Overview

The article delineates five essential steps for individuals aspiring to invest in commercial property:

- It is crucial to grasp the fundamentals of real estate.

- Selecting a niche that aligns with your interests and market demand is vital.

- Learning the intricacies of underwriting will empower you to assess potential investments effectively.

- Building a professional team is indispensable; collaborating with experts can enhance your decision-making process.

- Making strategic offers is key to securing favorable deals.

Each step underscores the necessity of thorough research, expert collaboration, and effective negotiation, ensuring informed decision-making and successful investment outcomes.

Introduction

Navigating the world of commercial real estate can indeed be a daunting task, particularly for individuals eager to establish their presence in this lucrative market. With a variety of property types, investment strategies, and financial implications to consider, grasping the nuances is crucial for success. This guide provides a step-by-step approach designed to empower aspiring investors with the knowledge and tools necessary to purchase commercial property with confidence.

But what challenges might arise along this journey, and how can investors effectively overcome them to secure a profitable investment?

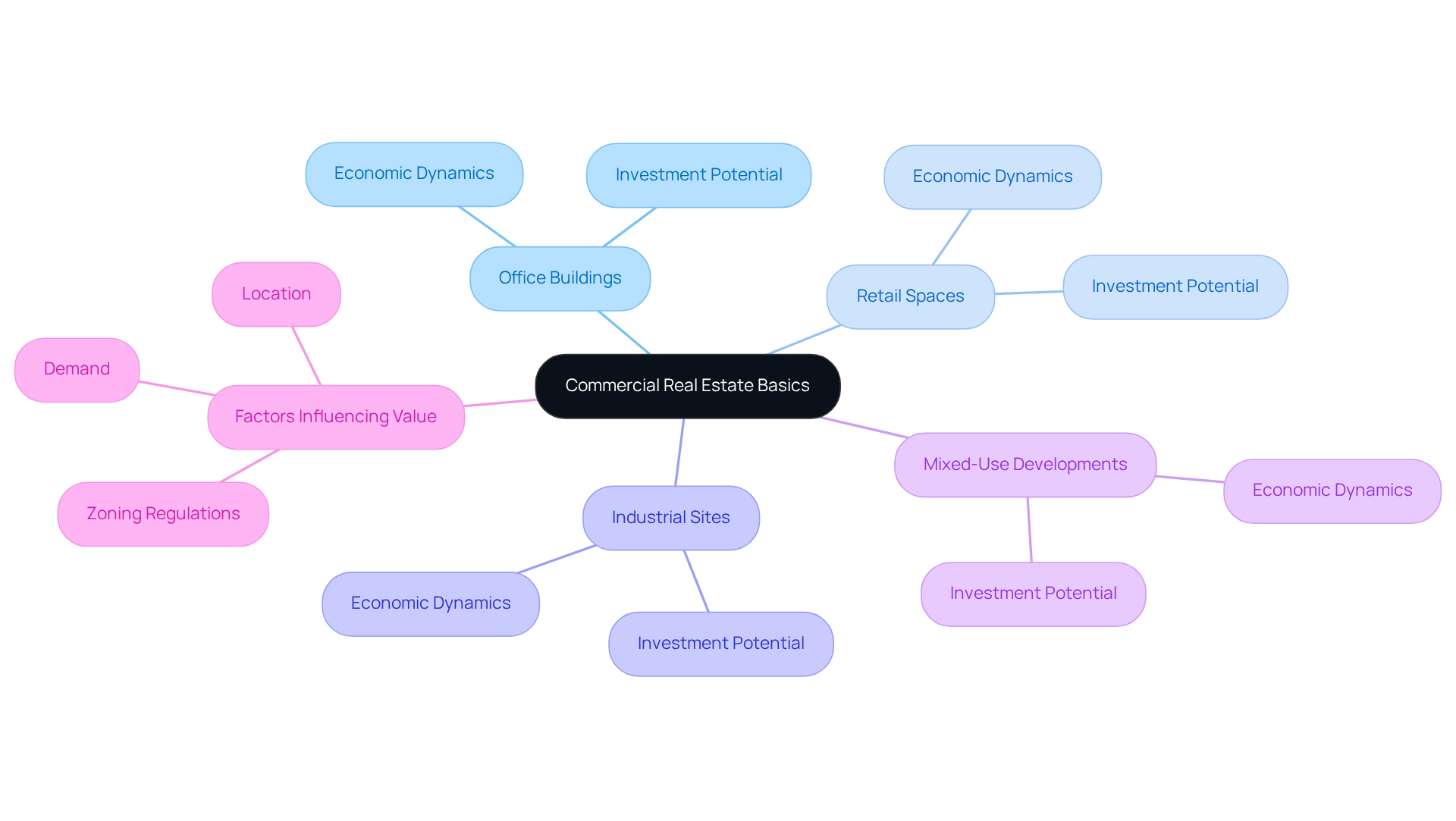

Understand Commercial Real Estate Basics

Before embarking on the purchasing process, it is crucial to grasp the key concepts of business real estate. Understanding the various categories of commercial real estate—such as office buildings, retail spaces, industrial sites, and mixed-use developments—is essential. Each type possesses its own economic dynamics and investment potential.

Furthermore, consider the elements that influence real estate values, including:

- Location

- Zoning regulations

- Demand

Resources like local real estate analyses and online listings can provide valuable insights into current trends and availability, equipping you with the knowledge needed to make informed decisions.

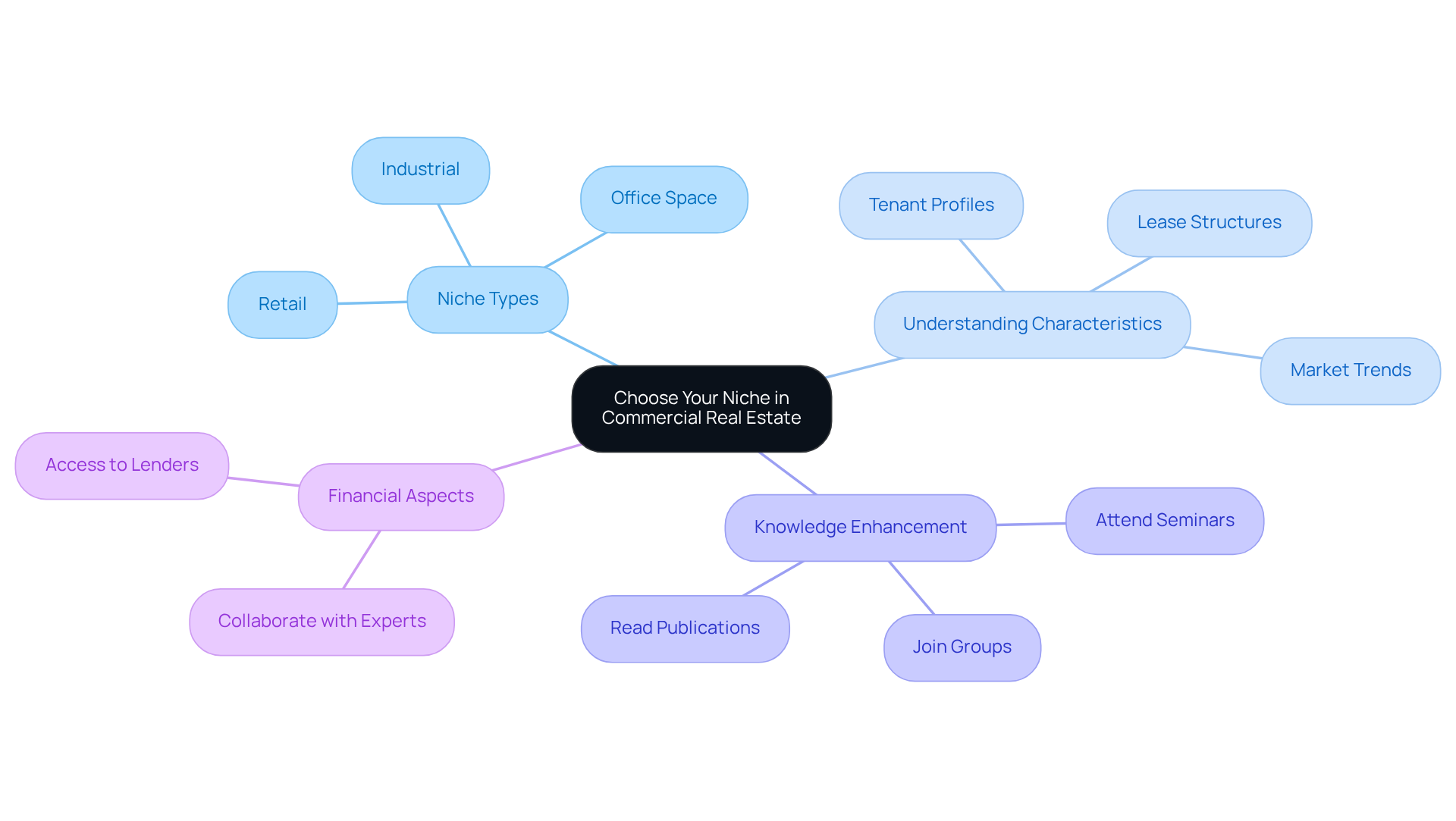

Choose Your Niche and Become an Expert

Identify a specific niche within commercial real estate that captures your interest, such as retail, office space, or industrial properties. Understanding the unique characteristics and demands of your chosen niche is crucial. Explore typical tenant profiles, lease structures, and prevailing market trends.

Attend industry seminars, join local real estate development groups, and immerse yourself in specialized publications to enhance your knowledge. Furthermore, consider the financial aspects of your endeavor. Collaborating with experts like Finance Story can yield tailored loan proposals and financing solutions that align with the specific needs of your niche.

By mastering your field and comprehending the financing options available—including access to a comprehensive array of lenders—you will be better equipped to identify profitable opportunities and make informed financial decisions.

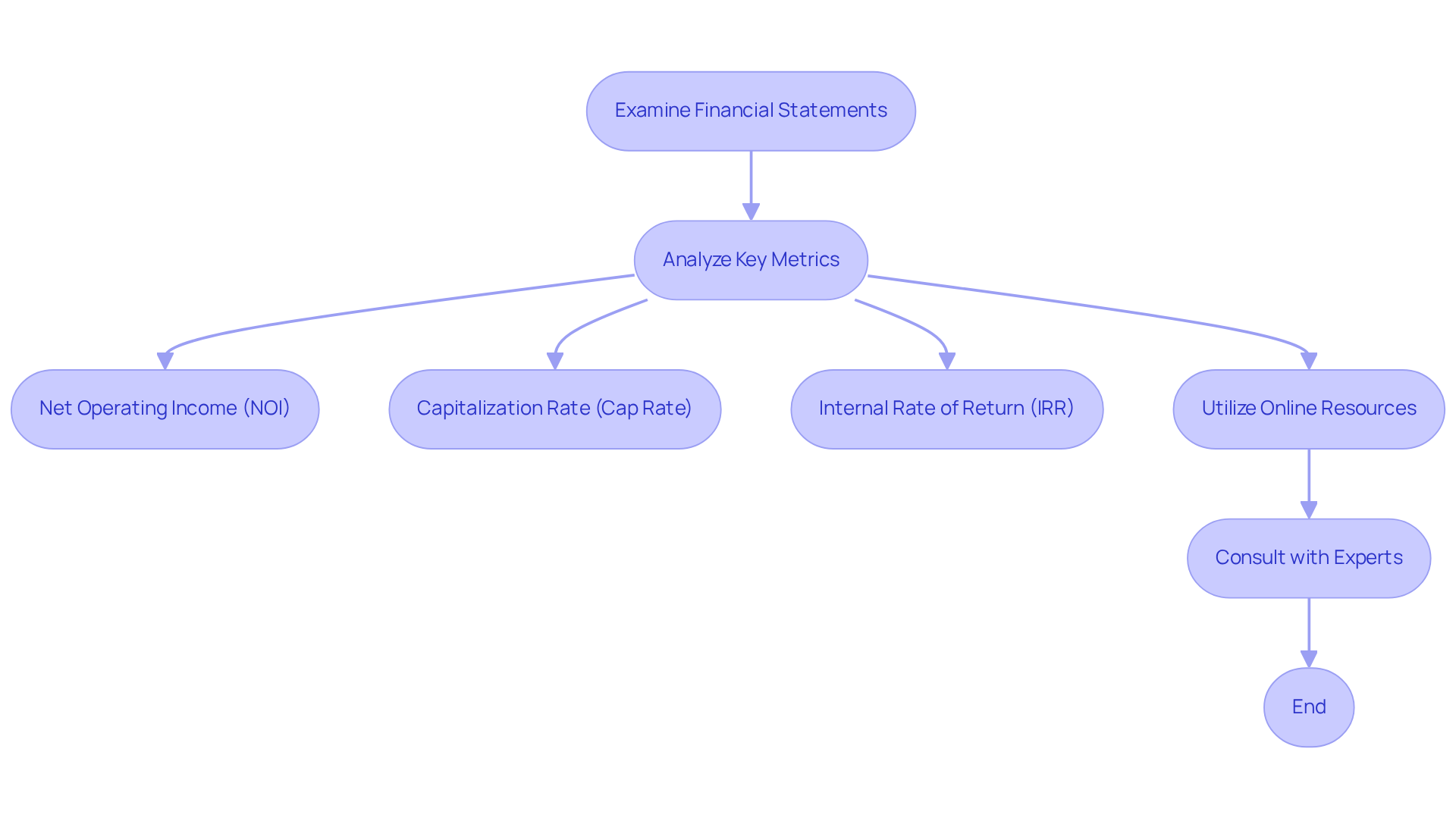

Learn How to Underwrite Commercial Real Estate Investments

To effectively underwrite real estate investments, it is essential to begin by examining the asset's financial statements, which include income, expenses, and cash flow forecasts. Familiarize yourself with key metrics such as:

- Net Operating Income (NOI)

- Capitalization Rate (Cap Rate)

- Internal Rate of Return (IRR)

These metrics are crucial for understanding the potential profitability of an investment. Furthermore, utilize online courses, webinars, and financial modeling tools to enhance your skills and knowledge in this area.

In addition, consider consulting with experienced underwriters or financial analysts. Their insights into best practices and common pitfalls in the underwriting process can prove invaluable. By engaging with experts, you can gain a deeper understanding of the nuances involved in real estate investment underwriting.

Have you thought about how these strategies can improve your investment decisions? By leveraging these resources and insights, you can position yourself for success in the competitive real estate market.

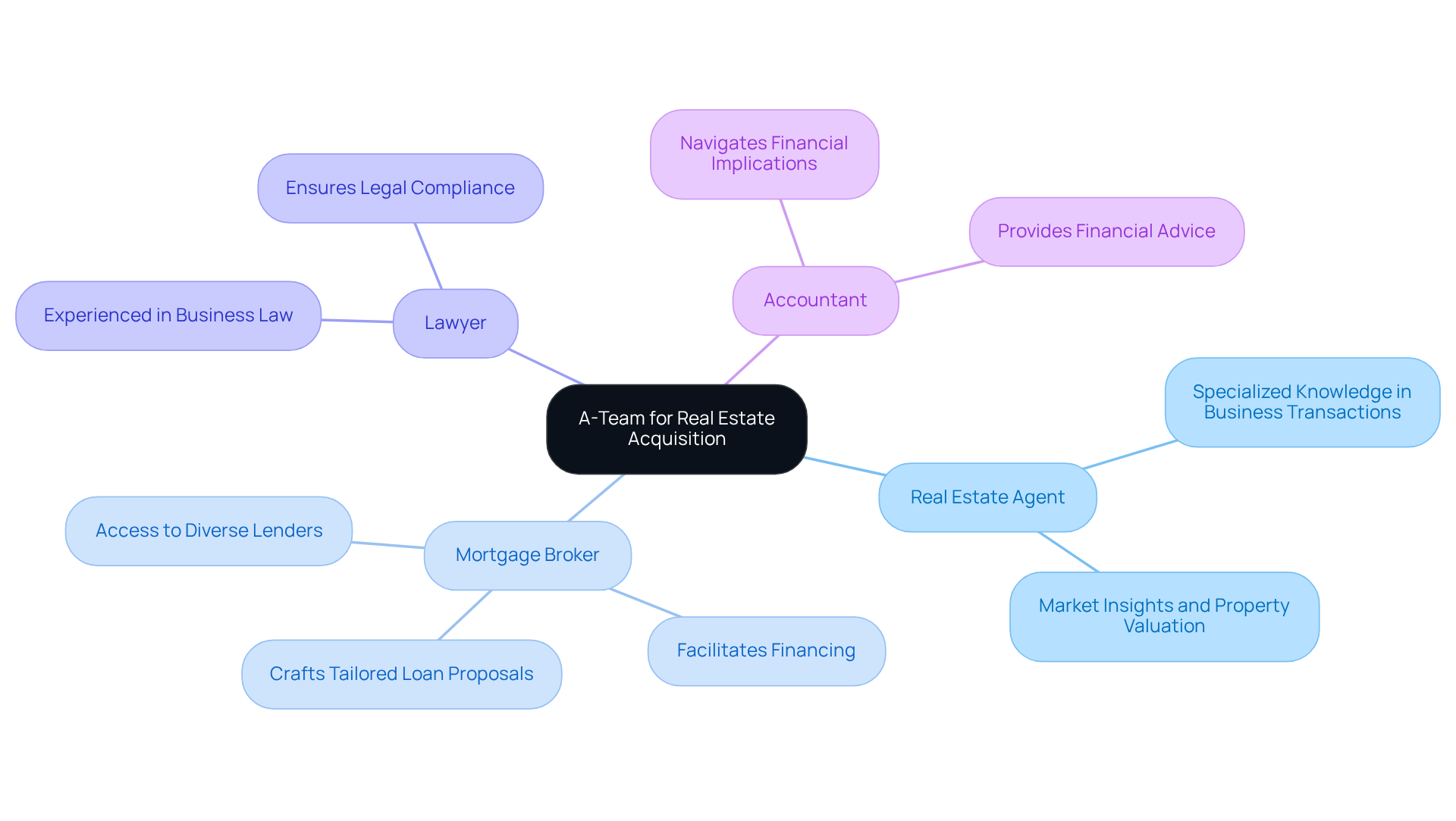

Build Your A-Team of Professionals

Assembling a proficient team of experts is essential for a successful real estate acquisition. Consider including:

- A real estate agent with specialized knowledge in business transactions

- A mortgage broker to facilitate financing

- A lawyer experienced in business law

- An accountant to navigate the financial implications

Each professional plays a crucial role in ensuring that every aspect of the purchase is managed effectively and adheres to legal standards. It is advisable to conduct thorough interviews with potential team members, selecting those who align with your funding goals and principles. This collaborative approach not only increases the likelihood of a successful transaction but also streamlines the process, making it more efficient and less stressful.

Furthermore, partnering with a mortgage broker like Finance Story can be particularly advantageous, as they specialize in crafting polished and highly individualized loan proposals tailored to your unique financing needs. With access to a comprehensive portfolio of lenders, including private and boutique business investors, Finance Story can assist you in navigating complex financial situations and securing the right funding solutions for your business ventures. As one satisfied client, Natasha B. from VIC, remarked, 'I will definitely be recommending your business to anyone. We are finished with the constant worry.' This statement underscores the positive impact of Finance Story's services on their clients' experiences.

To explore how Finance Story can support you in your financing journey, consider reaching out for a consultation.

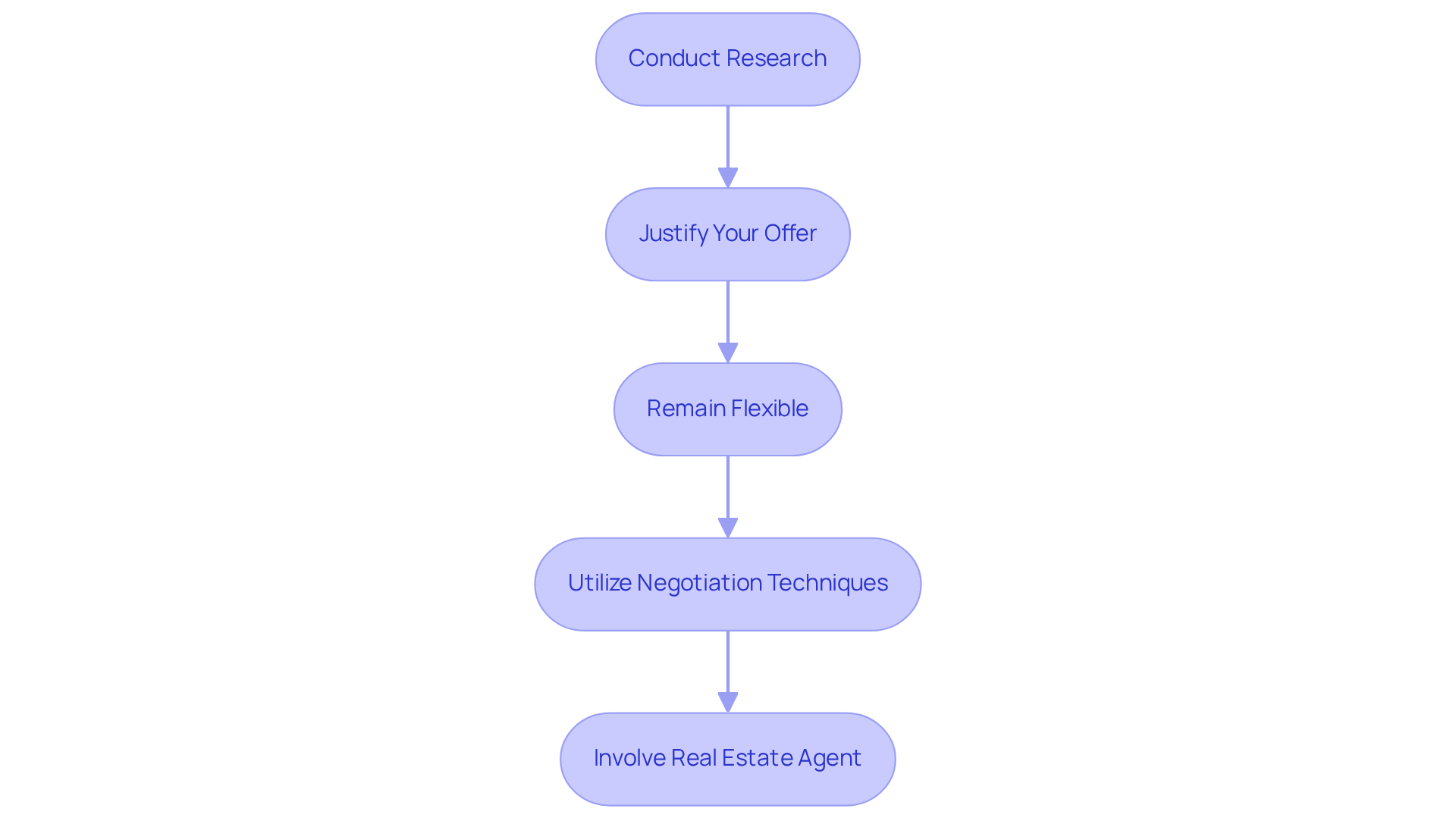

Make Strategic Offers and Negotiate Effectively

When presenting a proposal on a business asset, it is essential to conduct extensive research to establish a reasonable cost based on comparable transactions and current conditions. Are you prepared to justify your offer? Gather data and insights during your research to support your position.

During negotiations, remain flexible and open to compromise while clearly communicating your needs and objectives. Utilize effective negotiation techniques—such as anchoring your offer and understanding the seller's motivations—to create a win-win situation. Furthermore, consider involving your real estate agent in negotiations to leverage their expertise and experience.

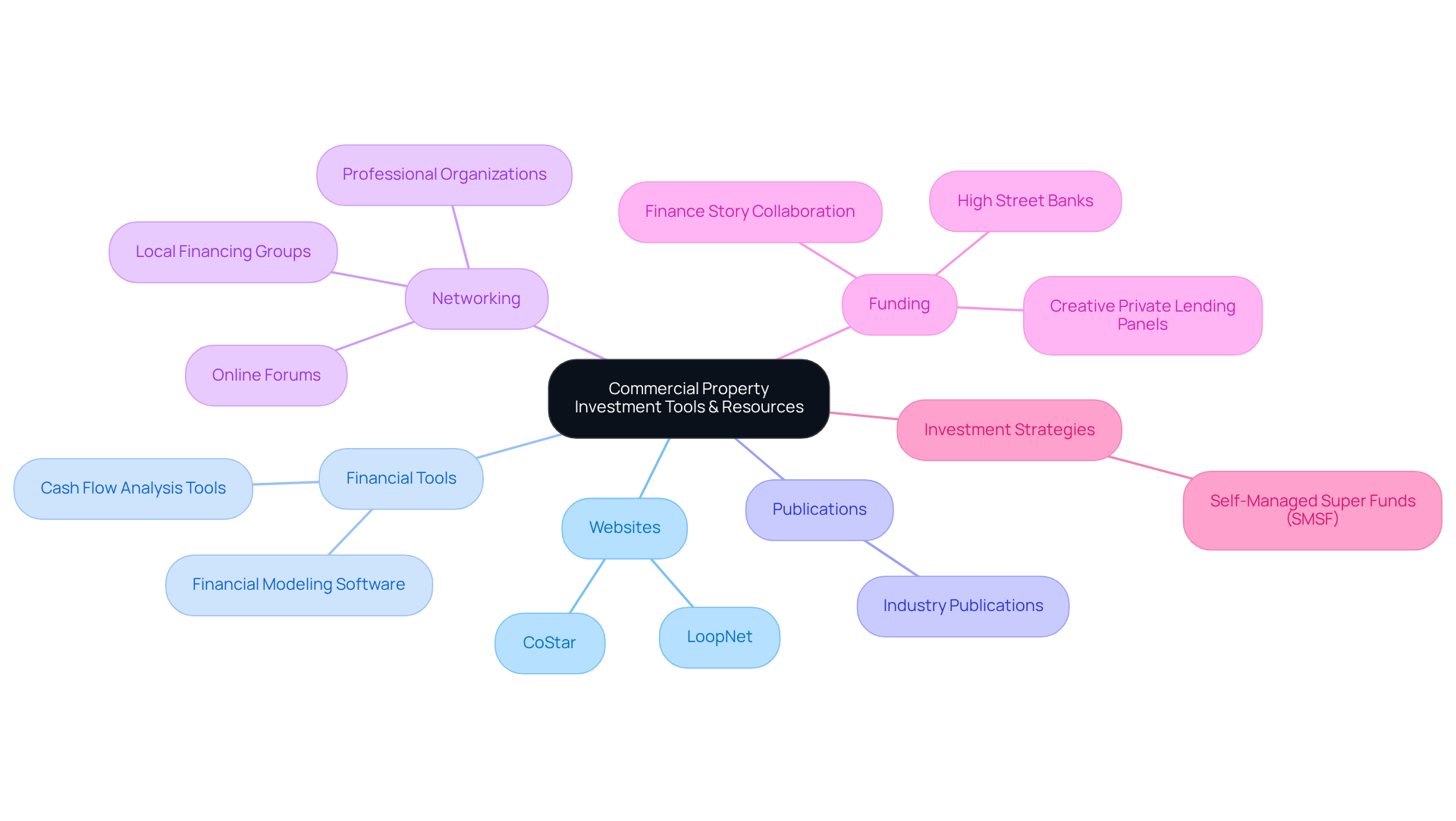

Tools and Resources for Successful Commercial Property Investment

To support your commercial real estate investment journey, it is essential to utilize a variety of tools and resources. Websites such as LoopNet and CoStar are invaluable for locating available properties and examining industry trends. Additionally, financial modeling software can greatly assist in underwriting and cash flow analysis. Furthermore, consider subscribing to industry publications and joining professional organizations to stay informed about market developments and networking opportunities.

Engaging with online forums and local financing groups can also provide valuable insights and assistance from fellow investors. When it comes to funding your venture, think about collaborating with Finance Story to develop a refined and customized loan proposal that addresses the specific requirements of your business. With access to a comprehensive array of lenders—including high street banks and creative private lending panels—you can secure the right business loan for your acquisition or refinance your current loan to adapt to your evolving business needs.

Moreover, buying commercial property as an individual can be a strategic option for financing your investments through Self-Managed Super Funds (SMSF). This approach not only enhances your investment strategy but also aligns with your long-term financial goals.

Conclusion

Understanding the intricacies of purchasing commercial property as an individual is essential for making informed investment decisions. By following the outlined steps, individuals can navigate the complexities of commercial real estate, from grasping the basics to assembling a skilled team of professionals. This comprehensive approach not only enhances the likelihood of a successful acquisition but also empowers investors to leverage their knowledge and resources effectively.

Key insights discussed in this guide include:

- The importance of selecting a niche

- Mastering underwriting processes

- Employing strategic negotiation tactics

Each of these elements plays a vital role in ensuring that investments align with personal financial goals while maximizing potential returns. Furthermore, utilizing the right tools and resources, such as financial modeling software and industry publications, can significantly bolster an investor's ability to make sound decisions.

Ultimately, the journey into commercial real estate investment offers numerous opportunities for growth and financial success. By embracing the steps outlined, individuals are encouraged to take proactive measures in their investment endeavors. Engaging with professionals, conducting thorough research, and remaining adaptable throughout the purchasing process will pave the way for a rewarding experience in the commercial property market.