Overview

This article presents a structured approach to calculating the price of commercial property, highlighting the critical significance of factors such as location, income potential, and market conditions. It details methods like the Income Capitalization Method, offering step-by-step calculation techniques that illustrate how to accurately assess property value. This ensures that investors can make informed decisions in the commercial real estate market.

Introduction

Grasping the intricacies of commercial property valuation is essential for investors aiming to make informed decisions in a competitive market. Factors such as location, income potential, and market conditions play pivotal roles in this process. By mastering the calculation of property prices, investors can unlock significant financial opportunities.

However, how can one effectively navigate the complexities of valuation methods and market fluctuations to ensure accurate assessments? This article explores the essential steps and strategies for calculating the price of commercial property, equipping readers with the knowledge necessary to thrive in the real estate landscape.

Understand Commercial Property Valuation Basics

The assessment of commercial real estate includes understanding how to calculate price of commercial property that is utilized for business purposes. Several critical elements significantly influence how to calculate price of commercial property, including:

- Location

- Asset size

- Income potential

- Prevailing market conditions

As we approach 2025, emerging trends indicate an increasing emphasis on location, with properties situated in high-demand areas commanding premium prices. Grasping essential terms such as Net Operating Income (NOI), Capitalization Rate (Cap Rate), and Gross Rent Multiplier (GRM) is vital for understanding how to calculate price of commercial property accurately.

Net Operating Income (NOI) reflects the total income generated from a real estate asset after deducting operating expenses. In Melbourne, business assets have shown resilience with an average NOI, indicative of the city’s robust economic landscape. The Cap Rate, which is essential for investors and relates to how to calculate price of commercial property by dividing the NOI by the asset's value, serves as a crucial metric for assessing potential returns.

Expert insights underscore the importance of factors such as market demand, asset condition, and economic indicators in shaping real estate assessments. As industry experts assert, 'Real estate is a timeless asset, constantly appreciating in worth,' highlighting the long-term investment potential inherent in commercial real estate.

Real-world examples further illustrate the significance of NOI in valuation. Consider a business asset generating an NOI of $150,000 with a Cap Rate of 6%; this would yield an estimated market value of $2.5 million. Such calculations underscore the importance of understanding how to calculate price of commercial property, which involves both income potential and market dynamics in determining real estate values. Notably, 90% of millionaires achieve their wealth through real estate ownership, emphasizing the wealth-generating potential of commercial assets.

For small business owners, comprehending financing options is equally crucial. If your business operates under a lease or lacks a physical structure, you may need to tap into cash reserves or equity from other assets to secure funding for acquisitions. Additionally, refinancing opportunities can provide access to funds by leveraging the equity in your existing assets. By familiarizing yourself with these concepts and the diverse range of lenders available, including high street banks and private lending panels, you will be well-equipped to navigate the complexities of real estate valuation and financing effectively.

Explore Key Methods for Calculating Property Price

Calculating the price of commercial properties involves several key methods that can significantly impact your investment decisions:

- Income Capitalization Method: This approach evaluates the asset's worth based on its income-generating potential. By calculating the Net Operating Income (NOI) and dividing it by the desired Capitalization Rate (Cap Rate), you can learn how to calculate the price of commercial property and gain insight into the property's financial viability.

- Comparable Sales Method: This technique examines recent transactions of similar assets within the area to establish a fair market value. By analyzing these comparables, you can understand how to calculate the price of commercial property and make informed pricing decisions that reflect current market conditions.

- Cost Approach: This method assesses value based on the cost to replace the asset, taking into account depreciation and land value. Understanding how to calculate the price of commercial property can provide a solid foundation for evaluating your investment.

- Gross Rent Multiplier (GRM): A straightforward approach, the GRM is calculated by dividing the sale price of the asset by its gross rental income. This multiplier can then be applied to comparable assets, which helps in understanding how to calculate the price of commercial property for potential investments.

By familiarizing yourself with these methods, you can make more informed decisions in the commercial property market. Which method aligns best with your investment strategy?

Apply Step-by-Step Calculation Techniques

To calculate the price of a commercial property using the Income Capitalization Method, follow these essential steps:

- Determine the Net Operating Income (NOI): Start by calculating the total income generated from the asset, then deduct all operating expenses. For instance, if an asset generates $100,000 in rental income and incurs $30,000 in expenses, the NOI would be $70,000.

- Select a Suitable Capitalization Rate: Research the market to identify an appropriate Cap Rate for similar assets. In Melbourne, the average Cap Rate for commercial real estate in 2025 is expected to be approximately 7%, which can be utilized for your calculations.

- Calculate the Property Value: Divide the NOI by the selected Cap Rate. Using the earlier example, $70,000 divided by 0.07 yields an asset worth roughly $1,000,000.

- Cross-Verify with Comparable Sales: Review recent sales of similar properties to ensure your assessment aligns with current market trends. This step is crucial as it helps confirm that your calculated value is realistic and competitive within the market.

Understanding how to calculate the price of commercial property is vital for making informed investment choices in real estate, as precise valuation directly impacts potential returns. Furthermore, when creating tailored loan proposals to secure funding for business investments, it is essential to examine the full range of lenders available and explore refinancing options to meet the evolving needs of your enterprise.

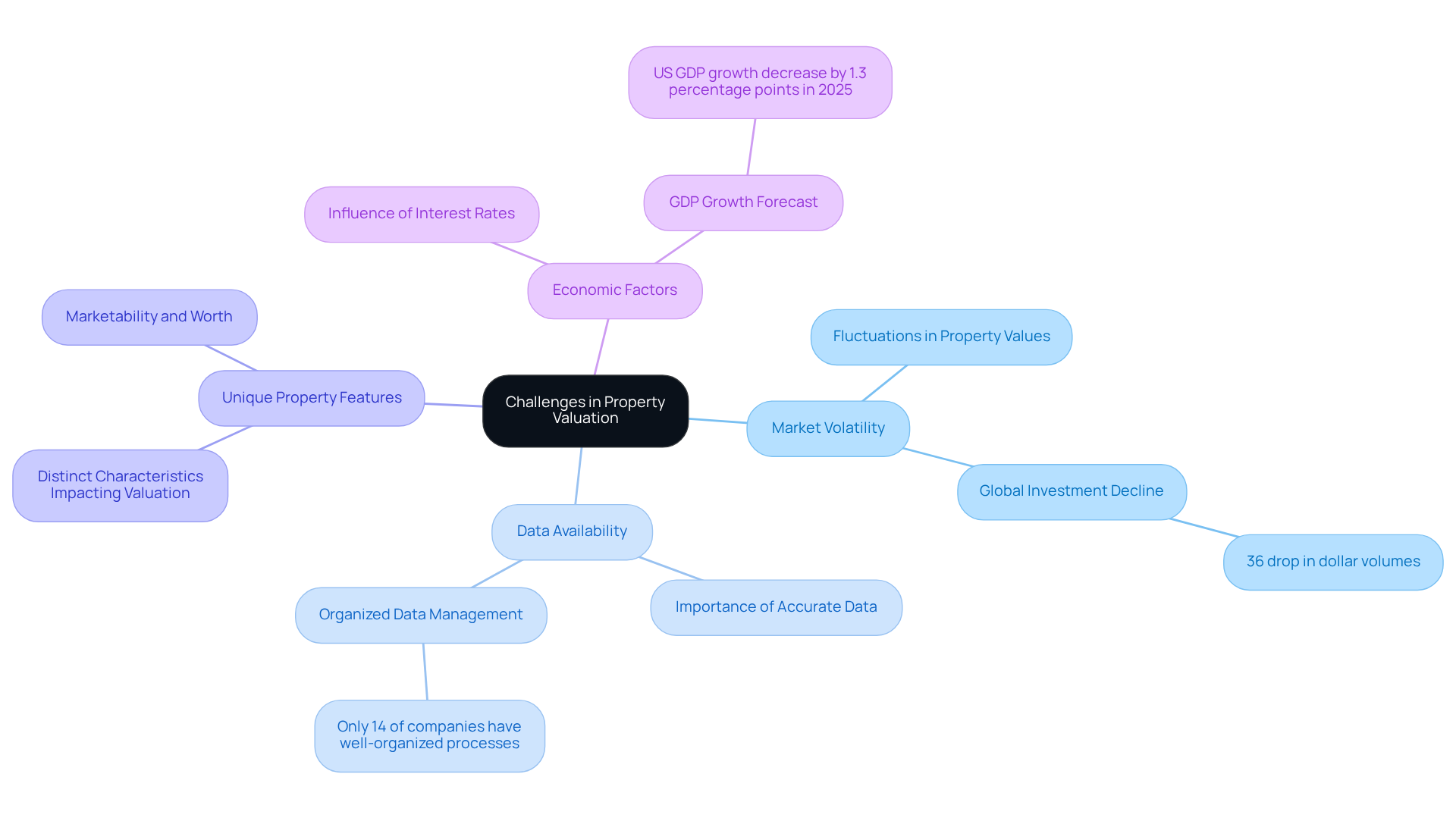

Navigate Challenges in Property Valuation

Valuing commercial properties requires navigating several challenges that can significantly impact the accuracy of your assessments:

- Market Volatility: Fluctuations in the market can lead to unpredictable changes in property values. Staying informed about current market trends is essential for adjusting your calculations effectively. For instance, dollar volumes for global real estate investment fell by 36% year over year to US$1.2 trillion in 2023, highlighting the importance of being aware of market conditions.

- Data Availability: Access to precise and complete data is essential for effective assessment. Utilize multiple sources to gather information on comparable sales and prevailing market conditions. However, challenges remain, as only 14% of companies have well-organized data management processes, which can impede the dependability of your assessment efforts.

- Unique Property Features: Properties with distinctive characteristics may not align with typical assessment models. It is essential to take into account these unique features when implementing assessment techniques, as they can greatly affect the marketability and worth of the asset.

- Economic Factors: Broader economic conditions, such as interest rates and employment rates, play a critical role in influencing real estate worth. For instance, Deloitte’s economics team forecasts that the United States is anticipated to experience GDP growth decrease by 1.3 percentage points in 2025, which could influence business real estate assessments. Observing these economic indicators will offer insights into possible changes in real estate values.

By addressing these challenges, you can enhance your approach to how to calculate price of commercial property and make more informed investment decisions.

Conclusion

Understanding how to calculate the price of commercial property is an essential skill for investors aiming to navigate the complexities of the real estate market. By mastering this process, investors can make informed decisions that maximize returns and capitalize on financial opportunities. This article details the essential steps and methodologies required for accurate property valuation, emphasizing the importance of factors such as location, income potential, and market conditions.

Key insights discussed include various methods for determining property value, such as:

- Income Capitalization Method

- Comparable Sales Method

- Cost Approach

- Gross Rent Multiplier

Each method offers unique advantages that can significantly affect investment outcomes. Furthermore, the article highlights the challenges faced during property valuation, including:

- Market volatility

- Data availability

- The impact of economic factors

By addressing these challenges, investors can enhance their valuation strategies and ensure more reliable assessments.

Ultimately, the ability to accurately calculate the price of commercial property empowers investors and opens the door to wealth-building opportunities. As the real estate landscape evolves, staying informed and adapting to market conditions will be crucial. Embracing these valuation techniques and understanding their implications can lead to smarter investment choices and long-term financial success in the commercial property sector.