Overview

This article outlines the essential rules and considerations for owner-occupied loans in Australia, highlighting their critical role for homeowners navigating the mortgage landscape.

Understanding eligibility requirements, interest rates, and potential penalties for misusing loans is paramount, as these factors significantly influence financial stability and compliance with lender regulations.

Are you aware of how these elements can affect your financial future? By grasping these key concepts, you can make informed decisions that align with your goals and safeguard your investments.

Introduction

Navigating the intricate landscape of owner-occupied loans in Australia can indeed be daunting for homeowners, especially given the evolving regulations and economic pressures. Understanding the essential rules governing these loans is crucial for making informed financial decisions that can significantly shape one's home-buying journey.

As homeowners grapple with rising interest rates and stringent eligibility criteria, a pressing question emerges: how can they effectively leverage these regulations to secure the most favorable financing options?

This article explores the ten essential rules of owner-occupied loans in Australia, providing insights that empower homeowners to confidently navigate their financial futures.

Finance Story: Tailored Owner-Occupied Loan Solutions in Australia

Finance Story excels in delivering customized funding solutions for homeowners across Australia, compliant with owner-occupied loan rules Australia. As of early 2025, the average interest rate for new owner-occupier financing ranges between 6.04% and 6.55% per annum, with an average owner-occupier variable rate for new financing at 5.83% per annum, reflecting a decrease from the previous month. This positions the brokerage to ensure clients benefit from competitive rates and flexible repayment terms. Grasping the intricacies of the mortgage landscape, Finance Story offers a range of options that correspond with each client's economic situation, enabling a smoother home-buying experience.

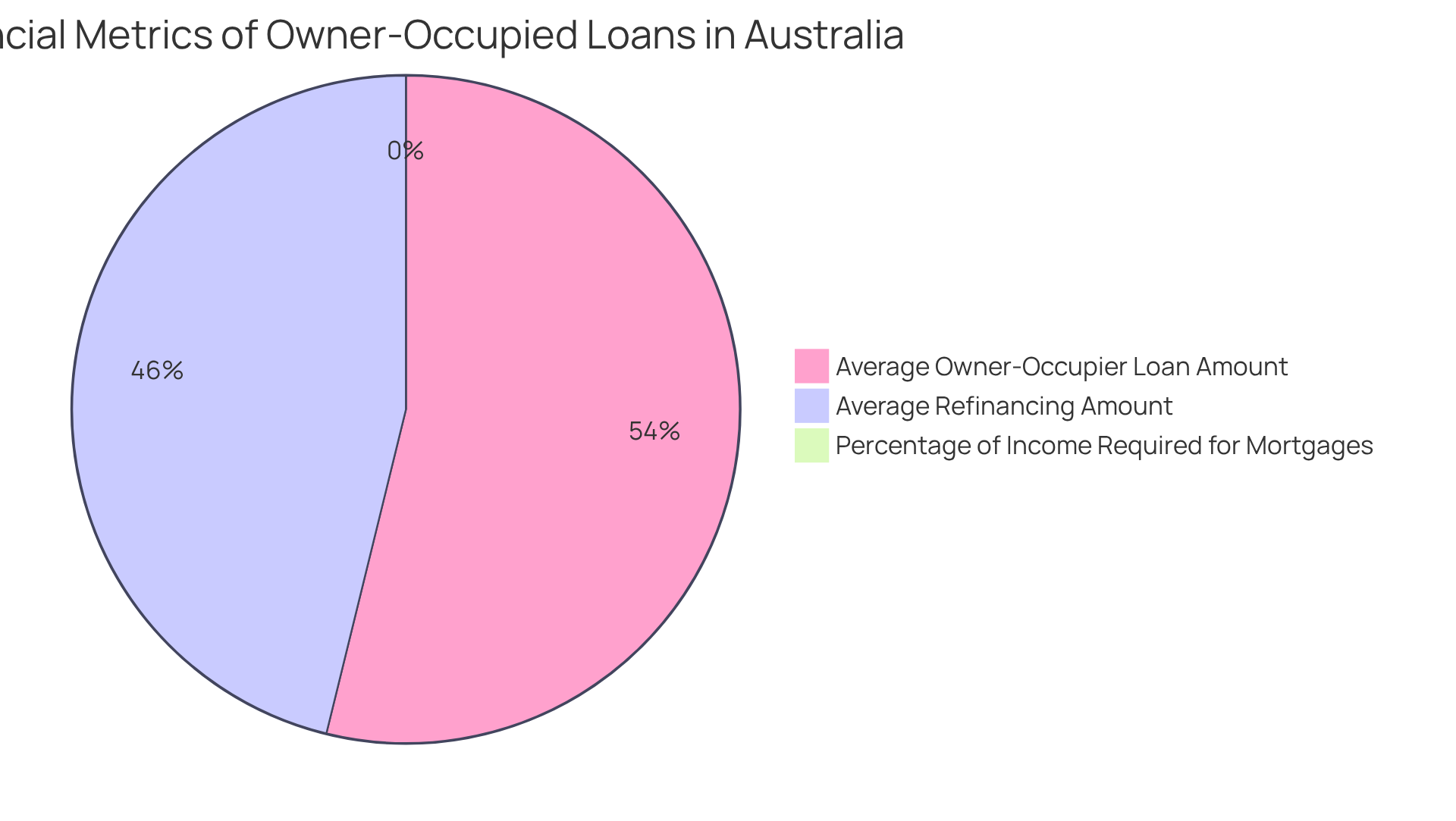

Current patterns suggest a notable change in the owner-occupied loan rules Australia, characterized by escalating amounts and heightened economic pressures on purchasers. The typical home financing amount for owner-occupiers has reached around $660,000, while the average refinancing figure stands at $566,000, underscoring the increasing demand for customized mortgage solutions. Furthermore, over 50% of income is now required to service mortgages in Brisbane, emphasizing the economic challenges homeowners encounter. Finance Story's expertise in navigating these challenges establishes it as a reliable ally for homeowners, providing tailored assistance throughout the financing process.

Examples of customized services include options for offset accounts, which have gained popularity among mortgage holders. Notably, 67.1% of those with $50,000 or more in savings utilize them to manage repayments more effectively. By concentrating on developing robust, lasting connections, Finance Story guarantees that clients feel acknowledged and supported, ultimately enhancing their financial experiences in the competitive Australian real estate market.

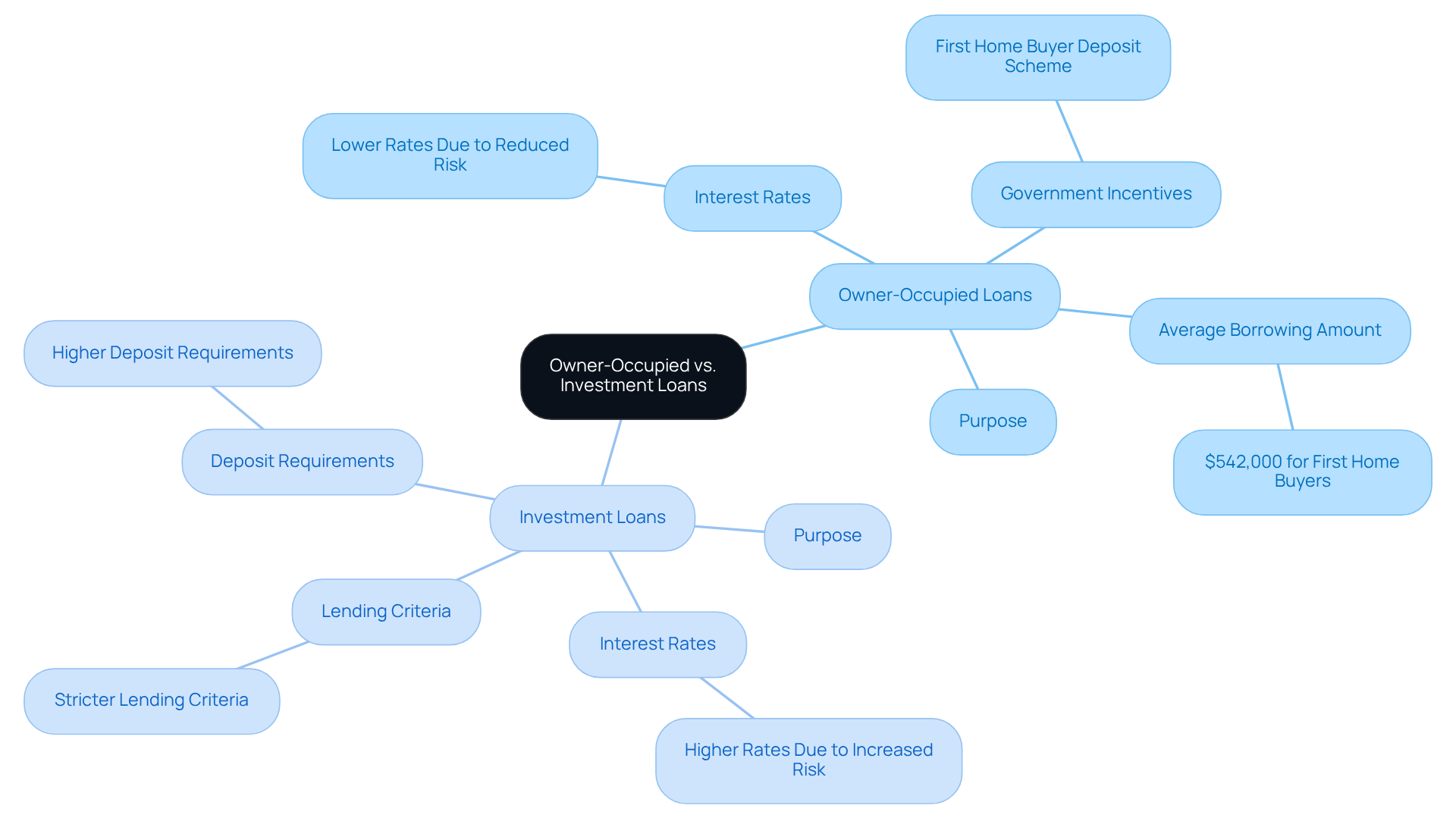

Owner-Occupied vs. Investment Loans: Key Differences Explained

The owner-occupied loan rules Australia cater to individuals intending to live in the property, while investment financing targets properties acquired for rental income or capital appreciation. One of the key distinctions lies in interest rates; the owner-occupied loan rules Australia typically allow for lower rates due to reduced risk for lenders. Additionally, owner-occupiers may benefit from government incentives and grants due to the owner-occupied loan rules Australia, such as the Albanese Federal Government's extension of existing programs like the first home buyer deposit scheme. In contrast, investment financing often imposes stricter lending criteria and higher deposit requirements.

In the March 2025 quarter, total new lending for owner-occupied residences (excluding refinancing) reached an impressive $54 billion, which emphasizes the relevance of owner-occupied loan rules Australia in the current market landscape. First home purchasers averaged a borrowing amount of $542,000, often securing loans that are less than those of other property owners and investors. This highlights the importance of understanding these financing options.

As Warren Buffett aptly stated, "Price is what you pay. Value is what you get," which reinforces the necessity of making informed financial decisions that align with long-term objectives. Are you ready to explore your financing alternatives and make choices that enhance your financial future?

Eligibility Requirements for Owner-Occupied Loans in Australia

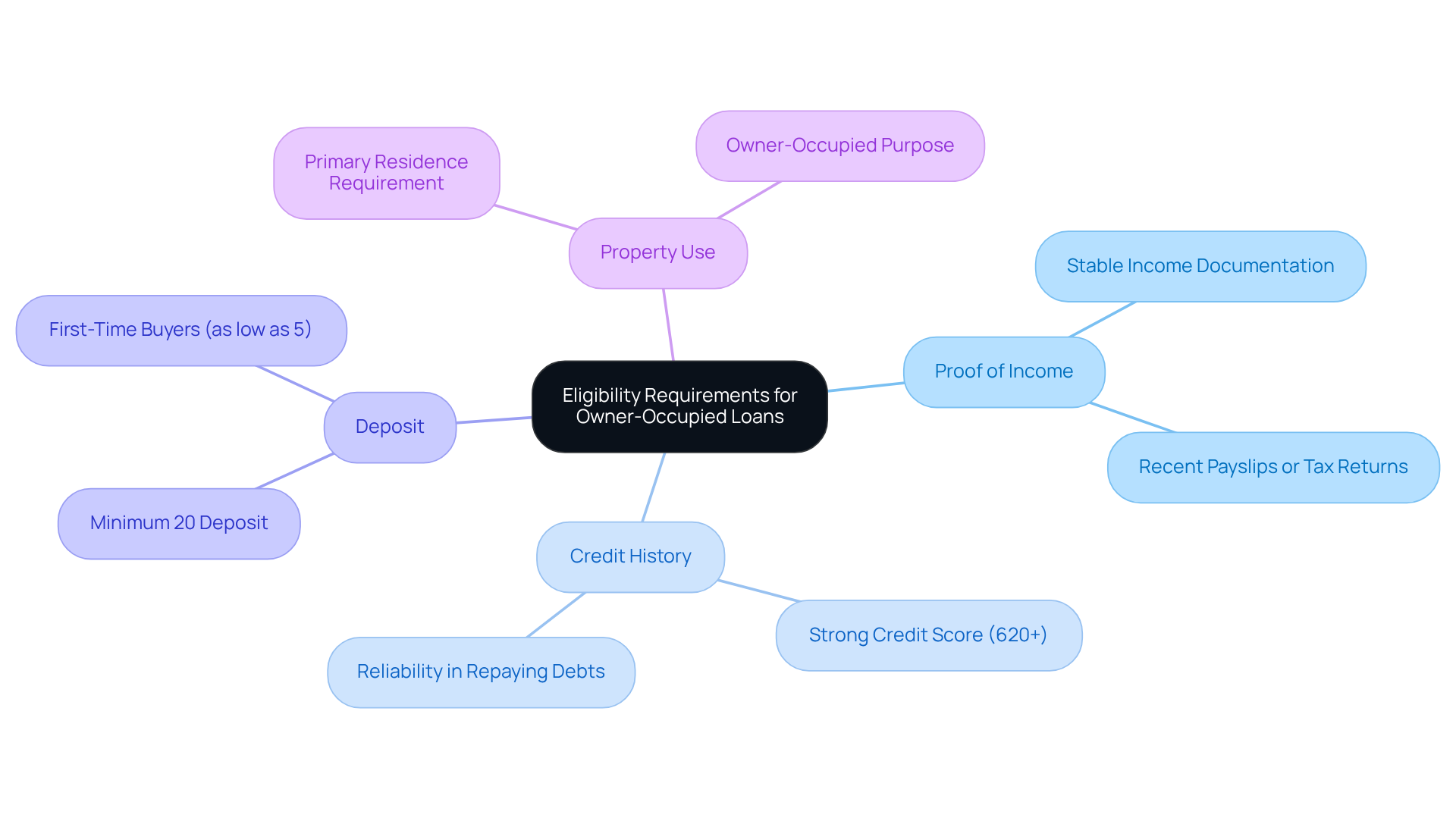

To qualify for an owner-occupied loan in Australia, borrowers must meet several key criteria:

- Proof of Income: Lenders require documentation demonstrating stable income, such as recent payslips or tax returns. This is essential for assessing the borrower's ability to meet repayment obligations. As Harrison Astbury observes, "The current average home mortgage amount for owner occupiers, by our calculation of original ABS quarterly data, is $660,000," highlighting the importance of demonstrating sufficient income to support such commitments.

- Credit History: A strong credit score is crucial, typically around 620 or higher, as it indicates the borrower's reliability in repaying debts. A robust credit history can greatly improve the likelihood of approval for financing.

- Deposit: Most lenders expect a minimum deposit of 20% of the asset's value. However, some programs may permit smaller deposits, especially for first-time home purchasers, who frequently obtain financing with deposits as low as 5%.

- Property Use: The property must be designated as the borrower's primary residence. This requirement guarantees that the financing is utilized for owner-occupied purposes in accordance with the owner-occupied loan rules Australia, rather than for investment.

Satisfying these criteria is essential for a successful credit application, as they indicate the financial institution's evaluation of risk and the borrower's fiscal stability. Furthermore, as the market evolves, potential borrowers should consider checking their credit score and gathering necessary documentation before applying for a loan to enhance their chances of approval.

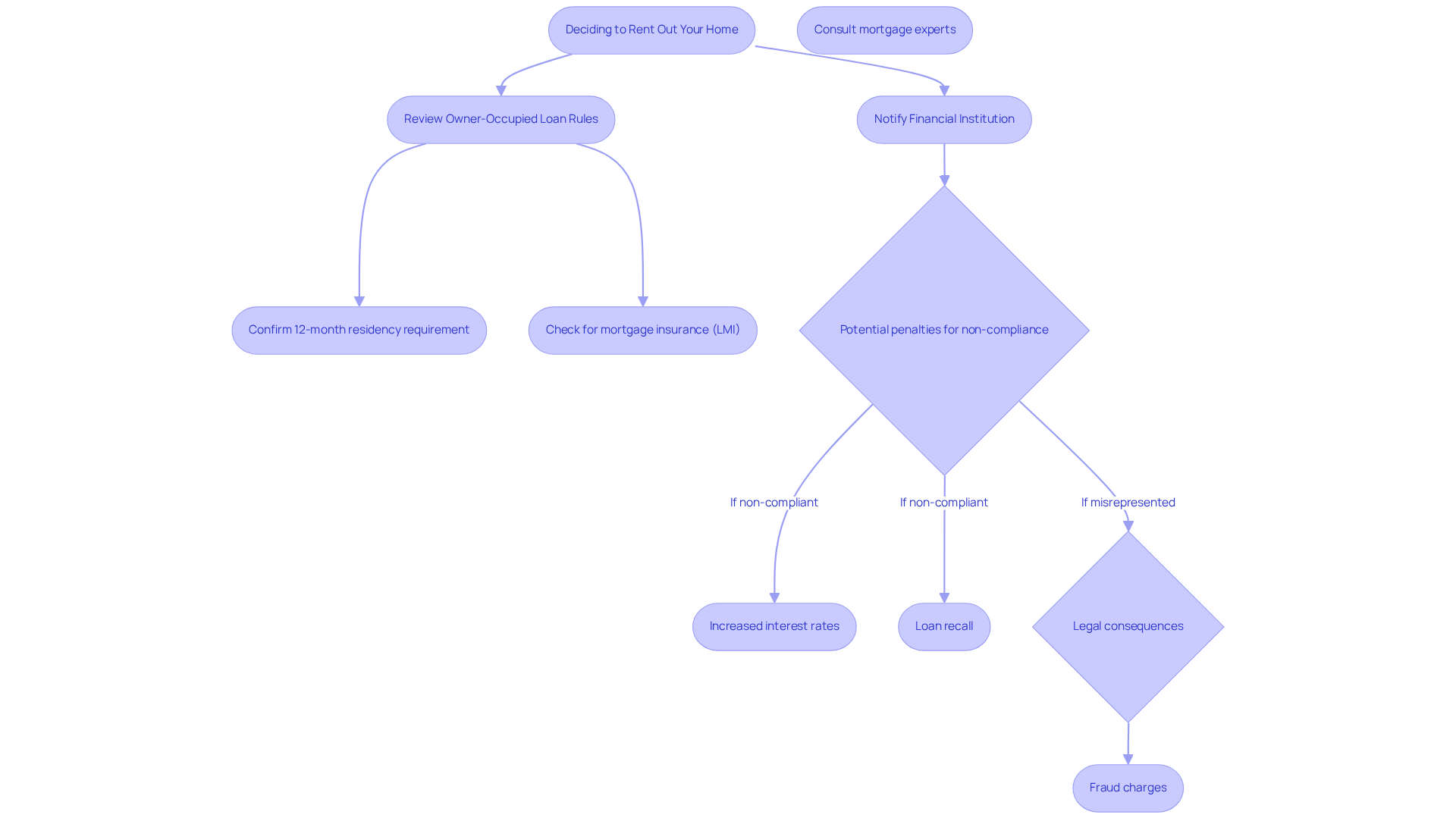

Renting Out Your Owner-Occupied Home: What You Need to Know

Renting out your home while adhering to owner-occupied loan rules Australia requires careful consideration of the associated consequences. According to the owner-occupied loan rules Australia, most financial institutions mandate that the asset serves as your primary residence for a minimum of 12 months before any rental activity can commence.

If you are borrowing over 80% of the asset's value, mortgage insurance (LMI) is typically required by financial institutions, adding to the financial implications of renting. Neglecting to inform your financial institution about your intention to rent can lead to significant penalties due to the owner-occupied loan rules Australia, including increased interest rates or even the recall of your loan.

As Alasdair Duncan, Content Editor at Canstar, states, "If you leave your owner-occupied residence and convert it into a rental, you must notify your financial institution about the owner-occupied loan rules Australia." Should a creditor discover that a homeowner has misrepresented the asset's use, it may result in immediate repayment requests.

Moreover, fraudulent misrepresentation of property use can lead to severe legal consequences, including potential charges of fraud. To mitigate these risks, homeowners should thoroughly examine their financing agreements and maintain open communication with their creditors regarding any changes in occupancy status, particularly in light of owner-occupied loan rules Australia.

Consulting with mortgage experts can offer valuable insights into navigating these complexities and ensuring compliance with lender requirements.

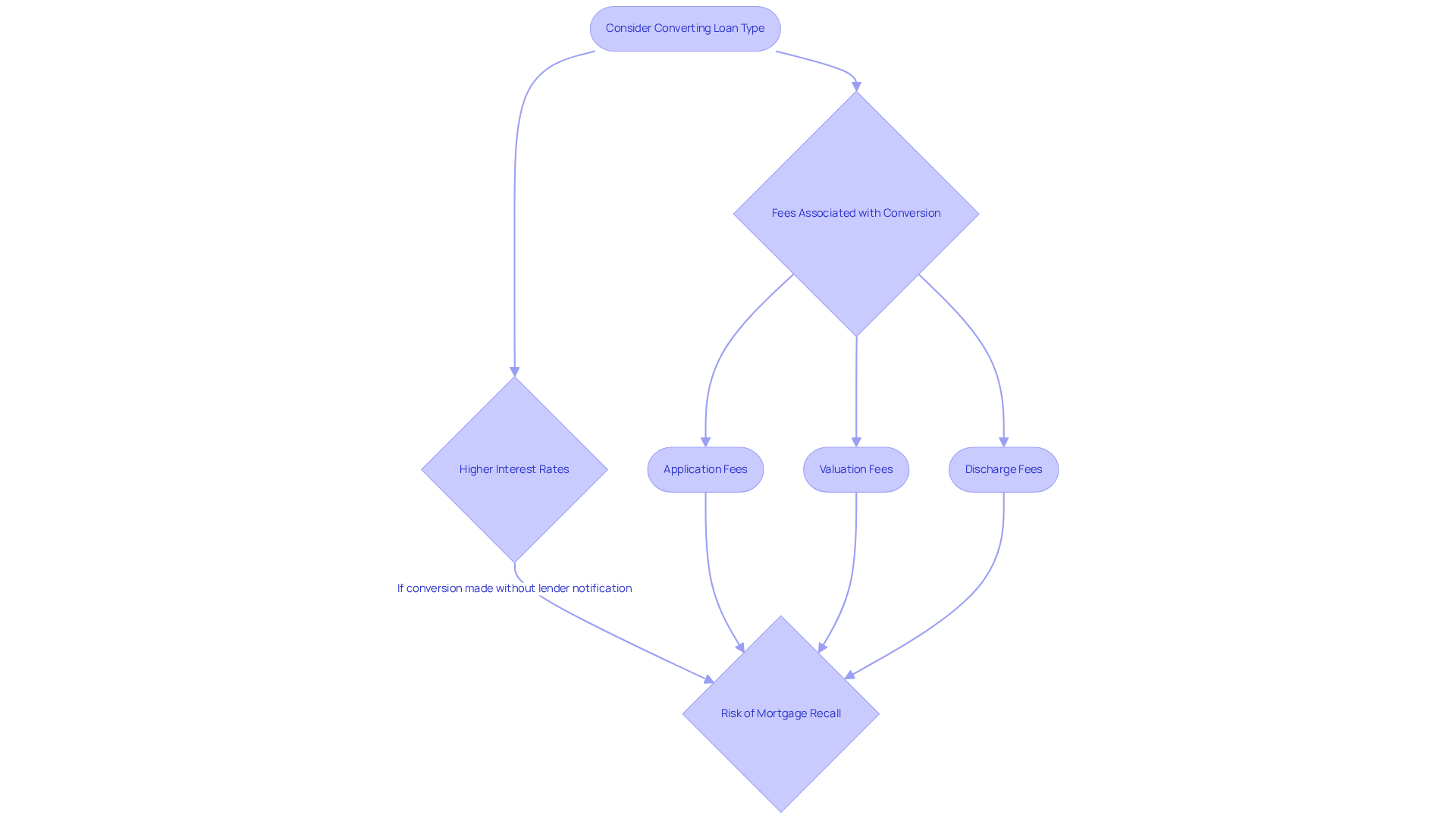

Penalties for Converting Owner-Occupied Loans to Investment Loans

Transforming an owner-occupied mortgage into an investment mortgage can lead to significant financial consequences according to the owner-occupied loan rules Australia. Lenders typically impose higher interest rates on investment financing due to the increased risk associated with rental properties. For instance, the interest rate for investment financing can be up to 0.5% higher than that for owner-occupied properties, reflecting the lender's assessment of risk. Additionally, borrowers may face fees related to refinancing or changing the purpose of the credit, which may include:

- Application fees

- Valuation fees

- Discharge fees

It is essential for homeowners to carefully evaluate these expenses against the potential benefits of leasing their residence in accordance with owner-occupied loan rules Australia. Have you considered the implications of leasing your home without notifying your financial institution? Such actions could lead to severe repercussions, including the risk of having your mortgage recalled, necessitating immediate repayment. Therefore, discussing any changes to the financing arrangement with a lender is crucial to avoid unforeseen financial consequences and ensure compliance with agreement terms.

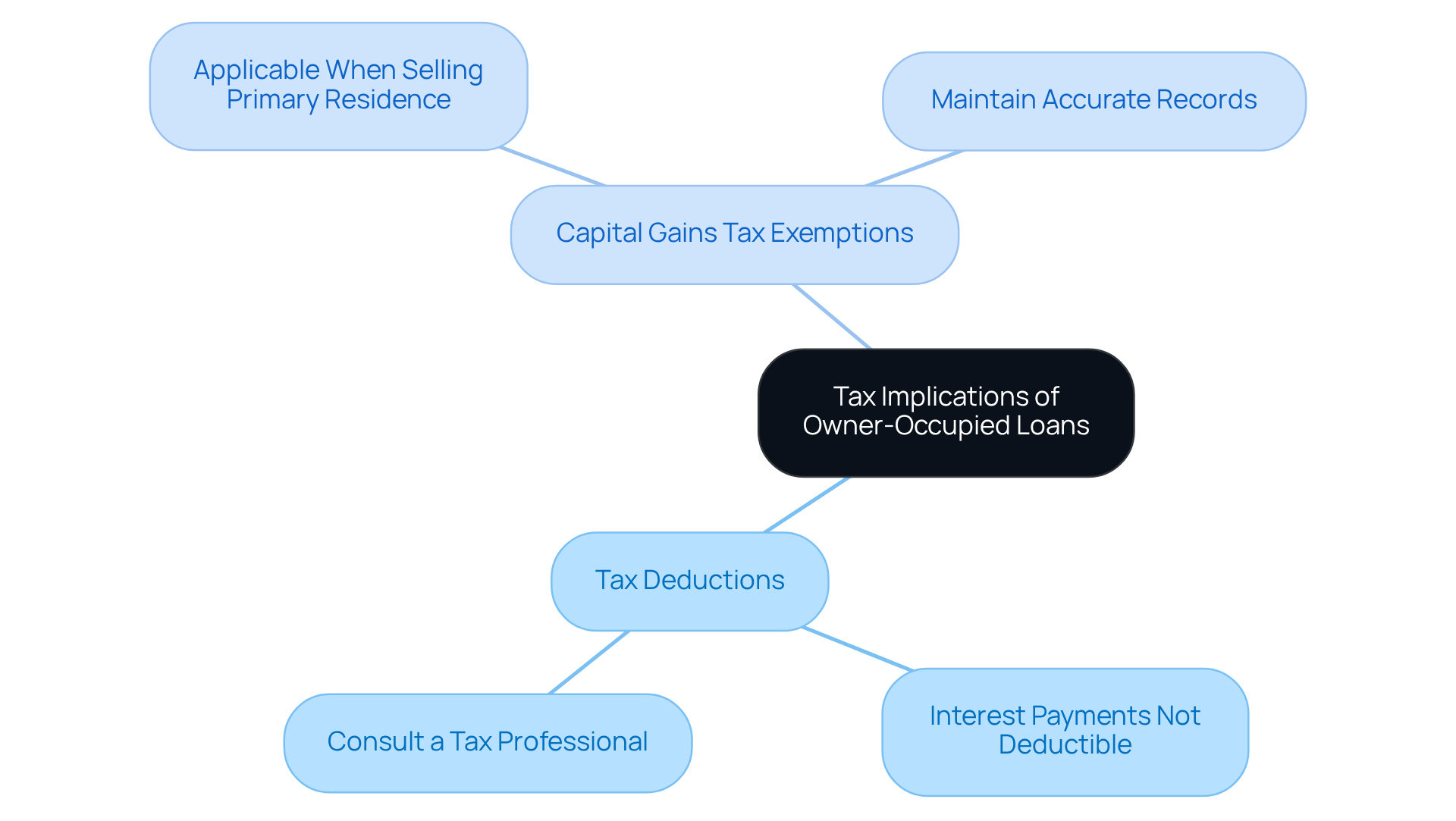

Tax Implications of Owner-Occupied Loans: What Homeowners Should Know

According to owner-occupied loan rules Australia, these mortgages typically do not offer tax deductions for interest payments, as these properties are not income-generating. However, homeowners can benefit from the owner-occupied loan rules Australia, which include capital gains tax (CGT) exemptions when selling their primary residence.

Are you aware of the potential benefits this could bring? It is crucial for homeowners to maintain accurate records of their expenses and consult with a tax professional about owner-occupied loan rules Australia. This ensures compliance with tax regulations and helps explore any possible deductions related to home improvements or other qualifying expenses.

By understanding these aspects, you can make informed decisions regarding your financial future.

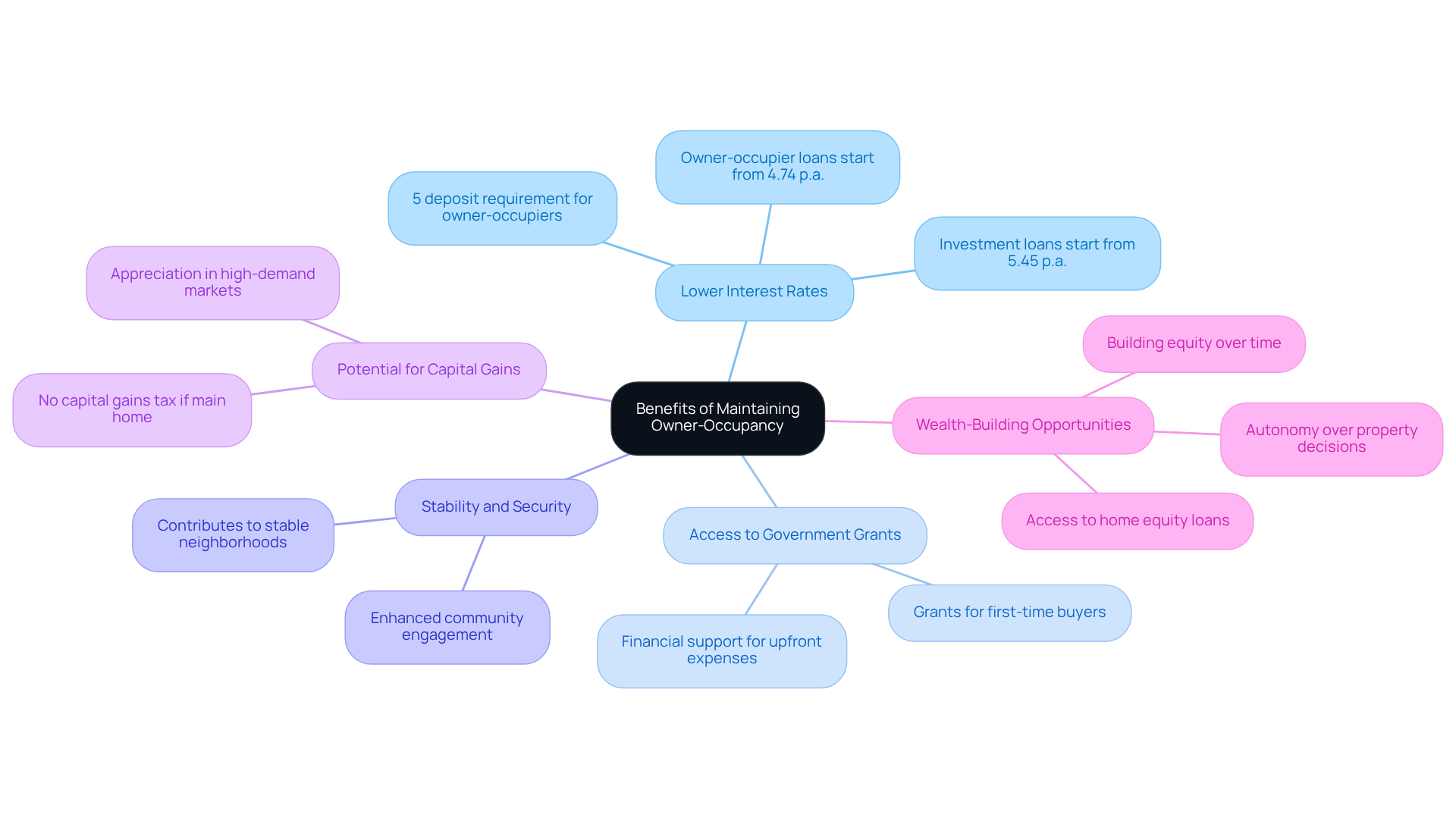

Benefits of Maintaining Owner-Occupancy for Homeowners

Maintaining owner-occupancy offers several significant benefits for homeowners, including:

-

Lower Interest Rates: Owner-occupied loans generally feature lower interest rates compared to investment loans, substantially reducing overall borrowing costs. As of July 2025, interest rates for owner-occupier loans start from 4.74% p.a., compared to 5.45% p.a. for investors, making them a more economical choice for homeowners. Furthermore, owner-occupiers can enter the market with a 5% deposit, enhancing accessibility.

-

Access to Government Grants: Homeowners may qualify for various government grants and incentives aimed at supporting first-time buyers and owner-occupiers. These grants can provide significant monetary support, helping to alleviate the burden of upfront expenses related to purchasing a home. A financial advisor noted, "Government grants can significantly ease the financial strain for new homeowners, making the dream of homeownership more attainable."

-

Stability and Security: Residing in the residence fosters a sense of stability and community, enhancing overall quality of life. Owner-occupiers are often more engaged in civic activities, contributing to the development of stable and friendly neighborhoods. This involvement not only benefits the individual homeowner but also strengthens community ties.

-

Potential for Capital Gains: As real estate appreciates in value, homeowners can benefit from capital gains when they decide to sell. Importantly, if the asset has served as their main home, they may not face capital gains tax (CGT) upon sale, resulting in substantial economic advantages.

-

Wealth-Building Opportunities: Owner-occupants build equity in their homes over time, which can be leveraged for various financial opportunities, such as home renovations or retirement savings. This equity not only boosts personal wealth but also provides access to home equity loans, making owner-occupied residences a valuable asset. As highlighted in a case study, owner-occupiers enjoy full autonomy and control over their properties, allowing them to make decisions that enhance their living situation and property value.

By understanding and leveraging these benefits, homeowners can make informed decisions that enhance their financial well-being and contribute positively to their communities.

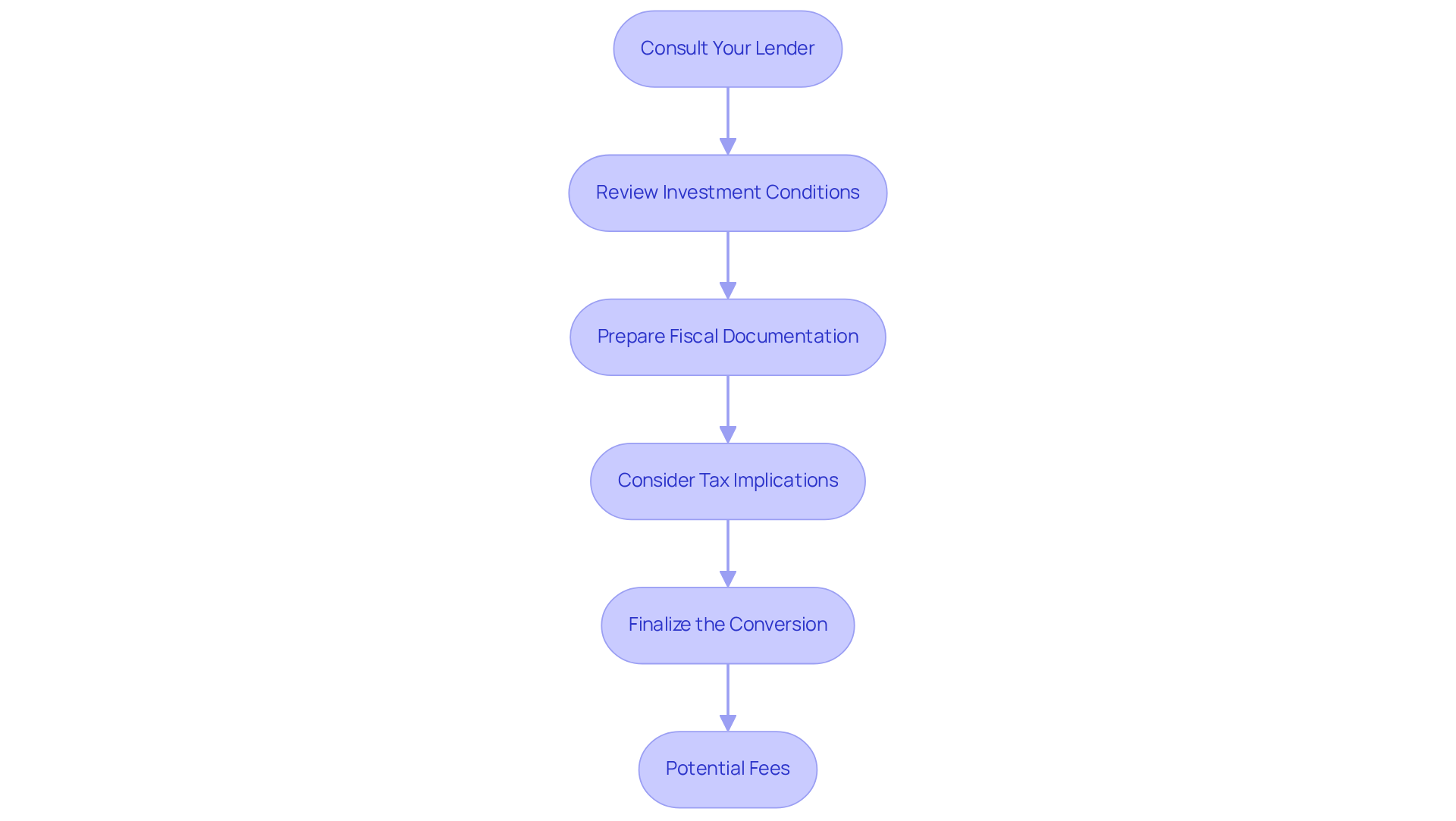

How to Convert Your Owner-Occupied Loan to an Investment Loan

To convert your owner-occupied loan to an investment loan, follow these steps:

-

Consult Your Lender: Notify your lender of your intention to alter the purpose of the financing and inquire about any specific requirements or penalties. As Mark Bristow, a Personal Finance Editor, notes, transitioning from an owner-occupier mortgage to an investor mortgage may necessitate refinancing your current financing.

-

Review Investment Conditions: Understand the new terms associated with investment financing, including interest rates and repayment structures. As of March 2025, the average interest rate on a new investment credit was 6.22%, compared to 5.99% for owner-occupier mortgages. This highlights the economic implications of this transition.

-

Prepare Fiscal Documentation: Gather the necessary fiscal documents, such as income statements and tax returns, to support your application for the new credit type.

-

Consider Tax Implications: Consult with a tax advisor to comprehend the tax consequences of converting your debt and ensure compliance with regulations. Professional guidance is vital for financial transitions, especially regarding investment real estate finance.

-

Finalize the Conversion: Complete any required documentation and finalize the conversion process with your lender to officially change the type of financing. Additionally, establishing a separate borrowing account for the investment property is crucial for tax efficiency, aiding in maintaining clear records for compliance.

Successful credit transformations in Australia often demand meticulous planning and consultation with experts to navigate the complexities of owner-occupied loan rules Australia and the broader economic landscape. The typical duration required to transform financial agreements can vary, but being well-prepared can significantly streamline the process. Be mindful of potential fees associated with the conversion, as these can influence your overall financial strategy.

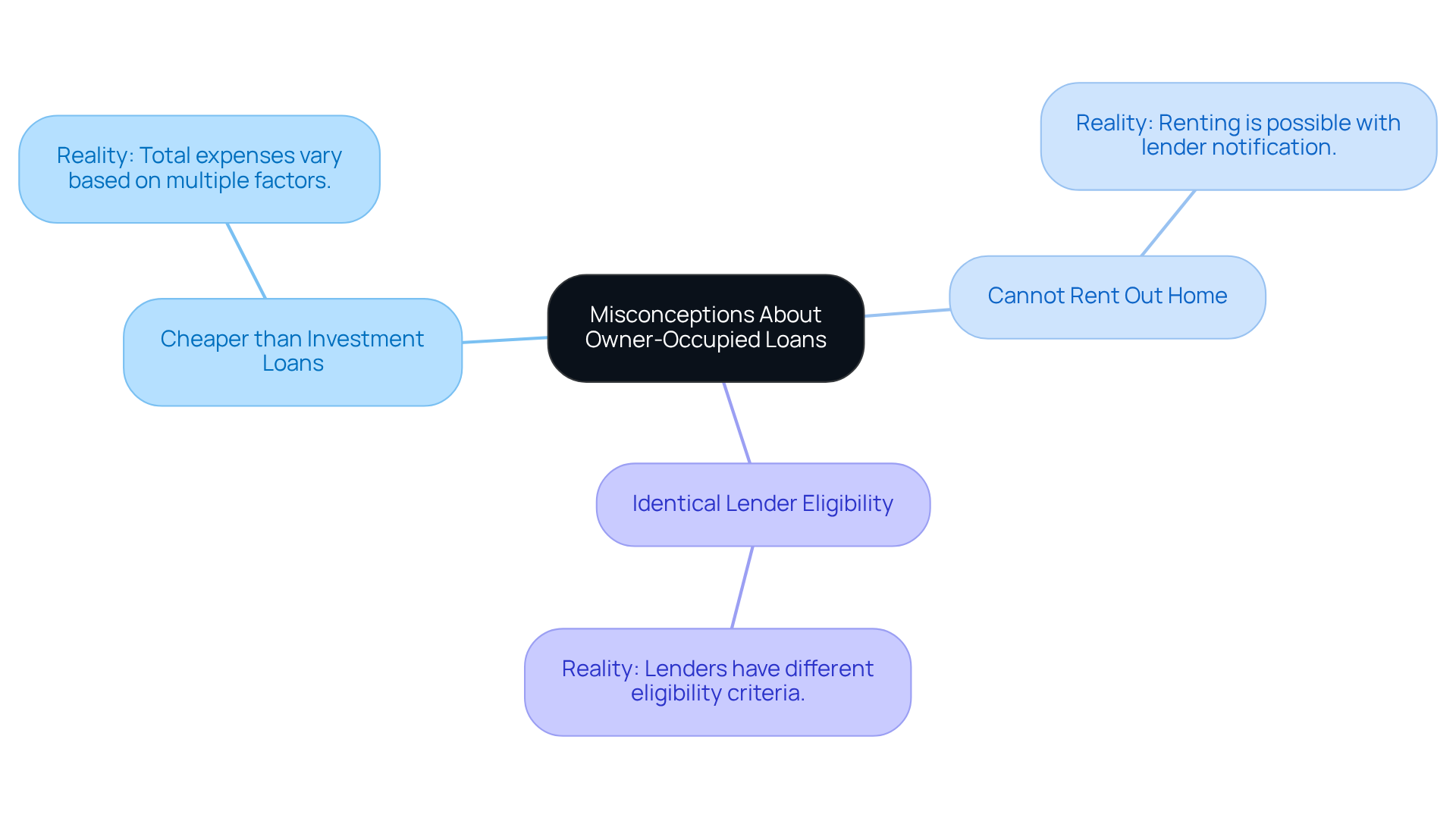

Common Misconceptions About Owner-Occupied Loans in Australia

Numerous misconceptions surround the owner-occupied loan rules Australia, leading to confusion among potential borrowers. Here are some prevalent myths and their corresponding realities:

-

Myth 1: Owner-occupied loans are always cheaper than investment loans.

Reality: While the owner-occupied loan rules Australia generally offer lower interest rates, the total expense can differ greatly depending on factors such as the financial institution, financing conditions, and individual borrower situations. -

Myth 2: You cannot rent out your home if you have an owner-occupied mortgage.

Reality: Leasing your residence is indeed achievable; however, it requires informing your mortgage provider. Failing to do so may lead to penalties or increased charges. -

Myth 3: All lenders share identical eligibility standards for owner-occupied mortgages.

Reality: Lenders have varying eligibility criteria, making it essential for borrowers to explore and evaluate different options to find the best match for their economic circumstances.

Understanding these misconceptions is vital for homeowners to navigate the owner-occupied loan rules Australia, enabling them to make informed decisions regarding their financing options. With the typical mortgage amount in Australia reaching $659,922 and first home buyers now taking approximately 10 years to save up a 20% deposit, being knowledgeable can lead to substantial savings and improved economic outcomes. Furthermore, with the average yearly earnings of a typical home borrower at $137,000, comprehending financing options becomes even more essential. Notably, as many as 75% of new home mortgages are arranged by mortgage brokers, emphasizing the significance of seeking expert guidance in navigating these monetary choices.

Understanding Lender Requirements for Owner-Occupied Loans

Lenders establish specific criteria according to owner-occupied loan rules Australia to ensure borrowers are financially capable of repaying their debts. Key requirements include:

- Proof of Identity: Valid identification, such as a driver's license or passport, is essential for verifying the borrower's identity.

- Income Verification: Lenders require documentation of income through payslips, tax returns, or bank statements. This process is crucial for assessing the borrower's repayment capacity. As noted by mortgage professionals, the owner-occupied loan rules in Australia indicate that owner-occupiers are seen as more reliable borrowers than investors and, as such, are routinely offered lower interest rates. Thorough income verification is a critical step in the lending process, ensuring that borrowers can meet their financial obligations.

- Credit Assessment: A comprehensive credit check evaluates the borrower's creditworthiness and history, which significantly influences approval decisions.

- Asset Valuation: An assessment of the asset is essential to verify it satisfies the financial institution's criteria and to establish the suitable borrowing amount. This step is crucial, as it safeguards both the creditor and the borrower by ensuring the asset value corresponds with the financing. Comprehending the average mortgage-to-value ratio (LVR) for owner-occupied loan rules Australia, which is usually about 80%, can assist borrowers in assessing their financial preparedness.

- Loan-to-Value Ratio (LVR): Most lenders prefer an LVR of 80% or lower, meaning borrowers should ideally have a deposit of at least 20% of the property's value. This ratio is a key factor in determining borrowing eligibility and terms.

Understanding these requirements is essential for borrowers preparing their applications, as it can significantly enhance their chances of securing approval. With the average loan size for owner-occupied loan rules Australia currently around $373,000, being well-prepared can make a substantial difference in navigating the competitive lending landscape. To improve your chances, consider gathering all necessary documentation ahead of time and consulting with a mortgage professional for personalized advice.

Conclusion

Understanding the owner-occupied loan rules in Australia is crucial for homeowners navigating the complexities of the mortgage landscape. These guidelines shape the borrowing experience and influence financial decisions that can have lasting impacts on individual wealth and community stability. By adhering to these rules, homeowners unlock a range of benefits, such as lower interest rates, access to government grants, and potential capital gains.

Key insights highlighted throughout the article include:

- The importance of meeting eligibility requirements

- Distinctions between owner-occupied and investment loans

- The potential consequences of mismanaging loan statuses

Homeowners are encouraged to stay informed about their rights and responsibilities, particularly regarding renting out their properties or converting their loans. Awareness of the financial implications and lender requirements is essential for making sound decisions that align with long-term financial goals.

In conclusion, the landscape of owner-occupied loans in Australia is evolving, presenting both challenges and opportunities for homeowners. It is vital for individuals to educate themselves, seek expert advice, and remain proactive in managing their mortgage situations. By doing so, homeowners enhance their financial security and contribute positively to their communities, ultimately fostering a more stable and prosperous environment for all.