Overview

Owner-occupied commercial mortgages offer small businesses substantial advantages. These include:

- Financial stability

- Equity building

- The ability to customize workspaces to fit specific needs

Notably, such mortgages provide lower interest rates and tax benefits, empowering entrepreneurs to secure their properties. This empowerment leads to enhanced operational efficiency and a promising potential for long-term growth.

Have you considered how these mortgages could transform your business? By investing in your own property, you not only stabilize your financial footing but also build equity over time. This strategic move can significantly impact your company's trajectory, allowing for greater control over your workspace and operations.

Furthermore, the ability to tailor your environment can foster productivity and innovation. As your business grows, having a space that aligns with your vision becomes crucial. Owner-occupied commercial mortgages are not just a financial tool; they are a pathway to realizing your entrepreneurial dreams.

In conclusion, exploring owner-occupied commercial mortgages could be one of the most impactful decisions for your business. Take the next step towards securing your future and enhancing your operational capabilities.

Introduction

The landscape of commercial financing is evolving, marked by a significant increase in owner-occupied commercial mortgage applications from small business owners. This trend not only indicates a rising confidence in property investment but also underscores the numerous advantages these tailored mortgages present. Entrepreneurs can substantially benefit from grasping how these financial tools can bolster operational stability, build equity, and offer tax benefits.

However, as the intricacies of securing such financing unfold, what potential pitfalls could impede their success? Delving into the benefits and challenges of owner-occupied commercial mortgages provides vital insights for small businesses striving to excel in a competitive market.

Finance Story: Tailored Owner Occupied Commercial Mortgages for Small Business Owners

Finance Story specializes in customized owner occupied commercial mortgage solutions, meticulously designed for small business owners. By prioritizing an understanding of each client's unique financial situation, Finance Story empowers entrepreneurs to secure the ideal funding necessary for acquiring their premises, a crucial element for fostering stability and growth. This tailored approach streamlines the financing process, ensuring alignment with the organization’s long-term goals.

Recent trends reveal a significant increase in owner occupied commercial mortgage applications, with a notable portion of new financing featuring high loan-to-value ratios (LVRs) of 80% or more. This trend reflects a growing confidence among independent business owners in investing in their own properties. The substantial growth in commercial lending finalized by loan brokers, which surged from $8.79 billion in 2019 to $20.31 billion in 2024—an increase of 131%—further underscores this confidence.

Numerous successful instances illustrate how small enterprises have leveraged owner occupied commercial mortgage to enhance their operational capabilities. For example, a local bakery secured financing to purchase its storefront, facilitating expansion and increasing customer engagement. Such cases highlight the tangible advantages of these loans, including improved cash flow management and the potential for property appreciation.

The benefits of owner occupied commercial mortgage extend beyond mere financing. They provide entrepreneurs with the opportunity to build equity in their properties, serving as a financial buffer during challenging times. Additionally, customized commercial loans offer flexibility in repayment terms and interest rates, tailored to meet the specific cash flow needs of businesses. This bespoke service not only strengthens financial stability but also cultivates a deeper relationship between Finance Story and its clients, ensuring ongoing support throughout their financial journey.

As financial consultant Jane Doe aptly states, "Customized loan solutions are vital for independent enterprises, as they enable owners to manage their distinct financial obstacles while obtaining the most favorable conditions for their investments.

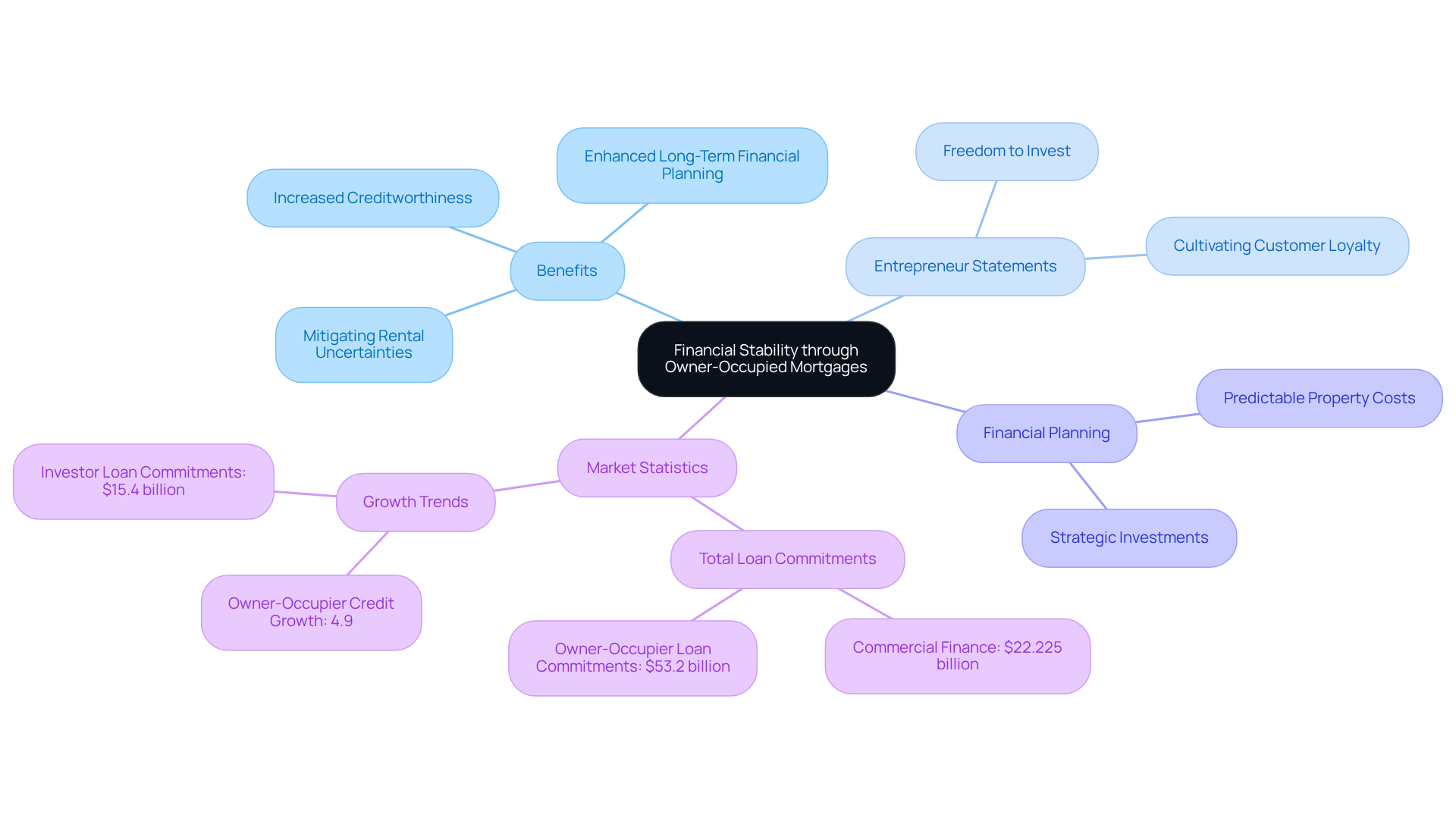

Financial Stability: Secure Your Business Premises with Owner Occupied Mortgages

Owner-occupied commercial mortgages empower small enterprises to secure their premises, significantly bolstering financial stability. By owning their property, companies can mitigate the uncertainties associated with rental agreements and fluctuating lease expenses. This stability fosters enhanced long-term financial planning, enabling organizations to allocate resources more efficiently toward growth and operational improvements.

For instance, small businesses that own their locations often express greater confidence in their financial strategies, as they can anticipate their property-related costs with increased accuracy. This predictability facilitates strategic investments in their operations, ultimately enhancing profitability.

Statements from independent entrepreneurs underscore these advantages:

- One owner remarked, "Owning our property has granted us the freedom to invest in improvements that elevate our customer experience without the worry of lease extensions."

- Another shared, "Having a stable location has allowed us to cultivate a loyal customer base, knowing we won't be compelled to relocate unexpectedly."

Moreover, the benefits of owning commercial property extend beyond immediate financial gains. It can also enhance a company's creditworthiness, simplifying the process of securing additional funding for growth or operational needs. As the market for owner occupied commercial mortgages continues to expand, small enterprises are increasingly recognizing the importance of property ownership as a cornerstone of their financial strategy.

Indeed, statistics reveal that the total value of new loan commitments for commercial finance in Australia reached $22.225 billion in the March quarter of 2025, underscoring the significance of this financing option in the broader market. Additionally, as Warren Buffett famously stated, "Real estate is an imperishable asset, ever increasing in value," reinforcing the long-term advantages of property ownership. To capitalize on these benefits, small business owners should consider consulting a loan broker like Finance Story for tailored financing options.

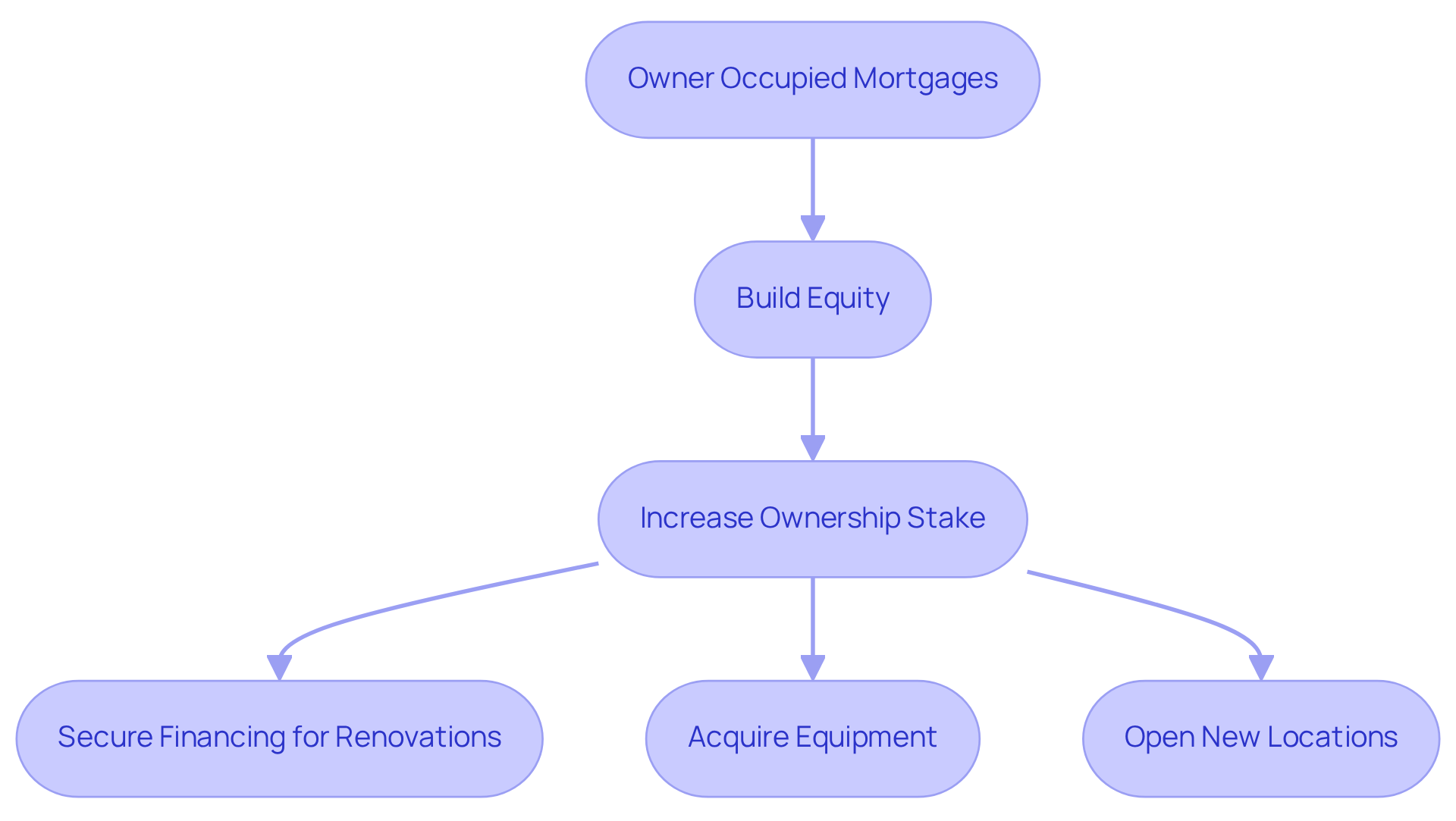

Equity Building: Increase Your Business's Financial Value with Owner Occupied Mortgages

Owner occupied commercial mortgage loans offer significant advantages, enabling businesses to build equity in their properties. As mortgage payments are made, companies gradually increase their ownership stake, transforming the property into a valuable asset. This equity can be strategically harnessed for additional financing, allowing businesses to pursue expansion opportunities or invest in new initiatives.

For instance, small enterprises can leverage the equity accrued in their commercial properties to secure financing for renovations, equipment acquisitions, or even new locations. This strategy not only enhances their operational capacity but also fortifies their financial standing.

Financial experts underscore the critical role of leveraging equity for growth. Tracey Pye, a loan advisor at Mortgage Express, notes, 'Demands for first home buyer loans remain strong, with many still finding it challenging to enter the market, and I believe that we will soon be reaching a peak.' This statement highlights the ongoing challenges and opportunities within the market, reinforcing the necessity for businesses to utilize their property equity.

In today's landscape, where the total value of new loan commitments for commercial finance in Australia reached $21.687 billion in late 2024, the potential for enterprises to capitalize on equity through owner-occupied mortgages is more relevant than ever. As companies navigate the complexities of financing, understanding how to effectively build and leverage equity can be transformative in achieving their financial goals.

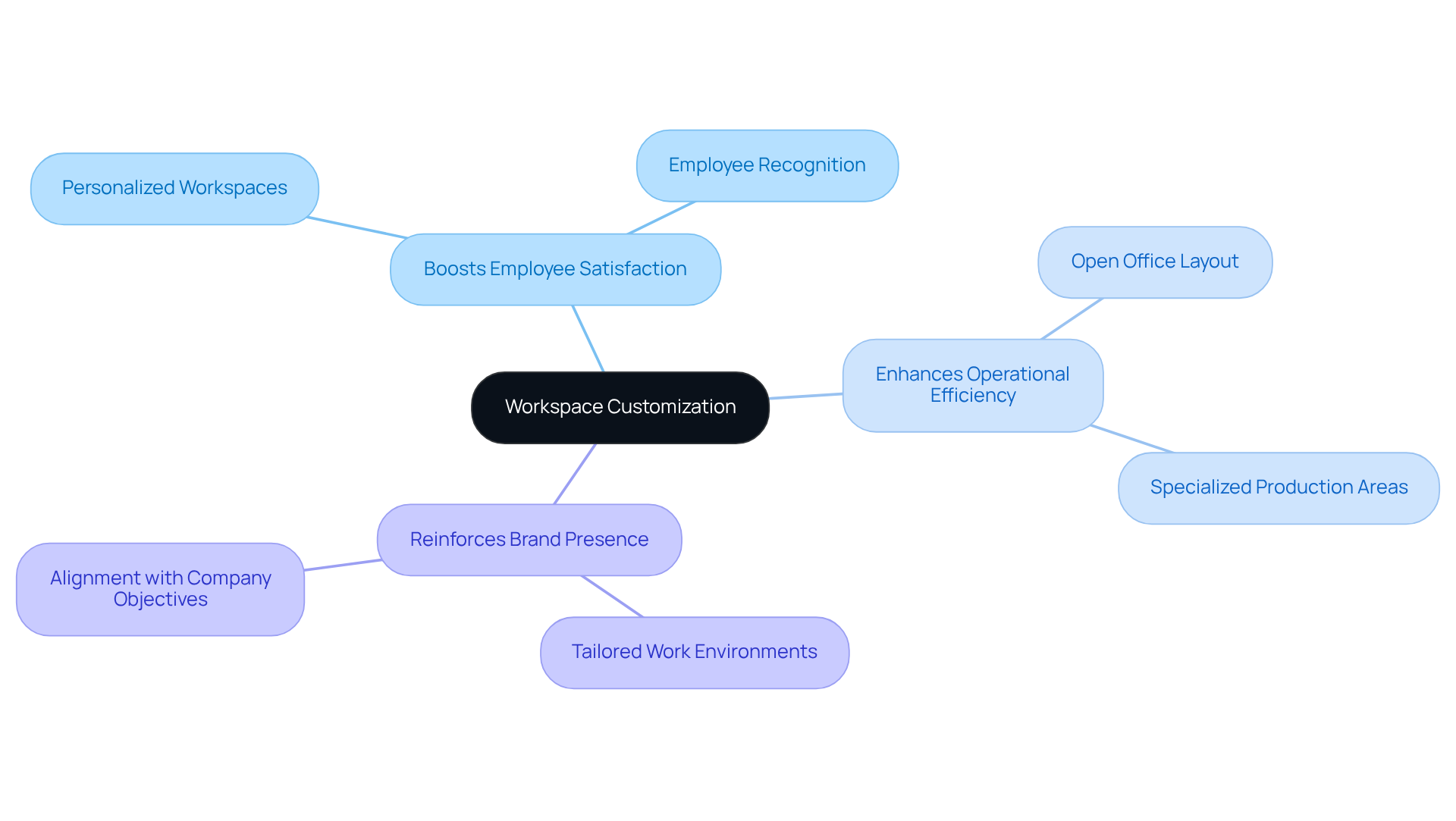

Customization: Tailor Your Workspace with Owner Occupied Commercial Properties

Owning commercial property through an owner occupied commercial mortgage empowers small business operators to tailor their workspace to meet specific operational needs. This customization can significantly boost employee satisfaction and operational efficiency, ultimately reinforcing the brand's presence.

For example, the ability to design an open office layout or create specialized production areas cultivates an optimal working environment that aligns with the company's objectives. Entrepreneurs often report that personalizing their spaces not only elevates morale but also enhances productivity.

As one owner remarked, 'Having the freedom to design our workspace has transformed our team's collaboration and creativity.' This flexibility in an owner occupied commercial mortgage allows enterprises to adapt their environments to better accommodate their evolving needs, leading to improved performance and heightened employee engagement.

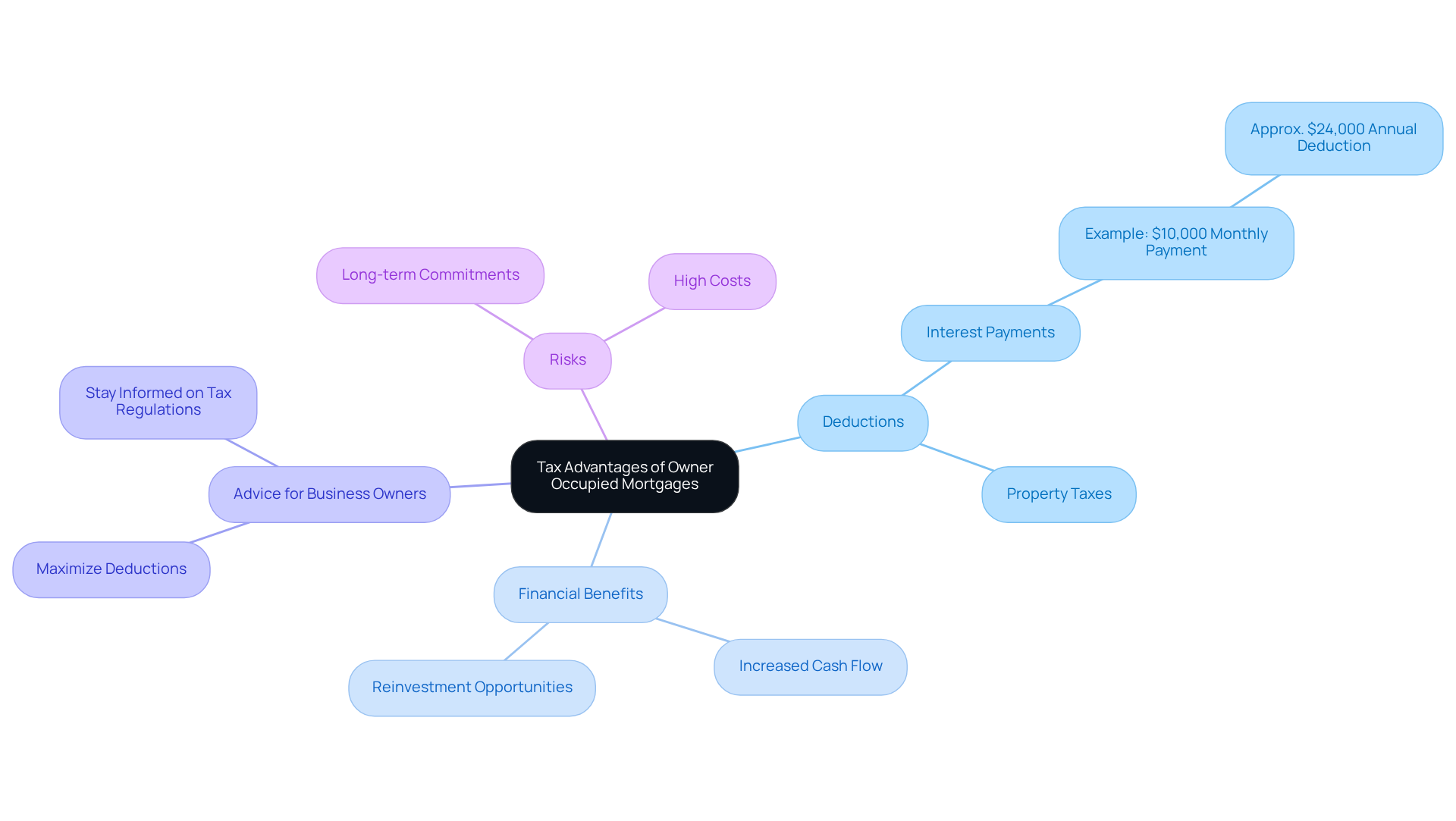

Tax Advantages: Leverage Owner Occupied Mortgages for Financial Benefits

Owner occupied commercial mortgages present significant tax advantages, particularly through the ability to deduct interest on loans and property taxes. These deductions can greatly diminish a company's tax burden, allowing for increased capital that can be reinvested into operations or growth initiatives. For instance, small business owners can deduct interest payments on their commercial loans, leading to substantial savings over time. A commercial real estate borrower making monthly payments of $10,000, with $2,000 allocated to interest, could potentially deduct approximately $24,000 annually, thereby enhancing cash flow.

Moreover, property taxes associated with commercial properties are also deductible, which further alleviates the financial pressures on the business. Tax professionals often advise entrepreneurs to fully leverage these deductions, as they can profoundly impact overall profitability. As one expert highlights, "The best way to maximize the tax benefits of investing in commercial real estate is to take advantage of the depreciation deductions available."

Furthermore, capitalizing on these tax benefits is crucial for small businesses striving to stabilize their finances and invest in future growth. By understanding and utilizing the tax deductions available through an owner occupied commercial mortgage, small business owners can cultivate a more favorable financial landscape, ultimately leading to enhanced operational capacity and sustainability. However, it is vital to recognize the potential risks associated with these loans, including long-term commitments and high costs. Additionally, the Tax Cuts and Jobs Act (TCJA) has influenced interest deductions on loans, making it imperative for business owners to remain informed about current tax regulations.

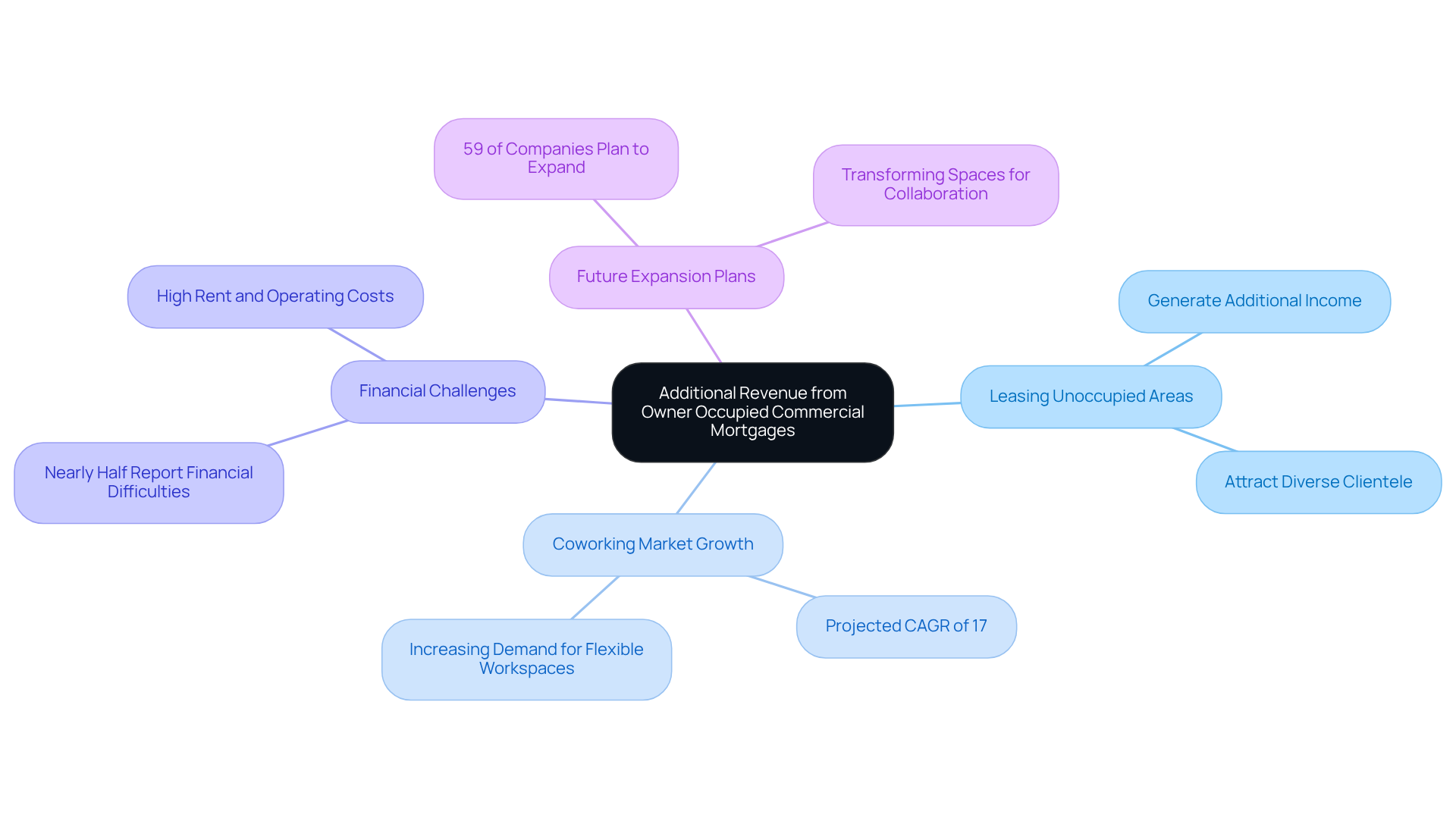

Additional Revenue: Rent Vacant Space with Owner Occupied Commercial Mortgages

Owner occupied commercial mortgage loans provide a compelling advantage: the ability to lease any unoccupied areas within the property. This additional revenue stream can significantly offset mortgage payments and enhance overall profitability. Small business operators can strategically leverage their available space to maximize income potential, whether by leasing to other enterprises or establishing coworking environments. With the coworking market projected to grow at a compound annual growth rate of 17% through 2026, integrating coworking options can attract a diverse clientele and foster community engagement. For instance, companies can transform unused spaces into adaptable work environments, catering to freelancers and startups seeking economical office solutions.

However, it is crucial to acknowledge that nearly half of coworking spaces report financial difficulties, underscoring the necessity for careful planning and management. In addition, 59% of companies plan to expand their office space through coworking in the next two years, indicating a growing demand for such arrangements. By considering these factors, small business owners can generate income while positioning their properties as centers for collaboration and innovation.

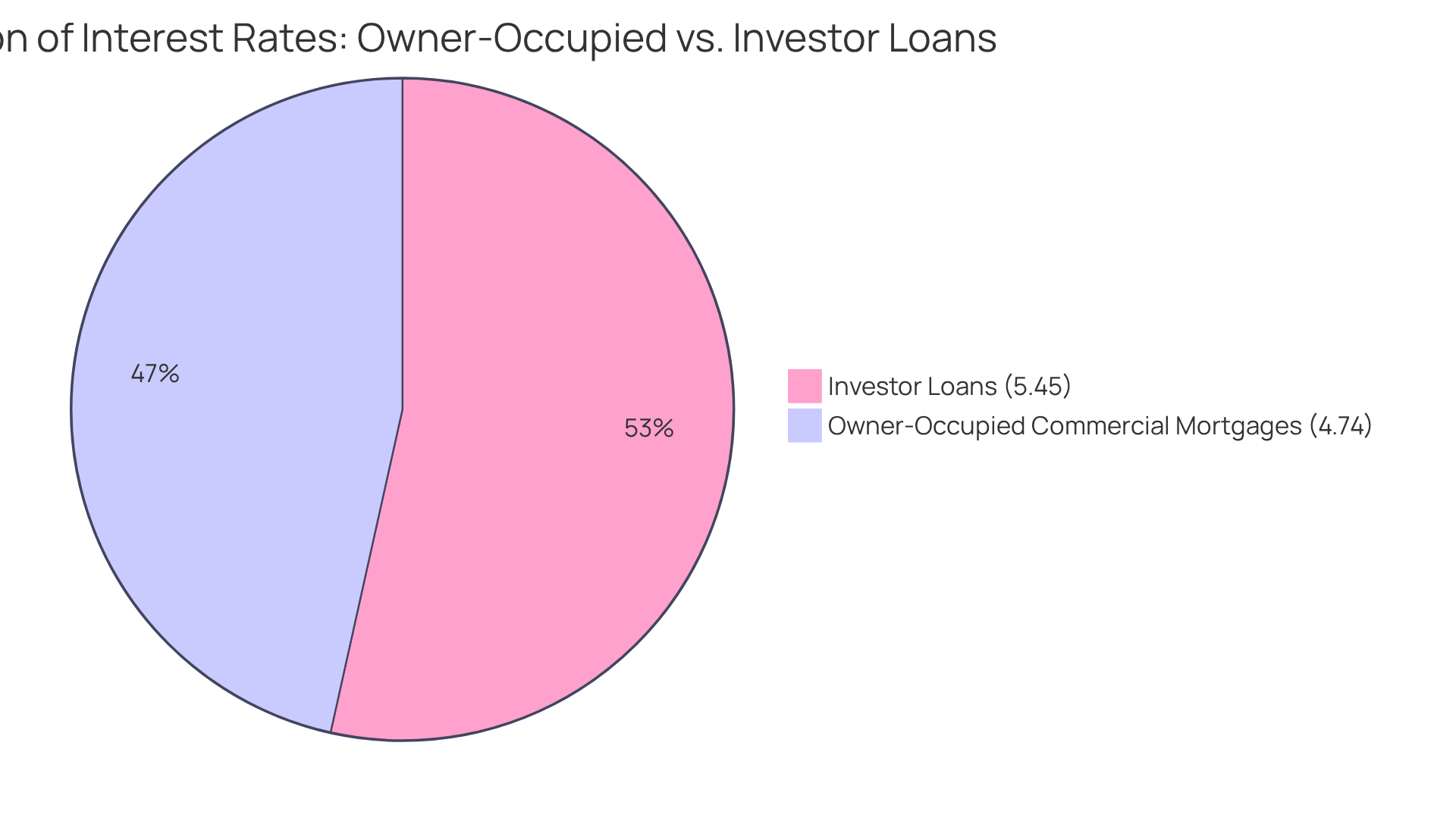

Lower Interest Rates: Benefit from Competitive Financing with Owner Occupied Mortgages

Owner occupied commercial mortgages provide a compelling advantage, as they usually come with lower interest rates than alternative financing options. This benefit stems from the reduced risk recognized by lenders when borrowers utilize the property for their commercial activities. As of July 2025, owner-occupier loans feature interest rates starting from 4.74% per annum, notably lower than the 5.45% associated with investor loans. This disparity can lead to substantial savings over time, empowering companies to redirect resources toward critical areas such as growth, recruitment, or upgrading equipment.

Consider the impact on minor enterprises. Those that secure competitive loan financing can save thousands in interest expenses, thereby enhancing their overall financial health and operational flexibility. By opting for an owner occupied commercial mortgage, businesses not only gain access to favorable rates but also secure a stable asset that can appreciate over time, further reinforcing their financial foundation.

In addition, this strategic choice positions enterprises to thrive in a competitive landscape, making it essential to evaluate the potential benefits of owner occupied commercial mortgages.

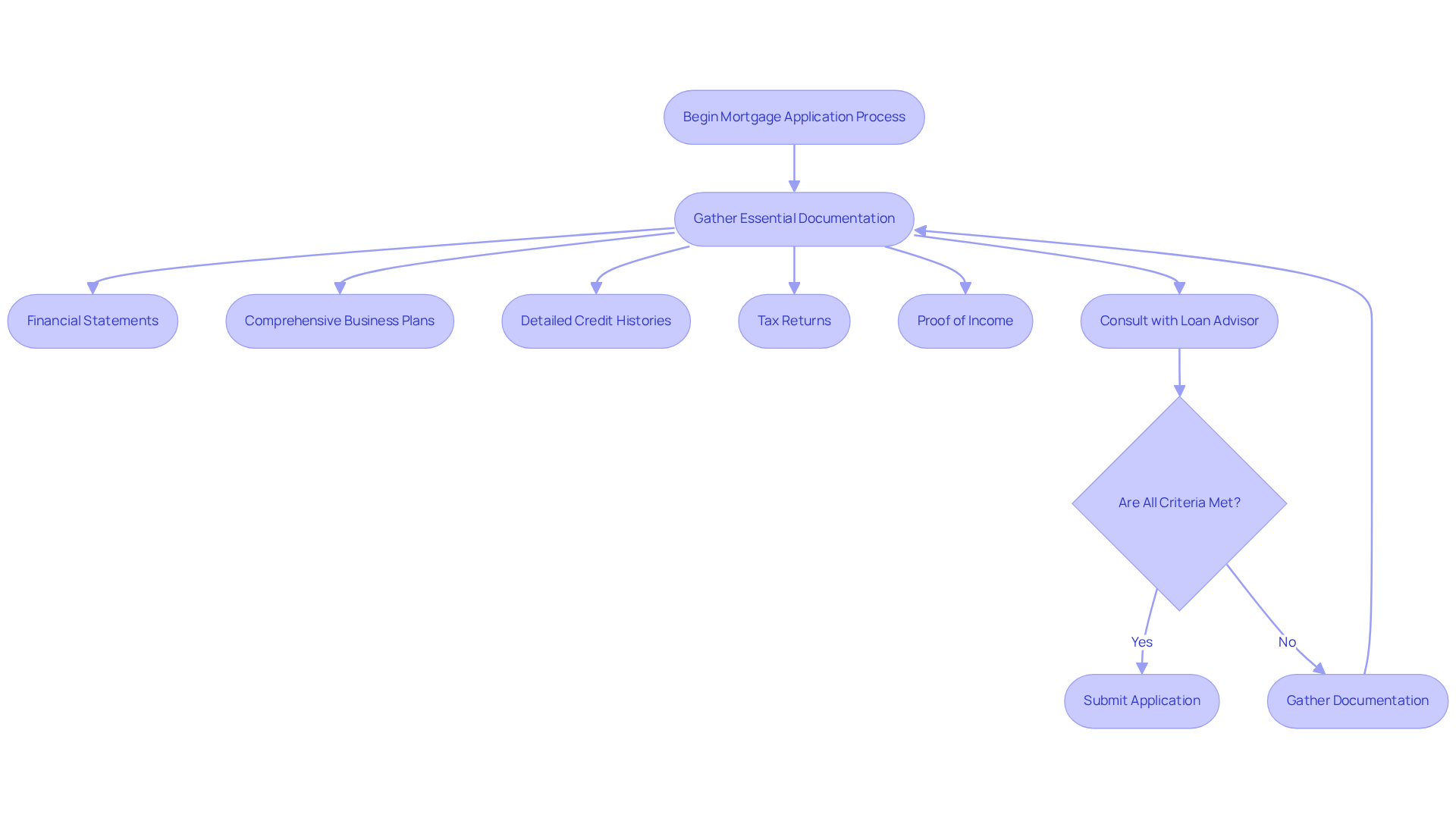

Application Process: Navigate Owner Occupied Commercial Mortgage Applications Effectively

Navigating the application process for owner occupied commercial mortgage loans can be intricate. However, small enterprise owners can significantly enhance their chances of success by being well-prepared. Essential documentation includes:

- Financial statements

- Comprehensive enterprise plans

- Detailed credit histories

According to industry insights, collaborating with a seasoned loan advisor can greatly simplify this process. These experts assist in ensuring that all criteria are met and provide valuable advice on best practices for small enterprises.

For instance, they can help identify common documentation required for commercial mortgage applications, such as:

- Tax returns

- Proof of income

These documents are critical for demonstrating financial stability. Furthermore, consultants offer customized guidance to navigate the application process efficiently, enabling entrepreneurs to present their case persuasively to lenders. With 33% of applicants facing denial for personal loans, thorough preparation is essential.

Moreover, the typical loan amount for an owner occupied commercial mortgage for owner-occupier residences in Australia is around $373,000, emphasizing the financial expectations for minor enterprise proprietors. Significantly, 59% of enterprises pursued financing to cover operating costs, highlighting the necessity of obtaining a loan. By utilizing specialized knowledge and comprehensive preparation, small enterprise leaders can enhance their chances of securing the funding they require.

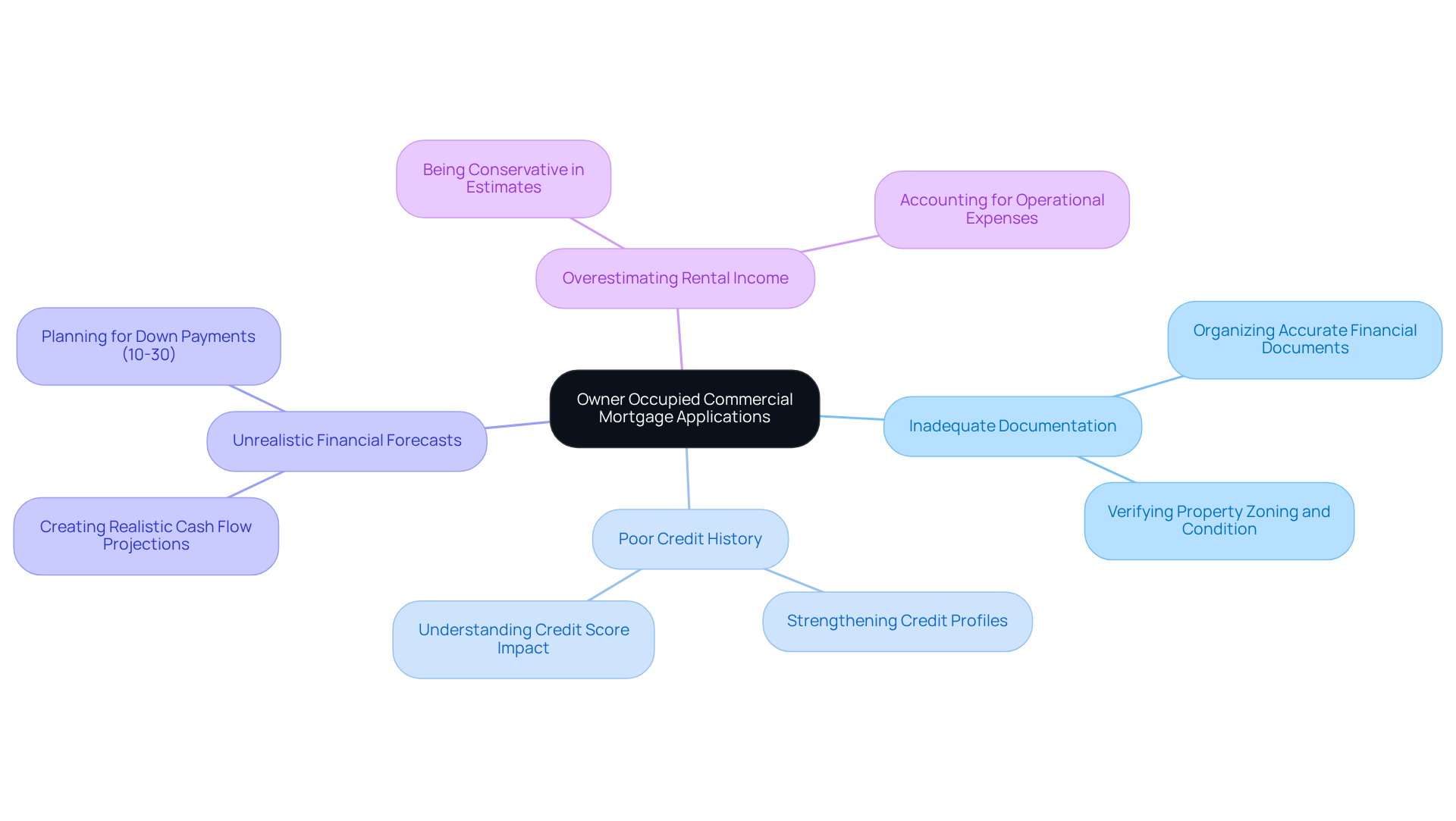

Avoid Mistakes: Key Pitfalls in Owner Occupied Commercial Mortgage Applications

Small enterprise proprietors must navigate several common traps when applying for an owner occupied commercial mortgage. Key mistakes include:

- Inadequate documentation, which can lead to delays or outright rejections.

- Poor credit history, significantly impacting loan approval chances.

Credit scores are critical in determining loan approval and interest rates; scores above 680 are generally favorable, while lower scores can result in higher interest rates or rejection. Moreover, unrealistic financial forecasts can weaken an application. It is essential to be cautious in estimating rental income to ensure that loan payments remain manageable. Overestimating rental income can lead to cash flow shortages when actual income falls short, making realistic cash flow projections based on past performance vital.

To enhance their applications, entrepreneurs should focus on thorough preparation. This includes:

- Organizing accurate financial documents.

- Strengthening credit profiles.

- Verifying property zoning, condition, and other factors to avoid potential legal issues.

Collaborating with a reliable financing advisor can align loan options with specific objectives, ultimately enhancing the chances of obtaining advantageous conditions. Additionally, it is important to plan for a standard down payment of 10%-30% for commercial real estate loans. By steering clear of these common errors, entrepreneurs can greatly enhance their likelihood of securing the funding they require.

Long-Term Benefits: Invest in Your Business Future with Owner Occupied Mortgages

Investing in owner-occupied commercial mortgages goes beyond just short-term financial benefits; it serves as a cornerstone for sustainable growth. By securing their own premises, small business owners not only acquire a stable asset but also position themselves for long-term appreciation, enhancing their financial security and facilitating future expansion. Statistics reveal that commercial real estate typically yields an annual return of 6% to 12% of the purchase price, establishing it as a prudent investment choice. Furthermore, ownership allows companies to sidestep the uncertainties associated with leasing, such as fluctuating rental costs and lease renewals. This stability significantly bolsters the overall success and sustainability of the enterprise.

Consider the numerous small businesses that have effectively harnessed property ownership to propel their growth. By investing in their own commercial spaces, they have redirected savings from avoided rent into operational enhancements and expansion projects. Financial planners frequently underscore the strategic advantages of property ownership, emphasizing that it not only builds equity but also offers tax benefits, including deductions for mortgage interest and depreciation. Moreover, owner occupied commercial mortgage options can provide up to 100% financing for businesses, further amplifying the appeal of property ownership. This multifaceted financing approach empowers small businesses to thrive in competitive markets, ensuring they are well-positioned for future opportunities. However, prospective buyers must remain cognizant of the challenges linked to purchasing commercial property, such as high initial investment costs and market volatility.

Conclusion

Investing in owner-occupied commercial mortgages presents a strategic opportunity for small business owners to secure their future while enhancing financial stability. These tailored mortgage solutions not only provide essential funding for property acquisition but also empower entrepreneurs to build equity, customize their workspaces, and leverage tax benefits, ultimately fostering sustainable growth.

Throughout this article, we have highlighted key advantages, including the ability to:

- Mitigate rental uncertainties

- Generate additional revenue from unused spaces

- Benefit from lower interest rates compared to alternative financing options

Real-world examples illustrate how businesses have successfully utilized these mortgages to expand operations, improve cash flow, and enhance customer engagement, demonstrating the tangible impact of property ownership on overall business success.

As the market for owner-occupied commercial mortgages continues to grow, small business owners are encouraged to consider these financing options as a cornerstone of their financial strategy. By understanding the multifaceted benefits associated with these mortgages, entrepreneurs can position themselves for long-term success, ensuring they harness the full potential of property ownership in building a resilient and thriving business.