Overview

Choosing the right business loan brokers in Sydney is a critical decision that can significantly impact your financial future. To ensure you make an informed choice, it is essential to evaluate key factors such as:

- Experience

- Lender network

- Transparency

- Client feedback

- Personal rapport

By systematically researching these brokers, you can secure tailored financing solutions that meet your specific needs.

Have you considered how each of these criteria affects your ability to obtain the best loan? Experience in the industry often translates to better insights and connections, while a robust lender network can provide you with more options. Transparency is crucial; you want to work with brokers who are open about their processes and fees. Client feedback serves as a valuable resource, offering real-world perspectives on the brokers' effectiveness. Lastly, establishing a personal rapport can make the financing process smoother and more comfortable.

In conclusion, taking the time to evaluate these essential criteria will empower you to select a broker who not only understands your unique financial situation but also guides you towards the most suitable financing solutions available.

Introduction

Navigating the world of business financing can often feel overwhelming, particularly for entrepreneurs seeking the right loan to fuel their growth. Business loan brokers serve a crucial role in this landscape, acting as intermediaries who simplify the process by connecting businesses with suitable lenders. Their in-depth knowledge of the lending environment and access to a diverse array of financial institutions enable these brokers to streamline the loan application journey, ensuring that businesses secure the best rates and terms available.

However, not all brokers are created equal. Understanding the key criteria for selecting the right broker, comparing options, and utilizing additional resources can significantly impact your ability to find the perfect financing solution tailored to your specific business needs. Are you ready to take the next step in securing the funding necessary for your success?

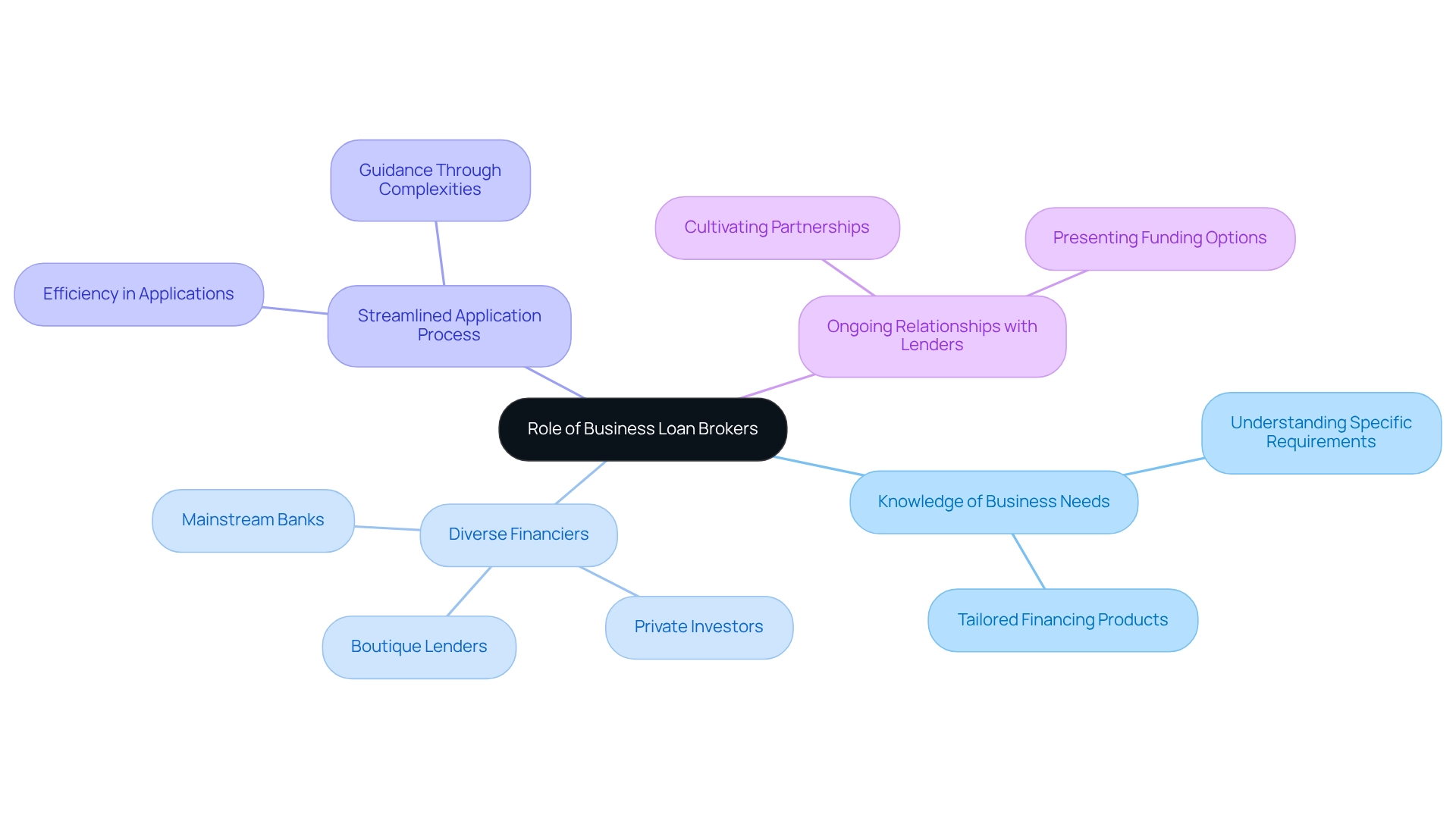

Understand the Role of Business Loan Brokers

Business loan brokers Sydney act as essential intermediaries between enterprises seeking funding and lenders providing credit. At Finance Story, we thoroughly understand business needs, which enables us to connect you with business loan brokers Sydney who can provide financing products tailored to your specific requirements. Our deep knowledge of the lending landscape, combined with extensive access to a diverse array of financiers—including boutique lenders, private investors, and mainstream banks—allows us, as business loan brokers Sydney, to streamline the application process and enhance its efficiency.

We discuss conditions and provide valuable insights into the various financing options available, ensuring that you secure the best possible rates and terms. By cultivating ongoing relationships with different lenders, business loan brokers Sydney can present funding options that support your growth, making the process of obtaining a commercial investment more efficient.

Are you ready to explore how we can help you achieve your financial goals? Let us guide you through the complexities of financing with confidence and expertise.

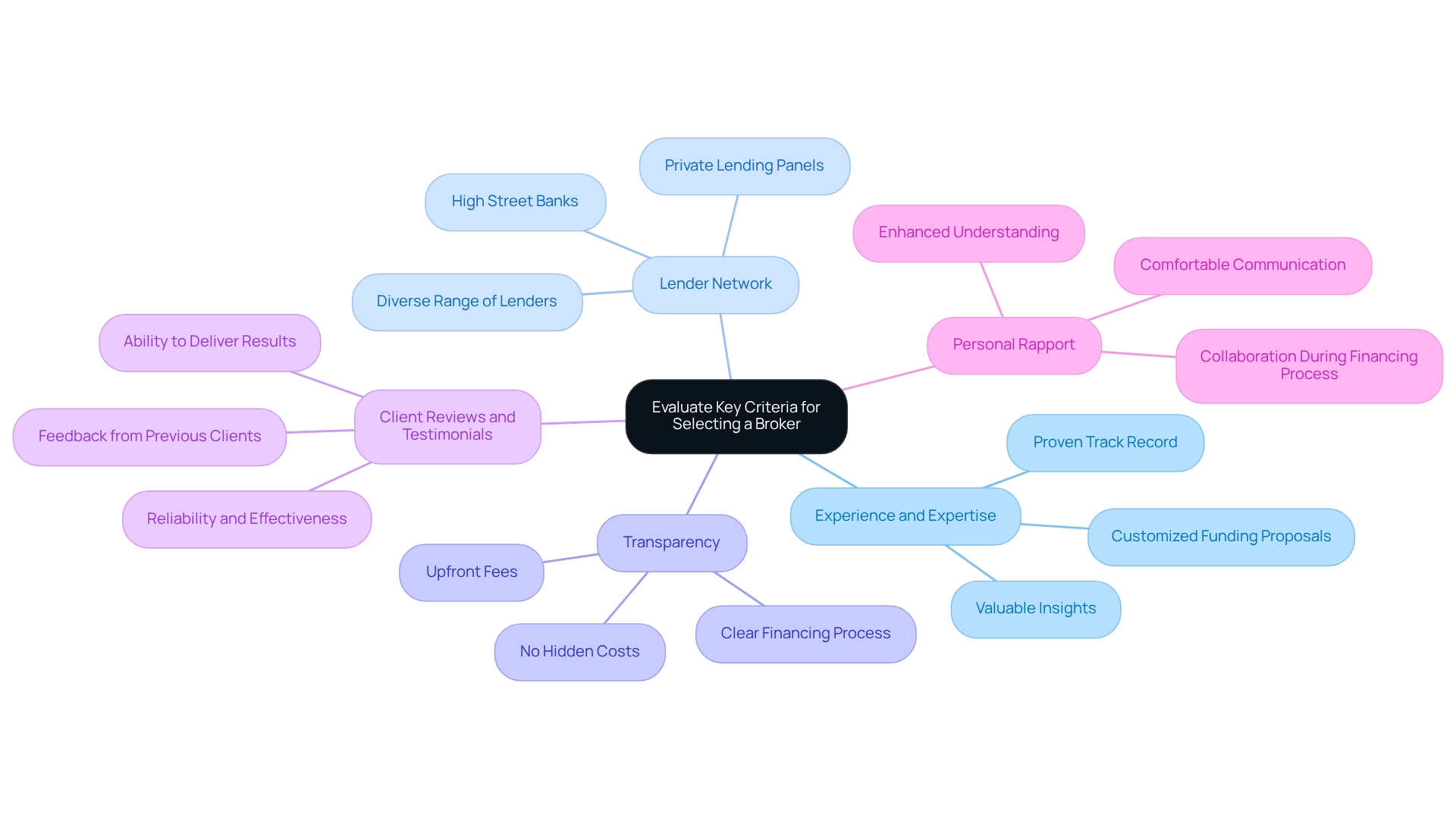

Evaluate Key Criteria for Selecting a Broker

When selecting a commercial financing intermediary, it is crucial to consider several essential factors that can significantly impact your financial journey.

Experience and Expertise: Look for agents with a proven track record in business financing, particularly in developing refined and customized funding proposals. Their expertise can provide valuable insights into the best financing options tailored to your specific needs.

Lender Network: An intermediary with access to a diverse range of lenders—including high street banks and innovative private lending panels—can offer you more choices. This broad network increases the chances of finding an appropriate financing solution that fits your situation, whether you are seeking funding for a warehouse, retail space, or hospitality business.

Transparency: It is vital to ensure that the intermediary is upfront about their fees, the financing process, and any potential conflicts of interest. A trustworthy intermediary will provide clear details without hidden costs, helping you understand the repayment requirements.

Client Reviews and Testimonials: Investigate feedback from previous clients to gauge the agent's reliability and effectiveness. Positive reviews can indicate a financial intermediary's ability to deliver results, especially in securing customized financing for commercial real estate investments.

Personal Rapport: Finally, choose an agent with whom you feel comfortable communicating. A strong rapport can enhance understanding and collaboration during the financing process, ensuring that your evolving business needs are met.

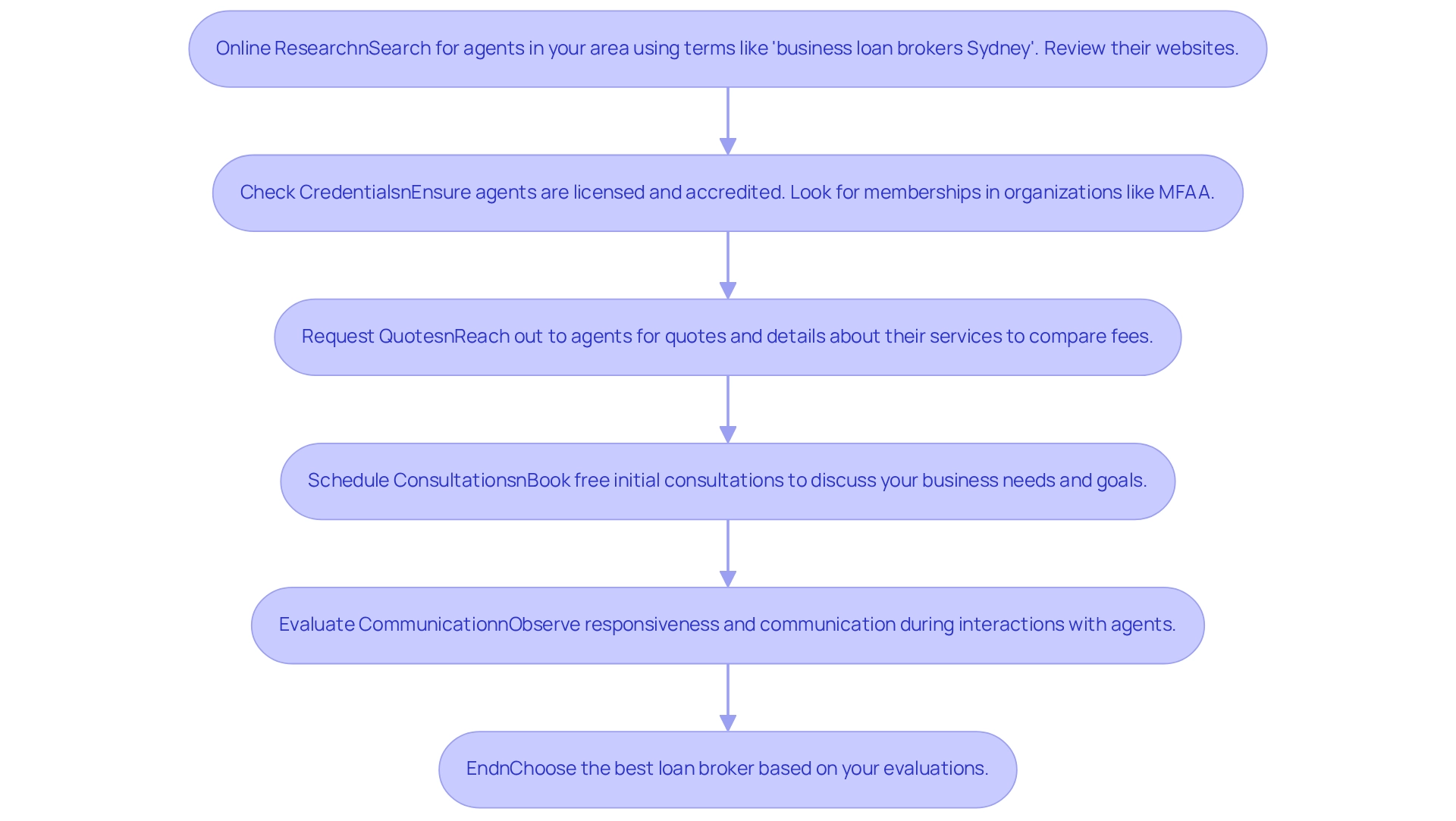

Research and Compare Business Loan Brokers

To effectively investigate and evaluate business financing intermediaries, follow these steps:

-

Online Research: Start by searching for agents in your area. Use terms like 'business loan brokers Sydney' to uncover local options. Review their websites to understand the services they offer, their lender partnerships, and client testimonials.

-

Check Credentials: Ensure that the agents are licensed and accredited. Look for memberships in professional organizations, such as the Mortgage and Finance Association of Australia (MFAA).

-

Request Quotes: Reach out to various agents to request quotes and details about their services. This will enable you to compare fees and offerings effectively.

-

Schedule Consultations: Many brokers provide free initial consultations. At Finance Story, you can book a complimentary personalized 30-minute meeting with our Head of Funding Solutions, Shane Duffy. This presents a valuable opportunity to discuss your specific business needs and goals, while understanding how business loan brokers Sydney can assist you in securing tailored financing solutions for your commercial property investments. Our expertise in crafting polished loan proposals ensures that we meet lender expectations effectively.

-

Evaluate Communication: Observe how responsive and communicative each agent is during your interactions. Effective communication is crucial for a successful partnership. Additionally, consider the range of lenders available through each agent, as this can significantly impact your financing options.

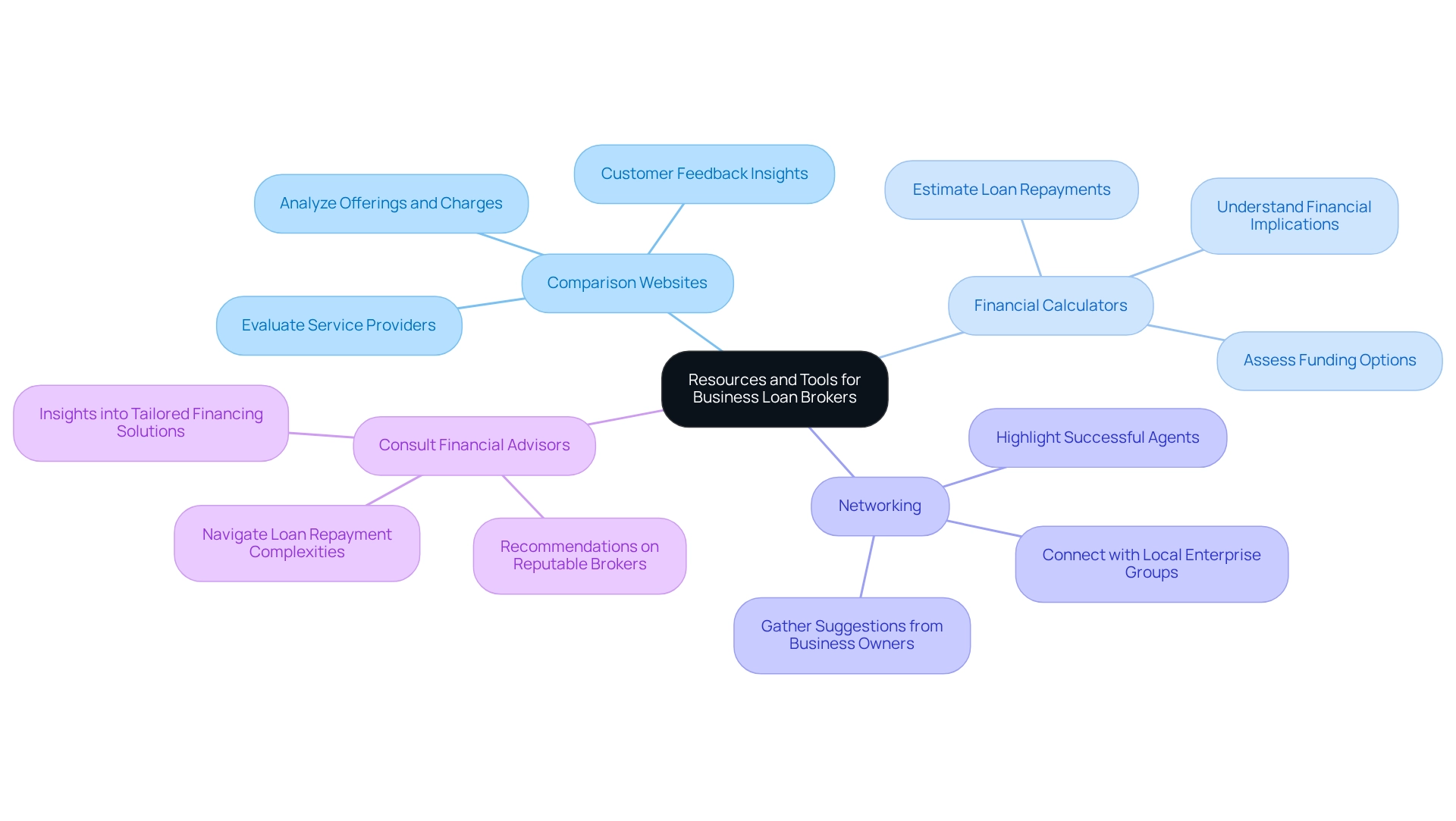

Consider Additional Resources and Tools

To assist you in your search for the right business loan brokers Sydney, consider utilizing the following resources:

-

Comparison Websites for Financial Services: Leverage platforms that allow you to evaluate various service providers side by side, based on offerings, charges, and customer feedback. This can help you identify business loan brokers Sydney who specialize in customized funding proposals, which are essential for securing capital for commercial property investments.

-

Financial Calculators: Online calculators can aid in estimating loan repayments and understanding the financial implications of different loan amounts and terms. Grasping these criteria is crucial when assessing your funding options, particularly with the assistance of business loan brokers Sydney, who can provide industry reports that analyze trends in commerce financing and intermediary performance. These resources can provide insights into which firms are excelling in the market and their approaches to loan proposals.

-

Networking: Connect with local enterprise groups or forums to gather suggestions and insights from other business owners about agents they have worked with. Personal experiences can highlight agents who excel in crafting refined and customized proposals.

-

Consult Financial Advisors: If you have a financial advisor, consult them for recommendations on reputable brokers who align with your business goals. They can offer insights into the importance of tailored financing solutions and assist you in navigating the complexities of loan repayment criteria.

Conclusion

Selecting the right business loan broker is a pivotal step in securing the financing necessary for growth and success. Business loan brokers act as vital intermediaries, simplifying the loan application process and connecting businesses with a diverse array of lenders. Their expertise, extensive networks, and commitment to transparency can significantly enhance the chances of finding a loan that aligns with specific business needs.

When evaluating brokers, consider key criteria such as:

- Experience

- Lender networks

- Client testimonials

Conducting thorough research, including comparing multiple brokers and utilizing additional resources, ensures that entrepreneurs make informed decisions. Engaging with broker comparison websites, financial calculators, and networking within local business communities can provide valuable insights into the best options available.

Ultimately, the journey to obtaining a business loan need not be daunting. By leveraging the knowledge and resources discussed, businesses can navigate the lending landscape more effectively, ensuring they secure the best financing solutions tailored to their unique requirements. The right broker not only facilitates access to funding but also fosters a partnership that supports long-term success and growth.