Overview

The insights regarding SMSF home loans in Australia reveal tailored solutions that allow individuals to leverage self-managed super funds for real estate investment. This strategy not only has the potential to enhance financial returns but also offers significant tax advantages.

It is crucial for prospective borrowers to understand the eligibility criteria, navigate the application process, and recognize both the benefits and risks involved. This knowledge empowers them to make informed investment decisions in the ever-evolving landscape of SMSF home loans.

Introduction

In the evolving landscape of property investment, Self-Managed Super Fund (SMSF) home loans have emerged as a powerful tool for savvy investors seeking to enhance their financial portfolios. These specialized financing options enable individuals to leverage their superannuation funds for acquiring investment properties, presenting unique benefits such as tax advantages and greater control over assets.

However, navigating the complexities of SMSF loans can be daunting, with various eligibility criteria, regulatory requirements, and potential risks to consider. As more Australians recognize the value of SMSF home loans in retirement planning, understanding the nuances of this financing avenue becomes crucial.

This article delves into the myriad aspects of SMSF home loans, from tailored solutions to common misconceptions, equipping readers with the knowledge needed to make informed investment decisions.

Finance Story: Tailored SMSF Home Loan Solutions for Your Needs

Finance Story excels in providing personalized solutions for SMSF home loans Australia, tailored to the unique financial situations of its clients. By emphasizing a thorough comprehension of personal requirements, the brokerage offers a range of choices that enable clients to efficiently utilize their self-managed super funds for real estate ventures. This tailored approach not only enhances financial results but also aligns with current trends in the self-managed super fund landscape, where over 31% of members also possess non-self-managed super funds.

Recent data indicates that, as of the latest survey, 55.5% of SMSFs remain in the accumulation phase, with a gradual shift towards retirement benefit payments. This transition reflects evolving financial needs and planning strategies among members, underscoring the importance of customized solutions.

Expert opinions underscore the advantages of SMSF home loans Australia for property investment, highlighting their capacity to enhance returns while offering flexibility in asset allocation. As rthomson1 noted, "Well over 80,000 by the time the 30/06/24 figures are crunched I expect," indicating a significant increase in self-managed super fund engagement.

With a sharp emphasis on innovation and a dedication to cultivating long-term connections, Finance Story is ideally situated to assist clients in navigating the intricacies of self-managed superannuation fund lending, ensuring they obtain the most beneficial funding options available. As the self-managed superannuation fund market continues to evolve, staying informed about these trends is crucial for making strategic financial decisions. Finance Story's commitment to personalized service and its vast understanding of the self-managed superannuation fund landscape make it a reliable partner for clients looking to navigate this dynamic environment. Additionally, clients have expressed their satisfaction, with one stating, "I will definitely be recommending your business to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey.

Understanding SMSF Home Loans: Definition and Importance in Australia

A Self-Managed Super Fund home loan represents a specialized financing option that empowers individuals to leverage their superannuation funds for acquiring assets, including commercial properties such as office buildings, warehouses, and retail locations. This financial product has gained significant traction in Australia, particularly among those strategizing for retirement with smsf home loans Australia. By utilizing a self-managed superannuation fund to invest in real estate, individuals can unlock potential tax advantages and exercise enhanced control over their retirement savings.

In contrast to residential real estate ventures, commercial real estate opportunities come with fewer limitations, rendering them an attractive choice for self-managed super fund holders. Finance Story is committed to assisting you in crafting a compelling case and ensuring compliance with regulations, preparing you to identify the right lender for your commercial investment property.

As of June 2019, over 1 million individuals were members of self-managed superannuation funds, with a notable 85% aged 45 years or older. This statistic highlights a mature market that prioritizes customized financial strategies. The trend towards smsf home loans Australia for self-managed superannuation funds is expected to grow, reflecting an increasing recognition of their importance in retirement planning.

With two-member funds constituting more than 68% of all SMSFs, these financial products are emerging as a strategic option for investors aiming to enhance their retirement portfolios. Moreover, it is essential for prospective borrowers to verify rates and product information with relevant credit providers, ensuring informed decision-making.

SCHEDULE A DISCUSSION to explore how smsf home loans Australia can elevate your retirement strategy.

Eligibility Criteria for SMSF Home Loans: What You Need to Qualify

To qualify for an SMSF home loan, borrowers must meet specific eligibility criteria, including:

- SMSF Compliance: The SMSF must comply with the Superannuation Industry (Supervision) Act 1993. Finance Story offers professional advice to ensure your SMSF home loans Australia comply with all standards, particularly when investing in commercial real estate, which has fewer limitations compared to residential real estate.

- Funding Approach: A definitive funding approach must be established, detailing how the asset aligns with the fund's overarching objectives. This includes specifying the types of commercial properties, such as office buildings, warehouses, and retail premises, that can be invested in. Finance Story can assist in creating a customized investment plan that aligns with your self-managed super fund goals, particularly through the use of smsf home loans Australia.

- Financial Stability: The self-managed superannuation fund should show adequate cash flow to cover the repayment obligations, alongside a minimum balance usually demanded by creditors. Our team at Finance Story will help you assess your financial position to ensure you meet lender expectations for SMSF home loans Australia.

- Trust Deeds: Proper documentation, including the superannuation fund trust deed, must be provided to the lender. Finance Story will guide you through the necessary documentation to facilitate a smooth lending process.

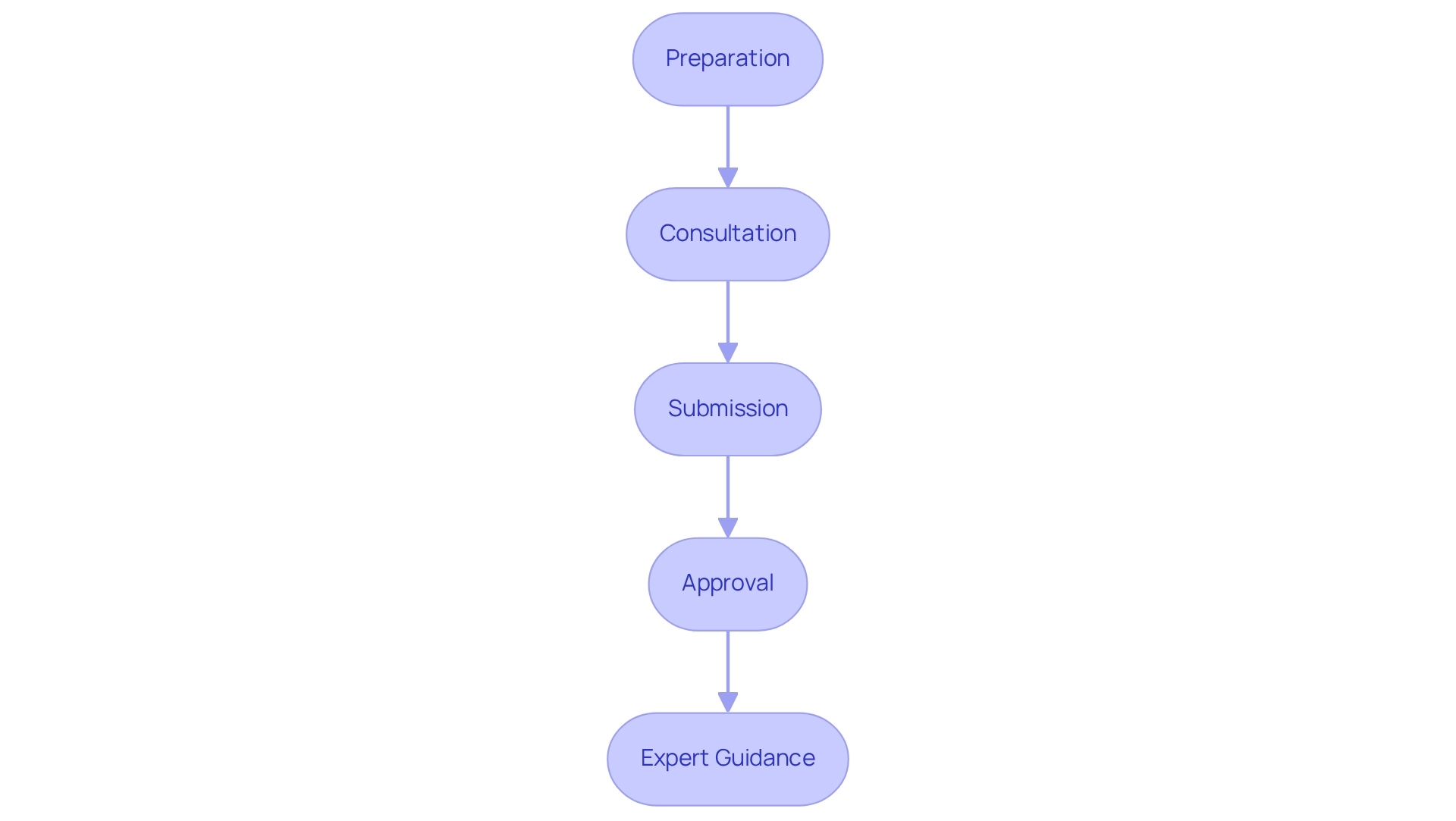

Navigating the Application Process for SMSF Home Loans

Navigating the application process for SMSF home loans involves several essential steps:

-

Preparation: Begin by gathering all necessary documentation, such as financial statements, trust deeds, and proof of income. This foundational step is crucial for a smooth application process.

-

Consultation: Collaborate with a mortgage broker or financial advisor who specializes in self-managed super fund financing. Their expertise ensures compliance with regulations and optimizes your application strategy. It is essential to comprehend the specific limitations on assets acquired with SMSF home loans Australia, which must satisfy the 'sole purpose test' for delivering retirement benefits. Finance Story provides customized advice to assist you in navigating these complexities and locating the appropriate lender for your commercial property.

-

Submission: Complete the financing application form and submit it along with the necessary documents to your selected lender. It is crucial to find a lender that aligns with your financial objectives.

-

Approval: After submission, the lender will assess your application. This review typically takes about one week, but be prepared to provide additional information if requested. Understanding the common documentation required can expedite this process.

Investors are urged to obtain expert guidance tailored to their unique situations before making financial choices, as this can greatly influence the success of their funding application. Successful funding application stories from Australian clients emphasize the significance of comprehensive preparation and professional advice in attaining positive results with SMSF home loans Australia. To further assist you, consider scheduling a complimentary personalized consultation with Finance Story's Head of Funding Solutions, Shane Duffy, to discuss your needs and objectives in commercial real estate.

Benefits of SMSF Home Loans for Property Investment

SMSF home loans Australia present a range of benefits for real estate ventures, positioning them as an appealing option for investors seeking to enhance their financial opportunities. The key advantages are as follows:

- Tax Advantages: Rental income derived from properties within an SMSF is taxed at a concessional rate of 15%. Furthermore, capital gains can be tax-free during the pension phase, significantly boosting the overall return. This tax efficiency is a pivotal consideration for many investors.

- Control Over Assets: Investors benefit from heightened control over their asset choices, enabling the implementation of tailored strategies that align with their specific financial objectives. This autonomy is essential for adapting to market fluctuations and personal circumstances, empowering investors to make informed decisions.

- Utilize Opportunities: Self-managed super funds allow investors to leverage their retirement savings to acquire real estate, potentially increasing the value of their asset portfolios. This strategic use of leverage can foster substantial growth over time, particularly in a thriving real estate market.

- Financial Preferences: Recent data reveals that a significant percentage of self-managed superannuation fund investors utilize loans for real estate acquisition, underscoring a growing trend towards leveraging superannuation for property investments. In fact, 74% of self-managed super fund assets are allocated to traditional options like Australian listed shares, cash, and term deposits, reflecting a conservative approach that could be enhanced by real estate. This cautious distribution highlights the importance of diversifying into real estate to elevate overall portfolio performance.

- Successful Investment Strategies: Case studies indicate that investors utilizing self-managed super fund home financing often achieve favorable outcomes by diversifying their portfolios and capitalizing on the tax benefits associated with real estate investments. For instance, investors who strategically allocate a portion of their self-managed super fund to real estate have reported significant growth in their overall returns, illustrating the effectiveness of this strategy. This approach not only amplifies growth potential but also mitigates risks linked to market volatility.

In summary, SMSF home loans Australia offer a compelling combination of tax benefits, control, and leverage options, making them a valuable asset for real estate investors aiming to refine their financial strategies. Finance Story is dedicated to providing tailored funding solutions for building homes, residential property investments, and commercial property investments, ensuring that both first-time buyers and seasoned investors can navigate their options with confidence.

Risks Involved with SMSF Home Loans: What to Consider

Investors considering SMSF home loans must be acutely aware of several inherent risks that could significantly impact their financial outcomes:

- Higher Costs: SMSF loans typically carry higher interest rates and fees compared to traditional loans. This can substantially affect overall returns, making it crucial for investors to evaluate the long-term financial implications of these costs.

- Regulatory Compliance: SMSFs are subject to stringent regulations, and non-compliance can lead to severe penalties. For instance, the Australian Taxation Office (ATO) enforces rigorous regulations on self-managed superannuation fund operations, and failing to comply can result in penalties or even the forfeiture of tax benefits.

- Market Risks: The real estate market is inherently volatile, with values subject to fluctuations. Investors must acknowledge that there is no guarantee of capital growth, which can adversely influence the performance of their self-managed super fund. A decline in property values can lead to diminished returns and potential losses.

- Compliance Failures: Notable instances of self-managed super fund borrowing compliance failures have occurred, resulting in substantial repercussions for investors due to insufficient adherence to regulations. Such failures can lead to costly penalties and a loss of investment opportunities.

- Cost Considerations: Beyond interest rates, self-managed superannuation fund financing may involve additional expenses such as establishment fees, ongoing management charges, and legal expenses. These costs can accumulate, further impacting the fund's profitability.

- Risks in 2025: As the self-managed super fund landscape evolves, new risks are emerging. Investors need to remain vigilant regarding alterations in regulations and market circumstances that could affect their home financing.

- Average Interest Rates: Currently, average interest rates for self-managed super fund home financing exceed those for conventional financing, which can influence borrowing choices. Investors should compare these rates carefully to ensure they are making informed decisions.

- Penalties for Non-Compliance: Statistics indicate that failure to adhere to self-managed superannuation fund regulations can result in fines amounting to thousands of dollars, underscoring the necessity of maintaining stringent compliance practices.

Understanding these risks is crucial for investors aiming to navigate the complexities of self-managed superannuation fund home financing effectively.

SMSF Home Loans vs. Traditional Home Loans: Key Differences

SMSF home loans distinctly differ from traditional home loans in several critical ways:

- Purpose: SMSF loans are specifically tailored for acquiring investment properties within a self-managed superannuation fund (SMSF). In contrast, traditional loans can be used for personal residences or various investment purposes.

- Regulations: Financing through self-managed superannuation funds must adhere to superannuation laws, which impose specific rules governing their use. Conversely, traditional financing is regulated under consumer credit laws, which feature different requirements and protections.

- Deposit Requirements: Typically, self-managed superannuation fund financing necessitates a larger deposit, ranging from 20% to 30%. This contrasts with conventional financing, which may permit reduced deposit amounts. Such elevated requirements reflect the unique characteristics of self-managed superannuation fund assets and the associated risks.

As the market for self-managed super funds expands, an increasing number of individuals are recognizing the potential of smsf home loans Australia for real estate acquisition and wealth growth. This trend is expected to shape the future landscape of smsf home loans Australia, as highlighted in recent case studies that explore evolving investor preferences and regulatory changes in self-managed superannuation fund lending. - Expert Insights: Mortgage specialists emphasize that self-managed superannuation fund financing offers unique advantages, such as greater control over asset selection and potential tax benefits, making it an attractive option for discerning investors seeking to leverage their superannuation.

Understanding these distinctions is vital for small business owners and individuals assessing their financing options, as it empowers informed decision-making in the property arena.

Legal and Compliance Requirements for SMSF Home Loans

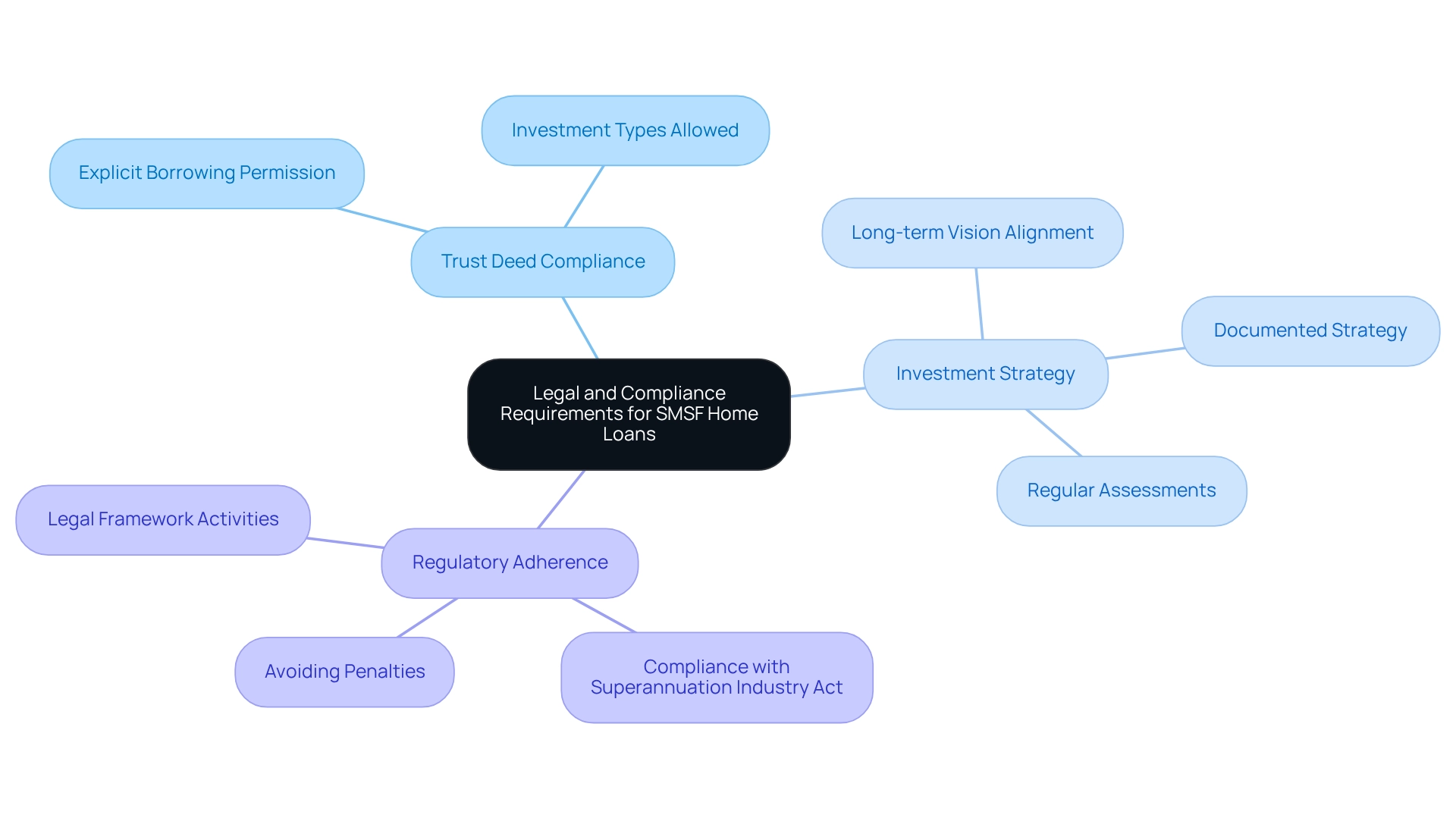

When seeking SMSF home loans in Australia, borrowers must navigate a series of legal and compliance requirements to ensure a smooth process and avoid potential penalties. Key considerations include:

- Trust Deed Compliance: The SMSF's trust deed must explicitly permit borrowing and outline the types of investments allowed. This foundational document is crucial for ensuring that all transactions align with the fund's objectives.

- Investment Strategy: A well-documented investment strategy is essential, detailing how the property investment supports the fund's overall goals. This strategy should embody the long-term vision of the fund and be regularly assessed to adjust to evolving situations.

- Regulatory Adherence: Compliance with the Superannuation Industry (Supervision) Act 1993 and other relevant regulations is mandatory. This compliance protects the self-managed super fund from penalties and ensures that all activities are conducted within the legal framework.

Furthermore, it is crucial to acknowledge that interacting with compliance specialists can offer useful perspectives on the legal obligations for SMSF home loans Australia. This ensures that trustees are knowledgeable and ready to fulfill their responsibilities. Successful instances of trust deed compliance in real estate showcase the advantages of following these legal structures. By understanding common legal issues encountered by self-managed superannuation fund borrowers, such as improper documentation or failure to comply with investment strategies, trustees can better position themselves for success in their property ventures.

Common Misconceptions About SMSF Home Loans: Debunking Myths

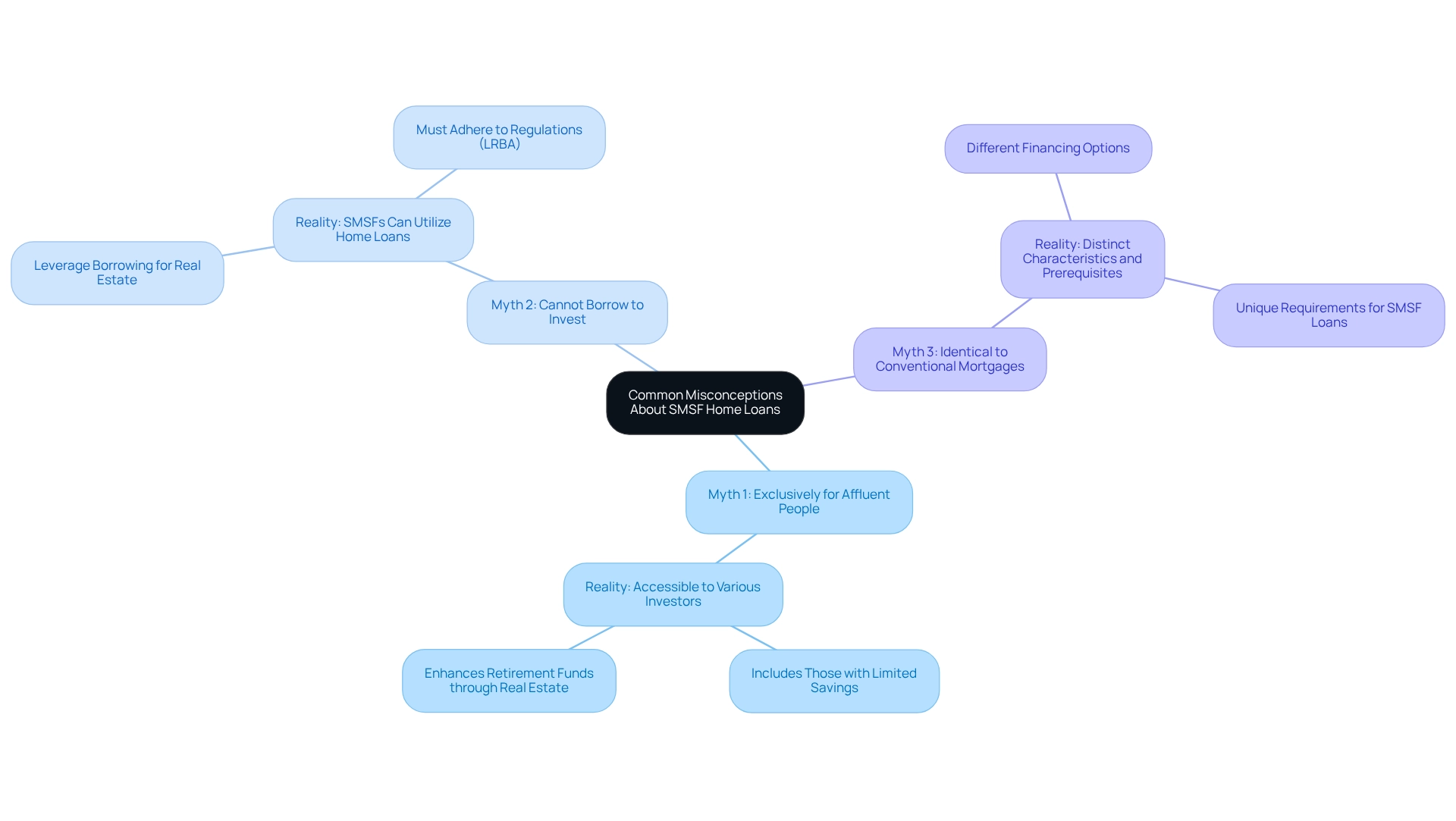

Many misunderstandings regarding smsf home loans Australia persist, causing uncertainty among prospective borrowers. Tackling these misconceptions is essential for a better comprehension of self-managed superannuation fund financing and its availability.

- Myth 1: Self-managed superannuation fund financing is exclusively for affluent people. This belief disregards the reality that smsf home loans Australia can be accessed by a wider variety of investors, including those with limited savings who aim to enhance their retirement funds through real estate investment.

- Myth 2: You cannot borrow to invest in real estate through a self-managed superannuation fund. In reality, SMSFs can utilize SMSF home loans Australia to leverage borrowing for obtaining real estate, provided they adhere to specific regulations, such as the 'limited recourse borrowing arrangement' (LRBA).

- Myth 3: Self-managed super fund borrowing is identical to conventional home mortgages. While both categories of financing serve the purpose of funding property, the smsf home loans Australia financing options come with distinct characteristics and prerequisites that set them apart from conventional home financing.

Statistics show that a considerable segment of Australians is unaware of self-managed superannuation fund financing alternatives, with only a small percentage acknowledging their possible advantages. This lack of awareness can hinder individuals from exploring viable investment strategies for their retirement.

Insights from financial educators emphasize the importance of debunking these myths to empower potential borrowers. For example, educational materials issued by authorities, like the document 'Starting an SMSF,' seek to improve trustees' comprehension of their duties and the possibilities accessible through self-managed superannuation funds.

Real-world examples demonstrate the diversity of self-managed super fund borrowers in Australia, showcasing individuals from various financial backgrounds successfully utilizing smsf home loans Australia to invest in property. By clarifying these misunderstandings, prospective borrowers can make informed choices and utilize smsf home loans Australia as a strategic resource for their financial future.

Resources for Further Information on SMSF Home Loans

For those seeking more information on SMSF home loans, consider these valuable resources:

- Australian Taxation Office (ATO): This resource provides comprehensive guidelines on SMSF regulations and compliance, ensuring that trustees are well-informed about their obligations.

- Self-Managed Superannuation Fund Association: A key organization that offers educational resources and support for self-managed super fund trustees, assisting them in navigating the complexities of managing their funds effectively.

- Financial Advisors: Collaborating with a financial advisor who focuses on SMSFs can provide customized advice suited to personal situations, increasing the chances of successful funding requests.

As of June 30, 2024, SMSFs collectively held $990.4 billion, representing 25% of the total $3.9 trillion in super assets under management. This significant figure underscores the growing trust individuals place in managing their retirement funds and highlights the importance of expert resources for SMSF home loans in Australia. With 85% of SMSF members aged 45 or older, the need for tailored financial advice is more critical than ever.

To maximize the benefits of these resources, consider scheduling your free personalized consultation with Finance Story's Head of Funding Solutions, Shane Duffy. Discuss your needs and goals, and let us assist you in navigating the best home loan solutions available. Please select a time that suits you from our live calendar.

Please note that while links to third-party websites are provided for convenience, they are not endorsed by Finance Story. To ensure you receive the best advice tailored to your specific needs, consulting with a financial advisor is highly recommended.

Conclusion

The exploration of Self-Managed Super Fund (SMSF) home loans unveils a powerful financial tool for Australian investors eager to enhance their retirement strategies through property investment. By leveraging their superannuation funds, individuals gain access to unique tax benefits and greater control over their investments. The tailored solutions provided by experts like Finance Story empower clients to navigate the complexities of SMSF loans effectively, aligning their investment strategies with personal financial goals.

However, potential borrowers must remain vigilant regarding the eligibility criteria and regulatory compliance associated with SMSF home loans. Understanding the distinct advantages and risks, such as higher costs and market volatility, is crucial for informed decision-making. Additionally, debunking common misconceptions about SMSF loans can enable more investors to utilize these financing options strategically.

As the SMSF landscape continues to evolve, the significance of staying informed and seeking expert guidance cannot be overstated. With a substantial portion of SMSF members nearing retirement age, the need for tailored financial strategies is more pressing than ever. By embracing SMSF home loans, investors can construct a robust property portfolio that not only secures their financial future but also maximizes the potential of their superannuation savings.