Overview

This article delineates four crucial steps for selecting alternative business finance brokers. It underscores the significance of evaluating their:

- Experience

- Network

- Transparency

- Communication

Such guidance is underpinned by specific criteria and practical strategies for assessing brokers, ensuring that businesses can choose an intermediary that adeptly fulfills their financing requirements.

Introduction

Navigating the complex world of business financing can be daunting for many entrepreneurs. With a plethora of options available—from traditional bank loans to innovative alternative funding sources—finding the right financial solution is crucial for success. Alternative business finance brokers play a pivotal role in this landscape, acting as intermediaries who connect businesses with lenders while tailoring proposals to meet individual needs.

Have you considered how the right broker could change your financial outlook? Understanding how to select the right broker and what financing options exist can empower businesses to secure the funding they require, ultimately driving growth and innovation.

This guide delves into the essential criteria for choosing a broker, evaluating their expertise, and exploring the diverse financing solutions available to modern businesses.

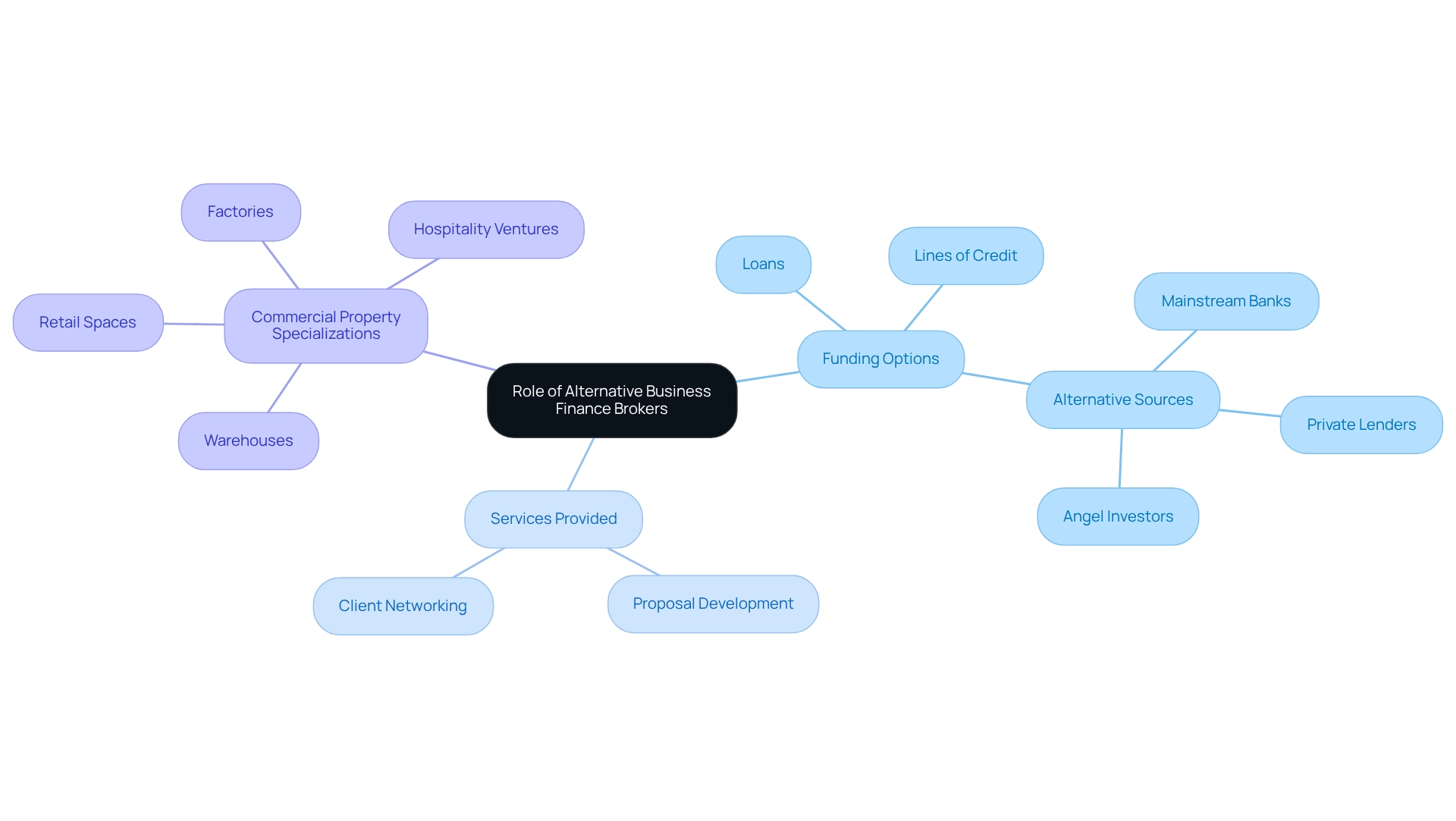

Understand the Role of Alternative Business Finance Brokers

Alternative business finance brokers serve as vital intermediaries between enterprises seeking funding and lenders offering financial products. At Finance Story, we possess a comprehensive understanding of business dynamics and work closely with our partners to develop robust business cases tailored to their unique needs. Our ongoing connection with clients guarantees that we remain aligned with their evolving financial requirements. Leveraging our expertise, we craft polished and highly individualized proposals that meet the increasing expectations of lenders. As alternative business finance brokers, we utilize extensive networks to connect clients with a variety of funding options, including:

- Loans

- Lines of credit

- Alternative sources from a diverse panel of lenders, such as mainstream banks, private lenders, and angel investors

We specialize in refinancing options and the acquisition of commercial properties, including:

- Warehouses

- Retail spaces

- Factories

- Hospitality ventures

By streamlining the borrowing process and saving time, we often secure better terms for our clients.

Understanding this role is the first step in effectively utilizing an intermediary's services to meet your financial needs. Are you ready to explore how we can assist you in achieving your funding goals?

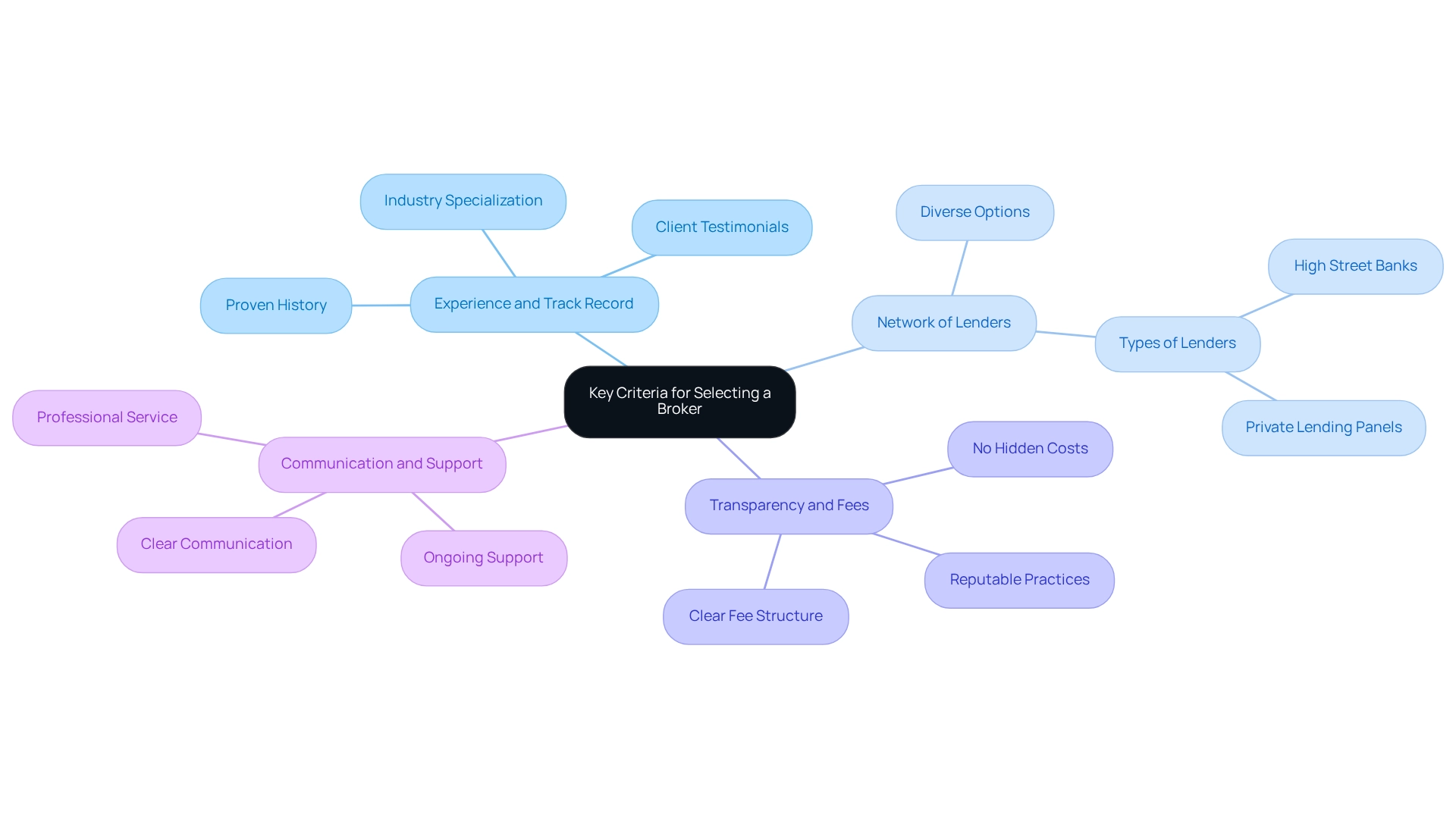

Identify Key Criteria for Selecting a Broker

When selecting alternative business finance brokers, it is crucial to consider the following key criteria:

-

Experience and Track Record: Look for professionals who have a proven history of successfully securing financing for ventures similar to yours. Examine client testimonials and case studies, such as those from Finance Story, which showcase their expertise in crafting polished and tailored presentations for lenders. Ensure that the intermediary you choose is one of the alternative business finance brokers who specializes in your specific industry or the type of financing you require. Finance Story, for example, possesses extensive experience across various sectors, including retail, hospitality, and warehousing, offering customized solutions that cater to distinct business needs.

-

Network of Lenders: An intermediary with a wide-ranging network can provide you with more options and potentially superior terms. Inquire about the types of lenders they collaborate with. Finance Story boasts a comprehensive portfolio that includes high street banks and innovative private lending panels, ensuring access to the best financing options available.

-

Transparency and Fees: Understand the fee structure of the intermediary and confirm that there are no hidden costs. A reputable intermediary, like alternative business finance brokers, will be forthright about their fees and compensation methods, a hallmark of Finance Story's approach to customer relationships.

-

Communication and Support: Choose an intermediary who communicates clearly and provides ongoing support throughout the funding process. This relationship is vital for navigating any challenges that may arise. Finance Story prides itself on delivering acutely professional service, guiding clients through every step of their financing journey.

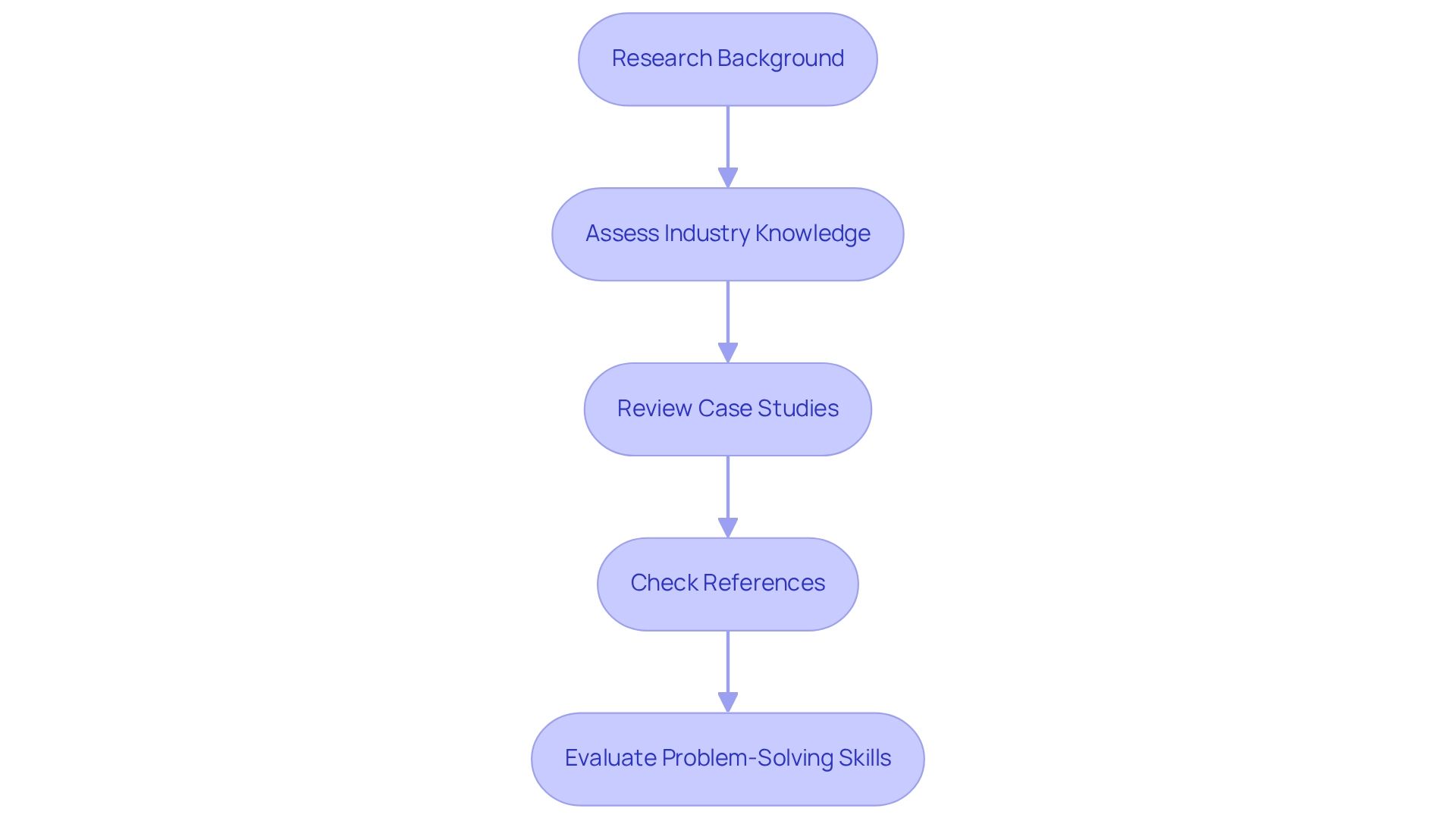

Evaluate Broker Experience and Specialization

To assess a financial professional's experience and specialization, follow these essential steps:

-

Research Background: Begin by examining the agent's professional history, including their years in the industry and prior positions. Look for relevant certifications or licenses that demonstrate their expertise in crafting tailored loan proposals.

-

Assess Industry Knowledge: It is crucial to determine if the broker possesses experience in your specific industry. Brokers, specifically alternative business finance brokers, who are knowledgeable about your field will recognize the unique challenges and opportunities you face, particularly when seeking funding for commercial real estate investments.

-

Review Case Studies: Request examples of previous clients and the financing solutions provided. This will offer insight into their problem-solving abilities and success rates, especially in refinancing and securing customized loans.

-

Check References: Ask for references from past clients to evaluate their satisfaction with the agent's services. Positive feedback from similar enterprises can serve as a strong indicator of reliability and expertise in navigating the complexities of growth and funding, often facilitated by alternative business finance brokers.

-

Evaluate Problem-Solving Skills: Engage in a discussion about potential challenges you anticipate in securing funds, and inquire how the broker would address them. Their responses will reveal their knowledge and adaptability, particularly in developing refined and personalized proposals to meet your funding requirements.

Explore Available Financing Options and Solutions

When exploring financing options, consider the following solutions:

- Traditional Bank Loans: Frequently the primary option for numerous enterprises, these loans provide competitive interest rates and conditions. However, alternative business finance brokers may require extensive documentation and impose stricter eligibility criteria. Alternative business finance brokers include online lenders and peer-to-peer platforms that may offer more flexible terms and quicker approval processes, making them suitable for enterprises with unique needs.

- Invoice Financing: This option allows companies to borrow against their outstanding invoices, providing immediate cash flow without incurring additional debt.

- Merchant Cash Advances: A rapid funding option where companies receive a lump sum in exchange for a portion of future sales. While convenient, this method often comes with higher costs.

- Equity Financing: This entails obtaining funds by selling ownership stakes in the company. It can be a viable option for startups seeking growth without incurring debt.

- Grants and Subsidies: Research available grants from government programs or private organizations that do not require repayment, offering a valuable funding source for eligible businesses.

- Customized Loan Proposals: For individuals looking to acquire commercial properties or refinance current loans, collaborating with a finance consultant can help develop refined and personalized cases to present to lenders. This expertise is crucial in meeting the heightened expectations of securing funds for developments of any size.

- Financing for Leasehold Enterprises: If your operation functions within a lease or lacks a physical structure, consider utilizing any property equity you own or cash savings to fund your acquisition. For instance, leveraging equity from a home can provide significant funds for purchasing a business, and by understanding these options, businesses can collaborate with alternative business finance brokers to identify the best financing solutions tailored to their specific circumstances.

Conclusion

Navigating the world of business financing is undeniably complex. However, understanding the role of alternative business finance brokers can significantly ease this journey. Brokers serve as vital intermediaries, connecting businesses with a diverse array of lenders and financing options. By leveraging their expertise and extensive networks, brokers can create tailored proposals that not only meet lenders' expectations but also align with the unique financial needs of businesses.

Choosing the right broker is essential, and several key criteria should guide this decision. Experience, specialization, and transparency in fees are crucial factors to consider. A broker's industry knowledge and their ability to communicate effectively can make a substantial difference in securing the appropriate financing. These elements collectively ensure that businesses are supported throughout the financing process, ultimately leading to better outcomes.

Furthermore, exploring the various financing options available—from traditional bank loans to innovative alternative funding solutions—empowers businesses to make informed decisions. Each financing avenue has its own set of advantages and considerations, and a knowledgeable broker can help navigate these choices to find the best fit for specific circumstances.

In summary, partnering with an experienced alternative business finance broker can transform the way businesses approach funding. By understanding the broker's role, selecting the right one, and exploring a multitude of financing options, entrepreneurs can secure the financial resources necessary for growth and innovation. Embracing these strategies not only enhances financial prospects but also paves the way for sustainable business success.