Overview

This article examines ten SME lenders that offer tailored financing solutions designed to foster the growth of small and medium enterprises. It underscores the significance of customized financial options—such as commercial property loans and rapid access to funds—which are crucial for SMEs to navigate economic challenges and effectively seize growth opportunities.

Introduction

In the ever-evolving landscape of small and medium enterprises (SMEs), access to tailored financial solutions is paramount for fostering growth and resilience. As SMEs significantly contribute to the economy, innovative lending options have emerged to meet their unique needs.

From boutique mortgage brokerages like Finance Story, which specializes in personalized financing, to agile online lenders like Prospa and Capify, businesses now have an array of choices to secure the capital they need swiftly.

This article explores various financing solutions that empower SMEs to navigate challenges, capitalize on opportunities, and ultimately thrive in a competitive environment. It highlights the importance of customized financial support in driving business success.

Finance Story: Tailored SME Lending Solutions for Business Growth

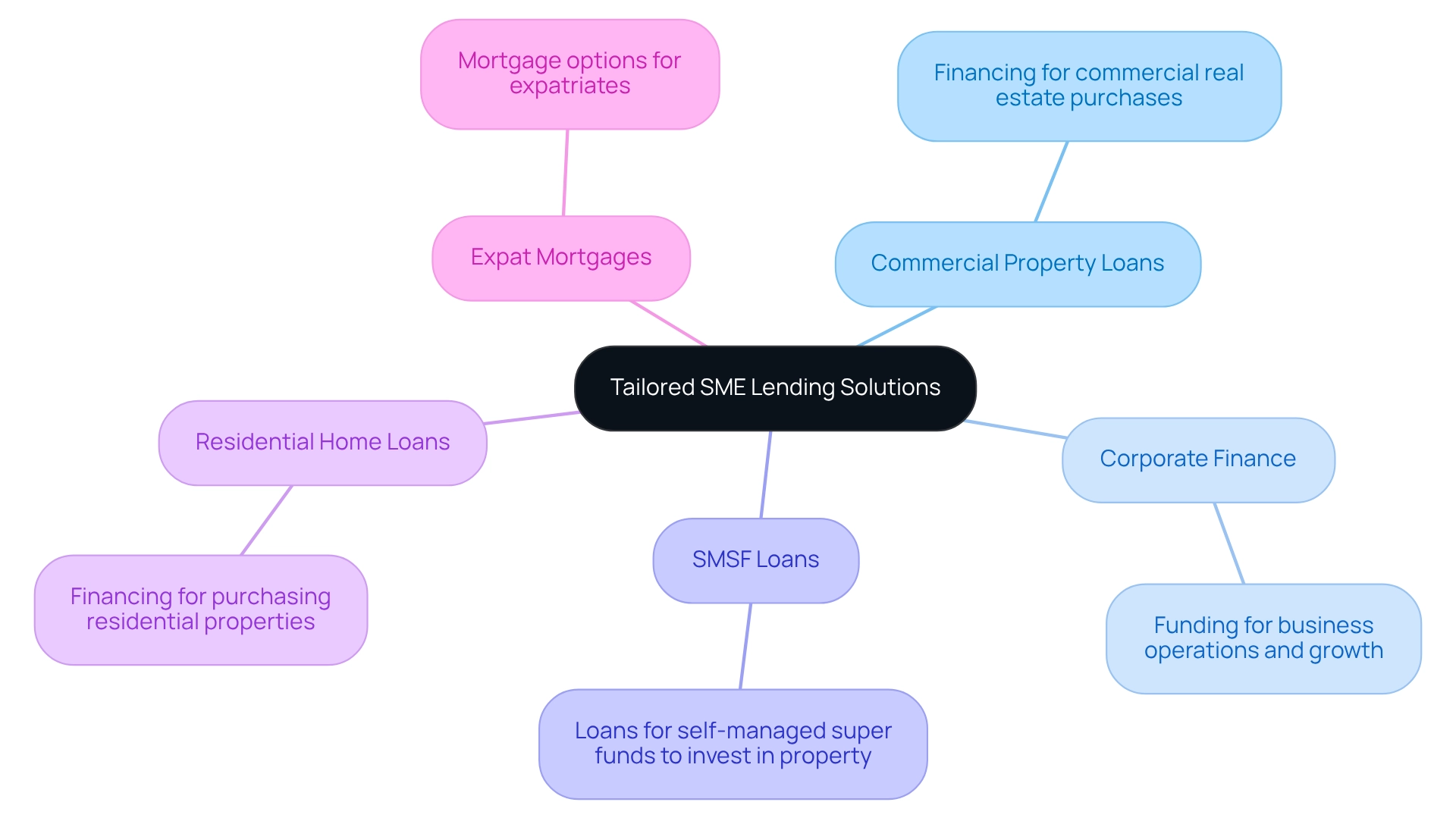

Finance Narrative, a boutique mortgage brokerage situated in Melbourne, stands out by delivering customized financial solutions specifically designed for SME lenders. By prioritizing a comprehensive understanding of each client's unique needs, Finance Narrative presents a diverse array of financing options, including:

- Commercial property loans

- Corporate finance

- SMSF loans

- Residential home loans

- Expat mortgages

This commitment to innovation and flexibility in the lending process empowers clients to secure the most appropriate funding for their individual situations, solidifying Finance Narrative's role as a supportive ally for businesses aiming for growth.

As of 2025, small and medium-sized enterprises contribute approximately two-thirds of Australia’s workforce, underscoring their vital significance in the economy. Recent trends indicate a remarkable increase in lending to enterprises, with outstanding financing to companies rising by nearly 9% by June 2023 compared to the previous year. This positive trajectory signifies improved access to funding options from SME lenders, which is crucial for small enterprises seeking growth, especially given the challenges they often face in acquiring adequate capital. Finance Narrative's tailored financing solutions not only meet the immediate needs of small enterprises but also foster sustainable development. The brokerage's specialized expertise in navigating complex financial scenarios, combined with its extensive connections to various private lenders, boutique lenders, and SME lenders, uniquely positions it to assist small and medium-sized enterprises in efficiently achieving their financial objectives. By partnering with Finance Narrative, small business owners can craft compelling business cases for diverse lending needs, ensuring they possess the right financial solutions to thrive.

Prospa: Fast and Flexible Funding for SMEs

Prospa emerges as a prominent online lender, offering swift and adaptable funding solutions for SME lenders, specifically designed for small and medium enterprises. With loan amounts spanning from $5,000 to $300,000, Prospa streamlines the borrowing experience through an efficient application process that can be completed in merely 10 minutes. Their dedication to rapid approvals allows SMEs to secure funds within as little as 24 hours, making Prospa one of the optimal SME lenders for those eager to capitalize on growth opportunities.

This immediate access to funding from SME lenders is crucial, particularly in a landscape where timely financial support can significantly influence an organization's ability to thrive and adapt. In conjunction with Prospa, Finance Narrative specializes in crafting refined and highly customized cases for SME lenders, ensuring that small business owners can secure the right funding for their commercial property investments.

Whether acquiring a warehouse, retail space, factory, or hospitality venture, Finance Narrative offers access to a comprehensive array of lenders, including high street banks and innovative private lending panels. This expertise in tailored loan proposals not only addresses the immediate funding requirements of small businesses but also nurtures long-term growth and resilience in an ever-evolving economic environment.

As noted by Adrian Suljanovic, a seasoned finance journalist, "The ability to obtain funding swiftly can be a transformative factor for small and medium enterprises, particularly in today's fast-paced market." Moreover, recent statistics reveal that New Zealand originations have surged by 10.6 percent quarter-on-quarter, indicating a positive trend in the lending landscape that Prospa is well-positioned to exploit.

Additionally, a case study titled "SME Growth Expectations" emphasizes the resilience and adaptability of SMEs in Australia, highlighting the necessity of quick funding solutions to support their growth trajectories. Industry experts agree that prompt credit approvals from SME lenders can significantly impact small enterprises, offering them the essential resources to navigate challenges and seize opportunities.

OnDeck: Streamlined Access to SME Loans

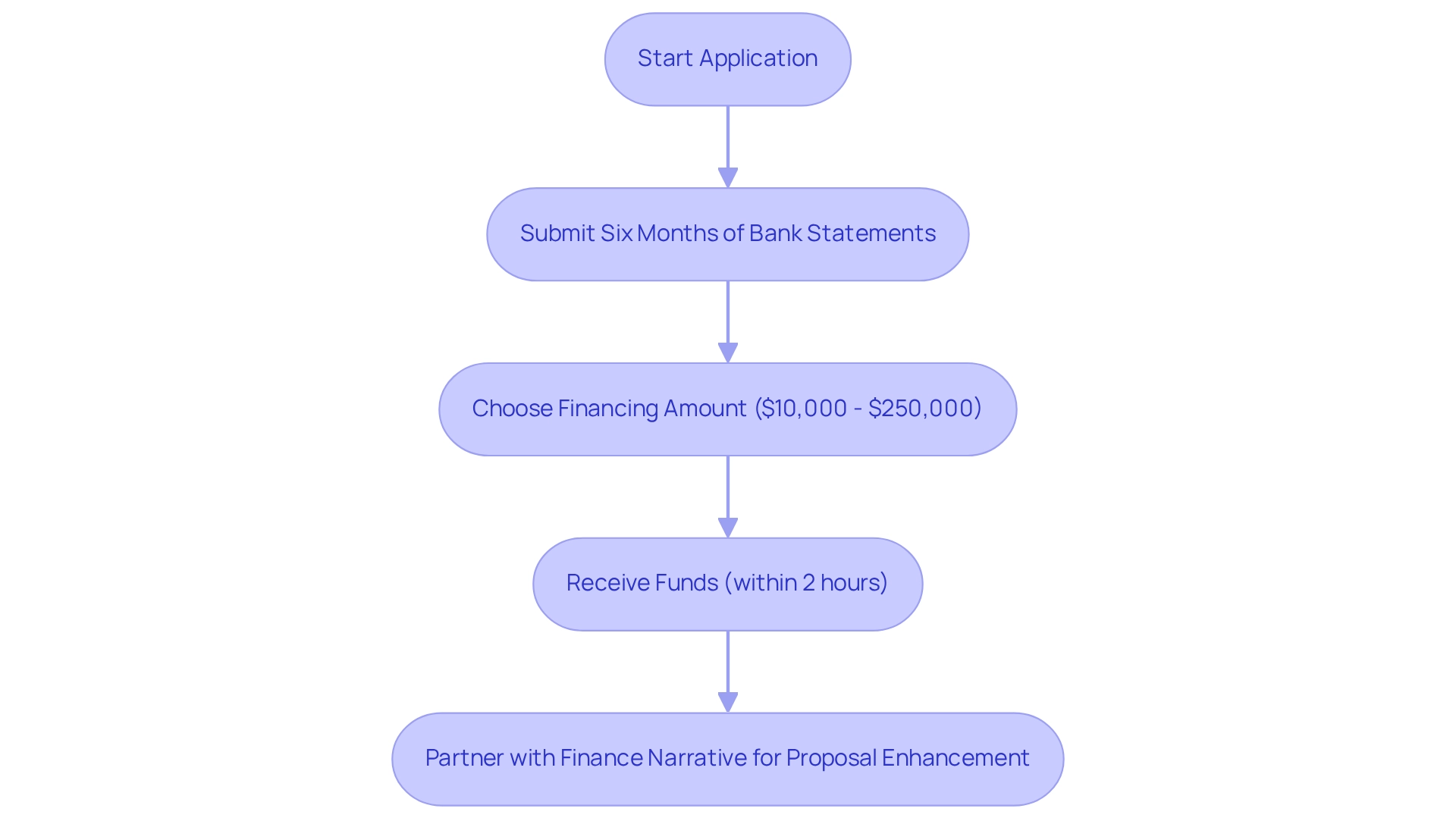

OnDeck offers a streamlined solution for SMEs, helping SME lenders gain rapid access to financing. Their online application process is efficient, taking just minutes to complete and requiring only six months of business bank statements. With financing options ranging from $10,000 to $250,000, OnDeck ensures that funds can be available in as little as two hours. This level of efficiency is crucial for SME lenders looking to swiftly seize market opportunities.

Furthermore, to fully leverage the benefits of OnDeck's services, partnering with Finance Narrative can enhance your funding proposal. This collaboration ensures that your proposal aligns with lender expectations, significantly improving your chances of securing the necessary financing. Are you ready to take the next step in optimizing your financial strategy?

Moula: Cash Flow-Focused Financing for Growth

Finance Story specializes in crafting polished and highly individualized loan proposals tailored specifically for SME lenders, offering customized financing solutions for commercial property investments and refinances. This expertise empowers companies to effectively manage their cash flow, which is crucial for sustaining operations and facilitating growth. The application procedure is streamlined, enabling companies to secure funding within 24 hours—a notable advantage for those in need of prompt financial assistance.

Effective cash flow management is vital for small business growth, particularly as 63% of small and medium enterprises prioritize employee well-being in their workforce strategies, reflecting a broader commitment to internal management. Furthermore, with 46% of small and medium-sized enterprises anticipating workforce growth over the next year, the demand for reliable cash flow solutions becomes even more apparent. As Guy Callaghan, chief executive, observes, "What we are witnessing are small and medium enterprises continually flexing and adapting their approach to managing inflation by focusing on both internal and external cost reductions, without burdening customers, and all the time still striving for growth."

Finance's financing options not only address urgent cash flow needs but also empower SMEs lenders to pursue their growth strategies. With access to a comprehensive range of SME lenders, including high street banks and innovative private lending panels, Finance can assist enterprises in financing various types of commercial properties such as warehouses, retail spaces, factories, and hospitality ventures. Recent developments in cash flow management underscore the increasing recognition of its significance, with industry experts emphasizing that businesses must adapt their financial strategies to successfully navigate economic challenges. By leveraging Finance's customized financing solutions, small and medium enterprises can enhance their operational resilience and prepare for sustainable growth. Additionally, for those seeking to improve their cash flow management skills, the free Cash Flow Management Course available online at AGSM's website offers valuable insights and strategies. For more information on how Finance can assist you, please reach out to us today.

GetCapital: Flexible Financing Options for SMEs

Finance provides a diverse array of adaptable funding solutions specifically designed for SME lenders, which includes commercial financing and credit lines that can reach totals of up to $500,000. Their streamlined application process allows companies to access funds swiftly, a crucial capability in today's fast-paced market. The flexibility of Finance Story's repayment conditions and financial structures makes them an appealing choice for SME lenders and small and medium enterprises navigating fluctuating economic conditions.

In 2023, the average SBA funding amount stood at $391,584, escalating to $458,584 by mid-2024. This upward trend underscores the growing financial demands of small enterprises. Notably, the SBA partially approved only 25% of small enterprise loan applications, revealing the significant challenges that SMEs and SME lenders face in securing financing. With 70% of small enterprises carrying debt and a staggering total of $18 trillion owed by the end of 2022, the sustainability of these debts is an urgent concern. Finance Story's flexible financing options can alleviate some of this burden, empowering companies to manage their cash flow more effectively.

Industry experts emphasize the importance of having flexible loan frameworks from SME lenders, as these can significantly boost a small enterprise's growth potential. Janet Gershen-Siegel, a finance writer, asserts, "Having the extra financial resources you need when scaling demands can be beneficial to your small business’s growth." By providing tailored funding alternatives, SME lenders enable small and medium enterprises to respond adeptly to market fluctuations and seize new opportunities, ultimately supporting their long-term success. Furthermore, sectors such as healthcare, retail trade, professional services, and construction employ the highest number of individuals, highlighting the necessity for effective financing solutions in these vital industries. With finance services well-equipped to assist clients in achieving their financial objectives efficiently and effectively, SME lenders emerge as an essential resource for SMEs.

Spotcap: Adaptive Credit Lines for Growing SMEs

Finance specializes in crafting refined and highly customized cases for presentation to SME lenders, ensuring that small proprietors can secure the appropriate funding for their commercial property investments and refinances. This expertise is essential for navigating the complexities of financing proposals, particularly in a landscape where expectations are continually rising.

For SMEs, understanding loan repayment criteria is crucial. Finance offers insights that assist enterprises in aligning their financial strategies with lender requirements. By collaborating with a full range of SME lenders, including high street banks and innovative private lending panels, Finance Story empowers small enterprises to purchase or refinance properties such as:

- Warehouses

- Retail premises

- Factories

- Hospitality ventures

This customized approach not only addresses the distinct requirements of each enterprise but also enhances their capacity to manage cash flow efficiently, thereby ensuring financial stability in a constantly changing market.

Swoop Funding: Diverse Financial Solutions for SMEs

Swoop Funding excels in delivering a comprehensive array of financial solutions tailored specifically for small and medium-sized enterprises, which includes loans from SME lenders, equity funding, and grants. Their innovative platform connects enterprises with customized funding alternatives, ensuring that SME lenders can help small and medium-sized enterprises easily identify the financial products that best meet their unique needs.

In 2025, Swoop Funding has significantly expanded its offerings, with average funding amounts reflecting a remarkable increase, enabling SME lenders to access up to $500,000 in line of credit, a substantial rise from $150,000. This streamlined approach simplifies the funding process, empowering small enterprises to secure the necessary capital for growth without the complexities often associated with traditional financing.

Real-life examples illustrate the impact of customized financial solutions; numerous small and medium-sized enterprises have effectively leveraged various services to enhance operational capabilities and expand market reach. Industry leaders emphasize the importance of tailored funding alternatives from SME lenders, highlighting that such solutions are critical for the sustainability and growth of small enterprises.

Swoop Funding's commitment to demystifying the funding landscape is evident in their objective to simplify jargon and provide impartial information, facilitating navigation through financial journeys. As they continue to innovate and adapt to the evolving needs of small and medium enterprises, Swoop remains an invaluable ally for companies striving to thrive in a competitive environment.

Furthermore, Finance Story is dedicated to crafting refined and highly customized proposals to present to banks, ensuring that small and medium-sized enterprises can secure the appropriate funding for their commercial property investments and refinances. With access to a diverse range of SME lenders, including high street banks and innovative private lending panels, it is essential for small and medium-sized enterprises to explore various financing options available in the market to identify the best fit for their specific needs. This encompasses financing options for various commercial properties such as warehouses, retail premises, factories, and hospitality ventures.

Capify: Quick Access to Business Loans for SMEs

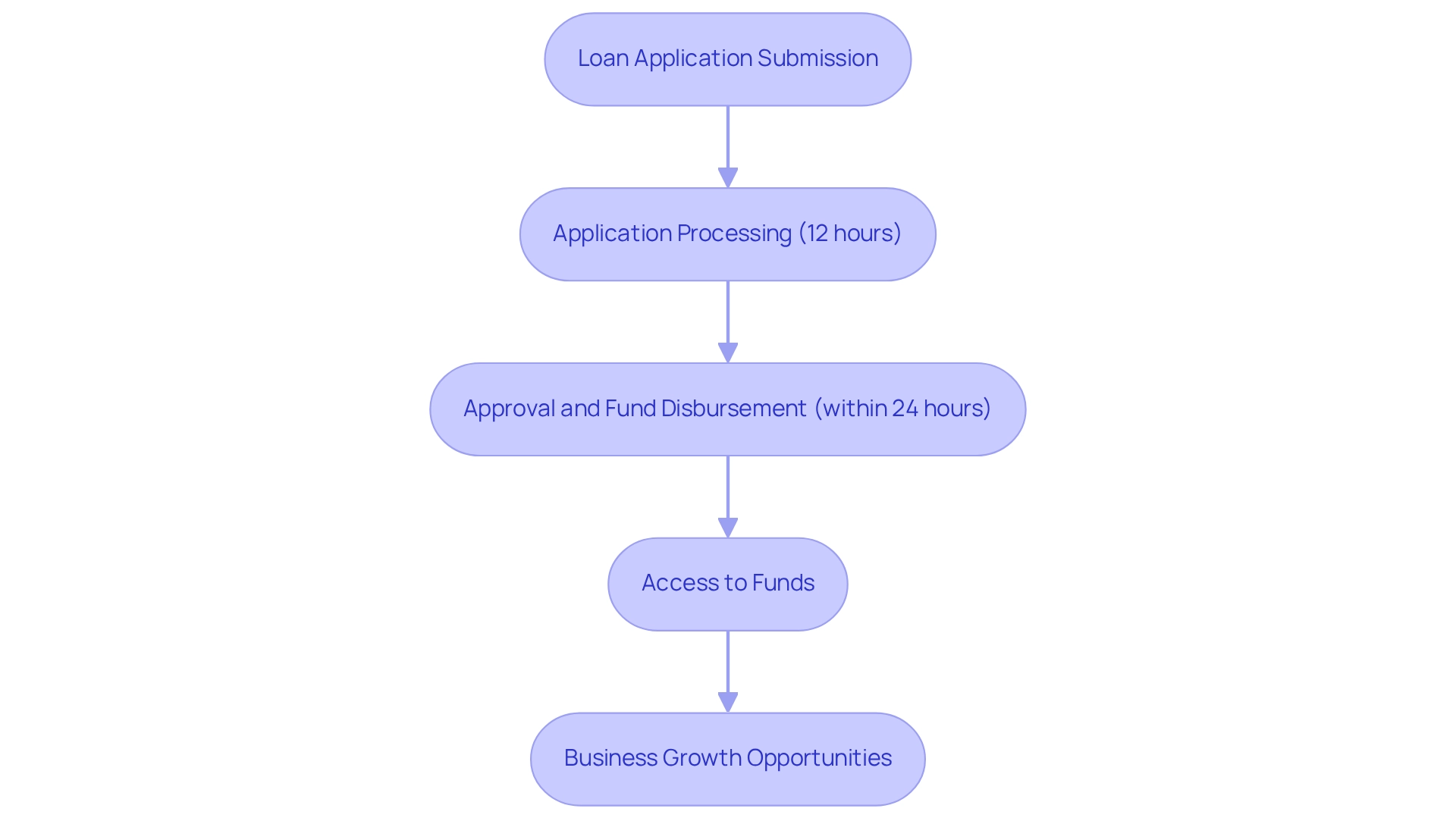

Capify stands out as a premier provider of rapid access to commercial financing for SME lenders of small and medium enterprises, delivering funds in as little as 24 hours. With financing amounts ranging from $5,000 to $500,000, Capify has streamlined its application process to ensure efficiency and speed. This focus on swift financing from SME lenders is crucial for small and medium-sized enterprises looking to seize growth opportunities, especially in a challenging economic landscape where 45% of businesses are considering loans to manage rising inflation. The Australian Small Business & Family Enterprise Report underscores the resilience of SMEs, which continue to play an essential role in the economy despite pressures such as high interest rates and inflation. This resilience is echoed in the words of inventor Thomas Edison: "Be courageous. I have observed many downturns in commerce. Always America has emerged from these stronger and more prosperous." Capify's ability to provide quick funding solutions not only addresses immediate financial needs but also fosters long-term growth for small enterprises.

In 2025, Capify has optimized its loan processing times, enabling SME lenders to access the capital they require without unnecessary delays. For instance, the average processing time has been reduced to just 12 hours, significantly enhancing the speed at which businesses can secure funding. This rapid response is increasingly recognized as a vital factor in obtaining financing from SME lenders, enabling enterprises to respond swiftly to market demands and opportunities. Real-world examples demonstrate Capify's impact on small business growth; a recent case involved a local café that expanded its operations and hired additional staff after receiving prompt funding from Capify. Overall, Capify's commitment to providing quick, accessible financing positions it as an ideal partner for SME lenders and small and medium enterprises navigating the complexities of the current economic environment, particularly as they strive to recover and thrive in the post-COVID landscape.

Lendio: Marketplace for Diverse SME Financing Options

Finance Story serves as a vital resource for small and medium enterprises, expertly crafting refined and highly customized funding proposals that connect business owners with a diverse range of lenders. This specialized knowledge empowers SMEs to secure the most suitable financing options tailored to their unique needs—be it for purchasing commercial properties like warehouses, retail spaces, factories, or hospitality ventures, or for refinancing existing loans. The streamlined application process simplifies the borrowing experience for SMEs, facilitating easier access to necessary funding from SME lenders.

In 2025, the demand for customized solutions among SMEs has surged significantly, reflecting the increasing complexity of financing requirements. Furthermore, industry insights reveal that nearly half of black entrepreneurs face financing denials, underscoring the importance of accessible resources and support in navigating the lending landscape.

Finance Story also provides valuable educational materials to help small business owners understand their financing choices and repayment standards. This is crucial, as a recent survey indicated a widespread lack of awareness among small enterprise owners regarding the loan application process, with 22% uncertain about their preferred financing type.

By leveraging the offerings of SME lenders through Finance Story, small and medium enterprises can effectively explore various financing avenues, ultimately fostering growth and stability in their operations. Additionally, understanding industry scores derived from factors such as average credit ratings, duration of operation, and monthly sales can further assist SMEs in their pursuit of funding.

Kiva: Community-Driven Microloans for SMEs

Kiva emerges as a pioneering platform that offers community-driven microloans to small and medium businesses through sme lenders across the globe. With funding starting at just $25, Kiva empowers individuals to lend directly to entrepreneurs who require essential capital. This innovative model not only fosters business growth but also enhances community involvement and social influence, making it an invaluable resource for small and medium enterprises that often struggle to secure financing from sme lenders.

In 2025, Kiva's microfinance statistics reveal an increase in the average amount offered to sme lenders, highlighting a growing recognition of the importance of microfinance in promoting entrepreneurship. A notable case study features Emilienne, who sought $100 to purchase chemical fertilizers to boost agricultural production in Madagascar. With only $75 remaining to meet her funding goal, this financial support exemplifies how Kiva's assistance can significantly improve farming capabilities, leading to higher crop yields and increased income. Additionally, Manal was able to start repaying her debt after just three months at a low interest rate, showcasing the accessibility of Kiva's repayment terms.

Moreover, Kiva's community-driven approach enables lenders to explore loans by category, focusing on specific demographics or issues they wish to address. This personalized lending experience not only promotes financial equality but also nurtures a sense of shared purpose among both lenders and borrowers. As Frank, a dedicated Kiva donor and lender, expresses, "I chose to include Kiva in my estate plans because I felt passionate about continuing to drive financial equality for future generations." Industry experts affirm that the impact of microfinance provided by sme lenders on small business growth is profound, offering essential resources that empower entrepreneurs to flourish in competitive markets. Kiva's unwavering commitment to this mission continues to inspire both sme lenders and borrowers, cultivating a vibrant ecosystem of support for SMEs worldwide. Every Kiva loan tells a unique story, further underscoring the personal connection between lenders and borrowers.

Conclusion

The diverse landscape of financing solutions available for small and medium enterprises (SMEs) underscores the critical role that tailored financial support plays in fostering business growth and resilience. From the specialized offerings of Finance Story, which provides bespoke financing options and expert guidance, to the rapid funding capabilities of online lenders like Prospa and Capify, SMEs now have access to a wide range of resources that cater to their unique needs.

As highlighted throughout this exploration, the ability to secure funding swiftly and effectively is essential for SMEs navigating the complexities of today's economic environment. The increasing trend of business lending, alongside innovative platforms such as Kiva and Swoop Funding, demonstrates a growing recognition of the importance of accessible financial solutions. These options not only address immediate cash flow needs but also empower businesses to invest in their future, adapt to changing market conditions, and seize growth opportunities.

Ultimately, the emphasis on customized financial support is a vital takeaway for SMEs. By leveraging these tailored solutions, businesses can enhance their operational resilience, improve cash flow management, and position themselves for sustainable growth. As the SME sector continues to evolve, the importance of having the right financial partner cannot be overstated—ensuring that small businesses are equipped to thrive in an ever-competitive landscape.