Overview

The article presents a comprehensive overview of four distinct financing options for launching a business:

- Self-funding

- Crowdfunding

- Bank loans

- Venture capital

Each option offers unique advantages and challenges that entrepreneurs must navigate. By highlighting the critical need for a strategic approach to funding, the article underscores how a thorough understanding of these options can significantly enhance a startup's prospects for success in a competitive marketplace.

Introduction

In the competitive landscape of startups, securing adequate financing often delineates the line between success and failure. Entrepreneurs encounter a multitude of challenges, ranging from high initial costs to unpredictable cash flow, making effective financial strategies a critical component of their journey. With concerning statistics revealing that nearly 20% of startups fail within their first two years, grasping the intricacies of financing options becomes essential.

From self-funding and crowdfunding to traditional bank loans and venture capital, each avenue presents unique opportunities and risks that can significantly shape the future of a business. By delving into these diverse funding strategies, entrepreneurs can better navigate the complexities of the startup ecosystem, enhancing their chances of long-term growth and sustainability.

Are you ready to explore the financing options that could transform your startup's future?

Understanding the Importance of Financing for Startups

Funding serves as the cornerstone for any new venture, empowering creators to transform innovative concepts into successful enterprises. Insufficient funding can hinder even the most promising ideas from gaining traction. Startups face unique challenges, such as high initial costs, unpredictable cash flow, and the urgent need for rapid scaling.

Statistics reveal that approximately 20% of new ventures fail within their first two years, with this figure escalating to 75% within 15 years. This underscores the critical necessity for effective monetary strategies. The high failure rate of new ventures emphasizes the importance of continuous evaluation and adaptation of business strategies to enhance survival rates.

Understanding the significance of financing enables business owners to explore four financing options to launch their ventures, accurately assess their financial needs, and formulate a strategic plan for securing essential capital. This foundational knowledge is vital for navigating the complexities of the entrepreneurial landscape. Furthermore, insights from industry leaders indicate that successful entrepreneurs frequently employ diverse financing strategies to bolster their chances of success.

For instance, entrepreneurs with prior experience in launching successful enterprises achieve a business success rate of approximately 30% when pursuing new endeavors, highlighting the value of experience in securing funding.

As new ventures face persistent funding challenges, including competition for investor interest—where the average venture capital firm receives over 1,000 proposals annually—it is crucial to adopt a proactive approach. Additionally, the U.S. is home to 49% of all unicorn enterprises, illustrating the significance of successful ventures within the funding ecosystem. By grasping these dynamics and the critical role of financing, entrepreneurs can position themselves for long-term sustainability and growth in an increasingly competitive market.

At Finance Story, we recognize the unique challenges faced by new businesses and are committed to providing tailored commercial and residential lending solutions. Under the leadership of Shane, our Founder and Funding Specialist Director, we leverage his extensive expertise in business expansion and customized financial solutions to assist new ventures in overcoming these obstacles. Our relationship-focused support ensures that business owners receive the guidance necessary to secure the funding essential for their success.

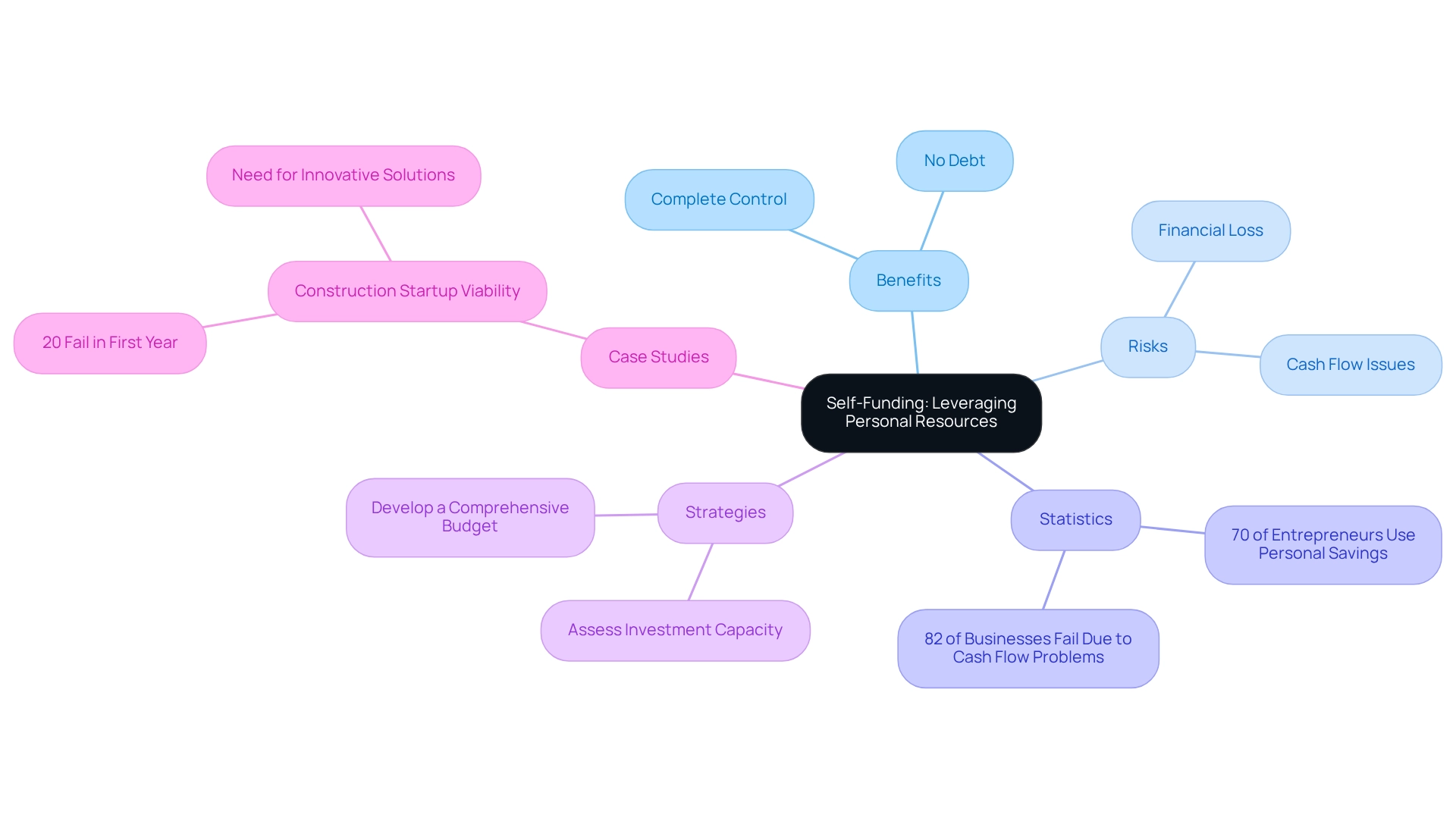

Self-Funding: Leveraging Personal Resources

Self-funding, often referred to as bootstrapping, is a financing approach where individuals leverage personal savings or assets to launch their businesses. This method provides complete control over the business, effectively sidestepping the pitfalls of debt and equity dilution. However, it is crucial to acknowledge the inherent risks; if the venture does not succeed, business owners may endure substantial financial losses, including the depletion of their personal savings.

Statistics reveal that approximately 70% of entrepreneurs rely on personal savings as their primary funding source, underscoring the significance of self-funding within the business ecosystem.

Furthermore, a case study on self-funded startups indicates that those who bootstrap often exhibit a heightened level of commitment to their ventures, which can be appealing to potential investors. Nonetheless, it is vital to recognize that 82% of businesses that failed did so due to cash flow issues, emphasizing the risks associated with self-funding and the necessity for a robust financial plan.

For entrepreneurs managing a leasehold venture or lacking physical assets to leverage, utilizing cash savings or the equity in owned property becomes essential. For example, an entrepreneur with a residence valued at $1.3 million and $300,000 owed could potentially access $740,000 in equity by borrowing up to 80% LVR. This equity can be combined with personal savings to finance company acquisitions, paving a path to economic stability even in the absence of commercial property.

To effectively harness personal resources, entrepreneurs should develop a comprehensive budget and monetary plan. This strategy not only aids in managing expenses but also ensures that the business can withstand the initial stages of operation. Moreover, it is crucial to assess how much one can realistically invest without jeopardizing personal financial stability.

While self-funding provides the advantage of maintaining control, it also comes with considerable risks. Entrepreneurs must carefully weigh these factors. As industry experts have noted, a well-conceived financial strategy can mitigate risks and enhance the likelihood of success.

For instance, a recent analysis highlighted that startups in the construction sector, where 20% fail within their first year, often prosper when they adopt innovative funding strategies, including self-funding. This sentiment is echoed by Indra Nooyi, CEO of PepsiCo, who stated, "Just because you are CEO, don't think you have landed. You must continually increase your learning, the way you think, and the way you approach the organization."

In summary, self-funding is one of the four financing options available for starting a business that can be viable for owners willing to invest their personal resources. By understanding the advantages and risks, and by implementing a solid financial plan, entrepreneurs can navigate the challenges of starting a business more effectively, particularly when exploring the four financing options that utilize property equity and cash savings.

Crowdfunding: Tapping into Community Support

Crowdfunding represents a dynamic financing approach that enables business owners to gather small sums of money from a vast number of people, primarily via online platforms. This method not only secures essential funding but also serves as an effective marketing tool, allowing entrepreneurs to gauge interest in their product or service prior to launch. Prominent platforms like Kickstarter and Indiegogo empower creators to showcase their concepts and attract supporters who resonate with their vision.

Successful crowdfunding campaigns are marked by several key elements:

- Compelling storytelling

- Well-defined goals

- Enticing rewards for backers

For example, the comics category on Kickstarter boasts an impressive success rate of 66.14%, while other categories also demonstrate significant potential. Entrepreneurs must conduct thorough research on various crowdfunding platforms to identify the best fit for their projects, taking into account factors such as audience demographics and platform fees.

Notably, 64% of Kickstarter backers are male, 88% are college-educated, and the largest age group of backers is 25 to 34 years old. These insights are invaluable for understanding the target audience for crowdfunding campaigns.

To maximize visibility and support, a robust campaign strategy is essential. This includes targeted marketing and outreach efforts, which can significantly enhance the chances of success. In 2025, the average amount raised through crowdfunding campaigns is projected to reach substantial figures, with dance projects alone garnering $16.28 million in pledges.

Additionally, case studies, such as the $106 million raised on GoFundMe for natural disaster relief in 2023, illustrate the power of community support through crowdfunding. This emphasizes how collective efforts can mobilize significant financial resources for urgent needs.

As Lyn Wildwood, a member of the Blogging Wizard content team, notes, "Crowdfunding has become a popular way to generate money for a variety of different purposes, personal and professional." By leveraging these insights and strategies, entrepreneurs can effectively navigate the crowdfunding landscape, transforming their innovative ideas into reality while fostering a supportive community around their ventures.

Bank Loans: Navigating Traditional Financing

Bank loans represent one of the four primary financing options available to entrepreneurs looking to start a business, providing substantial capital to drive growth. However, the path to securing a loan can be challenging, often necessitating a robust business plan, a solid credit history, and adequate collateral. Entrepreneurs should begin by meticulously preparing the necessary documentation, which includes financial statements, comprehensive business plans, and realistic economic projections.

Understanding the different types of loans is essential when evaluating the four financing options for starting a business. Secured loans, which are backed by collateral, generally offer lower interest rates, while unsecured loans, which do not require collateral, may come with higher rates but can be more accessible for startups lacking substantial assets. It is crucial to compare interest rates and terms across various lenders to ensure the most favorable financial outcome.

Establishing a rapport with a bank representative can significantly enhance the loan application process. These professionals can offer valuable insights into the specific lending criteria of the bank and assist entrepreneurs in navigating the often-complex application landscape. Moreover, the ability to articulate the business model and repayment strategy clearly is vital; this clarity can greatly improve the chances of loan approval.

Recent statistics reveal that bank loan approval rates for new businesses have gradually increased in 2025, indicating a more favorable lending environment. On average, new ventures can anticipate loan amounts starting from Rs. 10 crores and above, contingent on their business model and economic health.

Successful case studies highlight new ventures that have adeptly secured bank loans through the four financing options available, demonstrating robust planning and a clear pathway to profitability. These examples underscore the importance of preparation and strategic communication in the lending process.

As Anna Bligh, CEO of the Australian Banking Association, noted, "This Budget provides extra support to Australians in the short-term whilst at the same time helping to address some of our longer-term challenges." This statement underscores the importance of recent monetary initiatives that could positively impact new businesses seeking loans. Additionally, the Australian Banking Association's response to the Federal Budget illustrates how these initiatives aim to maintain trust in the financial system, which is crucial for new businesses seeking funding.

Finance Story is well-equipped to assist startups in navigating these components efficiently, leveraging its expertise to develop refined and tailored cases for presentation to banks. By understanding loan repayment criteria and securing customized commercial loans for property investments—including warehouses, retail spaces, factories, and hospitality ventures—Finance Story helps clients access the best financing options available. Furthermore, we provide a comprehensive range of lenders, including high street banks and innovative private lending panels, to meet the diverse needs of our clients, including refinancing options to adapt to their evolving requirements.

Venture Capital: Attracting Investors for Growth

Venture capital (VC) serves as a pivotal funding avenue for startups, involving investments from individuals or firms in exchange for equity stakes in the company. This funding is particularly suited for enterprises with high growth potential that require substantial capital to scale effectively. To attract venture capital, entrepreneurs must craft an engaging economic model and present a robust management team alongside a clear path to profitability.

Networking is essential for securing VC funding. Actively participating in industry events and forging connections with potential investors can significantly improve funding prospects. Entrepreneurs should also prepare a comprehensive pitch deck that effectively communicates their business plan, market analysis, and financial projections.

This preparation is crucial, as venture capitalists typically seek rapid growth and have specific exit strategies in mind. Recent trends indicate a resurgence in venture capital distributions, with 2025 poised to witness increased activity driven by a recovering IPO market and notable acquisitions. As new businesses mature and achieve growth milestones, they present more opportunities for strategic exits, thereby boosting investor confidence. Notably, statistics reveal that an increasing percentage of startups are successfully securing venture capital, reflecting a positive shift in the funding landscape.

In fact, the average deal size and number of deals in the VC market are key metrics that underscore this trend. Understanding the expectations of venture capitalists is vital; they often prioritize enterprises that can demonstrate scalability and a clear strategy for returns on investment. By aligning their goals with those of potential investors, business owners can significantly enhance their chances of attracting the necessary capital to fuel their ambitions.

Additionally, insights from industry leaders, such as David Solomon, CEO of Goldman Sachs, suggest that dealmaking in M&A and equities could exceed the 10-year average in 2025, indicating a favorable environment for venture capital investments. Furthermore, the global context of venture capital is influenced by factors such as Israel's military tech expertise and Singapore's pro-business policies, which enrich the venture capital landscape and create opportunities for startups. This backdrop emphasizes the importance of understanding broader market dynamics as business founders strive to attract funding. Finance Story's reputation for professionalism and deep expertise in the finance sector positions it as a valuable partner for entrepreneurs navigating this landscape, ensuring they are well-equipped to secure the capital necessary for their ventures.

Conclusion

Navigating the complex landscape of startup financing is crucial for entrepreneurs aiming for success. This article emphasizes the vital role that various funding options play in ensuring the survival and growth of startups.

From self-funding, which offers control but carries significant risks, to crowdfunding that harnesses community support, each financing avenue presents unique opportunities and challenges. Bank loans remain a traditional yet effective choice, requiring careful preparation and understanding of lending criteria, while venture capital provides a pathway for high-growth potential businesses to scale rapidly.

Understanding these diverse financing strategies allows entrepreneurs to tailor their approaches to securing the necessary capital, ultimately enhancing their chances of long-term sustainability. With nearly 20% of startups failing within their first two years, it is evident that an informed and strategic approach to financing can make a substantial difference in a startup's trajectory.

Furthermore, the journey of entrepreneurship is fraught with challenges. However, with the right financial strategies in place, startups can overcome obstacles and thrive in a competitive environment. By leveraging personal resources, engaging with communities, navigating traditional loans, and attracting venture capital, entrepreneurs can position themselves for success. As the startup ecosystem continues to evolve, staying informed about financing options and adapting strategies accordingly will be key to unlocking potential and achieving business goals.