Overview

When selecting the right business loan brokers in Perth, small enterprise owners must prioritize evaluating brokers based on their:

- Experience

- Specialization

- Reputation

- Transparency

- Network of lenders

Why is this crucial? Brokers with a strong track record and extensive connections to lenders can significantly enhance your chances of securing favorable financing terms. This underscores the necessity of choosing a qualified intermediary who can adeptly navigate the complexities of business loans. By focusing on these key factors, you position yourself to make informed decisions that can lead to more advantageous financial outcomes.

Introduction

Navigating the world of business financing can be daunting for many small business owners, particularly in an environment filled with complex loan options and varying lender requirements. Business loan brokers emerge as essential allies in this journey, providing the expertise and support necessary to significantly enhance the chances of securing favorable financing. This article delves into the pivotal role these intermediaries play, the criteria for selecting the right broker, and the importance of client testimonials in evaluating their effectiveness. By understanding these elements, business owners can make informed decisions that lead to financial stability and growth.

Understand the Role of Business Loan Brokers

Business loan brokers Perth serve as essential intermediaries between borrowers and lenders, streamlining the loan application process for small enterprises. At Finance Story, we fully understand organizational needs and collaborate with our partners to create robust cases tailored to their specific situations. With our extensive knowledge of the financial market, we access a diverse array of loan products from multiple lenders, including boutique lenders, private investors, and mainstream banks, ensuring companies find the most suitable funding options.

Our brokers play a crucial role in negotiating favorable terms and conditions, leading to significant cost savings for clients. By managing the intricacies of the application process, we save valuable time and reduce stress for entrepreneurs. This is especially advantageous for small enterprises that may lack the resources or knowledge to navigate the complexities of obtaining funds independently. For instance, our proficiency in developing refined and highly tailored proposals has enabled numerous clients to acquire the capital needed for commercial property investments and refinances.

Statistics indicate that intermediaries can assist small enterprises in securing essential funds, regardless of credit ratings or cyclical market fluctuations, underscoring their significance in the funding landscape. As small enterprises increasingly rely on business loan brokers Perth like Finance Story for their funding needs, the influence of these specialists on funding success rates continues to grow. This trend positions intermediaries as essential allies in the pursuit of financial stability and growth, significantly enhancing the chances of obtaining advantageous funding alternatives.

Identify Key Criteria for Selecting a Broker

When choosing business loan brokers Perth, small enterprise owners must evaluate several essential factors to ensure they make an informed decision:

- Experience and Expertise: Opt for agents with a proven track record in commercial funding. Research indicates that agents with over five years of experience often provide superior service and a wider array of funding options. Their familiarity with the market can significantly impact the success of your loan application. At Finance Story, we specialize in crafting polished and highly individualized business cases to present to banks, utilizing insights from business loan brokers Perth to ensure that your proposal meets the elevated expectations of lenders.

- Specialization: It is crucial to find an agent who specializes in the specific type of funding you require, whether it’s for commercial properties like warehouses, retail spaces, factories, or hospitality projects. Specialized agents are more likely to understand the nuances of your needs and can tailor solutions accordingly. Finance Story collaborates with business loan brokers Perth to offer a comprehensive range of lenders that accommodate various circumstances, ensuring you discover the right financing solution.

- Reputation: Investigate the agent's reputation through online reviews, testimonials, and referrals from fellow business owners. An agent with a strong positive reputation typically signifies reliable service and successful outcomes. For instance, case studies suggest that agents with high client satisfaction rates can lead to improved financing terms and more seamless processes. Furthermore, a recent case study highlighted that over 30% of small businesses are located outside major capital cities, underscoring their vital role in supporting local economies and communities.

- Transparency: Choose an intermediary who is transparent about their fees and the loan process. They should clearly explain how they are compensated and any potential costs involved. Transparency builds trust and ensures that you are fully aware of what to expect throughout the financing journey. Brokers must possess in-depth knowledge of property-related information to uphold transparency.

- Network of Lenders: An intermediary with a broad network of lenders can offer more options and potentially better terms for your loan. This diversity is particularly beneficial in a competitive market, enabling agents to connect clients with lenders that best match their financial profiles. Partnering with Finance Story grants access to a wide range of lenders, including major banks and innovative private lending groups, ensuring you find the appropriate financing option with business loan brokers Perth.

By focusing on these criteria, small enterprise owners can enhance their chances of finding an intermediary who not only meets their financing needs but also supports their long-term objectives.

Research and Evaluate Potential Brokers

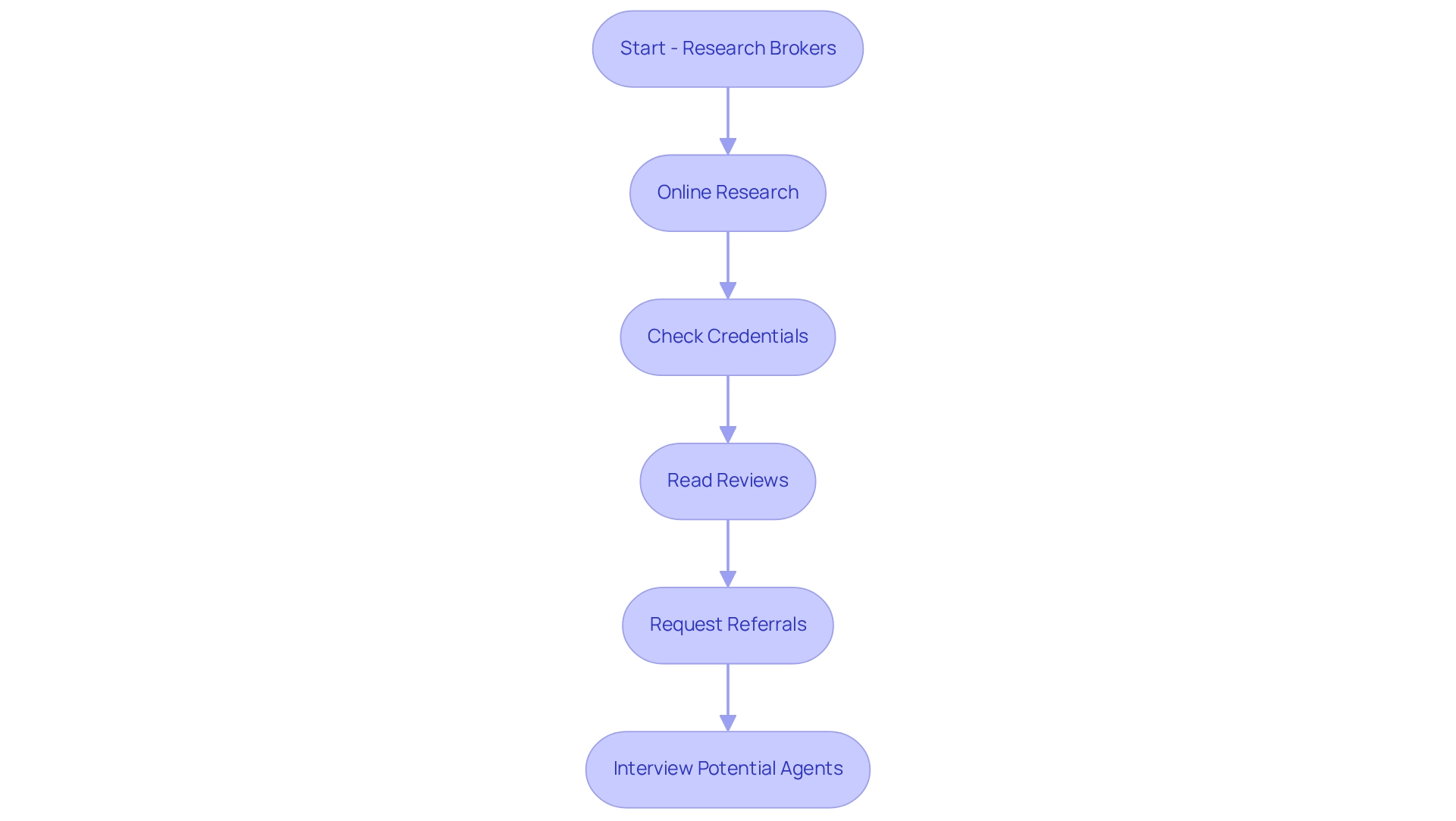

To effectively research and evaluate potential business loan brokers, follow these essential steps:

-

Online Research: Begin your journey by searching for financial advisors in your area with keywords like 'business loan advisors Perth.' Examine their websites to uncover insights into their services and expertise. With access to over 80 lenders, companies such as Finance Story offer a diverse array of choices tailored to your requirements, including specialized assistance for refinancing commercial properties. However, be mindful that public search limitations may restrict your ability to find all available agents; therefore, consider utilizing multiple sources.

-

Check Credentials: It is imperative to verify the broker's credentials, including licenses and certifications. This step is crucial to ensure they are qualified to operate in your region and comply with industry standards, particularly regarding loan repayment criteria that can influence your financing options.

-

Read Reviews: Delve into customer reviews on platforms like Google, Yelp, or dedicated finance forums. Analyzing both positive and negative feedback will provide insight into overall satisfaction and highlight any recurring issues. Current statistics reveal that the average ratings of business loan brokers Perth indicate a strong reputation for professionalism and expertise. For instance, one client remarked, "Scott was a pleasure to deal with...very prompt," underscoring the significance of customer service in your selection process.

-

Request Referrals: Seek recommendations from fellow entrepreneurs. Personal referrals can yield valuable insights into a financial advisor's reliability and effectiveness, bolstering your confidence in your choice. Business loan brokers Perth, like Finance Story, excel at crafting refined and personalized proposals that can significantly enhance your likelihood of securing appropriate funding for various commercial properties, including warehouses, retail spaces, factories, and hospitality projects.

-

Interview Potential Agents: Schedule meetings with multiple agents to discuss your specific needs. This interaction enables you to assess their communication style, responsiveness, and dedication to understanding your business. Customers have noted that agents who prioritize personalized service can greatly simplify the loan acquisition process. For example, Finance Story has garnered a reputation for providing tailored personal loan solutions, demonstrating the effectiveness of their services and the advantages of personalized support.

Consider Client Testimonials and Reviews

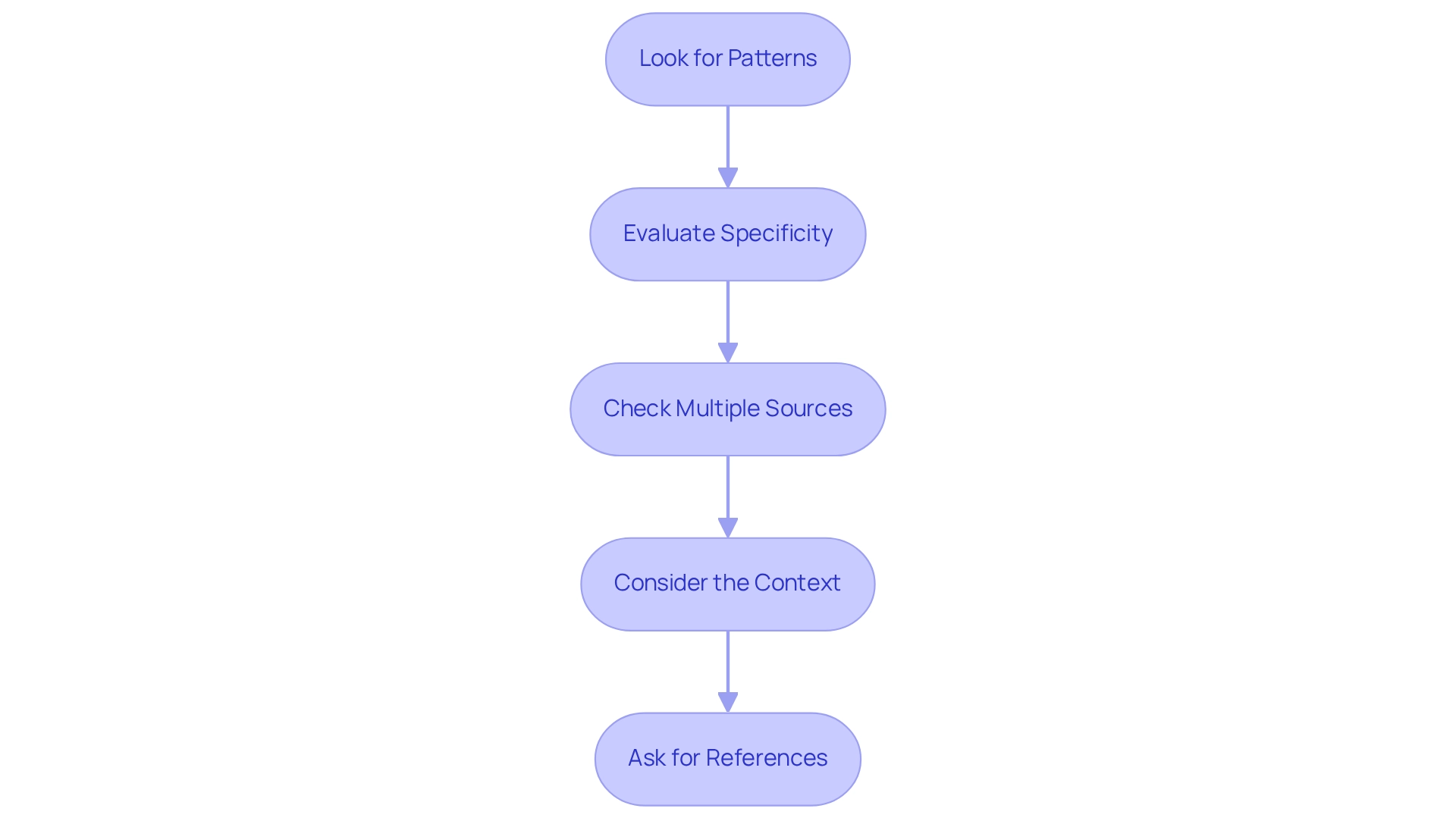

Client testimonials and reviews serve as crucial instruments for assessing a trader's performance. Here’s how to effectively consider them:

- Look for Patterns: Identify recurring themes in reviews. When numerous customers emphasize comparable strengths or weaknesses, it acts as a dependable sign of the agent's abilities. For instance, clients of Finance Story often convey relief from persistent concerns, demonstrating the firm's effectiveness in offering customized solutions. Natasha B. from VIC stated, "I will definitely be recommending your business to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey."

- Evaluate Specificity: Focus on detailed testimonials that recount specific experiences. Vague reviews often lack the depth needed to accurately evaluate a financial advisor's effectiveness. Testimonials from satisfied clients emphasize the bespoke mortgage services that Finance Story offers, which can be a strong indicator of their expertise.

- Check Multiple Sources: Avoid relying on a single platform for reviews. Cross-referencing feedback from different sources offers a more thorough perspective on the agent's reputation. Finance Story's reputation as one of Australia’s most innovative funding specialist brokerages is supported by positive feedback across multiple platforms.

- Consider the Context: Understand the context surrounding the reviews. A broker may have a few negative comments, but if these are significantly outweighed by positive feedback, they may not be a dealbreaker. The testimonials from Finance Story customers emphasize their capacity to discover solutions even in difficult situations, strengthening their dependability.

- Ask for References: Whenever feasible, request referrals from previous customers. Direct discussions with prior customers can provide deeper insights into their experiences and satisfaction levels. Clients often recommend Finance Story to others, indicating a high level of trust and satisfaction.

In the context of business finance, the stakes are high; independent mortgage banks reported a loss of $2,812 on each loan in the fourth quarter of 2022. This statistic highlights the financial consequences of selecting the appropriate intermediary, making robust customer feedback even more essential.

As Chris Meyer, chairman of the Strategic Alignment Group, Inc., observed, 'So little confidence do consumers have in these electronic surrogates...' This emphasizes the importance of personal interactions and testimonials in the selection process.

Moreover, positive customer experiences from personalized interactions can lead to increased loyalty and reduced churn, reinforcing the argument for considering customer testimonials. By carefully analyzing client testimonials, such as those from Finance Story, you can gain valuable insights into a broker's performance and make a more informed decision.

Conclusion

Business loan brokers play an essential role in the financing landscape for small business owners. Acting as intermediaries between borrowers and lenders, they simplify the often complex loan application process, thereby enhancing the likelihood of securing favorable financing options. Their expertise not only aids in negotiating better terms but also provides access to a diverse range of loan products tailored to unique business needs.

Selecting the right broker necessitates careful consideration of several key criteria, including:

- Experience

- Specialization

- Reputation

- Transparency

- The breadth of their lender network

By prioritizing these factors, business owners can identify brokers who align with their financing goals and are equipped to support their long-term growth. Conducting thorough research and evaluation, such as checking credentials and reading client reviews, further ensures that the chosen broker can deliver the desired outcomes.

Client testimonials and reviews are invaluable tools for assessing a broker's effectiveness. Patterns in feedback, specificity of experiences, and the overall context of reviews can provide insights into a broker's reliability and service quality. Given the high stakes in business financing, leveraging the experiences of previous clients can guide business owners in making informed decisions about their financing partners.

In conclusion, partnering with a knowledgeable business loan broker can significantly influence a small business's journey toward financial stability and growth. By understanding their pivotal role, carefully selecting the right broker, and valuing client feedback, business owners can enhance their chances of securing the funding necessary to thrive in a competitive marketplace.