Overview

This article highlights four essential practices that significantly enhance the effectiveness of SMSF property lending:

- Understanding eligibility is paramount, as it lays the foundation for leveraging benefits effectively.

- Navigating the application process can be complex, yet it is crucial for ensuring compliance with regulations.

- By outlining these practices, the article emphasizes that thorough preparation and adherence to legal frameworks are vital for maximizing investment potential.

- Furthermore, safeguarding retirement savings within SMSF property ventures requires a strategic approach.

Are you prepared to take full advantage of these insights to secure your financial future?

Introduction

In the realm of retirement planning, self-managed super funds (SMSFs) are revolutionizing property investment. By empowering individuals to leverage their superannuation savings for real estate—particularly in the commercial sector—SMSFs present a distinctive opportunity to build wealth while enjoying substantial tax benefits.

However, successfully navigating the complexities of SMSF property lending necessitates a solid understanding of regulations, compliance, and strategic investment choices. This article explores the essential components of SMSF property lending, the advantages it offers, and the critical steps for effectively securing funding for commercial properties.

By doing so, we ensure that investors are well-equipped to optimize their retirement savings.

Understand SMSF Property Lending Basics

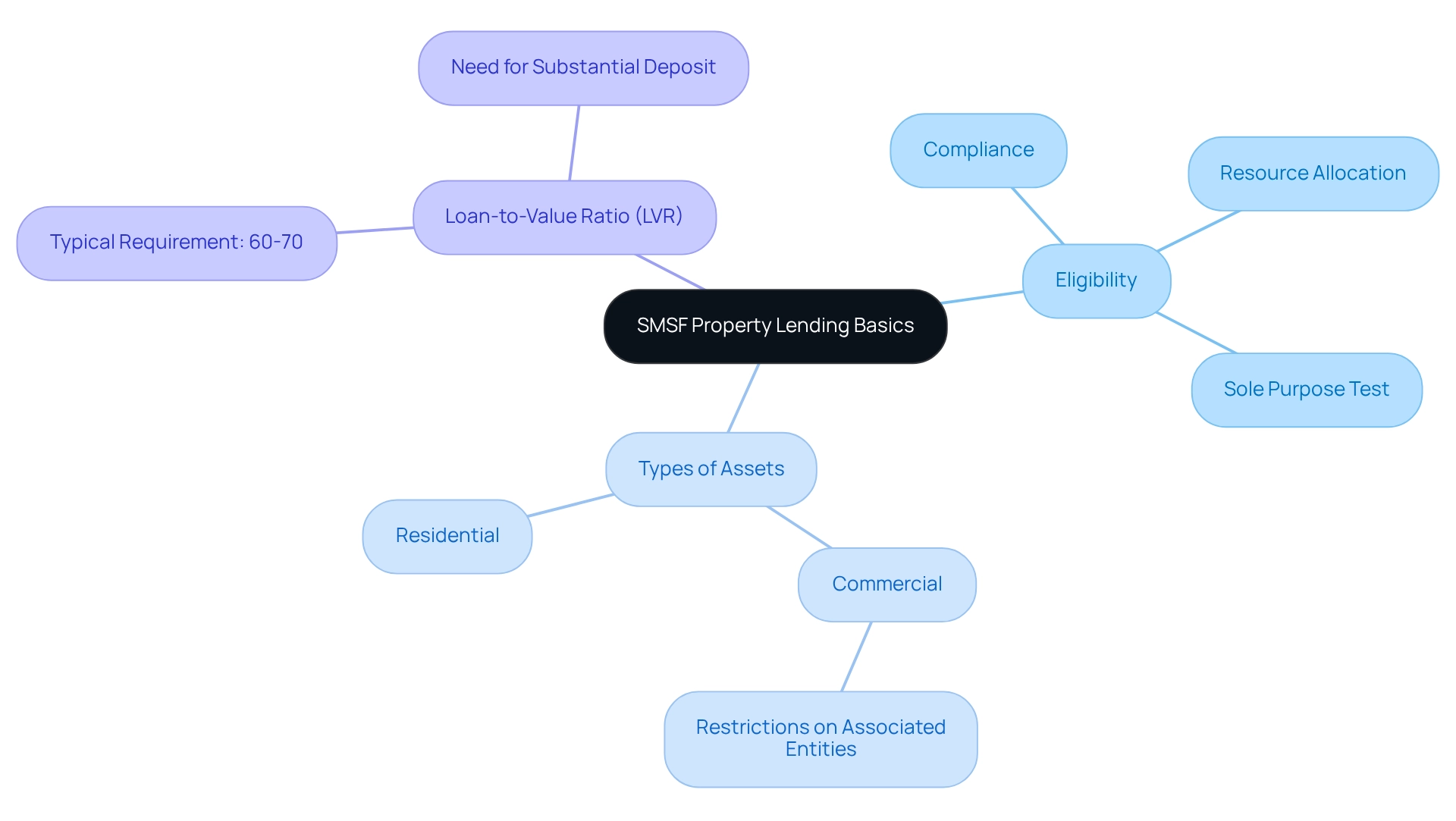

SMSF property lending empowers individuals to leverage their superannuation savings for real estate investments, particularly in commercial assets such as office buildings, warehouses, and retail locations. A pivotal element of SMSF lending is the Limited Recourse Borrowing Arrangement (LRBA), which allows the SMSF to borrow funds for property acquisitions while restricting the lender's recourse solely to the asset itself. Understanding the key components of SMSF lending is essential:

- Eligibility: To qualify, the SMSF must be established and compliant with relevant regulations, ensuring it meets all legal requirements. This includes a clear strategy for resource allocation and adherence to the sole purpose test, which mandates that the fund's primary objective is to provide retirement benefits.

- Types of Assets: SMSFs can invest in both residential and commercial assets; however, there are fewer restrictions on commercial allocations compared to residential ones. Notably, SMSFs are prohibited from acquiring real estate from associated entities, which helps maintain compliance with superannuation regulations regarding SMSF property lending.

- Loan-to-Value Ratio (LVR): Most lenders typically require an LVR of 60-70%, necessitating that the SMSF provides a substantial deposit to secure financing.

Grasping these fundamentals is crucial for anyone contemplating SMSF property lending involvement, as they lay the groundwork for more in-depth discussions on effectively utilizing these loans. At Finance Story, we are dedicated to providing expert guidance, helping you build a compelling case and ensuring compliance with regulations as you seek the right lender for your commercial real estate needs. Thorough preparation and a careful assessment of future requirements are vital for achieving success in real estate ventures within this framework.

Leverage Benefits of SMSF Loans for Property Investment

Utilizing SMSF property lending for property investment presents numerous advantages that can significantly enhance retirement savings.

-

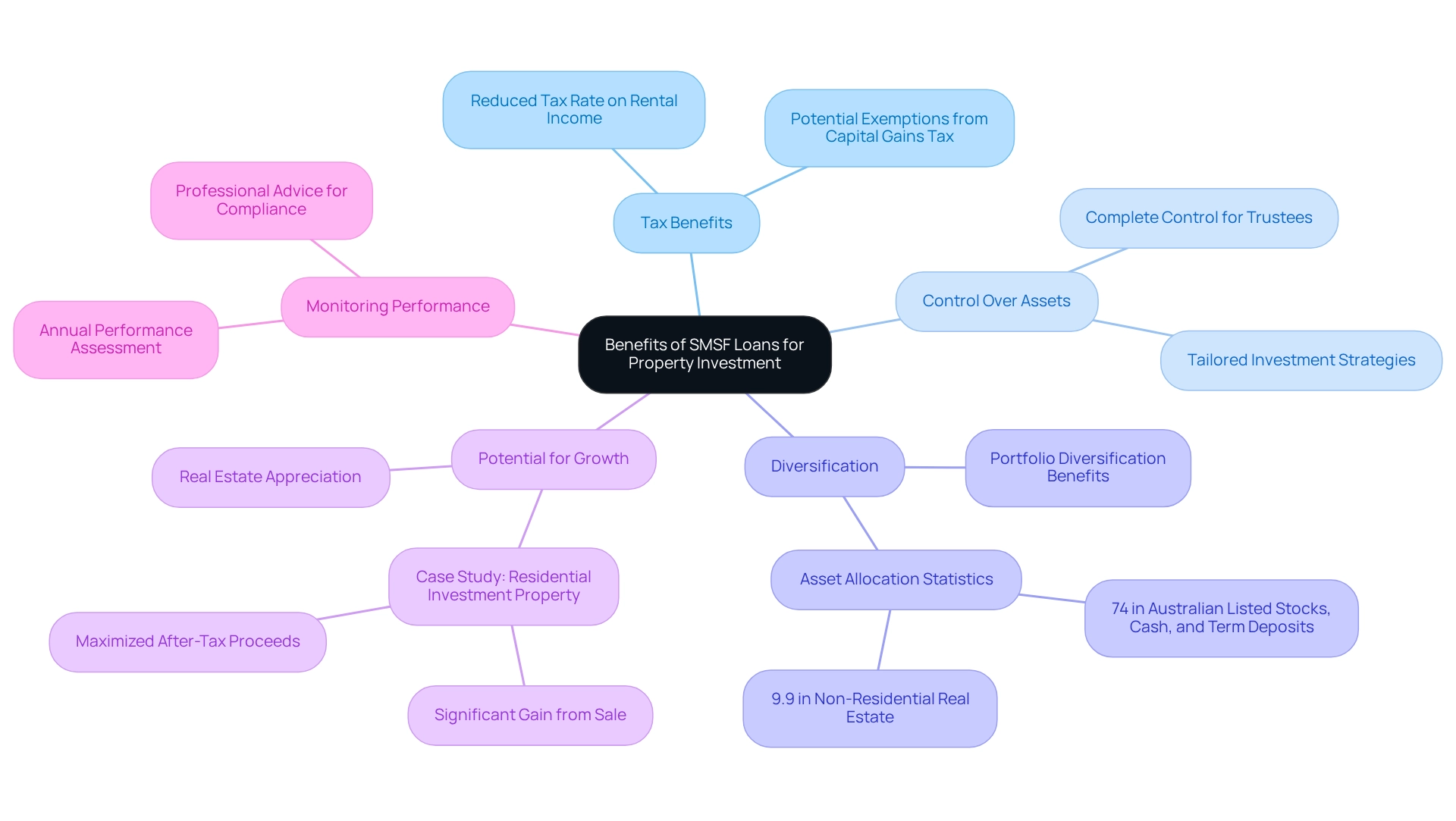

Tax Benefits: SMSFs benefit from a favorable tax regime, including a reduced tax rate on rental income and potential exemptions from capital gains tax upon retirement. This can lead to substantial savings and increased wealth accumulation.

-

Control Over Assets: Trustees of SMSFs maintain complete control over their asset choices, enabling them to implement tailored strategies that align with their unique financial objectives. This autonomy is crucial for optimizing investment performance.

-

Diversification: Investing in real estate through a self-managed super fund enables portfolio diversification, which can reduce risks and enhance long-term gains. With 9.9% of self-managed superannuation fund assets assigned to non-residential real estate and 74% of self-managed superannuation fund assets invested in Australian listed stocks, cash, and term deposits, this approach is becoming increasingly favored among knowledgeable investors.

-

Potential for Growth: Real estate typically appreciates over time, providing a robust foundation for retirement savings. A significant case study demonstrates this: a self-managed superannuation fund with two members effectively utilized their resources to purchase a residential asset, which increased in value considerably. Upon selling, they maximized their after-tax proceeds by strategically timing the sale around their retirement. Finance Story can assist in developing customized funding solutions for both first-time purchasers and experienced investors, ensuring optimal strategies.

-

Monitoring Performance: Regularly assessing the performance of self-managed superannuation fund real estate holdings is vital to ensure alignment with retirement objectives, assisting trustees in making informed choices regarding their portfolios. Finance Story also provides professional advice for navigating commercial real estate ventures, ensuring adherence to regulations and aiding in lender selection.

As Aoife Reilly points out, "The lender will evaluate the asset’s value, income, and location to decide if it’s qualified." These compelling benefits make SMSF property lending an appealing option for individuals aiming to optimize their superannuation investments and secure a prosperous financial future.

Navigate the SMSF Loan Application Process

Navigating the SMSF property lending application process involves several essential steps that can significantly enhance your chances of securing funding for commercial property investments.

-

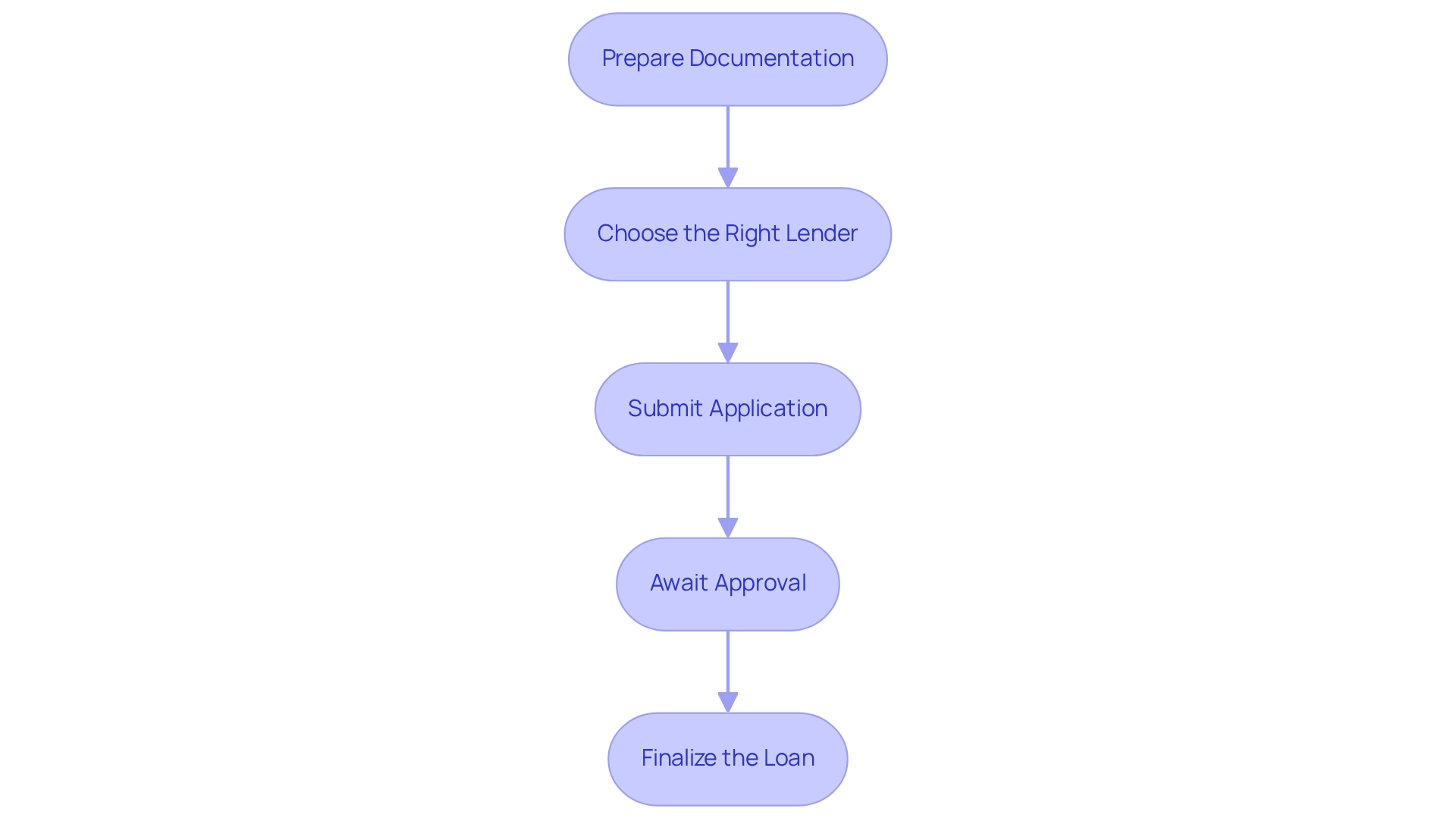

Prepare Documentation: Begin by gathering all necessary documents, including the trust deed, financial statements, and comprehensive details about the commercial real estate being acquired, such as office buildings, warehouses, and retail spaces. Proper documentation is crucial, as it lays the groundwork for a seamless application process. Finance Story can assist in ensuring your documentation meets compliance standards.

-

Choose the Right Lender: Conduct thorough research to identify lenders who specialize in self-managed super fund loans for commercial properties. Compare their terms, interest rates, and fees to discover the most suitable option for your financial situation. Engaging with lenders who understand the intricacies of SMSF property lending can provide valuable insights. Finance Story is here to help you build a compelling case to present to potential lenders.

-

Submit Application: Complete the loan application with meticulous attention to detail, ensuring that all information is accurate and comprehensive. Incomplete or incorrect applications can lead to delays or rejections, making precision paramount. Finance Story can guide you through this process to enhance your chances of approval.

-

Await Approval: After submission, the lender will evaluate the application. Be prepared for potential requests for additional information, as this is a common part of the assessment process. Proactive involvement with self-managed superannuation fund experts, such as those at Finance Story, can help resolve any issues that may arise during this phase. As noted by Shelley Banton, head of technical for ASF Audits, "These factors will likely play a key role in influencing investor sentiment and self-managed super fund performance in the coming months."

-

Finalize the Loan: Once approved, carefully review the loan agreement before signing. Ensure that all terms are clearly understood to prevent misunderstandings and ensure a smooth lending experience.

It's also essential to recognize the potential risks associated with self-managed superannuation fund lending, including financial risk, cash flow difficulties, and personal guarantees. By understanding these risks and following these steps, borrowers can navigate the loan application process for SMSF property lending more efficiently, thereby increasing their likelihood of obtaining the necessary financing for real estate investments.

Furthermore, understanding the distinction between repairs and enhancements on self-managed superannuation fund assets is vital, as repairs can be promptly deducted while enhancements must be capitalized, affecting the fund's taxable income and overall tax strategy. By adhering to these guidelines and seeking expert advice from Finance Story, small business owners can enhance their self-managed super fund loan application experience.

BOOK A CHAT.

Ensure Compliance with SMSF Regulations

Adherence to self-managed superannuation fund regulations is crucial for successful real estate ventures, particularly when it comes to SMSF property lending for commercial assets. Key considerations include:

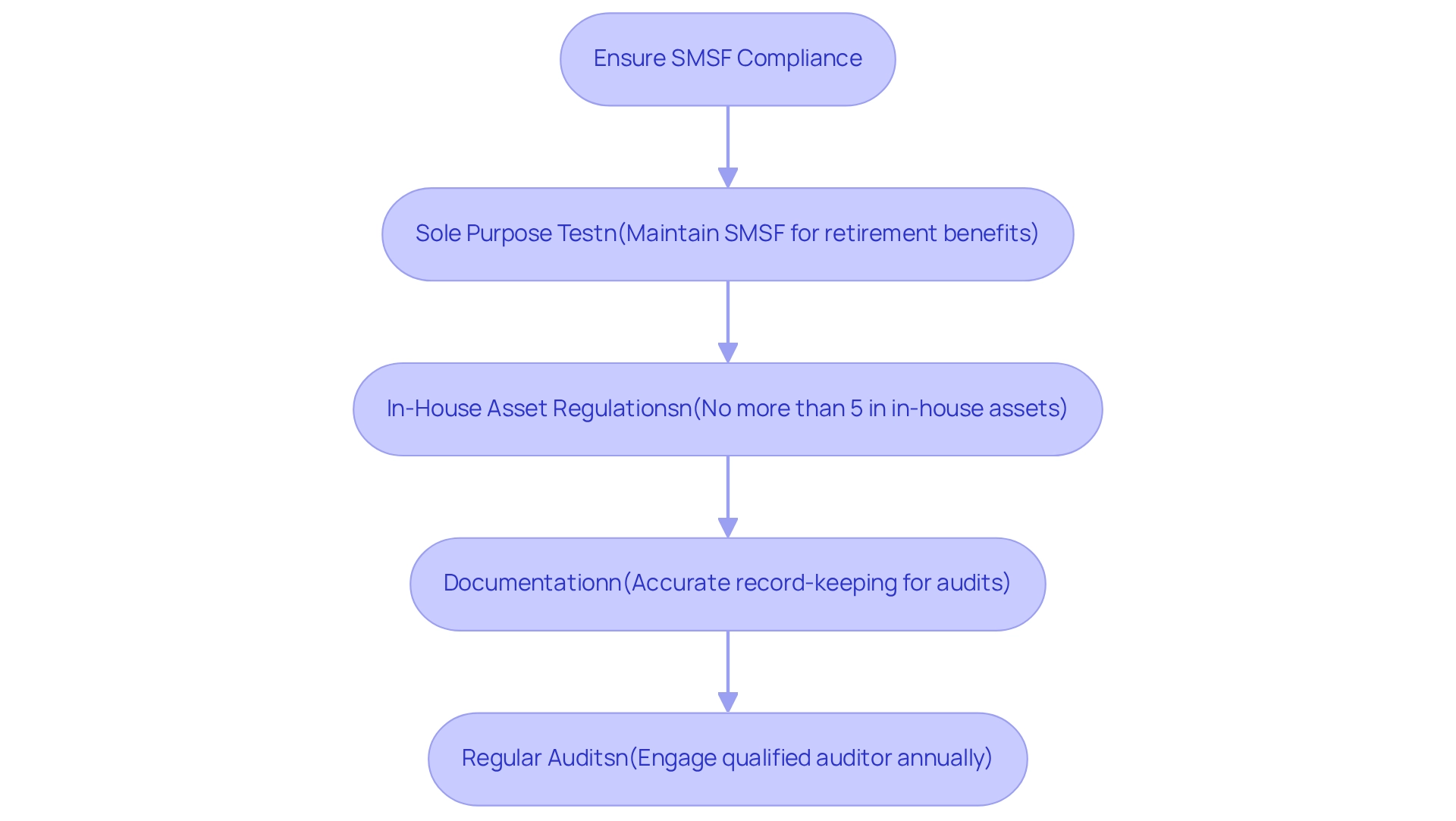

- Sole Purpose Test: The SMSF must be maintained exclusively for providing retirement benefits to its members, ensuring that all investments align with this objective.

- In-House Asset Regulations: To ensure adherence, no more than 5% of the fund's total assets can be allocated to in-house assets, which includes properties owned by associated parties. This regulation helps prevent conflicts of interest and ensures that the fund's primary focus remains on retirement benefits.

- Documentation: Accurate record-keeping of all transactions and decisions made by the fund is crucial. This documentation acts as proof of adherence during audits and assists in monitoring the fund's performance.

- Regular Audits: Engaging a qualified superannuation fund auditor for annual audits is vital. These audits confirm adherence to regulatory requirements and offer a chance to tackle any adherence issues proactively.

By emphasizing these regulatory steps, trustees can safeguard their investments and improve the sustainability of their retirement funds. Significantly, recent statistics show that adherence rates for SMSFs have improved, reflecting a growing awareness among trustees of the importance of following regulations. Moreover, 85% of self-managed super fund members are 45 years or older, highlighting the importance of adherence in building trust among this group regarding their long-term wealth management plans. The establishment of new SMSFs has seen a notable increase, particularly in New South Wales, where they accounted for 36.9% of total new establishments, suggesting a shift in regional dynamics that advisers can leverage to tailor their services effectively. As Shelley Banton, Head of Technical for ASF Audits, noted, "Reduced closures combined with higher returns suggest that SMSF members are gaining confidence in long-term wealth management strategies." This reinforces the importance of compliance in achieving successful property investment with SMSF property lending.

Conclusion

The exploration of self-managed super funds (SMSFs) for property investment unveils a transformative approach to retirement planning, particularly within the commercial property sector. Grasping the fundamentals of SMSF property lending—such as eligibility requirements, the types of properties eligible for purchase, and the implications of Limited Recourse Borrowing Arrangements (LRBAs)—is essential for prospective investors.

The benefits of utilizing SMSF loans extend far beyond investment opportunities; they encompass significant tax advantages, enhanced control over investment choices, and the potential for substantial growth in retirement savings. By strategically leveraging these loans, investors can diversify their portfolios and optimize their financial outcomes.

Navigating the loan application process demands meticulous attention to detail, from preparing the necessary documentation to selecting the right lender. Furthermore, adherence to SMSF regulations is crucial for ensuring compliance and safeguarding the integrity of retirement investments. Regular audits and thorough record-keeping further underscore the importance of maintaining a compliant and sustainable investment strategy.

In conclusion, SMSFs present a powerful avenue for wealth building through property investment while delivering essential tax benefits and control that can significantly enhance retirement savings. By comprehending the complexities of SMSF property lending and committing to compliance, investors can confidently embark on a journey toward a prosperous financial future.