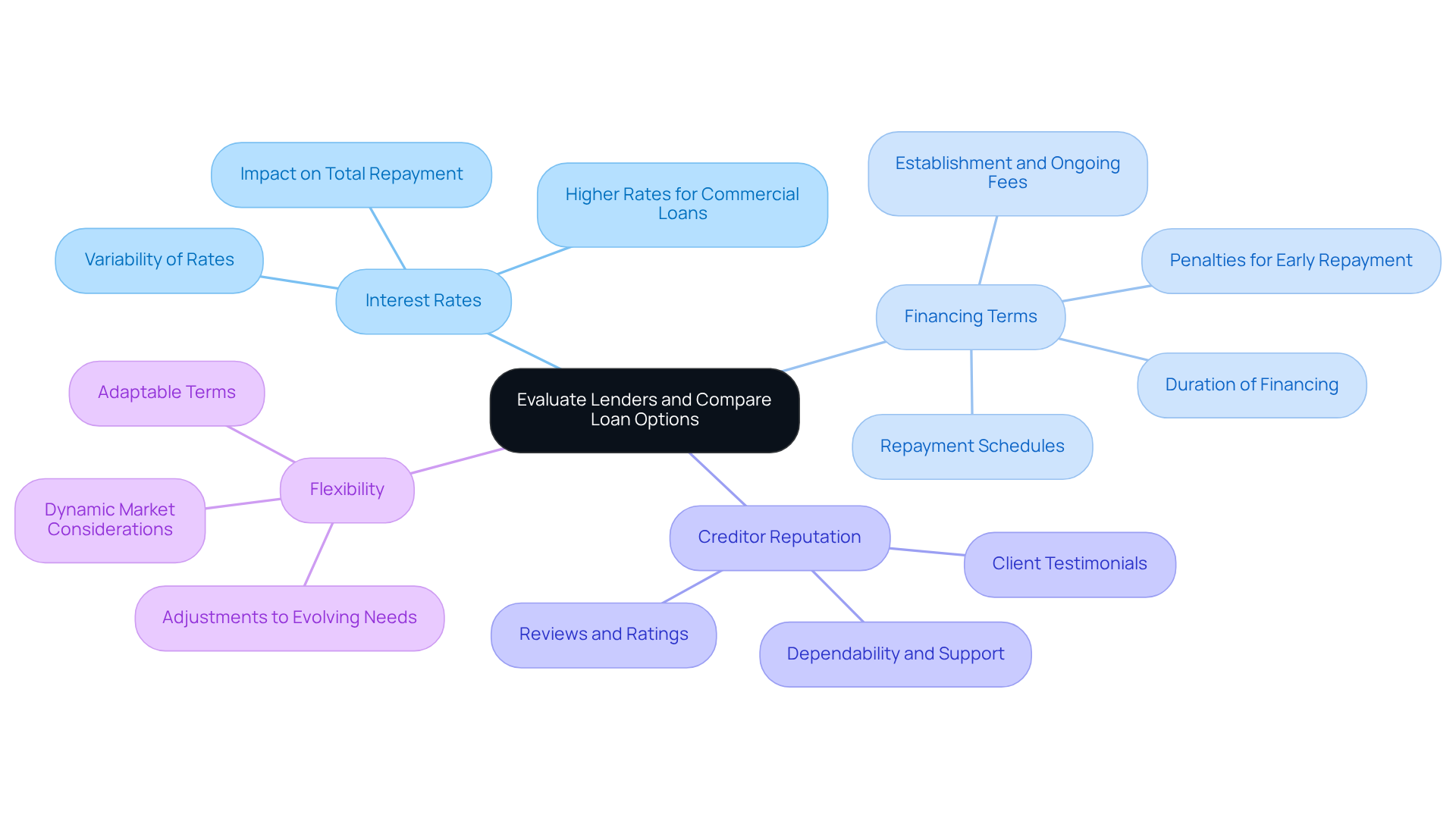

When evaluating lenders for commercial property financing, it's essential to consider several key factors that can significantly impact your financial decisions:

- Interest Rates: Different lenders offer varying rates, and even a minor difference can lead to substantial changes in your total repayment amount. As of July 2025, borrowing for commercial property generally comes with higher interest rates than residential rates, reflecting the increased risk associated with commercial properties. Current rates can range significantly, so it's vital to compare offers from multiple lenders.

- Financing Terms: Examine the duration of the financing, repayment schedules, and any penalties for early repayment. Additionally, be aware of potential higher charges associated with borrowing for commercial property, including establishment and ongoing fees. Understanding these terms can help you avoid unforeseen expenses and align the loan with your operational strategy.

- Creditor Reputation: Investigate reviews and ratings of creditors to assess their dependability and customer support. Client testimonials often highlight exceptional service and personalized support, which can provide peace of mind and assistance throughout the borrowing process.

- Flexibility: Determine if the lender offers adaptable terms that can adjust to your organization's evolving needs. This flexibility can be crucial in a dynamic market environment, enabling you to modify your financing as your enterprise expands.

Utilizing online comparison tools and consulting with a mortgage broker can streamline this evaluation process, ensuring you find the most suitable financing options tailored to your specific requirements. By focusing on these aspects, you can make informed decisions that align with your financial goals.

Negotiate Loan Terms and Conditions

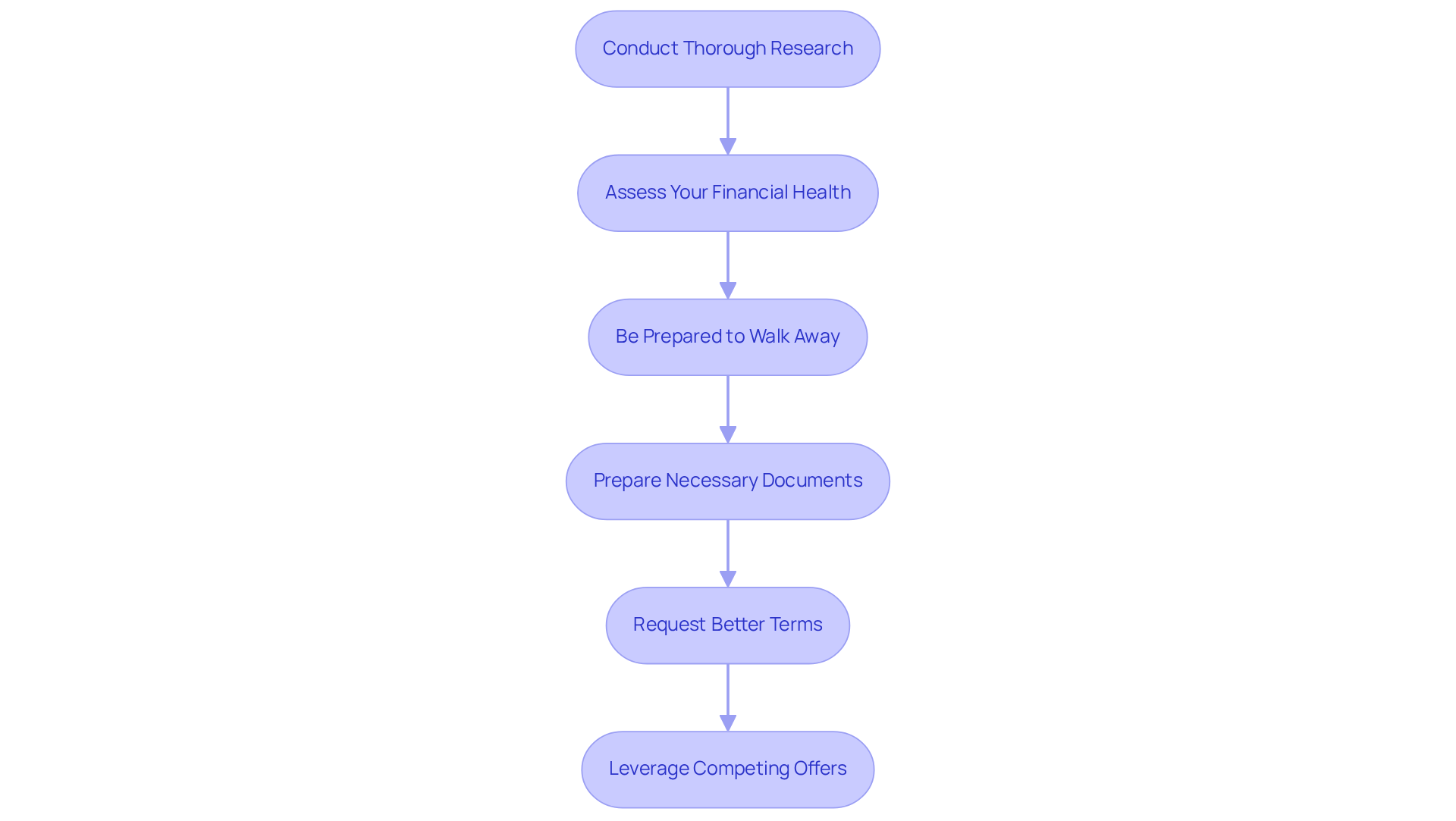

To negotiate effectively, follow these essential strategies:

-

Conduct Thorough Research: Familiarize yourself with current market rates and terms. This foundational knowledge empowers your negotiations, allowing you to pinpoint favorable conditions and avoid potential pitfalls. Staying informed about market dynamics can unveil new negotiation opportunities.

-

Assess Your Financial Health: Prior to applying for borrowing for commercial property, evaluate your credit history and financial statements. Understanding your financial situation is crucial for successful negotiations, particularly when it comes to borrowing for commercial property, and equips you to present a compelling case to creditors.

-

Be Prepared to Walk Away: Showing that you have alternative options can significantly strengthen your position. If financial institutions fall short of your requirements, be ready to explore other offers.

-

Prepare Necessary Documents: Having all required paperwork at hand can expedite the loan application process and demonstrate your preparedness to financial institutions. Essential documents include personal and commercial credit reports, legal documents, tax returns, and recent bank statements.

-

Request Better Terms: Don’t shy away from asking for lower interest rates, reduced fees, or more favorable repayment terms. Many borrowers have successfully attained average interest rate reductions of up to 1.5% through effective negotiation strategies in 2025.

-

Leverage Competing Offers: Utilize multiple offers as leverage during negotiations. Presenting competing proposals can motivate your preferred lender to match or enhance the terms offered by others.

Successful negotiation can lead to borrowing for commercial property that aligns closely with your financial strategy, ultimately supporting your company's growth and success.

Finalize Your Loan Application and Secure Funding

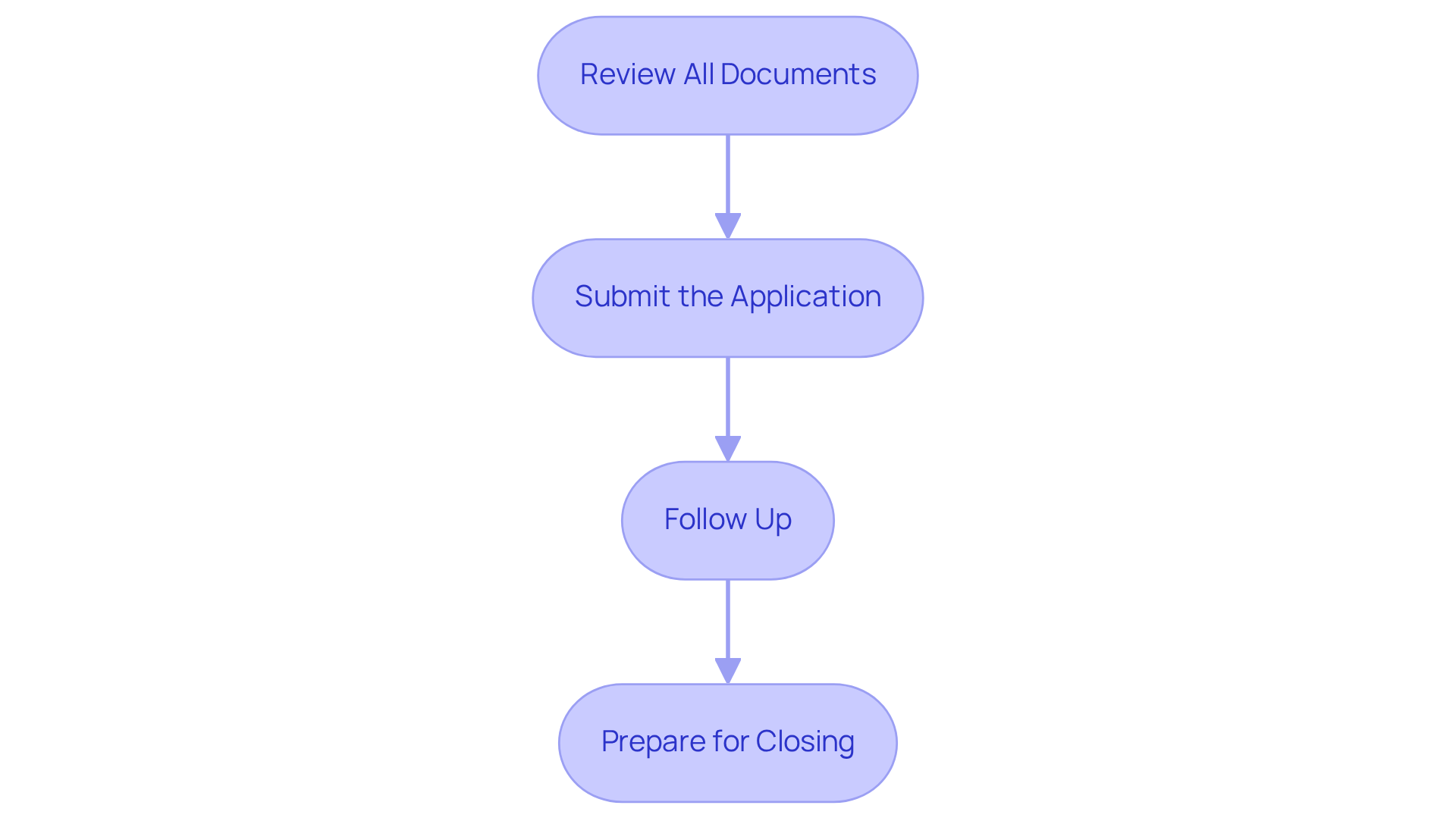

To finalize your loan application and secure funding for your commercial property, it is crucial to follow these essential steps:

-

Review All Documents: Begin by ensuring that all your financial documents are accurate and complete. This includes profit and loss statements, business plans, and personal information. Financial institutions typically require two years of business and personal tax returns, along with a detailed business plan and cash flow projections. If the property is tenanted, lease agreements will also be necessary.

-

Submit the Application: Adhere to the provider's instructions for submitting your application, whether online or in person. Proper submission is vital to avoid delays in processing your request.

-

Follow Up: Maintain open communication with the lender after submission. This proactive approach allows you to address any questions or provide additional information they may require, expediting the approval process.

-

Prepare for Closing: Once your application is approved, carefully review the financing agreement before signing. Understanding all terms and conditions is crucial, as a clearly outlined credit agreement clarifies repayment terms and safeguards against unforeseen changes. In certain situations, seeking independent legal advice may also be beneficial.

By diligently adhering to these steps, you can effectively manage the financing application process and secure the necessary funding through borrowing for commercial property investments. Remember, the average time to finalize loan applications for commercial properties can range from 4 to 8 weeks, so starting early and being thorough is key.

Conclusion

Successful borrowing for commercial property necessitates a comprehensive grasp of financing principles coupled with strategic preparation. By mastering the fundamentals of commercial property financing—including critical metrics such as Loan-to-Value Ratio (LVR) and interest rates—borrowers can adeptly navigate the complexities of the lending landscape. This foundational knowledge empowers informed decision-making, ultimately paving the way for successful investments.

Essential steps have been meticulously outlined, ranging from the preparation of financial documents and the crafting of a robust business plan to the evaluation of lenders and the negotiation of favorable loan terms. Each phase is integral to the overall success of securing funding. By diligently gathering necessary documentation, comparing loan options, and employing effective negotiation tactics, borrowers can significantly enhance their chances of obtaining the best financing terms tailored to their specific needs.

In conclusion, the journey of borrowing for commercial property is multifaceted, with each step playing a crucial role in achieving financial success. As the commercial real estate market continues to evolve, remaining informed and proactive is essential. Whether you are a seasoned investor or a newcomer, embracing these strategies will not only facilitate a smoother borrowing process but also position you for long-term growth and profitability in your commercial ventures.