Overview

This article delineates a comprehensive five-step process for securing financing to acquire commercial property. It underscores the critical need for:

- A thorough understanding of the market

- Robust financial preparedness

- Diverse financing options

- Diligent due diligence

- Proficient negotiation skills

Each step is meticulously supported by relevant data and insights, including the anticipated growth trajectory of the Australian commercial real estate market and the imperative of establishing a solid financial foundation. Together, these elements empower prospective buyers to make informed investment decisions.

Introduction

Navigating the intricate realm of commercial property investment can indeed be a daunting task, particularly when it comes to securing the right financing. It is vital for prospective buyers to grasp the nuances of the commercial property market, as this understanding can profoundly impact investment decisions and outcomes. This article presents a thorough five-step guide to borrowing for commercial property purchases, unveiling essential strategies and insights that empower investors to make informed decisions. However, as the market continues to evolve, what challenges and opportunities may emerge within this complex borrowing landscape?

Understand the Commercial Property Market

To secure financing effectively for borrowing to buy commercial property, conducting thorough research on the current market landscape is essential. This involves analyzing various real estate types, including office spaces, retail locations, and industrial sites. Key trends to assess encompass average real estate prices, rental yields, and vacancy rates—vital indicators of market health. For instance, the Australian commercial real estate market is projected to reach approximately AUD 77.84 billion by 2034, reflecting a robust market with significant sector variations. Rental yields are anticipated to show positive growth, particularly in industrial assets, which are projected to increase by 2.3% next year and 3.1% in two years, surpassing other segments.

Utilizing resources such as real estate reports, market analysis tools, and local listings will yield valuable data for identifying optimal investment opportunities. Understanding the economic conditions influencing the market, including interest rates and local economic growth, is also crucial. Engaging with local real estate agents or consultants can provide customized insights that enhance your investment strategy. Notably, small enterprises are increasingly analyzing market trends, with 88% of CRE executives expecting their firms' revenues to rise in 2025. This suggests a broader trend of optimism that could influence their investment approaches. Furthermore, the NAB Business Real Estate Index recently reached an 8-year peak at +24 points, indicating improved sentiment in the business real estate market. However, it is vital to remain cognizant of the challenges in borrowing to buy commercial property, particularly in difficult situations, as these can significantly impact your investment decisions.

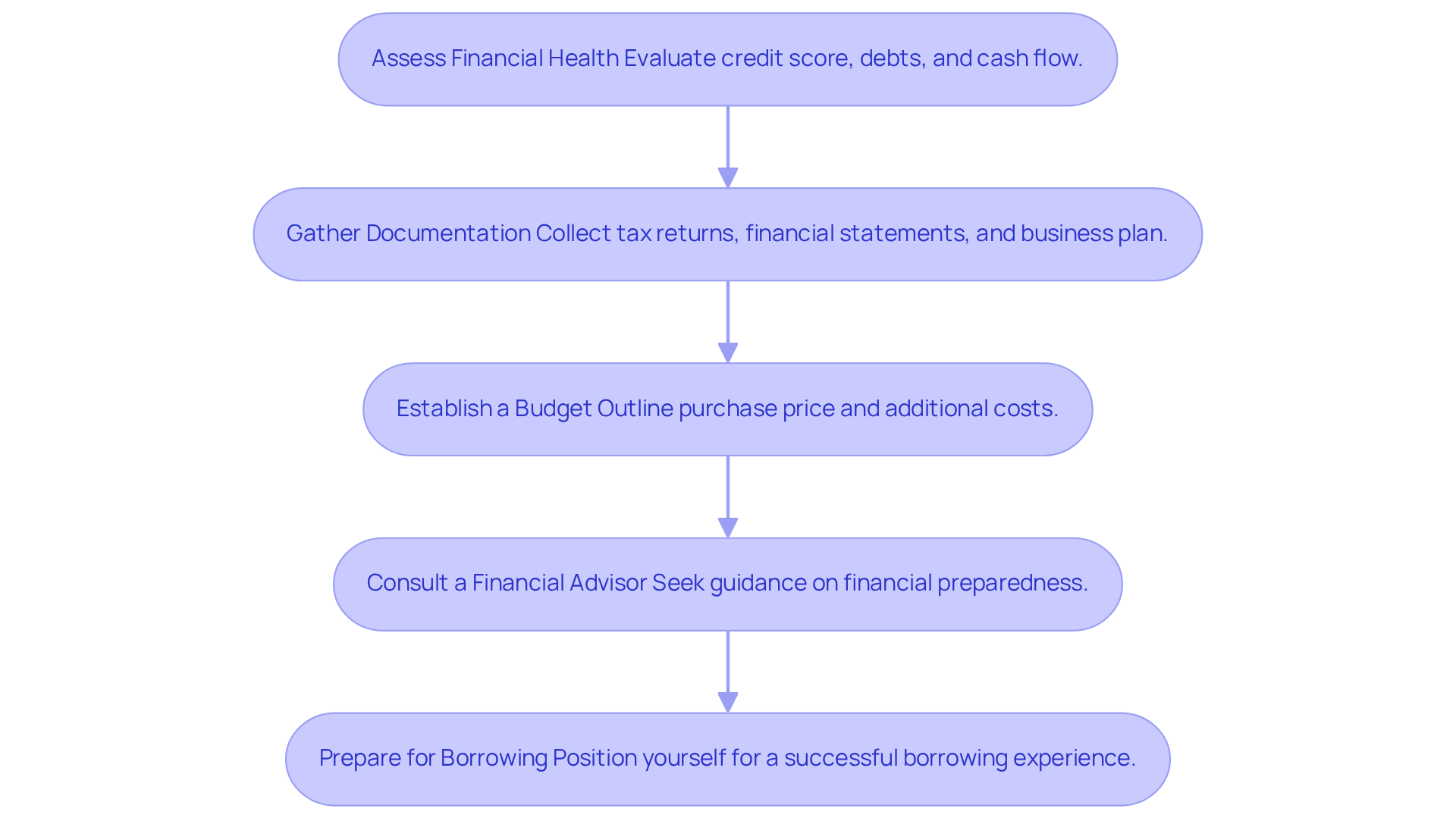

Prepare for Your Commercial Property Purchase

Before embarking on borrowing to buy commercial property, it is essential to confirm your financial preparedness. Begin by assessing your financial health, which encompasses evaluating your credit score, existing debts, and cash flow. A robust credit score is vital, as it significantly impacts your ability to secure favorable loan terms. In 2025, it is advisable to maintain a credit utilization ratio below 30% to uphold a good credit score, thereby enhancing your chances of loan approval. Notably, 76% of small business owners utilizing credit cards have drawn upon 30% or more of their credit limit, highlighting the importance of prudent credit management.

Gathering necessary documentation such as tax returns, financial statements, and a comprehensive business plan is crucial. This information will be pivotal when applying for a loan, as lenders will closely scrutinize your financial history and projections. It's important to recognize that 45% of small business owners have lost at least $10,000 in profits due to low financial literacy, underscoring the necessity for a thorough financial assessment prior to borrowing.

Next, establish a clear budget for borrowing to buy commercial property. Consider not only the purchase price but also additional costs such as taxes, insurance, and maintenance. In 2025, small business owners should be aware that the average loan amount sought for business acquisitions is approximately $94,845, emphasizing the significance of having a clearly outlined budget to prevent overspending.

Meeting with a financial consultant can provide critical guidance regarding your financial preparedness and assist you in navigating the complexities of borrowing to buy commercial property. Independent financial advice is recommended before making any financial decisions, ensuring you are well-prepared. By taking these steps, you can position yourself for a successful borrowing experience.

Explore Financing Options for Your Purchase

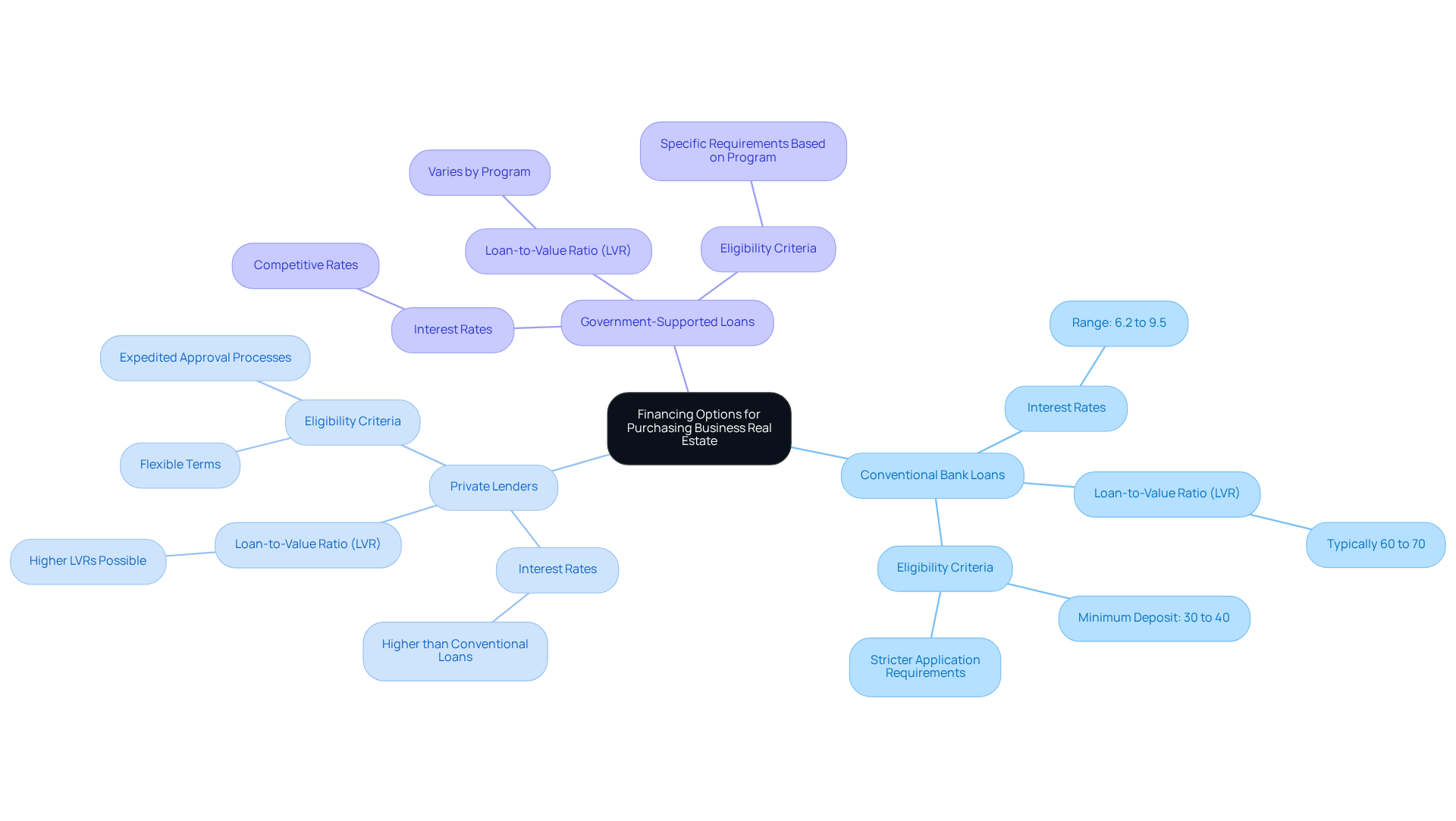

When preparing to invest in business real estate, it is essential to examine the various financing options available, such as borrowing to buy commercial property. The primary choices include:

- Conventional bank loans

- Private lenders

- Government-supported loans

Each presents distinct terms, interest rates, and eligibility criteria.

In 2025, interest rates for commercial property loans in Australia typically range from 6.2% to 9.5%, influenced by factors such as the lender, credit history, and property type. Traditional bank loans usually necessitate a minimum deposit of 30% to 40%, with a loan-to-value ratio (LVR) generally between 60% and 70%, reflecting the heightened risks involved. Conversely, private lenders may offer more flexible terms, including higher LVRs and expedited approval processes, albeit often at increased interest rates.

When evaluating funding options, it is important to consider:

- The loan-to-value ratio

- Repayment terms

- Additional fees beyond the interest rate

Partnering with a specialized mortgage broker who focuses on commercial financing can be particularly beneficial when borrowing to buy commercial property, as they can navigate the complexities of commercial loans and connect you with a broader range of lenders. As industry experts suggest, a tailored approach can significantly improve your chances of obtaining favorable financing terms that align with your investment objectives.

For small businesses, understanding the distinctions between traditional and private lenders is vital. While traditional banks may present lower interest rates, they frequently impose stricter application requirements and longer approval timelines. In contrast, private lenders can provide quicker access to funds but at a higher cost. Moreover, business loans typically entail greater vacancy risks and initial expenses, which should be factored into your decision-making process. By carefully weighing these elements and seeking professional guidance, you can make informed decisions that involve borrowing to buy commercial property and bolster your investment strategy.

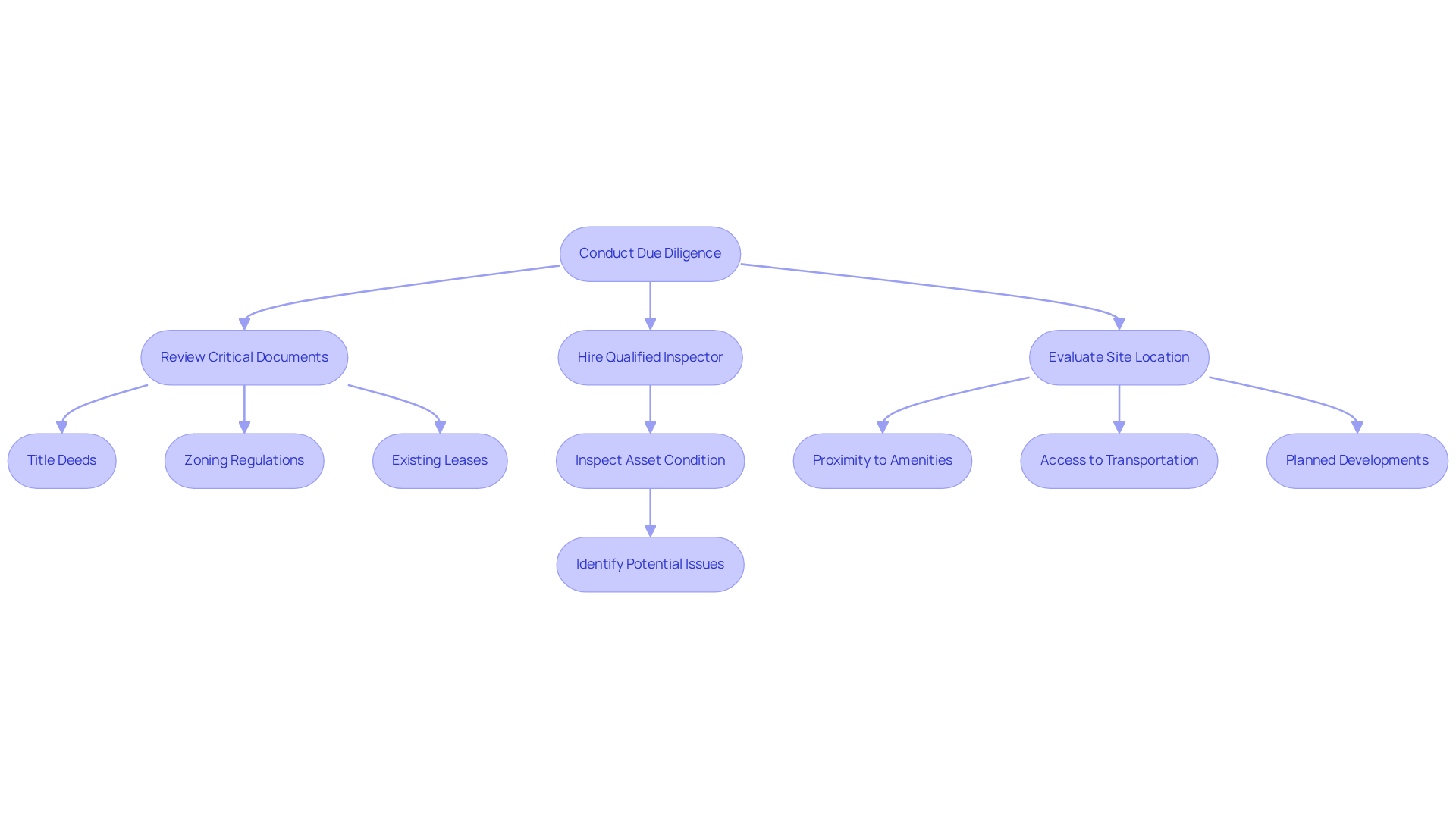

Conduct Due Diligence and Property Evaluation

Before finalizing your purchase, conducting thorough due diligence on the asset is essential. This process entails reviewing critical documents such as title deeds, zoning regulations, and any existing leases. Hiring a qualified inspector is vital to assess the asset's condition, as they can identify potential issues that may necessitate repairs or renovations.

Furthermore, evaluating the site's location is crucial for understanding its appreciation potential. Key factors to consider include:

- Proximity to amenities

- Access to transportation

- Any planned developments in the area

This comprehensive assessment not only empowers you to make an informed decision but also enhances your negotiating position when discussing terms related to borrowing to buy commercial property.

In 2025, common issues identified during commercial real estate inspections may encompass:

- Structural deficiencies

- Outdated electrical systems

- Compliance with current safety regulations

Therefore, having a detailed due diligence checklist can streamline your evaluation process, ensuring that no critical aspect is overlooked. By prioritizing these evaluations, you can mitigate risks and secure a sound investment.

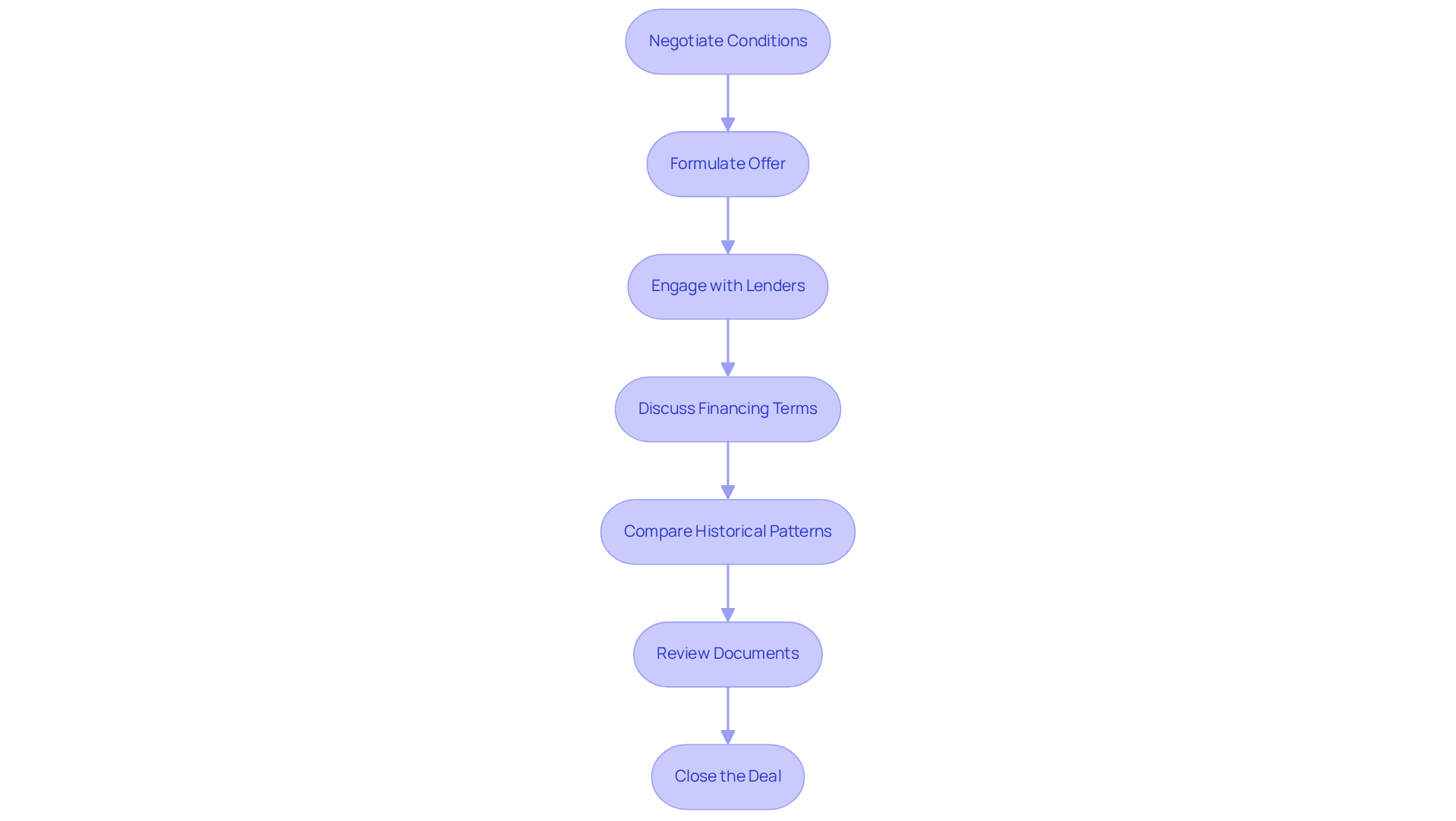

Negotiate and Close the Deal

After fulfilling your due diligence, the next essential step is to negotiate the conditions of your purchase and funding. Begin by formulating a fair offer based on your property evaluation and market research. It is crucial to back your offer with solid data and insights gathered during your research, as this will strengthen your position.

Furthermore, engage with lenders to explore options for borrowing to buy commercial property and secure the most advantageous financing terms. Discuss key components such as interest percentages, which currently span from 6.2% to 9.5% in 2025. Consider how these figures compare to historical patterns, as they may influence your total borrowing expenses. Additionally, review repayment schedules and any associated fees. Given the competitive environment, where demand for prime industrial and logistics assets is increasing—evidenced by Sydney's low retail vacancy rate of 3.9% and Melbourne's decline to 4.1%—being well-prepared can significantly influence your negotiations.

As you negotiate, remember the insights from Ben Burston, Chief Economist at Knight Frank, who notes that the worst of the economic news is behind us, suggesting a more favorable environment for negotiations. Once both negotiations are finalized, meticulously review all documents before closing the deal. Ensure that every term is clearly outlined and that you fully understand your obligations as a borrower when it comes to borrowing to buy commercial property. It may also be prudent to consider a suggested closing date, such as February 16, to keep your negotiations on track. This careful approach not only safeguards your interests but also sets the stage for a successful acquisition of commercial property.

Conclusion

Understanding the process of borrowing to buy commercial property is crucial for making informed investment decisions. By following a structured approach, investors can navigate the complexities of the commercial real estate market and secure financing that aligns with their objectives. This guide outlines essential steps, from comprehending market dynamics to conducting thorough due diligence and negotiating favorable terms.

Key insights discussed include:

- The importance of analyzing market conditions

- Assessing financial readiness

- Exploring various financing options

- Performing detailed property evaluations

Each of these components plays a vital role in ensuring a successful acquisition, particularly in a landscape characterized by fluctuating interest rates and evolving market trends. By being diligent in preparation and research, investors can mitigate risks and enhance their chances of securing a profitable investment.

Ultimately, the journey of borrowing to buy commercial property is not just about securing funds; it is about making strategic decisions that will yield long-term benefits. By adopting a proactive approach and leveraging available resources, potential investors can capitalize on opportunities within the commercial real estate market. Engaging with professionals and utilizing market analysis tools will further empower individuals to make sound financial choices, ensuring a successful and sustainable investment in commercial property.