Overview

Securing a commercial property deposit is a critical step for potential buyers. To navigate this process effectively, consider these three essential steps:

- Evaluating your financial situation

- Creating a budget

- Gathering necessary documentation

Firstly, evaluating your financial situation allows you to understand your capabilities and limitations. Are you aware of your credit score? This knowledge is vital as it influences your funding options.

Secondly, creating a budget is crucial. It not only helps you allocate funds appropriately but also prepares you for the financial obligations that come with purchasing commercial property. Have you accounted for all potential expenses?

Finally, gathering the necessary documentation is imperative for a smooth transaction. This includes financial statements, tax returns, and any other relevant paperwork. By following these steps, you enhance your chances of successfully securing funding and completing your property transaction. Remember, preparation is key to your success in the commercial real estate market.

Introduction

Navigating the world of commercial property investments can be daunting, particularly when it comes to securing a deposit. In Melbourne, where initial payments typically range from 20% to 35% of the purchase price, understanding the intricacies of these deposits is crucial for any potential buyer. This guide unveils effective strategies and essential steps to ensure a successful deposit process, empowering investors to make informed decisions. But what challenges lie ahead in this complex landscape? How can one effectively mitigate the risks associated with commercial property deposits?

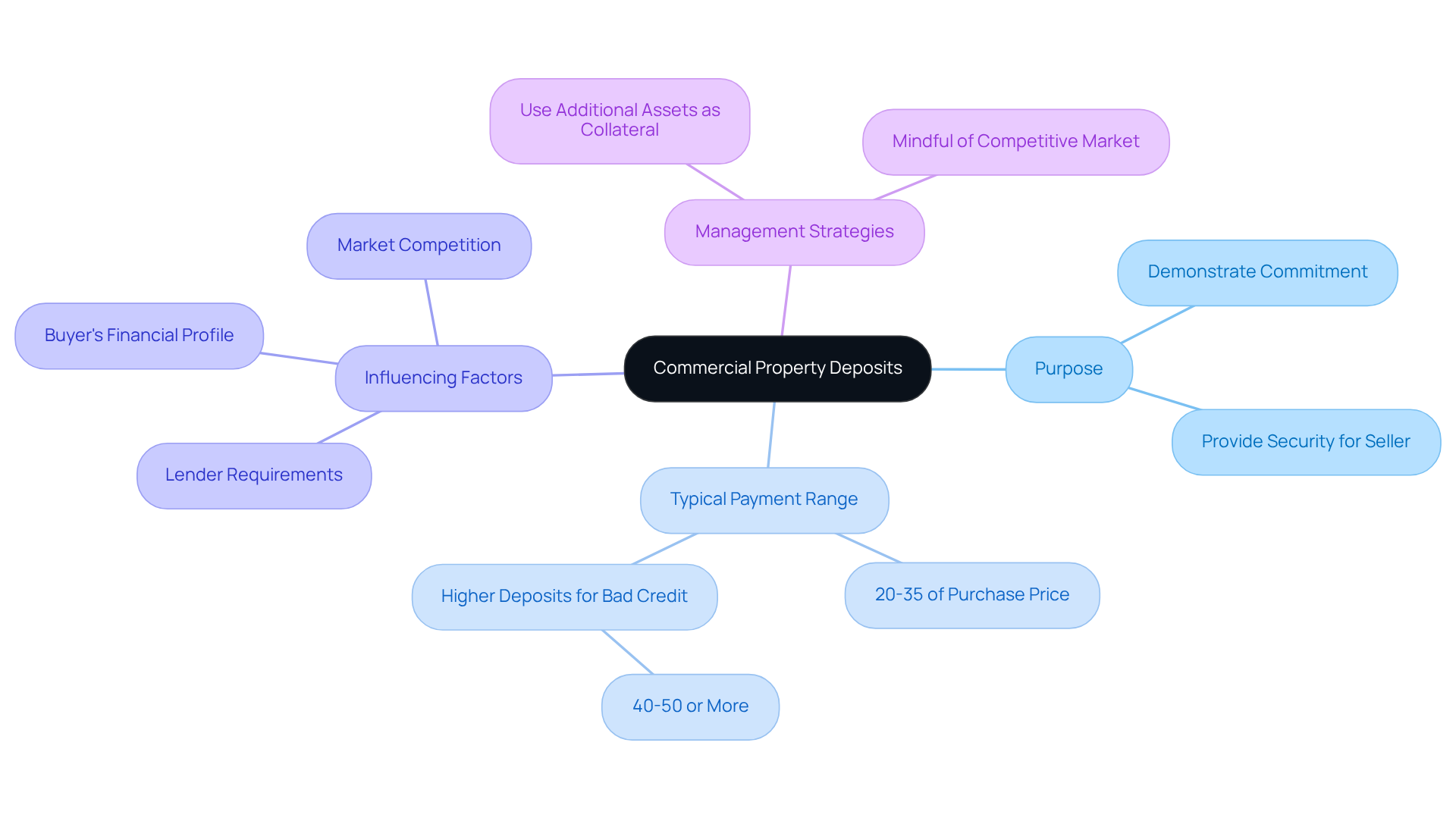

Understand Commercial Property Deposits

A commercial property deposit represents an upfront sum provided by a buyer to secure a location before finalizing the complete purchase price. In Melbourne, the average initial payment in 2025 typically ranges from 20% to 35% of the asset's purchase price, influenced by factors such as lender requirements, the buyer's financial profile, and the competitive market landscape. This payment is vital as it signifies the buyer's commitment to the transaction while providing security for the seller. It is generally held in a trust account until the sale is completed, at which point it is applied toward the purchase price.

Understanding the significance of contributions, such as a commercial property deposit, is crucial in real estate dealings. They not only demonstrate serious intent but also facilitate negotiations for favorable terms with sellers. As Michael Yardney, a prominent real estate strategist, aptly states, "Real estate investment is a game of finance with some houses thrown in the middle," underscoring the strategic nature of real estate investments.

Effective strategies for managing a commercial property deposit include utilizing additional assets as collateral, which can reduce the necessary deposit amount. For instance, leveraging residential real estate as collateral may help secure improved loan conditions. Furthermore, being mindful of the competitive market can guide buyers in making informed offers, potentially resulting in lower initial financial commitments.

In summary, comprehending the nuances of business asset payments is essential for any investor aspiring to navigate the complexities of real estate dealings successfully.

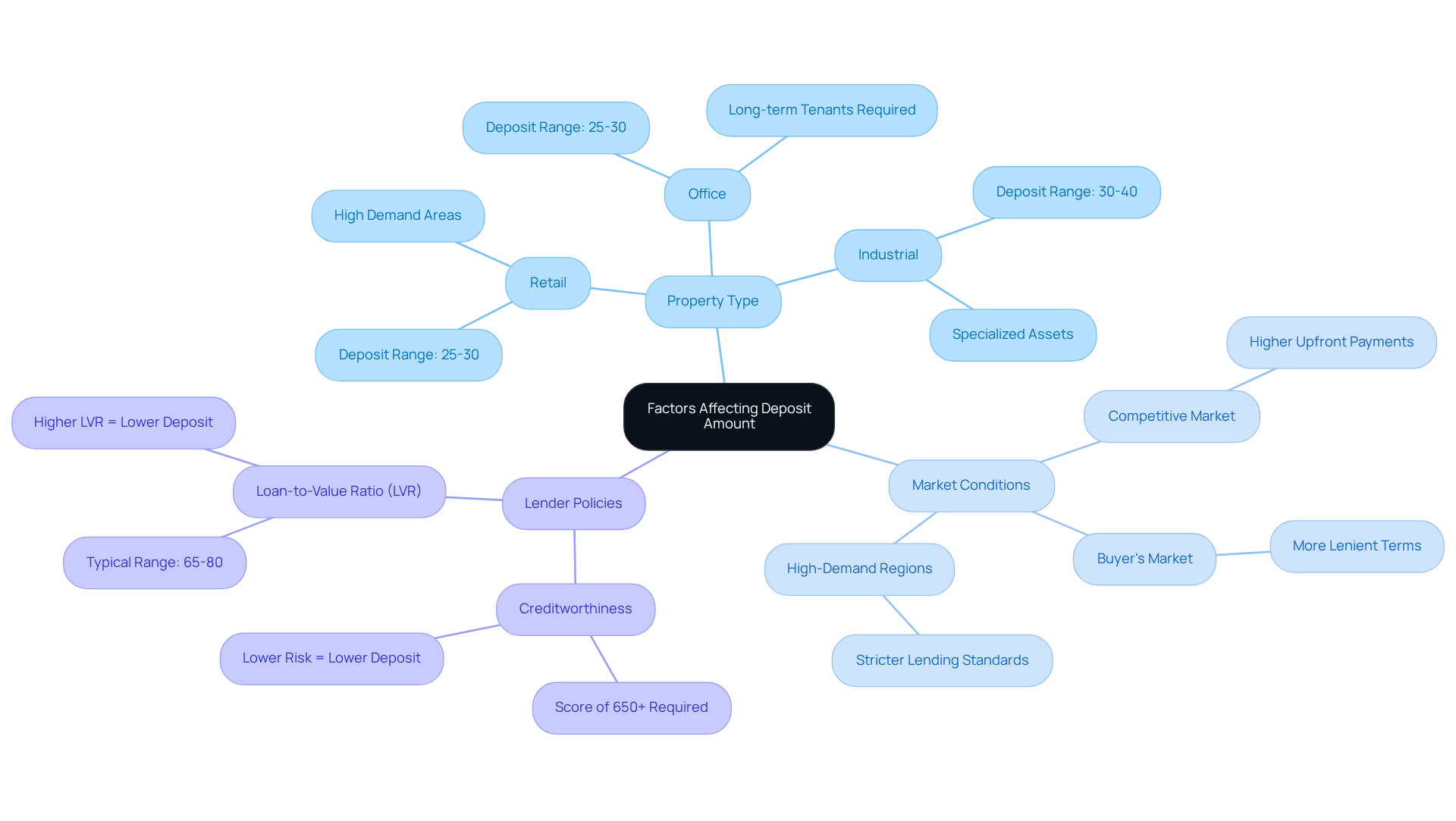

Evaluate Factors Affecting Deposit Amount

Several factors significantly influence the deposit amount required for purchasing a commercial property, including:

-

Property Type: The type of commercial property—such as retail, office, or industrial—plays a crucial role in determining deposit requirements. Specialized assets often require larger investments due to their distinct market positions and heightened risks. Retail and industrial assets may necessitate payments ranging from 25% to 40%, based on their location and demand. Established retail and office properties in Queensland generally necessitate a minimum down payment of 25-30%.

-

Market Conditions: The present market environment can significantly influence savings expectations. In a competitive market, sellers may require larger upfront payments to filter serious buyers, while a buyer's market may provide more leniency. Properties in high-demand regions generally draw more stringent lending standards, leading to increased upfront payment requirements. For example, assets in mining communities in Western Australia may need contributions of 35-45% because of perceived risks.

-

Lender Policies: Each lender has distinct criteria for funding amounts, often influenced by the buyer's creditworthiness and financial history. An immaculate credit record with a score of 650 or above is typically demanded by most lenders for business asset investments. Furthermore, lenders might necessitate larger upfront payments for assets situated beyond primary hubs because of perceived risks. The loan-to-value ratio (LVR) for business assets generally varies from 65% to 80%, additionally affecting the required upfront amounts.

Comprehending these elements is crucial for adequately preparing for the monetary obligation involved in securing a commercial property deposit. By assessing real estate type, market conditions, and lender policies, potential buyers can better estimate the amount they need to save, ultimately enhancing their investment strategy. Moreover, keeping detailed records of all monetary transactions is essential, as documentation discipline is frequently a challenge encountered by clients in obtaining funding.

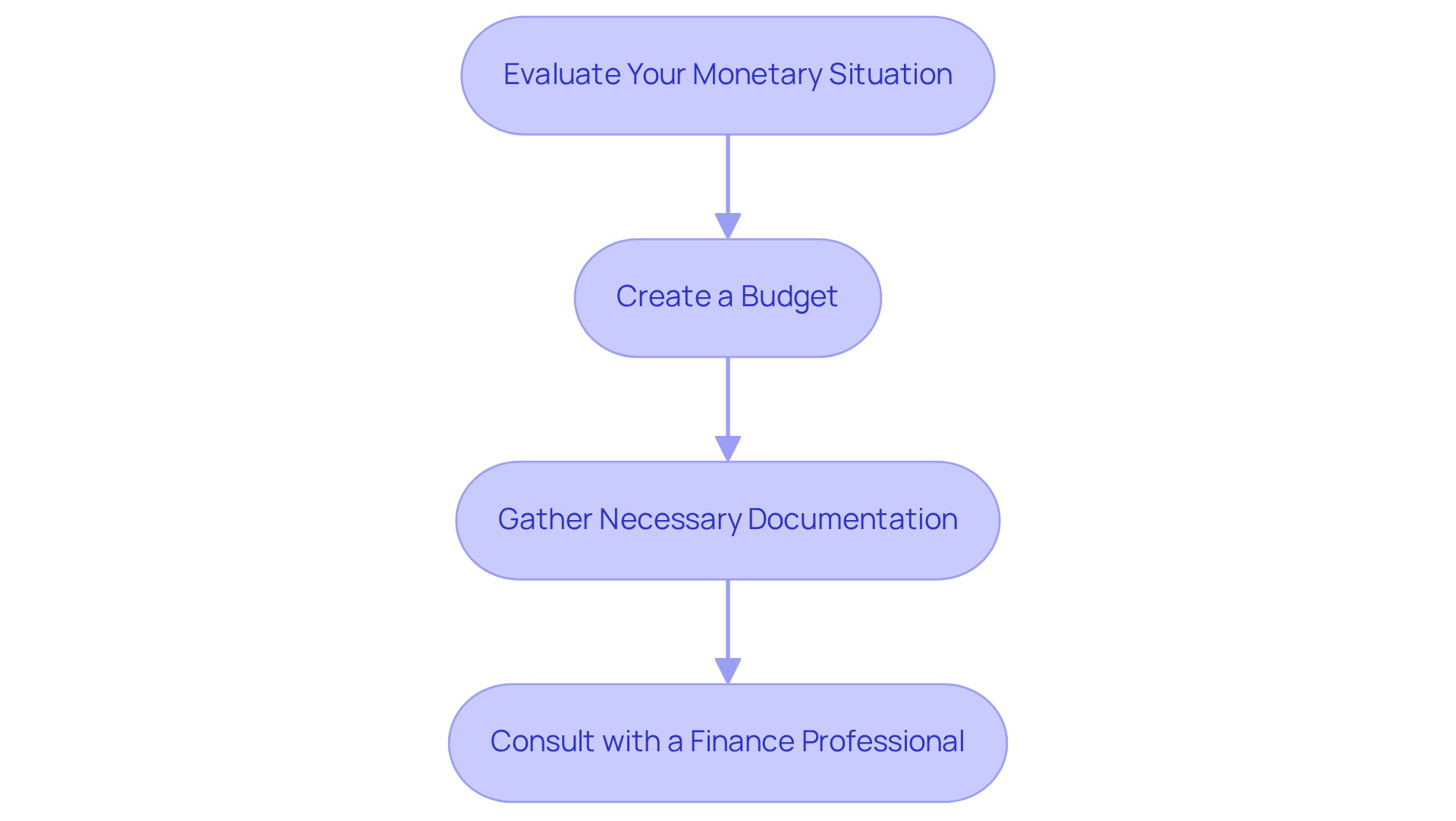

Prepare for Your Commercial Property Deposit

To effectively prepare for your commercial property deposit, follow these essential steps:

-

Evaluate Your Monetary Situation: Begin by thoroughly examining your current financial status, including savings, income, and expenses. Assess how much you can allocate for your down payment without jeopardizing your financial stability. Lenders scrutinize your financial history, so a robust profile can enhance your borrowing capacity. Maintaining a strong credit profile is crucial for improving your chances of securing favorable loan terms.

-

Create a Budget: Develop a comprehensive budget that encompasses not only the deposit but also other associated costs such as legal fees, inspections, and potential renovations. In Melbourne, typical initial expenses can include stamp duty, which usually ranges from 5-7% of the asset value, and building inspections, which may vary but generally cost around $300 to $1,000. This thorough approach will help you avoid unexpected financial strain.

-

Gather Necessary Documentation: Prepare essential documents such as financial statements, tax returns, and commercial property valuations in advance. Lenders require comprehensive documentation to evaluate your financial stability and serviceability, so preparing these in advance can simplify your loan application process.

-

Consult with a Finance Professional: Engaging with a business finance consultant can provide tailored insights and strategies for your specific situation. Their expertise can assist you in navigating the complexities of obtaining funding and ensure you are adequately prepared for your payment. As one finance expert advises, beginning your financial preparation at least 12 months prior to your intended purchase can significantly enhance your chances of success. Furthermore, consider discussing payment amounts with sellers, as this can offer greater flexibility in your financial planning.

By taking these steps, you will position yourself strongly to secure your deposit for commercial property and advance confidently with your property purchase.

Conclusion

Securing a commercial property deposit is a pivotal step in the real estate investment journey, embodying both the buyer's commitment and the seller's assurance. By understanding the intricacies of commercial property deposits, potential investors can navigate market complexities with enhanced confidence. The importance of grasping deposit amounts and related factors is paramount, as it lays the foundation for successful negotiations and financial planning.

Key insights emphasize the necessity of:

- Evaluating one’s financial situation

- Comprehending market dynamics

- Preparing essential documentation

Recognizing how property types, market conditions, and lender policies impact deposit requirements allows buyers to strategize their investments more effectively. Furthermore, proactive measures such as budgeting for all associated costs and consulting finance professionals can significantly improve the chances of securing favorable terms.

Ultimately, the process of securing a commercial property deposit transcends mere financial obligations; it presents an opportunity to establish a robust foundation for future investments. With adequate preparation and understanding, aspiring investors can approach the commercial real estate market with clarity and confidence, positioning themselves for success in their property endeavors.