Overview

This article provides essential insights into commercial property lending in Australia, specifically tailored for small businesses. It highlights solutions designed to enhance client satisfaction and streamline loan acquisition. Understanding loan-to-value ratios, creditworthiness, and the diverse types of loans available is crucial for small enterprises. Moreover, the article addresses the challenges and future trends in the lending landscape, equipping these businesses with the knowledge necessary to navigate the complexities of financing effectively.

Introduction

In the dynamic landscape of commercial property lending in Australia, small businesses encounter distinct challenges and opportunities. As entrepreneurs strive for financing that aligns with their specific needs and goals, tailored solutions have become increasingly vital. However, the complexities of loan-to-value ratios, interest rates, and various loan types can seem daunting.

What strategies can small business owners implement to secure the most advantageous terms in this evolving market?

Finance Story: Tailored Solutions for Commercial Property Lending in Australia

Finance Story distinguishes itself in the commercial property lending Australia sector by offering tailored solutions that meet the specific needs of small enterprises. This personalized approach not only elevates client satisfaction but also significantly increases the likelihood of securing advantageous loan terms. By thoroughly understanding each client's unique financial situation and objectives, Finance Story crafts strategies that align with their goals. The brokerage's access to an extensive panel of lenders—including boutique lenders, private investors, and mainstream banks—enables it to present clients with the most suitable financing options available, thereby reinforcing its reputation as a reliable partner in their financial journey.

As we look ahead to 2025, boutique mortgage brokerages like Finance Story are anticipated to capture an increasing share of the market, reflecting a shift towards personalized service in business lending. This trend underscores the necessity of customized financial strategies, which can lead to more effective loan solutions and improved outcomes for small enterprises navigating the intricacies of commercial property lending Australia.

As one satisfied customer, Natasha B. from VIC, expressed, 'I will definitely be recommending your service to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey.'

To discover how Finance Story can support you in developing robust business cases for your diverse lending needs, book your free consultation with Shane Duffy today.

Understanding Loan-to-Value Ratios (LVR) in Commercial Property Lending

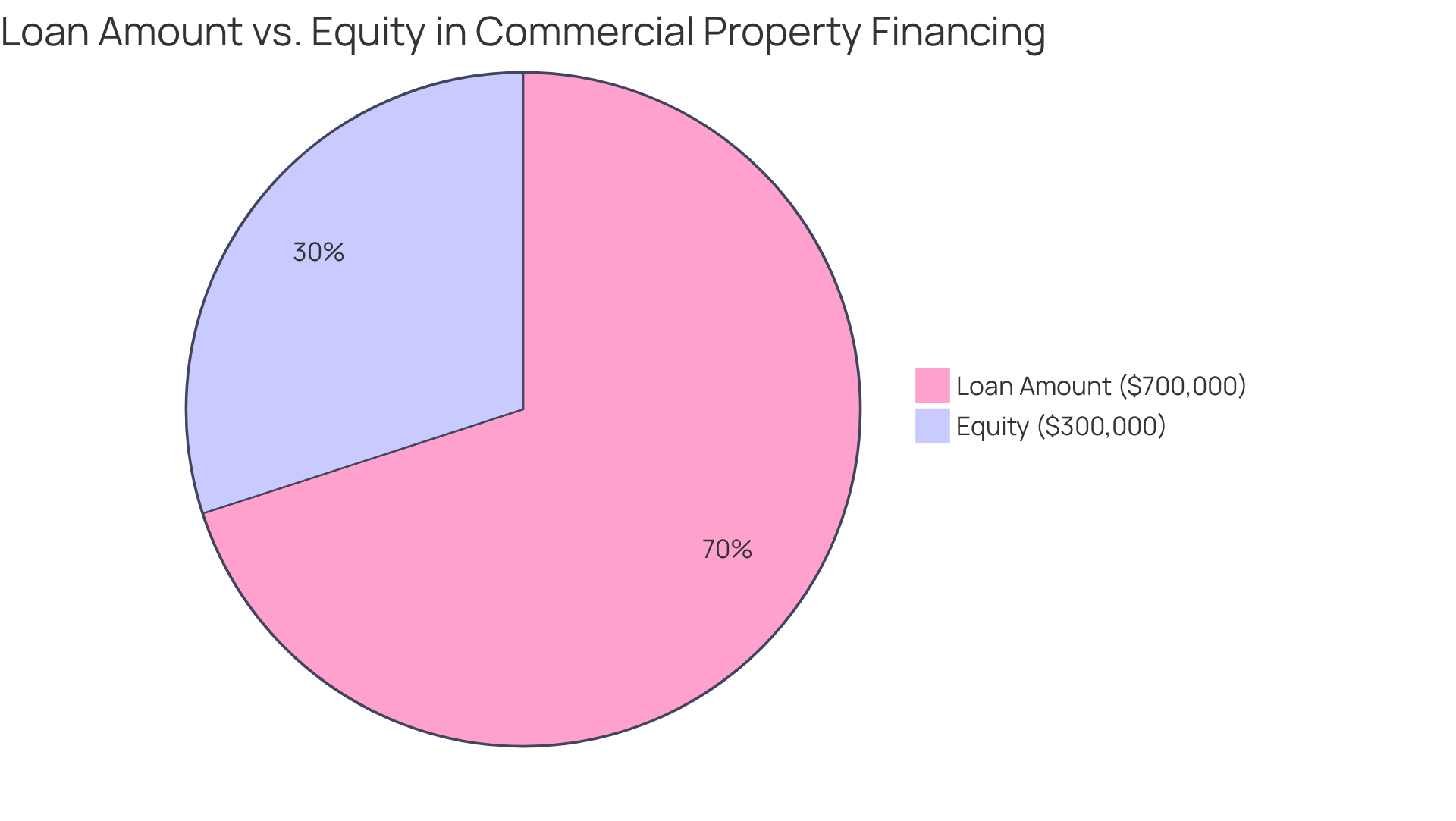

The Loan-to-Value Ratio (LVR) serves as a crucial metric for lenders assessing risk in commercial property lending Australia. It is calculated by dividing the borrowed amount by the appraised value of the asset, expressed as a percentage. A lower LVR signifies reduced risk for lenders, often leading to more favorable financing terms for borrowers.

Typically, lenders prefer an LVR of 70% or less for commercial properties, which necessitates that borrowers contribute a significant deposit. For instance, if a small business seeks a loan of $700,000 for an asset valued at $1,000,000, the LVR would be 70%. This example illustrates how maintaining a lower LVR can enhance borrowing capacity and result in better interest rates.

Financial analysts emphasize that understanding LVR is vital for small businesses, as it directly influences their borrowing capacity and the overall cost of financing. In today's commercial property lending Australia landscape, where many lenders impose stricter LVR limits, particularly for higher-risk assets, small business owners must navigate these requirements carefully to optimize their financing strategies.

Types of Commercial Property Loans Available in Australia

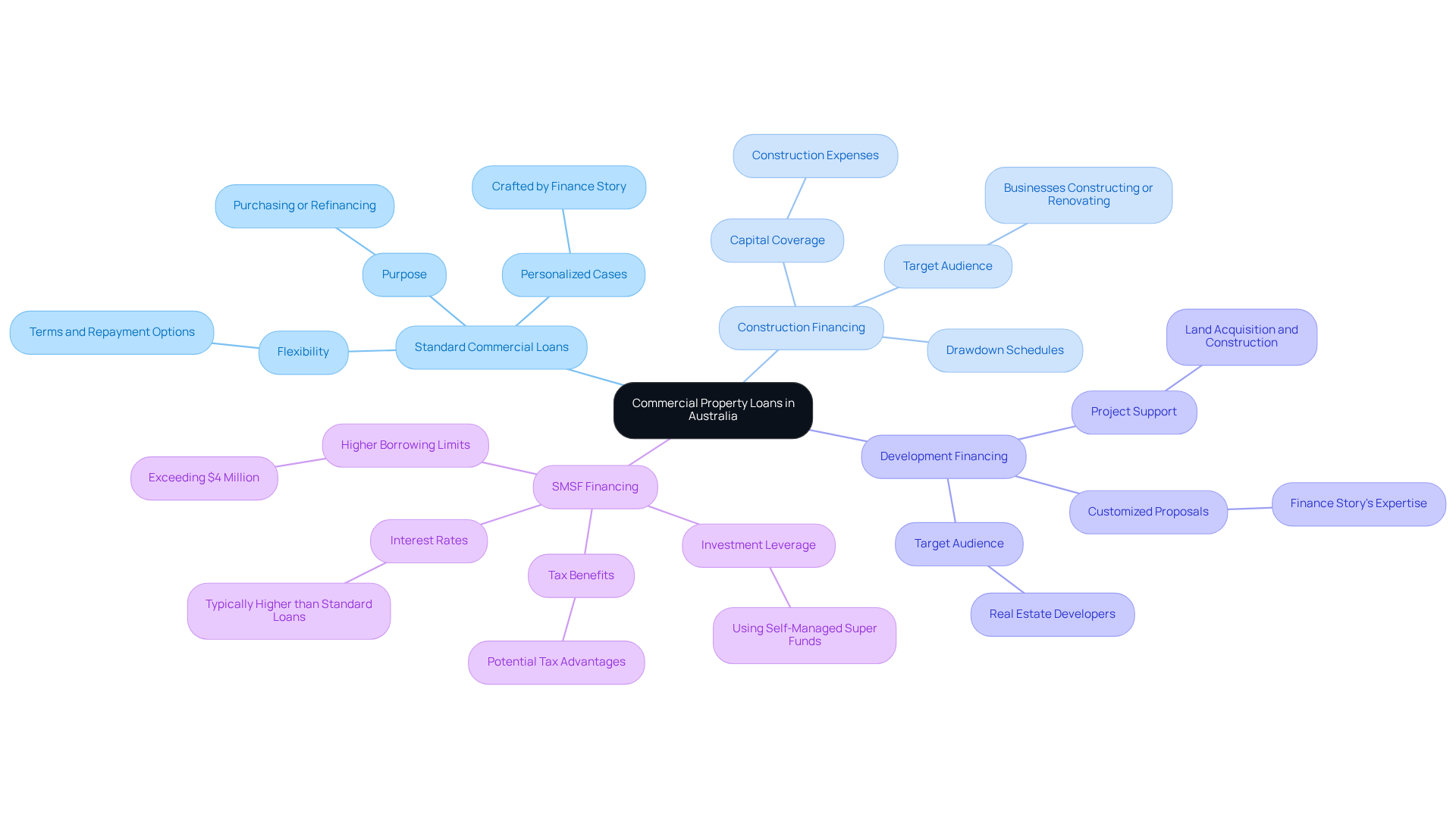

In Australia, a diverse array of commercial property loans is available to meet various business needs, including:

- Standard Commercial Loans: These traditional loans are designed for purchasing or refinancing existing commercial properties, providing flexibility in terms and repayment options. Finance Story excels in crafting refined and highly personalized cases to present to banks, ensuring that small enterprise owners can secure the appropriate funding through a comprehensive range of lenders.

- Construction Financing: Tailored for businesses aiming to construct or renovate commercial properties, this funding supplies the essential capital to cover construction expenses, often featuring specific drawdown schedules. Understanding the eligibility requirements for these financial products is crucial for making informed decisions.

- Development Financing: Designed for real estate developers, these funds support larger projects by facilitating financing for land acquisition, construction, and other associated expenses. Finance Story's expertise in customized financing proposals can help navigate the complexities of securing these funds.

- SMSF Financing: These funds allow individuals to leverage their Self-Managed Super Funds (SMSFs) to invest in business real estate, offering potential tax benefits and increased borrowing limits compared to standard financing. Notably, business real estate financing through SMSFs can present higher borrowing limits than residential real estate financing, potentially exceeding $4 million. However, it is essential to recognize that SMSF financing for commercial property lending in Australia generally carries higher interest rates than standard commercial property financing, which could affect overall investment costs.

Furthermore, refinancing options are available to assist entrepreneurs in adjusting their current financing to meet changing needs. Each category of credit has distinct eligibility standards and conditions, making it vital for entrepreneurs to evaluate their individual needs and financial situations before applying.

Impact of Interest Rates on Commercial Property Loans

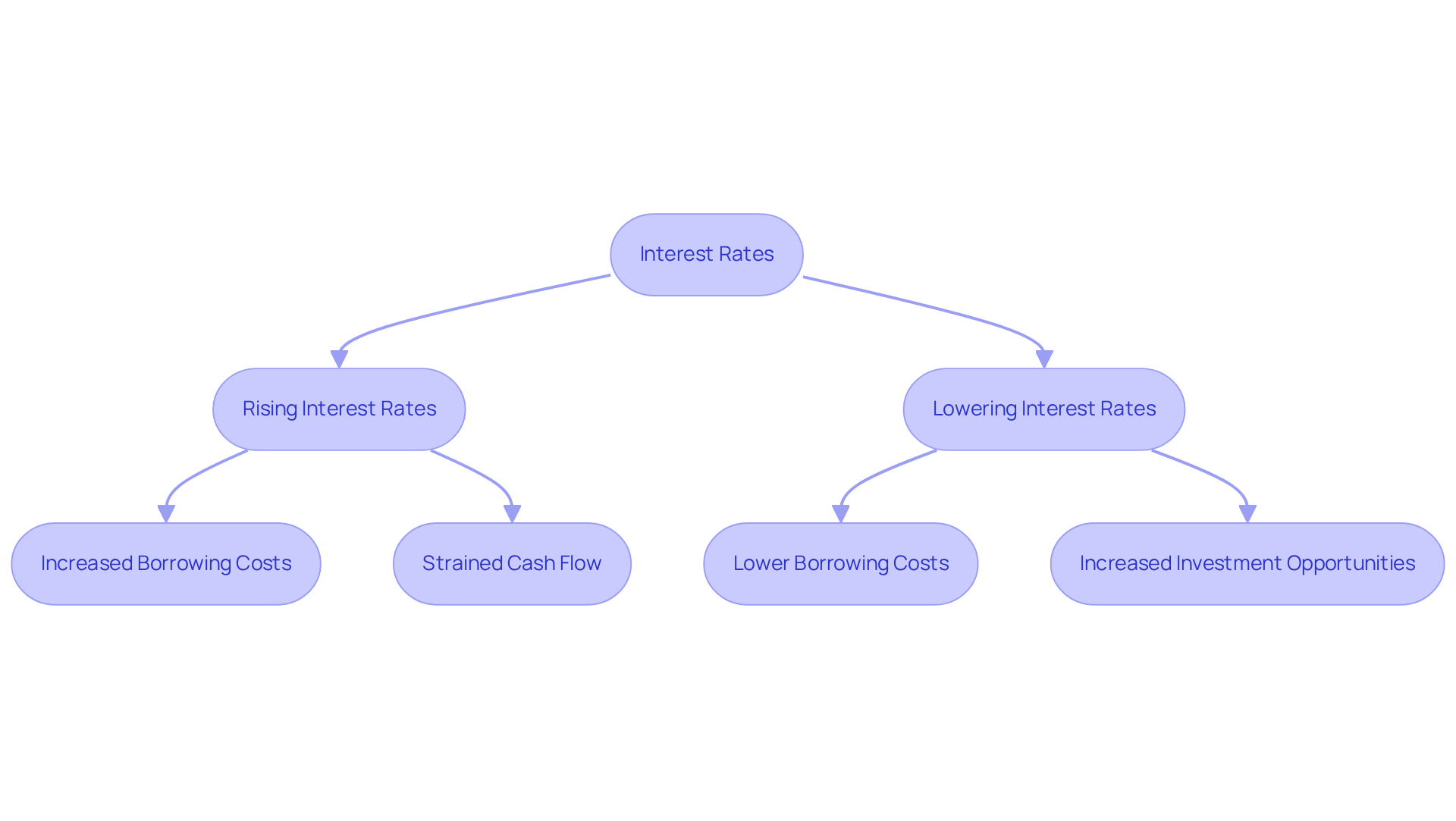

Interest rates are pivotal in real estate lending, significantly impacting both borrowing costs and the financial health of businesses. When interest rates rise, the cost of servicing debt escalates, potentially straining cash flow for small enterprises. Conversely, lower interest rates can render borrowing more affordable, particularly in the realm of commercial property lending in Australia, fostering investment in business real estate.

At Finance Story, we understand the critical nature of these dynamics in commercial property lending Australia, dedicating ourselves to crafting tailored loan proposals that specifically meet the unique needs of small business owners. By collaborating with a comprehensive array of lenders, including high street banks and innovative private lending panels, we assist you in securing the most advantageous financing options available.

Entrepreneurs should actively monitor interest rate trends and consider locking in favorable rates to minimize long-term costs, ensuring that their investment in business assets remains both sustainable and profitable.

Leveraging Self-Managed Super Funds (SMSFs) for Commercial Property Financing

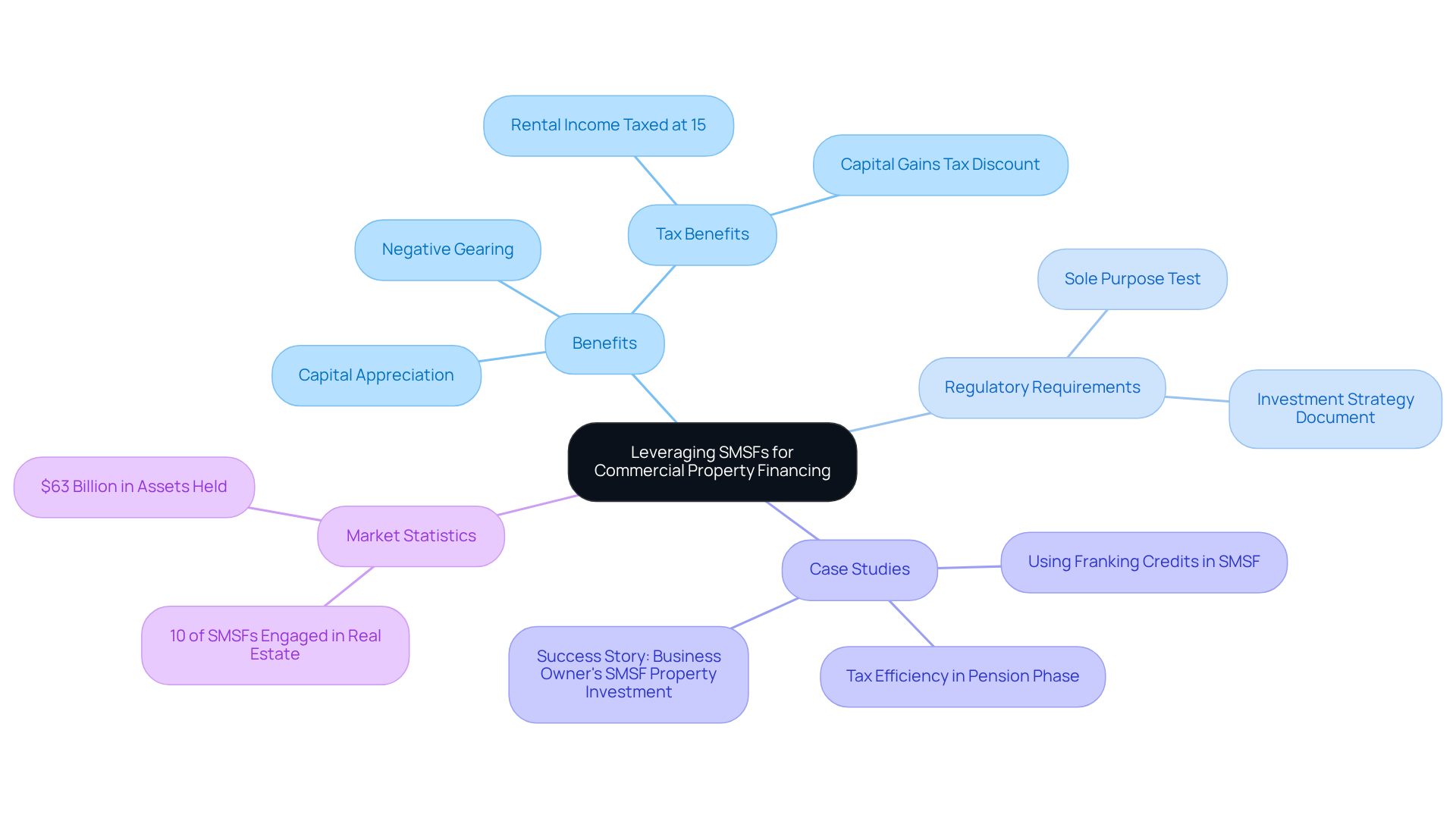

Self-Managed Super Funds (SMSFs) serve as a strategic asset for entrepreneurs keen on commercial property lending in Australia, particularly for investing in office buildings, warehouses, and retail spaces. By leveraging their superannuation savings, individuals can acquire properties that double as their business locations, effectively addressing both operational and investment goals. This strategy not only paves the way for capital appreciation but also offers substantial tax benefits. For instance, rental income from SMSF-held properties is taxed at a reduced rate of 15% during the accumulation phase, while capital gains tax can be minimized to 10% for assets held longer than 12 months.

However, strict adherence to regulations is paramount; assets must be utilized solely for investment purposes, in line with the 'sole purpose test' mandated by the ATO. A legally required SMSF investment strategy document must outline the fund's investment objectives and risk management protocols. Finance Story offers expert guidance to help you construct a compelling case and ensure compliance with regulations, ready to identify the right lender for your commercial investment asset.

Successful case studies demonstrate how business owners have effectively harnessed SMSFs to secure their premises, leading to significant financial growth and tax-efficient retirement strategies. As of 2025, approximately 10% of the 625,000 SMSFs in Australia are engaged in real estate investments, collectively holding around $63 billion in assets. This trend underscores the rising interest in SMSF real estate investment among savvy investors.

Moreover, SMSF financing typically begins at 6.39%, with interest rates expected to fluctuate between 6.5% and 8% in 2025, providing a clearer financial landscape for prospective investors. The potential for negative gearing within SMSFs further enhances tax advantages, making this investment strategy even more attractive. However, investors must remain vigilant about the costs associated with entering and exiting SMSF real estate investments, as these can significantly influence overall returns. Maintaining liquidity within the SMSF is crucial for managing repayment obligations and unexpected expenses.

Contact Finance Story today to explore your SMSF investment options.

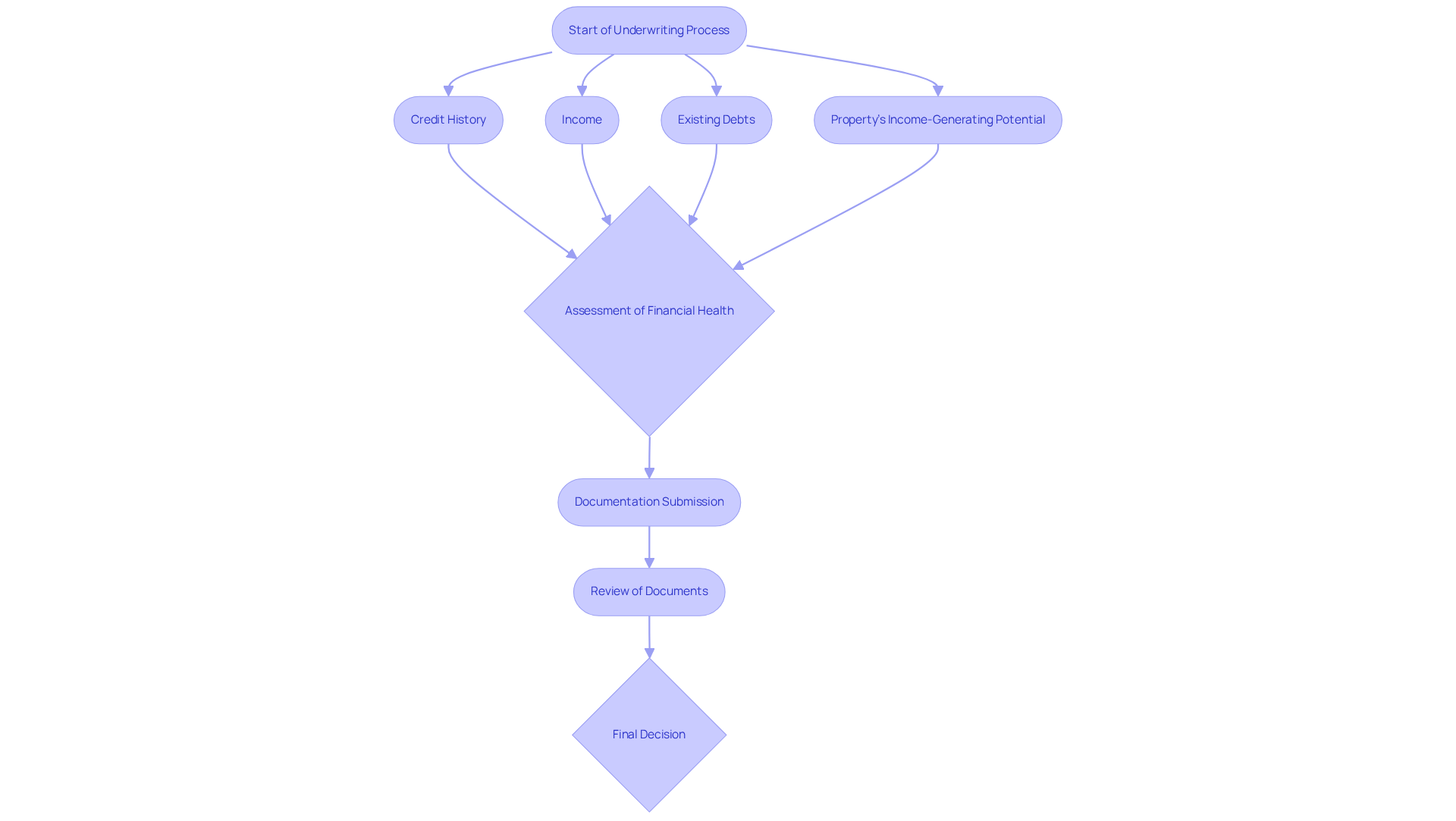

The Underwriting Process for Commercial Property Loans

The underwriting process for commercial real estate loans involves a meticulous evaluation of the borrower's financial health, the asset's value, and the associated risks. Lenders concentrate on several key factors:

- Credit history

- Income

- Existing debts

- The property's income-generating potential

This thorough assessment typically spans several weeks, making it essential for borrowers to submit accurate and complete documentation to facilitate a smoother approval process. Key documents include:

- Government-issued ID

- Bank statements

- W-2s

- Proof of income

Organizing these documents before applying for a mortgage can help avoid delays in the underwriting process.

Furthermore, owners should be cautious about seeking new credit during this period, as it can adversely affect their credit ratings and create difficulties in obtaining financing. Understanding these standards allows entrepreneurs to enhance their funding requests, ultimately increasing their chances of securing financing. Successful credit requests often emphasize the borrower's ability to demonstrate financial stability and a clear strategy for the asset's use, which can positively influence underwriting decisions.

At Finance Story, we focus on developing refined and highly personalized business cases that meet the elevated expectations of lenders. This ensures that your financing proposal stands out and effectively addresses the specific requirements of your real estate investment.

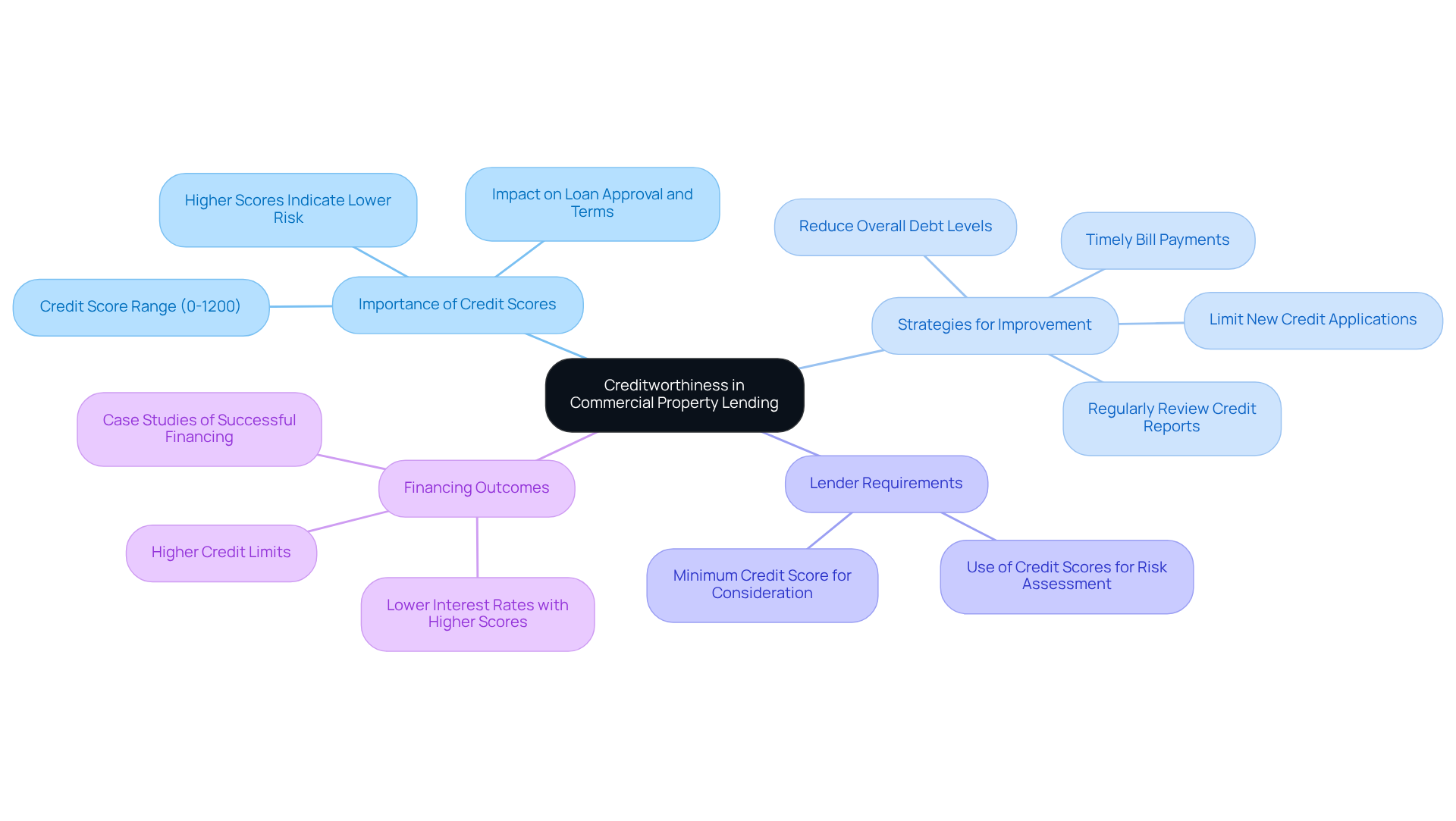

Importance of Creditworthiness in Commercial Property Lending

Creditworthiness is crucial in the commercial property lending Australia landscape. Lenders carefully assess a borrower's credit score, credit history, and overall financial health to determine their repayment capability. In Australia, credit scores range from 0 to 1,200, where higher scores signify better creditworthiness. A robust credit profile can lead to lower interest rates and more favorable borrowing terms, whereas a poor credit history may incur higher costs or even result in application denial.

For small business owners, maintaining a strong credit score is vital. Regularly reviewing credit reports for errors and correcting discrepancies can significantly bolster credit profiles. Additionally, making timely bill payments and reducing overall debt levels are effective strategies for enhancing credit scores. Statistics reveal that most lenders require a minimum credit score before considering a credit request, underscoring the importance of proactive credit management.

At Finance Story, we specialize in crafting refined and highly personalized proposals that not only highlight your creditworthiness but also meet the evolving expectations of lenders. By understanding the nuances of repayment criteria and having access to a comprehensive range of lenders, including high street banks and innovative private lending panels, we can assist you in securing the right financing tailored to your commercial property investment needs. Case studies illustrate that companies actively focusing on improving their credit profiles often secure more favorable financing terms. For instance, businesses that have effectively reduced their debt and maintained consistent payment records have reported higher credit limits and lower interest rates. By understanding the essential link between credit ratings and commercial property lending Australia, entrepreneurs can improve their chances of securing advantageous funding outcomes.

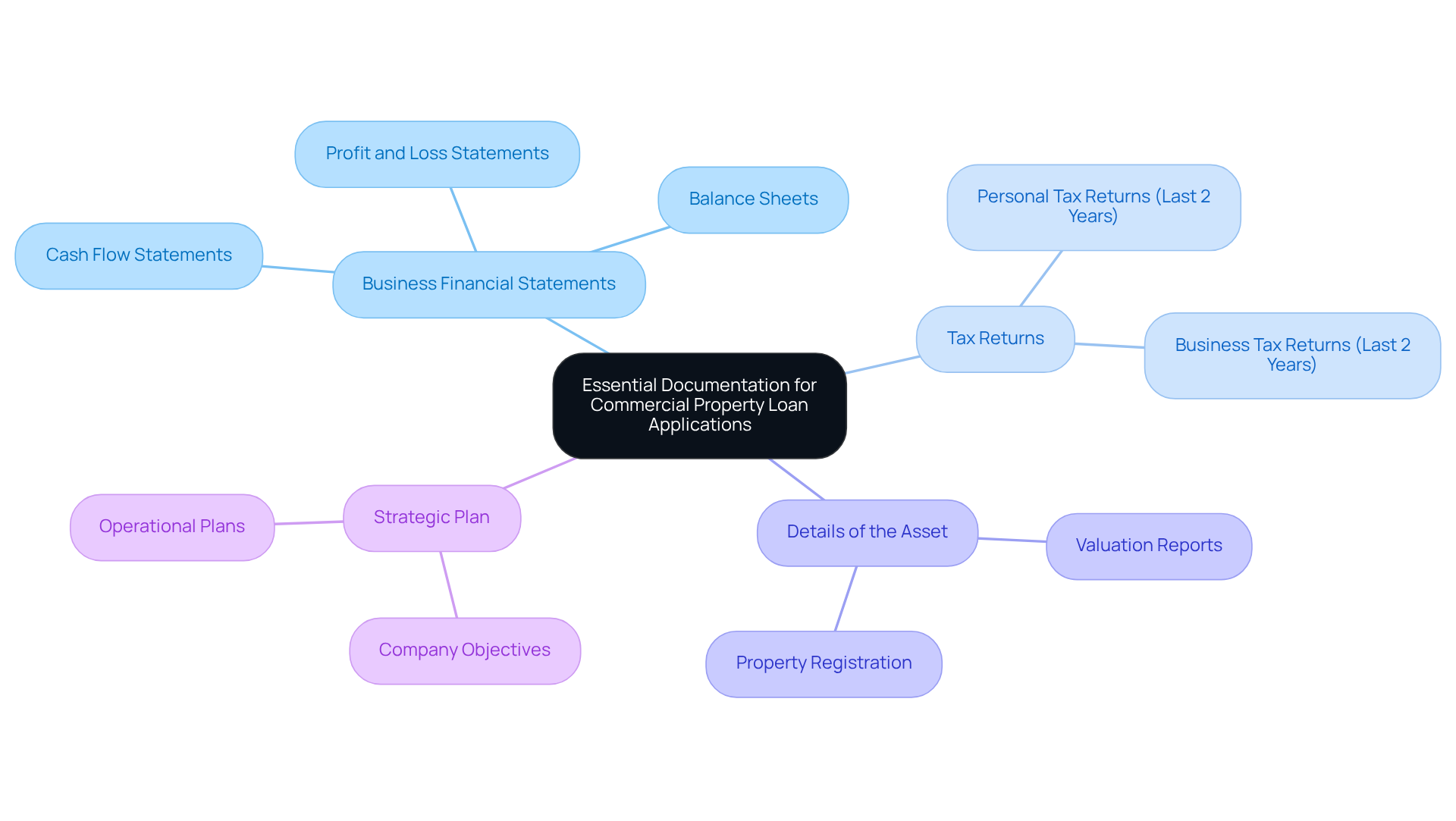

Essential Documentation for Commercial Property Loan Applications

When applying for commercial property lending in Australia, it is imperative for borrowers to prepare a comprehensive set of documentation that supports their application. Essential documents typically include:

- Business Financial Statements: Recent profit and loss statements, balance sheets, and cash flow statements are crucial for demonstrating the financial health of the business. These documents provide lenders with insights into the company's profitability and cash flow management.

- Tax Returns: Personal and business tax returns for the past two years are necessary to verify income and assess the borrower's financial stability. Lenders frequently require this information to evaluate the applicant's capacity to repay the debt.

- Details of the Asset: Information regarding the asset being acquired, including valuation reports, is essential. This documentation assists lenders in comprehending the asset's worth and its potential as security for the financing.

- Strategic Plan: A comprehensive strategic plan outlining the company's objectives and how the property will aid in its success is essential. This plan should articulate the strategic vision and operational plans, demonstrating to lenders that the investment is well thought out.

Having these documents prepared can significantly streamline the application process and enhance the likelihood of approval. Research indicates that applications with complete documentation have a higher success rate, often exceeding 90%. However, Finance Story boasts a 99% success rate for financing, underscoring the importance of thorough documentation and tailored proposals. Our expertise in creating refined and personalized cases ensures that your application meets the heightened expectations of lenders. Financial advisors emphasize that thorough preparation not only expedites the process but also instills confidence in lenders regarding the borrower's commitment and capability. Furthermore, most lenders require a deposit of 20-30% of the purchase price for commercial property lending in Australia, and a strong credit score is essential for obtaining these funds. Creditors also assess income consistency and require evidence of earnings or revenue for approval. Additionally, we offer access to a diverse range of lenders, including high street banks and private lending panels, to cater to various financing needs, whether for warehouses, retail premises, factories, or hospitality ventures. Refinancing options are also available to assist enterprises in adjusting to their changing financial needs.

Common Challenges in Commercial Property Lending

Borrowers often encounter several significant challenges when seeking commercial property loans, including:

- High Deposit Requirements: Many lenders demand substantial deposits, typically ranging from 20% to 30% of the property's value. This can pose a considerable barrier for small businesses. In 2025, the average loan-to-value ratio (LVR) for commercial property lending Australia is capped between 70% and 80%, necessitating higher upfront payments compared to residential loans. Finance Story focuses on developing refined and highly personalized cases to present to banks, assisting borrowers in obtaining the required capital for their commercial investments.

- Strict Lending Criteria: Lenders frequently impose stringent requirements that can disqualify potential borrowers. Factors such as credit history, company performance, and the nature of the property complicate the approval process for commercial property lending in Australia. Lenders anticipate a demonstrated capability to manage credit and a stable financial situation, making it crucial for borrowers to provide a compelling argument. With Finance Story's expertise, small enterprise owners can navigate these strict criteria more effectively, leveraging tailored solutions that enhance their chances of approval.

- Market Fluctuations: The real estate market is subject to variations that can influence asset values and, as a result, borrowing eligibility. Economic indicators, interest rates, and market demand play crucial roles in determining lenders' willingness to extend credit. Understanding these dynamics is essential, and Finance Story provides insights that help borrowers anticipate and adapt to changes in commercial property lending Australia.

- Complex Documentation: The extensive paperwork needed for business loans can be overwhelming for entrepreneurs. Comprehending and arranging documents like financial statements and asset evaluations is essential for a successful application. Finance Story assists clients in curating the necessary documentation, ensuring that all aspects of their financial situation are presented clearly and effectively.

Identifying these challenges enables borrowers to prepare more effectively and seek guidance from specialists like Finance Story, who can offer customized solutions and strategic advice to navigate the intricacies of commercial property lending in Australia. Additionally, with access to a comprehensive portfolio of lenders, including high street banks and innovative private lending panels, Finance Story offers a wide range of options to suit various circumstances. Testimonials from satisfied clients further attest to the effectiveness of Finance Story's services, showcasing their commitment to helping businesses succeed.

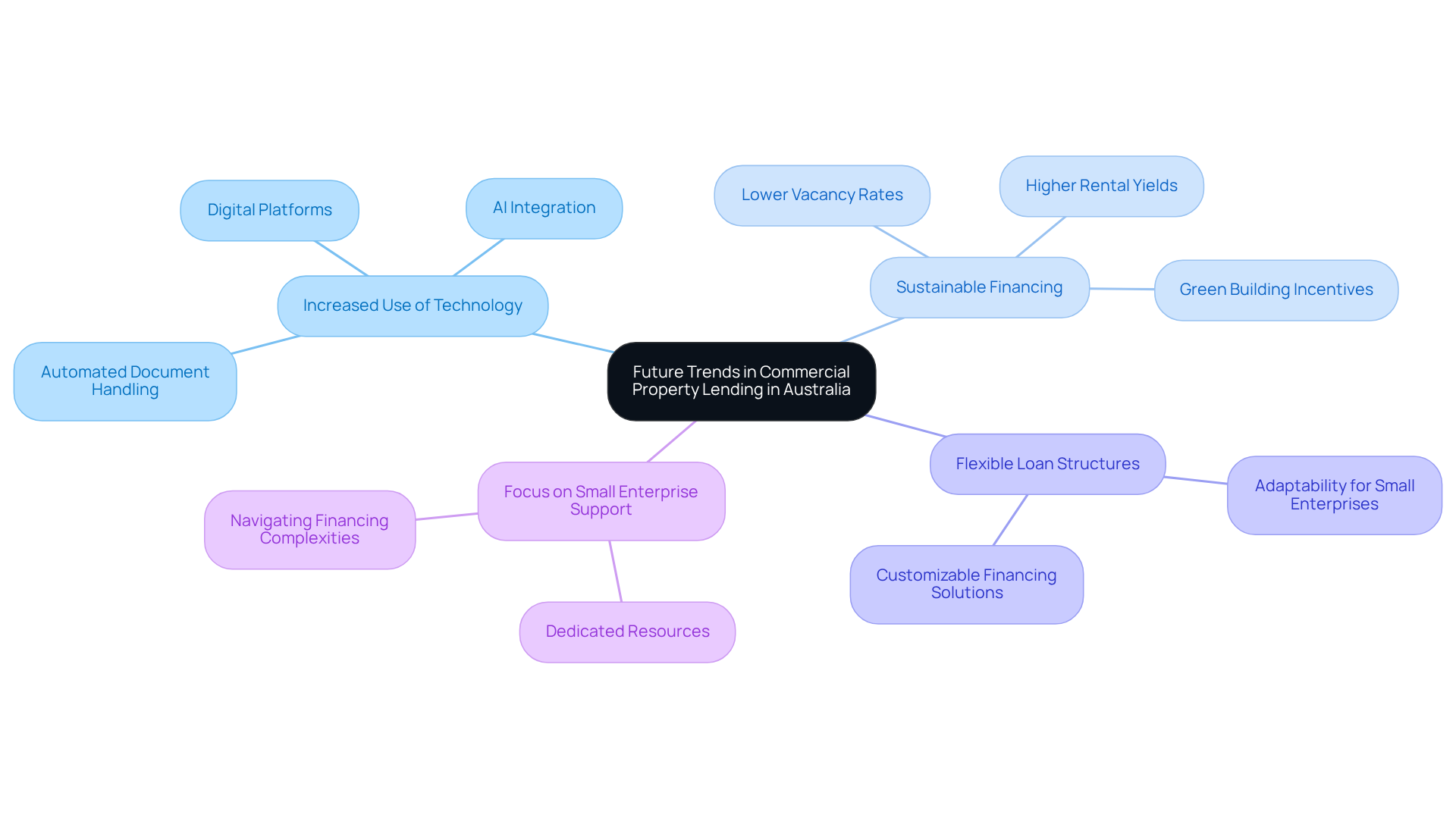

Future Trends in Commercial Property Lending in Australia

The commercial property lending landscape in Australia is experiencing significant transformation, influenced by several key trends.

- Increased Use of Technology: Digital platforms are revolutionizing the loan application process, enabling borrowers to access financing more efficiently. The integration of advanced technologies like AI and automated document handling has streamlined workflows, reducing processing times and enhancing customer experiences. This shift simplifies the application process and allows lenders to make quicker, data-driven decisions.

- Sustainable Financing: There is a notable rise in the emphasis on environmentally sustainable assets. Lenders are increasingly offering favorable terms for green buildings, reflecting a broader commitment to sustainability in the commercial real estate sector. Statistics indicate that properties with sustainable certifications often enjoy lower vacancy rates and higher rental yields, making them attractive investments.

- Flexible Loan Structures: In response to the diverse needs of borrowers, lenders are providing more flexible loan terms. This adaptability is essential for small enterprises, enabling them to customize financing solutions that align with their distinct operational needs and growth strategies.

- Focus on Small Enterprise Support: As the economy continues to recover, there is a renewed emphasis on assisting small enterprises through customized lending solutions. This includes not only flexible terms but also dedicated resources to help navigate the complexities of securing financing.

Remaining knowledgeable about these trends is crucial for entrepreneurs aiming to make strategic choices concerning their financing alternatives. By leveraging technology and understanding the evolving landscape, small businesses can position themselves for success in the competitive market of commercial property lending Australia.

Conclusion

In the dynamic realm of commercial property lending in Australia, small businesses face a multitude of challenges while seeking tailored solutions for optimal financing. The importance of personalized service and customized financial strategies has reached unprecedented levels, as these approaches not only elevate client satisfaction but also enhance the likelihood of securing favorable loan terms. Entrepreneurs must grasp the intricacies of the lending process, including loan-to-value ratios and the implications of interest rates, to thrive in this competitive landscape.

This article delves into various facets of commercial property lending, emphasizing the necessity of a strong credit profile alongside the array of loan options available, such as:

- standard commercial loans

- construction financing

- SMSF financing

Moreover, it underscores the critical nature of proper documentation and the underwriting process, while also addressing common hurdles faced by borrowers, including:

- high deposit requirements

- stringent lending criteria

As trends shift toward technology-driven solutions and sustainable financing, small business owners are urged to remain informed and adaptable, maximizing their opportunities.

Ultimately, the key takeaway is that small businesses stand to gain significantly by seeking expert guidance and tailored solutions in commercial property lending. By comprehending current trends and preparing diligently, entrepreneurs can position themselves for success in securing financing that aligns with their distinct needs. Embracing these insights and taking proactive measures will empower businesses to navigate the complexities of commercial property lending in Australia, ensuring they are well-equipped to achieve their financial objectives.